What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

For years, the Task Force on Climate-related Financial Disclosures (TCFD) served as a cornerstone, helping businesses disclose climate-related financial risks while aligning environmental responsibility with financial transparency.

In October 2023, the TCFD was officially disbanded, with its responsibilities fully integrated into the International Sustainability Standards Board (ISSB).

All TCFD recommendations have been incorporated into the ISSB's IFRS S2 Climate-related Disclosures Standard, alongside IFRS S1 General Requirements for Sustainability-related Disclosures. While businesses can still use TCFD guidelines during a transition period if required by regulations, the long-term goal is a unified global standard through the ISSB.

This marks a transformative step in corporate climate responsibility, simplifying the process for companies and investors while fostering greater consistency in sustainability reporting.

In this article, we’ll explore the legacy of TCFD, the benefits of its recommendations, and how its principles have been seamlessly integrated into the ISSB’s standards.

The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in 2015 as a strategic response to the growing recognition of climate change as a critical financial risk.

Its purpose was to provide a structured framework for companies and financial institutions to disclose climate-related financial information transparently.

The TCFD had a twofold aim:

By addressing the gap in reliable climate-related financial information, the TCFD played a pivotal role in elevating climate considerations in financial decision-making.

Having fulfilled its remit, the TCFD succeeded in driving significant improvements in corporate climate disclosure practices globally.

The Task Force issued its ‘Final Report’ in 2017, laying out 11 voluntary recommendations collectively known as the TCFD framework.

While this report established the foundation of the TCFD’s work, the Task Force continued to release supplementary reports and updates in subsequent years, reflecting ongoing developments and best practices in climate risk reporting. These recommendations quickly gained global recognition, reflecting the urgent need for greater transparency in climate risk reporting.

The TCFD's influence extended well beyond voluntary adoption.

This shift from voluntary guidelines to regulatory requirements reflects the global financial sector's commitment to integrating climate accountability into decision-making processes.

The 2023 TCFD Status Report, released in October 2023, highlights the significant progress made in climate-related financial disclosures while also identifying areas where further work is needed.

The report reflects a substantial increase in the adoption of TCFD recommendations across industries and geographies, driven by growing regulatory support and investor demand for transparent climate-related information.

Key findings from the report include:

The TCFD successfully laid the groundwork for standardised, comparable climate-related disclosures. Its principles have now been fully incorporated into the ISSB's IFRS S2 Climate-related Disclosures Standard, ensuring that its legacy continues through a unified global framework.

The TCFD standards were built around four core areas - designed to provide a structured and transparent approach to climate-related financial disclosures:

These standards formed the foundation for how companies reported on climate risks and opportunities, enabling consistent and comparable information for investors and stakeholders.

One of the TCFD's core principles is its focus on financial materiality, which examines how climate-related risks and opportunities impact a company's financial performance, such as revenues, cash flows, and asset valuations.

With the disbandment of the TCFD in 2024, these principles have been fully incorporated into the International Sustainability Standards Board’s (ISSB) IFRS S2 Climate-related Disclosures Standard. This ensures that the TCFD’s recommendations remain central to the global framework for sustainability reporting.

The TCFD emphasised the importance of translating climate change impacts into measurable financial risks and opportunities.

To foster a shared understanding between companies and investors, the task force developed a taxonomy that organisations were encouraged to reference in their disclosures.

The TCFD categorised climate-related risks into two main types:

By addressing these risks, companies provided transparency on how climate change could disrupt operations or create financial vulnerabilities.

The TCFD also highlighted opportunities that organisations could leverage to address climate change while deriving financial benefits.

Key areas included:

Organisations adhering to the TCFD framework were encouraged to disclose the potential current and future financial impacts of these risks and opportunities.

This critical element helps stakeholders better understand how climate change might affect revenues, cash flows, and balance sheets over time.

By incorporating forward-looking scenario analyses, companies can:

The TCFD framework consists of four key pillars (governance, strategy, risk management, and metrics and targets) which are further broken down into 11 specific recommendations. These recommendations provided a detailed roadmap for companies to structure their climate-related disclosures effectively.

The TCFD also distinguished between those relevant for all sectors and those tailored to specific sectors. This approach ensured that disclosures remained both comprehensive and adaptable to the unique challenges and opportunities faced by different industries.

Governance focuses on how a company’s board and management oversee and manage climate-related risks and opportunities.

The TCFD emphasized transparency in leadership structures. For example, companies are encouraged to disclose how the board integrates climate considerations into overall governance practices, such as through dedicated committees or oversight mechanisms.

Strategy addresses the actual and potential impacts of climate-related risks and opportunities on a company's business, strategy, and financial planning.

This includes scenario analysis to assess resilience under different climate futures, such as a 2°C or lower scenario. Today, IFRS S2 builds on this by requiring companies to disclose how climate-related risks and opportunities influence their strategic and financial planning.

Risk management is centered on how companies identify, assess, and manage climate-related risks.

The TCFD emphasized integrating these processes into broader risk management frameworks. Under IFRS S2, these principles are expanded to ensure companies articulate how climate risks are embedded in overall enterprise risk management practices.

Metrics and targets detail the specific indicators and goals companies use to manage climate risks and opportunities.

This includes mandatory reporting of greenhouse gas (GHG) emissions for Scope 1 (direct emissions) and Scope 2 (indirect emissions from energy use), while Scope 3 (indirect emissions across the value chain) is required only when deemed material to the organization's operations and impact. Under the ISSB standards, these metrics remain crucial, with IFRS S2 mandating the disclosure of emissions data and the targets used to address climate-related risks.

While the four key pillars of the TCFD framework (governance, strategy, risk management, and metrics and targets) and the 11 specific recommendations provided a detailed roadmap for climate-related disclosures, the Fundamental Principles for Effective Disclosure ensured these disclosures were actionable, reliable, and aligned with stakeholder needs.

These principles served as a guide to help companies implement the recommendations effectively and produce high-quality, decision-useful information.

The TCFD outlined these principles to enhance the usefulness and reliability of climate-related financial information. They include:

By adhering to these principles, companies can enhance transparency and ensure their climate disclosures meet the needs of stakeholders while aligning with global reporting frameworks.

The Task Force on Climate-related Financial Disclosures (TCFD) has officially concluded its work, following the successful integration of its recommendations into the International Sustainability Standards Board (ISSB) framework.

This marked the end of the TCFD as an active task force but solidified its legacy as the foundation for global climate-related financial disclosures.

The TCFD was disbanded to streamline and simplify sustainability reporting standards for companies and investors.

With the ISSB established to oversee global sustainability disclosure standards, the TCFD’s recommendations were fully incorporated into the ISSB’s IFRS S2 Climate-related Disclosures Standard. This transition ensures a single, unified framework for climate-related financial disclosures, reducing complexity and enhancing comparability across jurisdictions and industries.

The ISSB’s IFRS S2 Climate-related Disclosures Standard, along with IFRS S1 General Requirements for Sustainability-related Disclosures, has effectively replaced the TCFD framework.

These standards incorporate all 11 recommendations of the TCFD and expand upon them, providing a comprehensive and globally accepted structure for sustainability reporting.

The ISSB standards - IFRS S2 Climate-related Disclosures and IFRS S1 General Requirements for Sustainability-related Disclosures - fully integrate the TCFD’s foundational principles while addressing areas where the original recommendations could be enhanced.

This new framework is designed to deliver greater specificity, clarity, and global consistency in sustainability and climate-related financial reporting.

IFRS S1 mandates that companies disclose material information about sustainability-related risks and opportunities that could reasonably be expected to affect the entity's cash flows, access to finance, or cost of capital over the short, medium, or long term.

This includes details on governance, strategy, risk management, and metrics and targets related to sustainability.

| Requirement | Details |

|---|---|

| Materiality assessment | Identify and disclose sustainability-related risks and opportunities that could reasonably influence investor decisions. |

| Integration with financial statements | Explain how sustainability-related risks and opportunities impact financial performance, position, and cash flows. |

| Interconnected disclosures | Ensure sustainability information is consistent and connected with the financial statements for comparability. |

| Comprehensive scope | Cover all relevant environmental, social, and governance (ESG) factors, not limited to climate-related issues. |

| Forward-looking focus | Include forward-looking information, such as strategic responses and potential future financial impacts. |

| Consistency and comparability | Apply consistent metrics and methodologies to allow comparisons across reporting periods and with peers. |

Building upon IFRS S1, IFRS S2 focuses specifically on climate-related risks and opportunities. It requires companies to provide information on governance, strategy, risk management, and metrics and targets concerning climate-related issues.

This includes disclosures on greenhouse gas emissions and the potential financial impacts of climate change on the organisation.

The ISSB builds on the TCFD by expanding its scope and introducing new requirements aimed at addressing gaps and improving usability for investors and stakeholders:

| Requirement | Details |

|---|---|

| Climate risk and opportunity identification | Disclose climate-related risks and opportunities relevant to the organisation’s business and financial planning. |

| Financial impacts of climate change | Quantify and disclose how identified climate risks and opportunities affect revenues, costs, and overall performance. |

| Scenario analysis | Provide resilience assessments under different climate scenarios, including those aligned with limiting warming to 2°C. |

| GHG emissions reporting | Report Scope 1, Scope 2, and, where relevant, Scope 3 greenhouse gas emissions. |

| Climate-related targets | Disclose climate targets, strategies to achieve them, and progress over time. |

| Sector-specific guidance | Include industry-specific disclosures where applicable, ensuring relevance and comparability. |

The ISSB framework not only retains the core strengths of the TCFD, but also elevates its usability and relevance. These enhancements mean companies must now:

By addressing these areas, the ISSB creates a unified global standard that eliminates inconsistencies in sustainability reporting, ensuring disclosures are more comprehensive, comparable, and decision-useful.

The Task Force on Climate-related Financial Disclosures (TCFD) laid the groundwork for transparent and consistent climate-related financial disclosures worldwide.

Its recommendations, structured around governance, strategy, risk management, and metrics and targets, were widely adopted and formed the backbone of climate disclosure standards in numerous jurisdictions, including the UK and the US.

The ISSB’s IFRS S1 (General Requirements for Sustainability-related Disclosures) and IFRS S2 (Climate-related Disclosures) build on the TCFD framework by providing a more comprehensive and globally applicable approach to sustainability and climate reporting.

The UK has formally endorsed the adoption of ISSB S1 and S2 standards, reinforcing its commitment to enhancing the quality and consistency of sustainability reporting. These standards will complement the UK’s Sustainability Disclosure Requirements (SDR), introduced in late 2023, and are expected to provide a comprehensive framework for sustainability reporting.

The new UK Sustainability Reporting Standards (SRS) will incorporate ISSB S1 and S2 while aligning with SDR. This integration minimizes regulatory overlap and provides companies with a unified structure for sustainability disclosures.

The UK was the first G20 country to mandate TCFD-aligned disclosures for large companies and financial institutions in April 2022. This mandate will transition to ISSB standards, preserving the TCFD’s foundational principles while expanding reporting to include broader sustainability-related financial information.

The EU adopted mandatory European Sustainability Reporting Standards (ESRS) under the Corporate Sustainability Reporting Directive (CSRD) on July 31, 2023.

These standards require in-scope companies to disclose sustainability information aligned with ESRS, addressing environmental, social, and governance (ESG) issues.

To avoid duplicative reporting, the EU and ISSB are collaborating to ensure compatibility between ESRS and IFRS S1 and S2. This harmonization effort supports the global comparability of sustainability reports while meeting regional regulatory requirements.

The US has not adopted IFRS standards, with domestic companies continuing to report under Generally Accepted Accounting Principles (GAAP).

However, the Securities and Exchange Commission (SEC) is advancing its own climate disclosure rules, heavily influenced by the TCFD framework.

Although the ISSB standards are not mandatory in the US, multinational corporations operating across jurisdictions may choose to adopt them voluntarily to align with global practices and meet investor expectations.

Our expertise lies in providing cutting-edge tools and actionable insights to help your company understand, manage, and reduce its environmental impact while aligning with broader ESG goals.

Here’s how we can support you:

| Service | Description |

|---|---|

| Carbon Tracking | Greenly enables your company to measure and analyse Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions. Our intuitive platform helps identify emissions hotspots across your operations and supply chain, giving you the clarity needed to take targeted action. |

| Data-Driven Decisions | Our platform provides detailed insights into your environmental footprint, helping you understand the environmental impact of your business activities. By leveraging these insights, you can prioritise efforts to reduce emissions while identifying cost-saving opportunities. |

| Decarbonisation Strategy | We assist in developing a tailored decarbonisation roadmap with science-based reduction targets. Our tools allow you to design various emission trajectory scenarios, assess the reduction potential and associated costs of different actions, and implement effective strategies to achieve your sustainability goals. |

| Scenario Planning | Greenly supports your company in analysing the potential impacts of different emissions reduction scenarios, enabling you to make strategic decisions that align with long-term goals. |

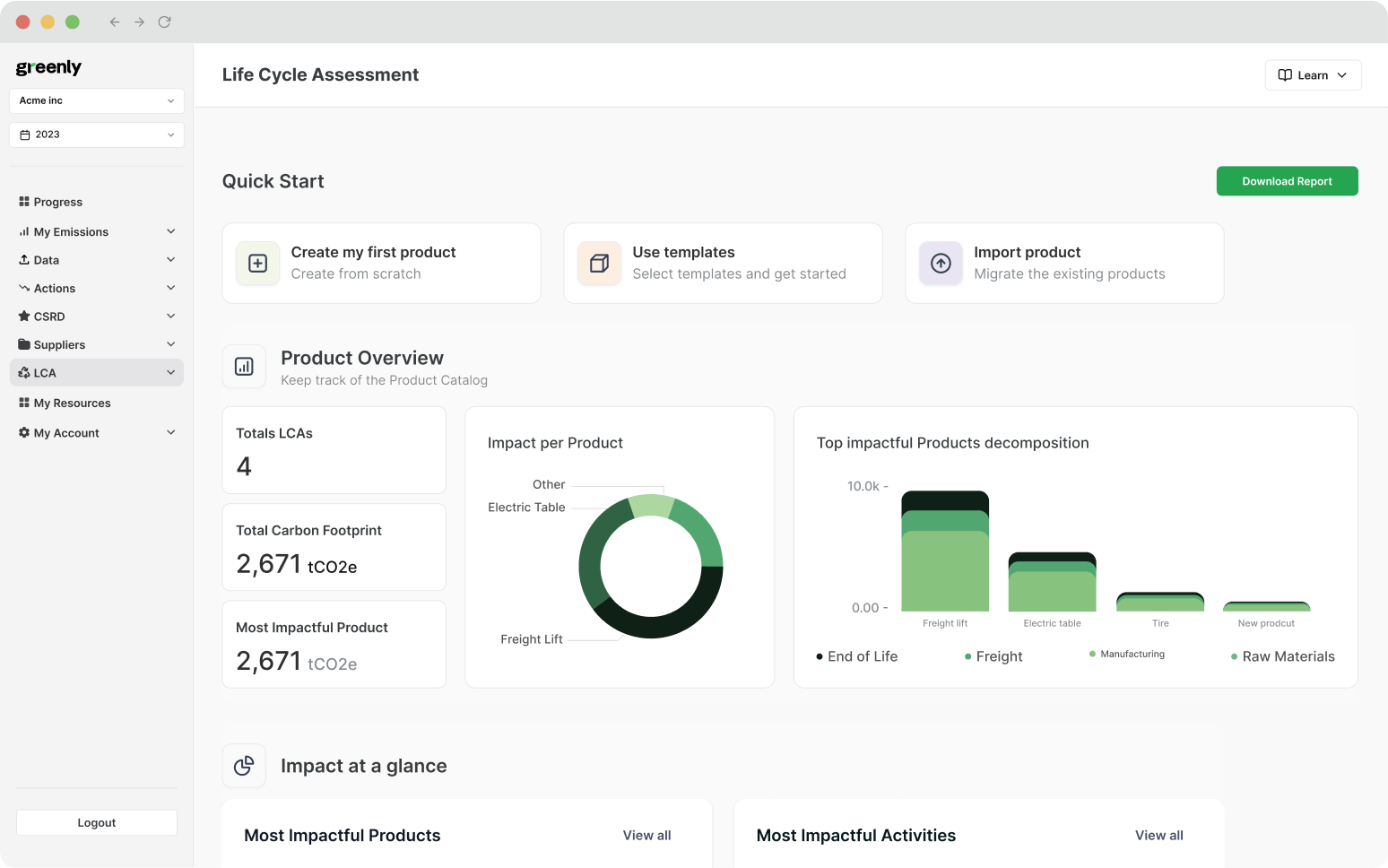

| Life Cycle Assessment | Greenly conducts thorough Life Cycle Assessments to evaluate the environmental impact of your products or services throughout their entire lifecycle. This analysis helps identify opportunities for improvement and supports sustainable product development. |

| CSRD Compliance | Greenly ensures your sustainability reporting aligns with the Corporate Sustainability Reporting Directive (CSRD) requirements. Our platform facilitates comprehensive data collection and reporting, helping you meet regulatory standards and enhance transparency with stakeholders. |

| SBTi Support | We guide you through setting and obtaining Science-Based Targets initiative (SBTi) certification, demonstrating your commitment to aligning with global climate goals. Our experts provide support in defining ambitious yet achievable targets and developing strategies to meet them. |

| Supplier Engagement | Greenly aids in deploying sustainable procurement policies by collecting and analysing data from your suppliers. This approach ensures a comprehensive understanding of your supply chain's carbon footprint and supports collaborative efforts to reduce emissions. |

Learn how Greenly can support your company in achieving measurable sustainability outcomes. Contact us today to get started!