What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

As organizations worldwide embrace more rigorous sustainability frameworks and climate related financial disclosures, forward-thinking companies are seeking to strategically integrate ESG principles and ESG strategies to demonstrate their measurable commitment to environmental reform and ESG criteria – but what exactly constitutes as proper ESG certification?

According to sustainability experts, an ESG certification can effectively validate your organization's dedication to environmental, social, and governance criteria — but navigating the complex landscape of sustainable business practices requires an in-depth understanding of ESG initiatives and the certification process to know which ESG certifications are actually worthwhile.

In this article, we’ll provide an evidence-based overview of ESG, analyze whether ESG certificate is worth acquiring, and offer expert guidance on which ESG certification may be right for your company.

An ESG certification provides companies with ample knowledge on how to manage ESG funds and other business activities related to environmental, social, and governance factors.

Acquiring an ESG certification can help your company to gain a competitive edge in the midst of a global push for sustainability, improve communication with your stakeholders, help to better manage your suppliers, and more.

ESG has become one of the most important identifiers for businesses today as it remains a key indicator for how well a company works to comply with stakeholder expectations, comply with environmental regulations, navigate risk management, and employ long-term sustainability efforts.

Here’s a breakdown of ESG factors:

As delineated by several independent assessments, validating performance across these diverse criteria through contrasting certification systems presents significant challenges. Consequently, many progressive organizations pursue comprehensive ESG certification frameworks that holistically demonstrate their integrated commitment to ESG considerations across all operational dimensions.

An ESG certification is worth it for any businesses looking to demonstrate their long-term commitment to sustainability alongside a goal to improve their profit and overall brand recognition, as acquiring an ESG certification can help to attract new talent, customers, and business partnerships.

According to a report from the European Banking Authority (EBA), organizations seeking to enhance their environmental governance, risk management strategies, or ESG investments typically realize significant returns from proper ESG certification – making the sometimes intensive process demonstrably worthwhile for improved corporate sustainability, responsible investing, and investment portfolios.

Independent research confirms that remaining aware of ESG trends, social responsibility, and committing to an ESG certification requires a comprehensive, long-term dedication to implementing sustainable practices across your entire organization, coupled with the agility to adapt these practices to maintain compliance with evolving certification standards.

Here are just a few of the things a company may learn while undergoing the process to acquire an ESG certification:

Leading business schools such as the University of Pennsylvania demonstrate that pursuing ESG courses and ESG certification equips organizations with enhanced capabilities to address complex sustainability challenges while simultaneously creating measurable competitive advantages that support long-term business resilience and market performance.

While there are various ESG certifications available, there is no universal ESG certification – such as how there is a universal standard for setting emission reduction targets with the SBTi.

Although ESG reporting experts emphasize that although there is no single universal ESG certification, organizations have discovered several credible pathways to validate their sustainability performance – including comprehensive certification with SGS or specialized ESG leadership development through institutions like Oxford.

Since there is no standardized framework for ESG, organizations who offer ESG certifications will develop their own guidelines based on various criteria – such as by following the criteria depicted in the United Nations Sustainable Development Goals or the Corporate Sustainability Reporting Directive (CSRD).

The Corporate Finance Institute offers a notable ESG certificate program designed to assist professionals in the development of more advanced business intelligence capabilities to further address complex ESG issues.

This certification provides participants with specialized knowledge in developing adaptive business models, implementing robust governance frameworks, and accurately measuring environmental impact.

Research indicates that professionals who complete this certification will be able to demonstrate improve capabilities in navigating the evolving regulatory landscape while also helping their organization to turn sustainability challenges into strategic advantages.

Completing an ESG courage with the Corporate Finance Institute (CFA) will entail the following:

Ultimately, an ESG certification should validate a company’s efforts to rectify their current activities related to environmental, social, and governance.

Leading sustainability consultants have noted the absence of a single comprehensive ESG certification has resulted in future-focused companies pursuing more than one ESG-based certification, such as those offered by the GRI, SASB, CDP, ISO 14001, B Corp, and additional sector-specific certifications aligned with their strategic sustainability objectives.

These ESG certifications are frequently complimentary to one another and can help to improve business operations, mitigate risks, and meet evolving demands from ESG experts.

The table below will compare and contrast current ESG certifications on the market:

| Certification | Focus | Pros | Cons | Best Suited For |

|---|---|---|---|---|

| Global Reporting Initiative (GRI) Certification | Sustainability reporting and ESG integration |

- Global recognition - Enhances transparency in ESG disclosures - Widely used framework |

- Can be complex and time-consuming to implement - Mostly reporting-based, less focused on actionable investments |

Sustainability professionals, CSR managers, compliance officers |

| CFA Institute Certificate in ESG Investing | Integration of ESG factors into investment decisions |

- Tailored for financial professionals - Highly reputable within the finance industry - Practical focus on ESG in investments |

- Limited to financial sector focus - Requires prior knowledge in finance |

Investment managers, portfolio analysts, financial professionals |

| Sustainalytics ESG Fundamentals Certification | ESG analysis and sustainable finance |

- In-depth training in ESG - Broad application for finance professionals - High demand for professionals with these skills |

- Primarily finance-focused - Requires ongoing updates with new ESG regulations |

Investment professionals, analysts, and ESG risk managers |

| Sustainability Accounting Standards Board (SASB) Fundamentals | Incorporating ESG into financial reporting |

- Industry-specific ESG standards - Focused on the financial impact of sustainability |

- Limited to financial and accounting roles - Less focus on broader sustainability goals |

Accountants, financial analysts, corporate financial officers |

| PRI Academy ESG Integration Course | Incorporating ESG factors into sustainable investments |

- Comprehensive ESG integration training - Shorter duration compared to other courses - Practical application |

- Lacks certification recognition - Mainly for beginner to intermediate professionals |

Investment professionals, fund managers, sustainability analysts |

| EFFAS Certified ESG Analyst (CESGA) | ESG valuation and integration into investment analysis |

- Europe-wide recognition - Focus on ESG metrics and valuation - Highly relevant for finance professionals |

- Primarily focused on the European market - Requires understanding of ESG financial tools |

Financial analysts, ESG risk evaluators, European investors |

| CDP Climate Change Course | Climate-related risks and environmental disclosure |

- Focuses on climate risks - Highly relevant for environmental disclosure and sustainability |

- Limited focus on social and governance aspects - Primarily environmental-centric |

Executives, sustainability professionals, risk managers |

There are several pros and cons to acquiring an ESG certification, such as the ability to improve risk management, attract ESG-focused investors, or to gain a competitive advantage – but pursuing an ESG certification could be costly and boost potential skepticism of greenwashing.

Here are some of the pros of acquiring an ESG certification:

ESG certification can prove time consuming and costly, as indicated by business sustainability experts, meaning that organizations must conduct a thorough analyses and search to find most suitable ESG certification for your business. This entails seeking a certification program aligned with your company's specific goals, stakeholder expectations, and long-term sustainability objectives to maximize return on investment.

As there is no universal ESG certification, it is important for each company to choose the ESG certification that will prove worth their time, money, and effort.

Sustainability governance experts indicate that sector-specific alignment is critical. For example, a financial institution or banking company should prioritize certifications focusing on ESG funding frameworks and sustainable investments protocols that demonstrate how ESG considerations can be meaningfully integrated into their specialized business models.

The interactive flip cards (move cursor over card to flip) will reveal 4 ways to ensure your organization chooses the right ESG certification:

Ultimately, all companies should choose ESG certifications specific to their individual goals in order to better demonstrate how ESG can be applied to their industry-specific business – as organizations achieve optimal results by strategically selecting certifications that address their specific environmental impact profile, community engagement priorities, and governance issues rather than pursuing a one-size-fits-all approach.

Here are some of the key points to remember when searching for an ESG certification:

Since there are several organisations and frameworks that offer ESG-related certifications or assessments, it is important to acquire the certifications most applicable to your business.

Here's a breakdown of various ESG certifications in order to choose which one is most applicable to your business operations:

Multiple studies demonstrate that organizations prioritizing the 'S' in "ESG," particularly those in consumer-facing industries like fashion or cosmetics, can achieve significant strategic opportunities through these specialized certifications:

If adhering to the ‘S’ in “ESG” is most important to your organization, such as with fashion or cosmetic companies, your company may want to consider the following ESG certifications:

According to the Task Force on Climate-related Financial Disclosures, organizations in the financial sector seeking to employ sustainable economy initiatives should consider these specialized certifications.

If your company values sustainable finance, these ESG certifications may be right for your business:

The three-way battle cards below will compare and contrast these ESG certifications:

Overall, it is important to remember that while there isn’t one, universal ESG certification – there are a wide variety of ESG-related certification available for your company to validate its effort towards reform for environmental, social, and governance.

We know how challenging it can be to choose the right ESG courses or climate related financial disclosures most suitable for your company.

Ultimately, many forward-thinking businesses will choose to certify themselves for several of these ESG certifications – but identifying which certifications will provide the most optimal results in terms of finances, regulatory environments, stakeholder expectations, and industry-specific materiality assessments can prove challenging.

At Greenly, we can help simplify this with the help of our personalized assistance, knowledge climate experts, and wide variety of resources available to our clients.

We’re here to help guide you through all of the requirements when applying to be certified for almost any ESG certification: from the CSRD, SBTi, and more.

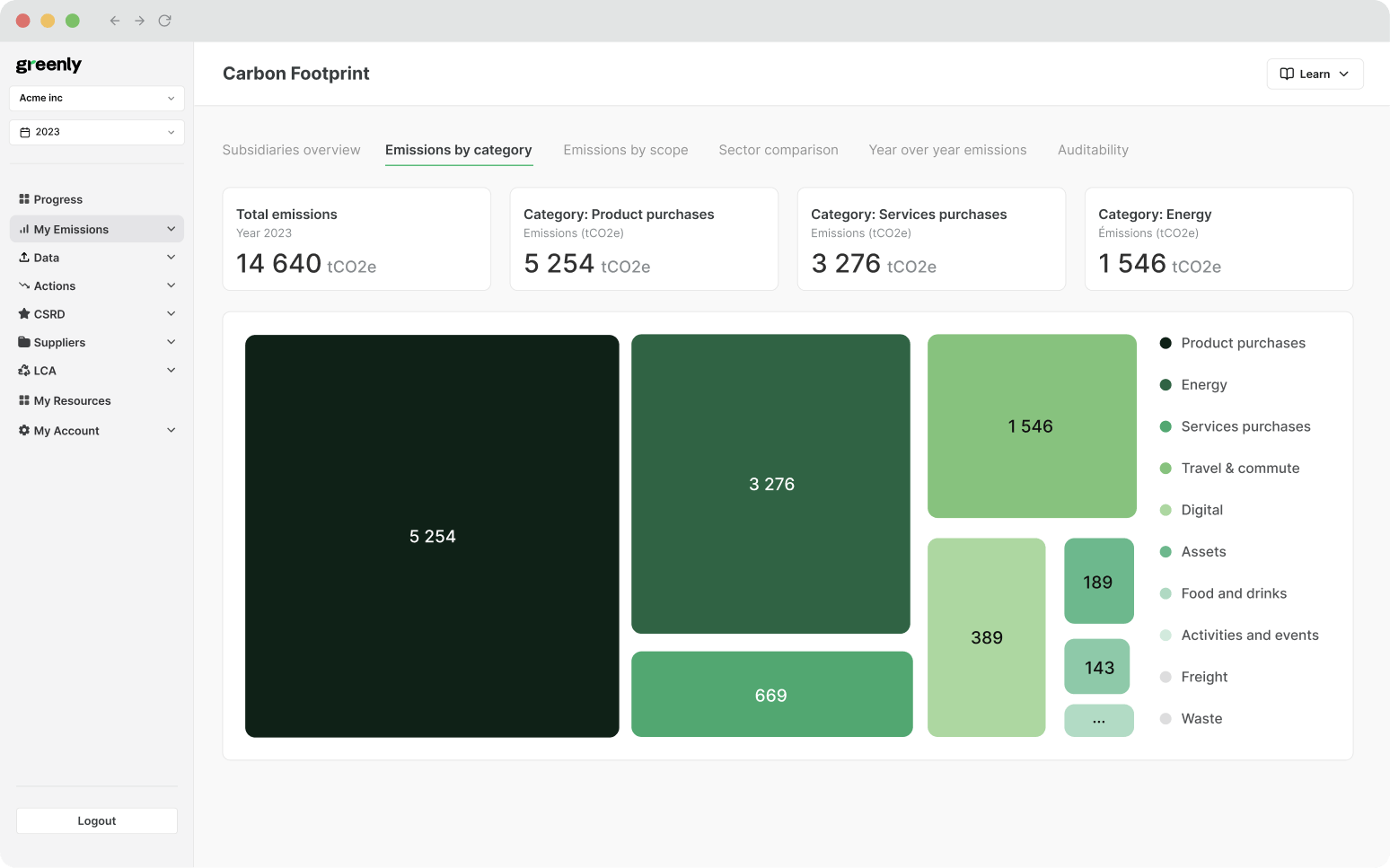

A: Yes, Greenly offers KPI reporting conducive for ESG – we provide robust performance tracking, AI-enabled ESG reporting, and automation for ESG metrics.

A: Greenly supports ESG reporting using a wide variety of frameworks such as CDP, TCFD, SBTi, GRI, and CSRD to help companies align with global sustainability standards. We also offer assistance with supplier engagement, LCA impact assessments, and automated data collection and audit-ready reports.

A: Greenly’s ESG reporting supports corporate social responsibility by tracking and disclosing environmental performance and encouraging greater transparency and accountability across supply chains. Our carbon footprint analysis and tailored decarbonization strategies empower businesses to lower their impact and meet sustainability goals.

If reading this article on ESG certification and an ESG certification really exists has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

Deciding which ESG certification to choose and apply for can be overwhelming, but don’t worry – Greenly is here to help. Click here to schedule a demo to see how Greenly can help you find ways to improve energy efficiency and decrease the dependency on fossil fuels in your own company.

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.