Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

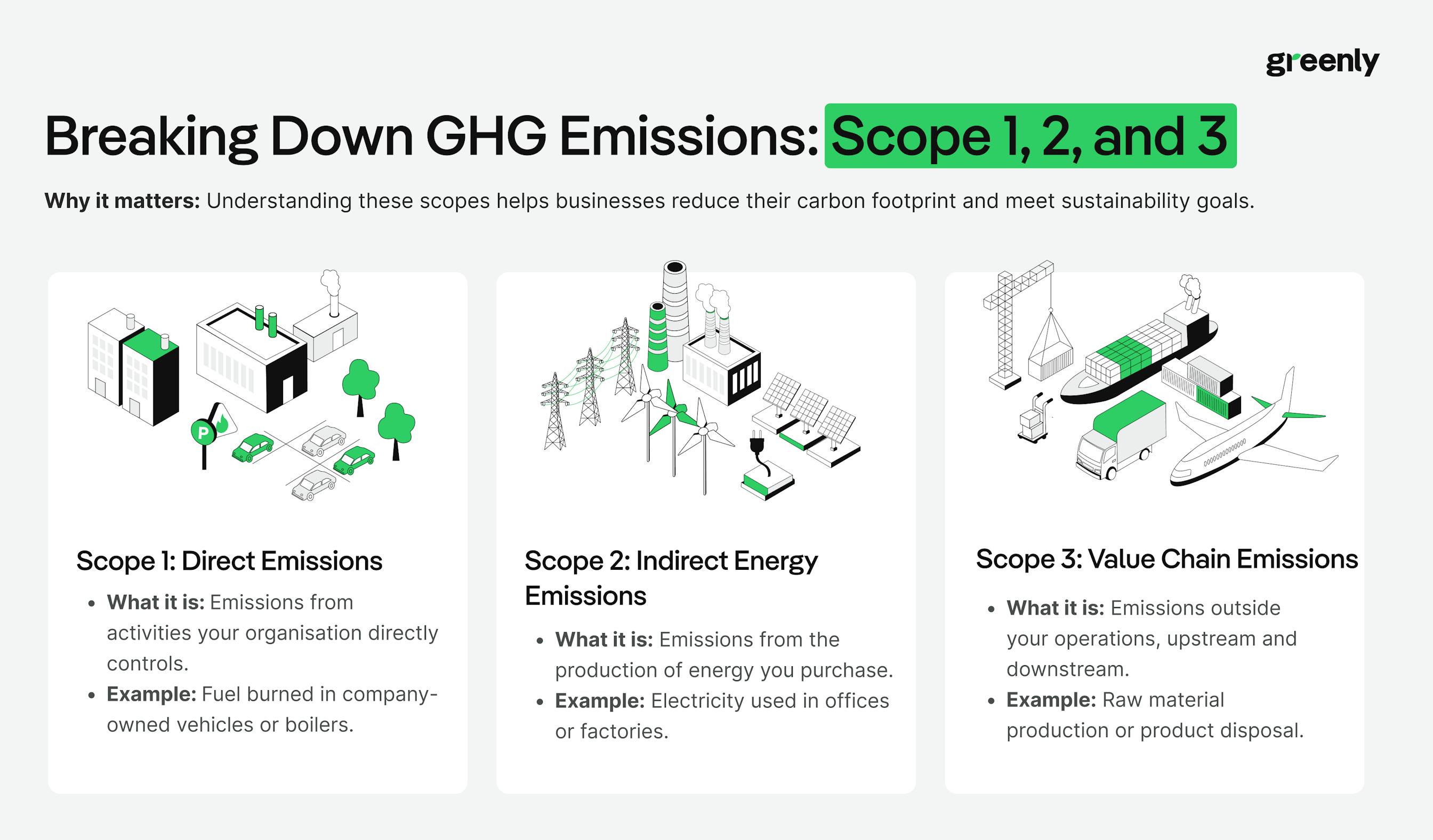

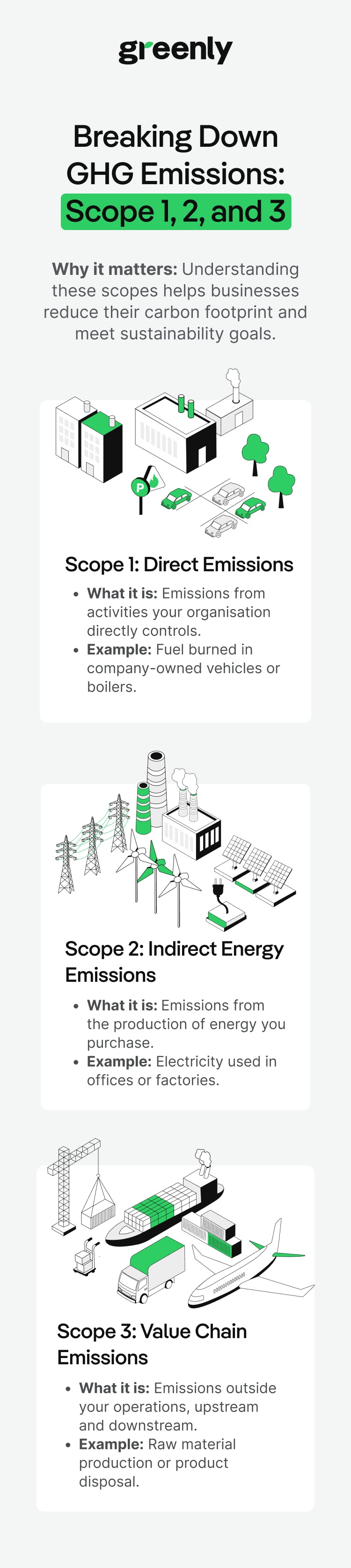

The Paris Agreement's 1.5°C target isn’t just a lofty ambition, it’s a scientifically backed threshold to avoid the worst climate impacts. But to stay on track, we need to dramatically cut global greenhouse gas emissions. And that begins with understanding what we’re emitting in the first place.

That’s where Scope 1, 2, and 3 emissions come in. These categories are powerful tools for tracking climate impact and uncovering where the biggest opportunities for emissions reductions lie.

This classification helps organisations map out their full carbon footprint, from operations to supply chains, and plays a critical role in identifying where reductions are most needed.

Whether you’re reporting on emissions, setting climate targets, or building a decarbonisation strategy, understanding the three scopes is an essential first step.

As greenhouse gas (GHG) concentrations in the atmosphere began to rise rapidly in the late 20th century, scientists and policymakers sounded the alarm about the consequences of unchecked emissions, including rising global temperatures, ecosystem collapse, and widespread disruption to societies and economies.

But while it was clear that emissions needed to be cut, there was no consistent way for companies and organisations to measure and report them.

This system allowed businesses to move beyond guesswork or siloed reporting. By dividing emissions into:

This became even more important following the Paris Agreement in 2015, where nearly every country on Earth committed to limiting global warming to well below 2°C, with efforts to cap it at 1.5°C above pre-industrial levels.

Hitting this target requires slashing global emissions by nearly half by 2030 and reaching net zero around mid-century. Given that a significant share of global emissions stems from corporate supply chains, production, energy use, and logistics, companies now play a central role in achieving those goals.

The Scope 1, 2, and 3 framework helps businesses:

Understanding how they differ is key to identifying where emissions come from and how to reduce them effectively.

They fall into four main categories:

Companies with manufacturing operations, large vehicle fleets, or temperature-controlled environments often have significant Scope 1 emissions. Because they result from a company’s own actions, these emissions are typically the first target in decarbonisation strategies.

For most businesses, electricity is the primary source of Scope 2 emissions. These emissions vary depending on how the energy is generated; for example, coal-fired power stations will have a much higher emissions intensity than renewable sources like wind or solar.

Reducing Scope 2 emissions often involves energy efficiency improvements or switching to lower-carbon energy sources, such as purchasing renewable electricity or installing on-site solar panels.

Scope 3 is usually broken down into 15 categories:

These emissions are often the hardest to measure, but also represent the biggest opportunity for meaningful reductions, especially for companies with global supply chains or consumer-facing products that are responsible for significant carbon emissions across the value chain.

Measuring Scope 3 emissions gives companies something that Scope 1 and 2 can’t: a complete view of their climate impact.

These emissions might fall outside a company’s direct control, but they’re deeply shaped by its choices. What materials are purchased, how goods are moved, how products are used and disposed of - it all adds up.

And as regulations tighten and stakeholders expect greater transparency, ignoring Scope 3 emissions is no longer an option.

Understanding these emissions allows companies to:

Scope 3 may be complex, but measuring it is now essential for any company serious about sustainability and long-term success.

Whether reporting on Scope 1, 2, and 3 emissions is required depends on where a company operates, its size, and which reporting frameworks or regulations it falls under.

Several major sustainability and climate disclosure frameworks either require or recommend that companies report across all three scopes:

| Framework | Scope 1 & 2 | Scope 3 | Notes |

|---|---|---|---|

|

GHG Protocol

|

Mandatory | Recommended when material | Forms the basis for most global emissions reporting standards. |

|

CDP (Carbon Disclosure Project)

|

Required | Required | Completeness of all three scopes affects scoring. |

|

TCFD (Task Force on Climate-related Financial Disclosures)

|

Expected | Encouraged | Scope 3 is included if relevant to material climate risks. |

|

Science Based Targets initiative (SBTi)

|

Required | Required if >40% of total emissions | Scope 3 target-setting mandatory above threshold. |

|

ESRS (EU Sustainability Reporting Standards)

|

Mandatory | Mandatory | Required under the CSRD for all in-scope companies. |

Now let’s look at how this plays out in different regions.

Streamlined Energy and Carbon Reporting (SECR): Mandatory for large UK companies (defined as meeting two of the following: £36M+ turnover, £18M+ balance sheet, 250+ employees). Requires Scope 1 and 2 reporting, but Scope 3 is voluntary.

TCFD-aligned reporting: Mandatory for large listed companies, banks, and insurers. Companies are expected to disclose Scope 1 and 2 emissions, and Scope 3 where 'material'.

Upcoming UK Sustainability Disclosure Standards (SDS): Will likely reinforce TCFD-aligned reporting with clearer expectations for Scope 3 in line with international standards.

Until recently, the U.S. Securities and Exchange Commission (SEC) had proposed rules that would have required publicly listed companies to disclose Scope 1 and 2 emissions, and Scope 3 if material or included in climate targets. However, in 2025, the SEC formally withdrew its defense of the rules following legal challenges and a change in administration. This effectively halts federal-level progress on mandatory climate disclosures for now.

That said, momentum is still building at the state level. California’s new legislation – SB 253 and SB 261 – will require large companies doing business in the state to report Scope 1 and 2 emissions by 2026, and Scope 3 by 2027. These laws are likely to shape national standards over time, particularly for companies with multi-state operations.

Corporate Sustainability Reporting Directive (CSRD): Requires large companies (and listed SMEs) to report Scope 1, 2, and 3 emissions under the ESRS standards.

EU Taxonomy & SFDR: Encourage emissions transparency across the entire value chain, as part of sustainability-related disclosures.

Carbon Border Adjustment Mechanism (CBAM): Requires embedded emissions disclosure for imports in certain sectors, linked to Scope 3 reporting by foreign producers.

Once you know which emissions you need to report, the next step is working out how to measure them accurately, and that starts with understanding what exactly you’re measuring.

Here’s a quick comparison of the most common greenhouse gases:

| Gas | Global Warming Potential (GWP) | Atmospheric Lifespan | Common Sources |

|---|---|---|---|

|

Carbon Dioxide (CO₂)

|

1 | 300–1,000 years | Burning fossil fuels, deforestation, cement production |

|

Methane (CH₄)

|

~28–34 (over 100 years) | ~12 years | Agriculture (livestock), landfills, oil & gas extraction |

|

Nitrous Oxide (N₂O)

|

~265–298 | ~114 years | Fertilisers, industrial processes, fossil fuel combustion |

|

HFCs (Hydrofluorocarbons)

|

12–14,800 | 15–29 years | Refrigeration, air conditioning, aerosol propellants |

|

PFCs (Perfluorocarbons)

|

~6,500–12,200 | Thousands of years | Aluminium production, electronics manufacturing |

|

SF₆ (Sulfur Hexafluoride)

|

~23,500 | ~3,200 years | Electrical insulation (e.g. circuit breakers) |

|

NF₃ (Nitrogen Trifluoride)

|

~17,200 | ~500 years | Semiconductor production, LCD panels |

In simple terms, measuring emissions means:

If your company burns 1,000 litres of diesel in company vehicles:

Emission factors are typically provided by:

You can use emissions calculators or databases provided by trusted sources to simplify the process. These tools often have built-in emissions factors for different fuels, activities, and countries.

Recommended resources:

Here’s how to get started:

Begin by identifying which activities in your operations and value chain generate greenhouse gas emissions. Use the Scope 1, 2, and 3 framework as your guide:

You’ll find that Scope 1 and 2 are generally easier to measure. Scope 3 is broader and more complex, but it also tends to account for the majority of a company’s carbon footprint, especially in sectors with long value chains or energy-intensive products.

There’s no one-size-fits-all approach. Choose a framework that aligns with your regulatory requirements and stakeholder expectations. Some of the most widely used include:

Once you’ve mapped your emissions and selected a reporting framework, the next step is to gather the right data and build a reliable emissions inventory using consistent, recognised methods.

This often involves converting activity data, like litres of fuel used or kilowatt hours of electricity consumed, into carbon dioxide equivalents (CO₂e), using emissions factors from sources like DEFRA, ADEME, or the EPA.

To help you understand what’s typically required for each scope, here’s a quick summary:

Start with what you already track and build from there:

Scope 1 data sources

Fuel logs, vehicle mileage reports, refrigerant top-ups, meter readings

Scope 2 data sources

Utility bills, energy meter data, green energy certificates (RECs, GOs)

Scope 3 data sources

Procurement records, supplier disclosures, freight invoices, travel booking systems, employee commuting surveys, lifecycle assessment tools

Even with the right framework in place, measuring and reporting emissions can be difficult, especially for companies navigating it for the first time. Challenges vary depending on company size, complexity, and value chain, but most fall into a few key areas.

Here’s a breakdown of the most common obstacles and how to address them:

| Challenge | Why it’s an issue | How to overcome it |

|---|---|---|

| 📉 Data availability and quality | Activity data may be missing, incomplete, or inconsistent — especially for Scope 3 emissions. | Start with what's available, prioritise high-impact areas, and work toward better data over time. Use spend-based estimates or industry averages where needed, and disclose your assumptions. |

| 🔗 Third-party data gaps (Scope 3) | Suppliers, distributors, and partners may not track or share emissions data. | Engage key suppliers early. Include data sharing in procurement policies or sustainability clauses. Use lifecycle databases or industry benchmarks when primary data isn’t accessible. |

| 🌍 Tracking emissions across sites or regions | Companies operating across multiple facilities or geographies often lack centralised data systems. | Implement a centralised emissions reporting platform or tool. Align internal teams on data formats and collection schedules. |

| 📏 Choosing the right emissions factors | Different countries or sources provide different values. Using inconsistent or outdated factors skews results. | Use emissions factors from recognised sources (GHG Protocol, DEFRA, ADEME, EPA). Stay consistent across scopes and update regularly. |

| ⏳ Time and resource limitations | Smaller organisations or overstretched teams may struggle to allocate time and expertise to reporting. | Focus on material categories first. Use external tools or platforms to automate data collection and calculation. Seek expert support when needed. |

| 📜 Regulatory changes and evolving standards | Keeping up with new legislation (like CSRD or California SB 253) requires ongoing attention and adaptation. | Stay informed through regulatory updates. Choose flexible reporting tools that adapt to new standards. Build internal expertise gradually. |

With growing reporting expectations and increasingly complex value chains, manual tracking isn’t becoming unsustainable. That’s where digital platforms and data tools come in.

They help you:

But not all tools are created equal, and choosing the right partner can make all the difference.

Choosing the right platform can make or break your emissions reporting.

The best tools not only calculate Scope 1, 2, and 3 emissions accurately but also simplify reporting, integrate with your existing systems, and guide you toward real reductions.

Below we highlight ten leading solutions – with Greenly at the top – to help companies of all sizes measure and manage their full carbon footprint.

| Rank | Software | Best for | Key features |

|---|---|---|---|

| 1 | Greenly |

Companies of all sizes seeking a full-scope solution | Automated Scope 1–3 tracking, supplier engagement tools, science-based target setting, custom reduction roadmaps |

| 2 | Persefoni |

Large corporations with complex reporting needs | Granular Scope 3 data capture, advanced analytics, compliance modules |

| 3 | Normative |

Businesses prioritising supplier emissions tracking | AI-driven spend-based calculations, supplier outreach, sustainability insights |

| 4 | Watershed |

Fast-scaling, tech-driven companies | Automated data pipelines, climate risk management, decarbonisation planning |

| 5 | Spherics |

SMEs starting their carbon reporting journey | Quick setup, spend-based emissions factors, simplified reporting |

| 6 | Carbon Analytics |

SMEs wanting lightweight carbon tracking | Financial data import, emissions calculation, sustainability templates |

| 7 | Emitwise |

Industrial and logistics-heavy sectors | Process-level data analysis, Scope 3 supply chain visibility, reduction tracking |

| 8 | Plan A |

EU companies needing CSRD-compliant reporting | Scope 1–3 tracking, EU taxonomy alignment, audit-ready sustainability reports |

| 9 | Sinai Technologies |

Businesses linking carbon management to investment planning | Carbon pricing tools, scenario analysis, abatement cost curves |

| 10 | VelocityEHS |

Enterprises seeking broader environmental management | Emissions inventory management, compliance tracking, sustainability KPIs |

A: The Greenhouse Gas Protocol (GHG Protocol) is the world’s most widely used standard for greenhouse gas reporting. It provides a framework for companies, governments, and organizations to measure and manage emissions consistently across operations and supply chains.

A: While both are used for carbon accounting, the GHG Protocol is more widely adopted globally and underpins many ESG frameworks (CDP, SBTi, CSRD). ISO 14064 is a technical standard often used for verification and auditing purposes.

A: Carbon management platforms like Greenly, Persefoni, and Watershed automate Scope 1–3 calculations, streamline data collection, and provide audit-ready, GHG Protocol-aligned reports.

A: Start by selecting the right standard, building a Scope 1–3 emissions inventory, setting science-based targets, and implementing reduction initiatives. Many businesses use software to simplify data tracking and reporting.

A: While not legally mandated itself, the GHG Protocol is widely used in federal and state-level climate reporting, supports EPA emissions programs, and is expected to play a central role in upcoming SEC climate disclosure requirements. It also underpins ESG frameworks like CDP, TCFD, and ISSB, making it essential for companies working toward US net-zero goals.

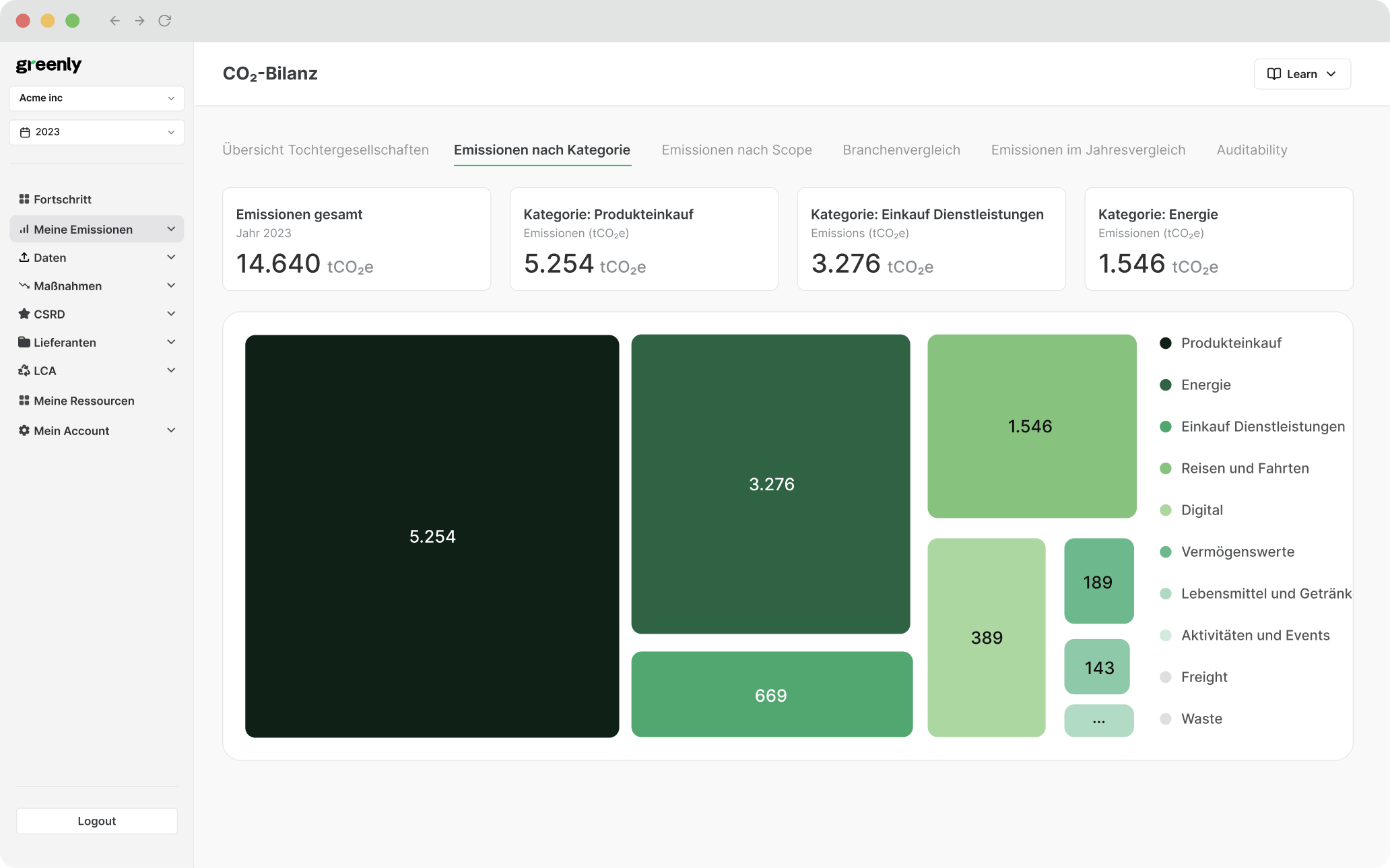

At Greenly, we know that measuring and managing your carbon footprint can feel overwhelming, especially when it comes to Scope 3. That’s why we’ve built a platform designed to streamline the process, without compromising on accuracy or credibility.

Here’s how we can support your emissions reporting journey:

| Greenly solutions | What it offers |

|---|---|

|

End-to-end emissions tracking

|

Our platform helps you track Scope 1, 2, and 3 emissions in one place, with user-friendly dashboards and automated data integration to make reporting intuitive, not burdensome. |

|

Advanced Scope 3 modelling

|

From spend-based estimates to supplier surveys and lifecycle data, we provide robust tools to help you map and improve value chain emissions, even when third-party data is limited. |

|

Framework-aligned reporting

|

Whether you're reporting under the GHG Protocol, CSRD, CDP, or setting targets with SBTi, Greenly ensures your data meets the latest standards and expectations. |

|

Custom action plans

|

We don’t just quantify emissions, we help you reduce them. Get tailored recommendations to cut carbon across operations, logistics, procurement, and product design. |