What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

Access to capital is changing. Today, investors aren't just looking at balance sheets; they’re looking at resilience.

That’s the driving force behind IFRS S1 and S2. Developed by the ISSB, these standards provide a clear, global lens through which to view climate-related risks. Since 2023, they have transformed from a proposed baseline into the foundation of modern financial reporting. For companies and regulators worldwide, S1 and S2 aren't just guidelines anymore - they’re the new reality of doing business.

What the IFRS Foundation and the ISSB do

Why IFRS introduced sustainability disclosure standards in the first place

What IFRS S1 and IFRS S2 require companies to disclose

How the standards approach materiality, risk, and financial impacts

When the standards apply and how adoption works across different countries

Sustainability is no longer a soft metric - it’s a financial one. Investors are looking for concrete answers to tough questions: How vulnerable is a company to supply chain shocks or sudden regulatory shifts? Is the business built to remain resilient in a changing climate?

For a long time, getting those answers was difficult. The reporting landscape was fragmented, and without consistent definitions, disclosures were often impossible to compare. This lack of clarity created a "compliance burden" for companies and a data gap for investors.

Recognizing this friction, the IFRS Foundation stepped in. Their 2020 consultation confirmed what many in the industry already knew: the market was ready for a single, investor-focused baseline. It wasn't just about asking for more data; it was about demanding better, more reliable information that actually informs a decision.

For decades, the IFRS Foundation has been the backbone of global corporate reporting. Most know them as the architects of international accounting standards -the universal rules that allow an investor in London to trust a financial statement from Sydney.

The Foundation’s mission is built on a straightforward principle: better information leads to better decisions. By providing a common financial language, they’ve brought a level of transparency and efficiency to capital markets that simply didn't exist before.

Today, IFRS Standards are the global benchmark, required in over 140 jurisdictions. They aren't just a set of rules; they are the baseline for international business.

Now, the Foundation is applying that same rigor to the world of sustainability. By bringing the same principles of consistency and comparability to ESG data, they are ensuring that sustainability disclosures are treated with the same seriousness - and the same financial weight - as the balance sheet.

To turn the demand for better data into action, the IFRS Foundation established the ISSB in 2021. It operates as a direct counterpart to the International Accounting Standards Board (IASB). If the IASB handles the traditional books, the ISSB handles the sustainability-related financial information that now dictates a company’s value.

The ISSB’s mandate is to build a global baseline. In practice, this means creating a clear, comparable framework for reporting how climate risks and social shifts actually impact cash flow, resilience, and long-term performance.

Crucially, these standards aren't meant to overrule local regulations. Instead, they serve as a universal foundation. Jurisdictions can add their own specific requirements on top, but the core remains the same. The result is a system where, regardless of where a company is based, investors are finally looking at the same set of essential facts.

The ISSB’s primary output consists of two core standards designed to be used in tandem. While they serve different purposes, they are meant to be applied together to give a complete picture of a company’s health.

IFRS S1 is built on the reality that a company doesn't operate in a vacuum. Its financial health is tied to how it interacts with its stakeholders, society, and the environment - not just in its own offices, but across its entire value chain.

The standard requires companies to disclose the sustainability-related risks and opportunities that directly impact their ability to generate cash over the short, medium, and long term. Whether it’s a dependency on a scarce natural resource or a vulnerability in a global supply chain, these factors have a tangible effect on a company's cost of capital and its attractiveness to investors.

Crucially, IFRS S1 isn't an invitation to report on everything. It is designed to be targeted and proportionate. Companies only need to disclose information that could reasonably be expected to influence an investor's decision. This ensures that reporting remains focused on what truly matters for financial performance, rather than becoming a checklist of every possible ESG metric.

To ensure investors get a complete picture, both IFRS S1 and S2 are organized around four core pillars. These pillars aren't just a checklist; they describe how a business actually integrates sustainability into its DNA:

Governance

Who is in charge?

Shows how the board and leadership oversee sustainability risks - including roles, controls, and the processes that drive accountability at the top.

Strategy

How does this change the plan?

Explains how sustainability factors influence the business model and long-term decisions - the big picture of how the company plans to stay resilient.

Risk management

How are threats spotted?

Covers how sustainability risks are identified and prioritized - and how those steps are built into the company’s wider risk management system.

Metrics & targets

How is progress measured?

Sets out the metrics used to track performance, the targets a company has set (or must meet), and a clear-eyed view of progress so far.

At the heart of IFRS S1 is the principle of materiality. In short, if a piece of information could change an investor’s mind or influence their decision, it must be disclosed. Whether it’s omitted, buried, or misrepresented, if it matters to the financial story of the company, it belongs in the report.

This isn't just about transparency; it’s about quality. The standard demands a complete, neutral, and accurate account of a company’s position. In practice, this means applying the same level of rigor to sustainability data that has always been reserved for the balance sheet.

To make this transition easier, the reporting mechanics - things like how often you report, how you handle estimates, and how you show year-over-year comparisons - are designed to mirror traditional financial statements. For companies already used to IFRS accounting, these requirements will feel familiar, allowing sustainability and financial data to sit naturally side-by-side.

While S1 provides the framework, IFRS S2 zooms in on the most pressing financial challenge of our time: climate change. It’s structured around the same four pillars we just covered, but it adds a sharp focus on the specific ways climate shift impacts a company’s outlook.

Under S2, companies are expected to look at climate through two distinct lenses:

To give investors a clear view of the future, S2 requires transparency across the business:

The transition to these standards is already well underway. IFRS S1 and S2 officially became effective for reporting periods starting in January 2024. For the early adopters, this meant that the first IFRS-aligned disclosures began reaching the market in 2025.

Now, in 2026, we’ve moved past the "first-look" phase. For many organizations, these standards are no longer a new project; they are being embedded into the regular, annual reporting cycle - whether as a strategic choice or a regulatory requirement.

On their own, the ISSB doesn't have the power to pass laws. Instead, they provide the global baseline. The decision to make these standards mandatory rests with national and regional regulators.

Since their launch, we’ve seen a wave of jurisdictions move to adopt or align with the IFRS framework. For companies, the mandatory question usually has two answers:

The adoption of IFRS S1 and S2 across global markets isn't just about following new rules; it’s about the tangible benefits of a more disciplined approach to data. For companies, these standards offer a clear path to both regulatory stability and investor confidence.

A universal language for capital

Using an investor-focused baseline helps companies “speak the same language” across borders — making disclosures clearer and comparisons across sectors and countries far more credible.

Future-proofing your reporting

As more jurisdictions align with ISSB standards, early adoption helps companies stay ahead — and avoid costly reporting whiplash when new rules arrive.

From storytelling to strategy

These standards push disclosures toward financially grounded insights. The focus on material risks and opportunities makes reporting leaner — and more useful for capital allocation decisions.

Leveraging what you’ve built

IFRS S1 and S2 build on frameworks like TCFD, SASB, and CDSB. If you’ve already done that work, you’re evolving your reporting — not starting from scratch.

Cutting through complexity

For multinationals, the goal is “report once, use often”. A shared global foundation reduces duplication — even when local requirements add extra layers.

The US does not require companies to apply ISSB standards directly, and the Securities and Exchange Commission (SEC) has its own climate disclosure rules. While those rules differ in scope and legal basis, they address similar themes around climate risk, governance, and financial impacts. That said, IFRS S1 and S2 still matter for US companies - particularly those with international operations, overseas listings, or global investor bases. Many investors now use the ISSB standards as a global reference point when assessing climate and sustainability risk, even where local regulation does not mandate them.

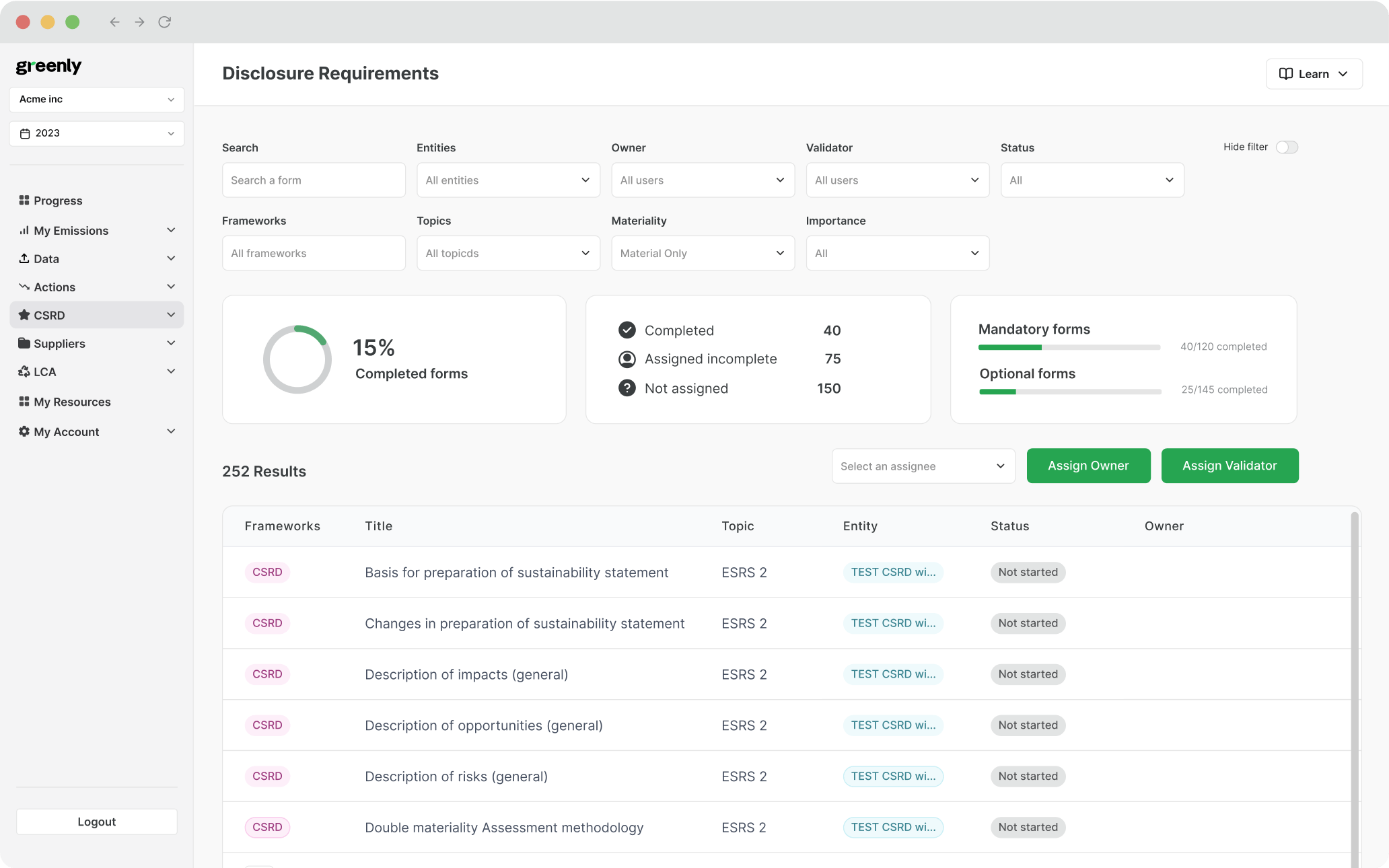

They serve different, but complementary, purposes. FRS S1 and S2 focus on financial materiality: what sustainability and climate issues matter for enterprise value and investor decision-making. CSRD/ ESRS apply a double materiality approach, covering both financial impacts and a company’s impacts on society and the environment. Many companies operating in the EU will need to report under both. In practice, IFRS-aligned disclosures are often used to support the financial materiality side of CSRD reporting, helping streamline internal processes.

Not in the same way as large companies. The ISSB standards are not designed for small, non-listed SMEs, and most jurisdictions applying them are doing so with proportionality thresholds. That said, SMEs that sit within large value chains may still be asked to provide data that supports IFRS-aligned disclosures at the group level.

Scope 3 emissions are required where they are material. IFRS S2 expects companies to disclose Scope 1, 2, and 3 greenhouse gas emissions where they form a significant part of the company’s climate-related risks or opportunities. The standard recognizes data challenges and allows for proportionality, but Scope 3 is increasingly unavoidable for many sectors.

The standards themselves do not mandate assurance. However, in practice, many regulators are introducing or considering assurance requirements for sustainability disclosures. Investors also increasingly expect externally assured climate and sustainability data.

That depends on jurisdiction, size, and capital market exposure. IFRS S1 and S2 are primarily designed for capital markets, so they are most relevant to: listed companies, companies with external investors, and companies seeking financing or preparing for future listing. However, many large private companies are choosing to align voluntarily, particularly where lenders, insurers, or investors expect ISSB-aligned climate and sustainability information.