Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

What the CBAM is and how it fits into the EU’s climate strategy

Why the mechanism was introduced, including the problem of carbon leakage

How it works – including timelines, reporting rules, and what products are affected

What changes to expect after 2026, including carbon pricing and penalties

Who the CBAM applies to, with a spotlight on UK and non-EU exporters

What businesses need to do to prepare, and how Greenly can help support compliance

To prevent companies from evading climate regulations by relocating production to countries with laxer standards, the EU has introduced the Carbon Border Adjustment Mechanism (CBAM), a tool designed to level the playing field and curb carbon leakage.

A transitional phase kicked off in October 2023, introducing new reporting requirements for importers of certain carbon-intensive goods. While the full pricing mechanism won’t apply until 2026, companies need to start preparing now, including businesses outside the EU.

Since CBAM targets emissions from imported goods, it has far-reaching implications for any company exporting to the EU.

As the EU tightens its climate policies through instruments like the Emissions Trading System (EU ETS), there’s been growing concern about carbon leakage.

To address this, the CBAM places a carbon price on certain imported goods to reflect the emissions released during their production. In other words, it ensures that imported products face the same carbon costs as those made within the EU.

This is particularly relevant given that imports of carbon-intensive goods into the EU account for over 20% of the EU’s total emissions.

The CBAM was formally adopted on 17 August 2023, and its transitional phase began on 1 October 2023.

During this initial period, which runs until the end of 2025, companies must report the embedded greenhouse gas emissions of goods they import.

From 1 January 2026, the full system will come into effect, with importers required to purchase CBAM certificates to cover those emissions.

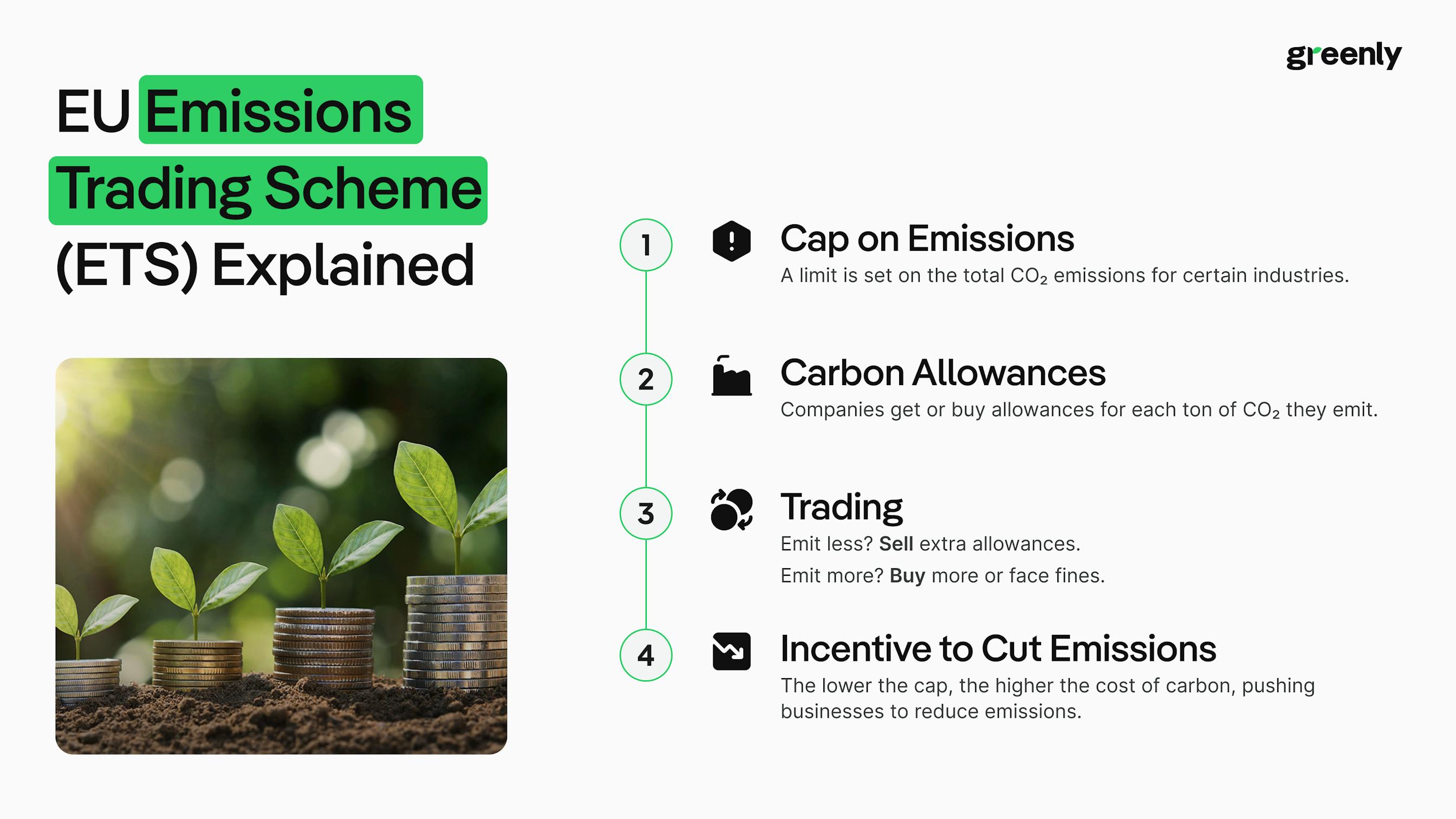

The ETS is the world’s first and largest carbon market and works by putting a price on carbon. It sets a cap on the total amount of CO2 that can be emitted by certain sectors each year, and companies must hold carbon allowances to match their emissions.

Over time, the emissions cap is reduced, increasing the pressure to decarbonise.

To support EU industry during the early years of the scheme, free allowances were granted to certain energy-intensive sectors. However, these are being phased out between 2026 and 2034 to ensure the system continues to drive emissions reductions.

Carbon leakage occurs when companies move their production to countries with weaker climate policies to avoid the costs of carbon pricing, or when lower-cost, high-emission imports replace EU-made products.

The result? Emissions are simply outsourced, not reduced.

As the European Commission explains:

Because the ETS only applies within the EU, it can’t prevent emissions shifting across borders. Research by the European Central Bank has shown that some companies have already relocated their most carbon-intensive operations outside the EU, undermining the impact of the ETS.

To address this loophole, the EU proposed the Carbon Border Adjustment Mechanism (CBAM) in late 2022. The goal? To apply a carbon price - similar to a carbon tax - to imported goods from countries not covered by the ETS, and ensure that EU climate efforts aren’t undercut by cheaper, more polluting products made abroad.

The Carbon Border Adjustment Mechanism (CBAM) requires importers to account for the greenhouse gas (GHG) emissions embedded in certain carbon-intensive goods they bring into the EU.

These emissions are tied to how the goods were produced, whether entirely or partially outside the EU, and will soon carry a carbon cost, similar to what EU producers already face under the Emissions Trading System (ETS).

CBAM applies to EU-based importers of specific goods produced outside the EU or in countries not covered by the EU ETS.

This includes:

Yes - to reduce the administrative burden on smaller importers and specific trade scenarios, the CBAM includes several targeted exemptions during the transitional phase.

These may evolve over time as the mechanism matures.

| Exemption | Description |

|---|---|

|

Low-value consignments

|

Shipments with a total intrinsic value under €150 are exempt from reporting obligations during the transitional period. |

|

Returned goods

|

Goods re-imported into the EU without modification after export are not subject to CBAM. |

|

Outward processing

|

Goods processed outside the EU and re-imported under the outward processing customs procedure are exempt. |

|

De minimis volume threshold (proposed)

|

In February 2025, the Commission proposed exempting importers of iron & steel, aluminium, cement, and fertilisers who import less than 50 tonnes per year. This measure is not yet in force but is intended to simplify compliance for smaller importers. |

To allow businesses time to adapt, CBAM is being rolled out in two phases. The current transitional phase began on 1 October 2023 and will run until 31 December 2025.

During this period:

As of 1 January 2025, importers are required to use only the EU method for calculating emissions, as simplified options (like default values and equivalent third-country systems) are no longer permitted.

To submit reports, importers must:

| Reporting requirement | What information needs to be provided |

|---|---|

|

Declarant details

|

Information identifying the declarant, including their role in the import process and responsibility for submitting the CBAM declaration. |

|

Origin and production site

|

The country of origin of the goods and the specific production facility where they were manufactured. |

|

Goods imported

|

The type of goods being imported, along with their quantity (usually in tonnes or units, depending on the product type). |

|

Emissions and carbon price

|

The amount of embedded greenhouse gas emissions associated with the goods and any carbon price or tax already paid at origin. |

|

Technical product data

|

Any relevant technical characteristics that influence emissions, such as composition, production method, or material quality. |

To help importers collect this data, the European Commission has published a guidance document and a communication template for requesting information from manufacturers.

From 1 January 2026, CBAM enters its 'definitive phase', marking the start of full financial enforcement.

At this point:

The price of CBAM certificates will reflect the weekly average auction price of EU ETS allowances (€/tonne of CO2). This means the carbon cost of imported goods will mirror that of domestic EU production. If an importer can prove that a carbon price has already been paid in the country of production, this amount can be deducted from their CBAM obligation.

These new obligations will also heighten financial exposure for businesses.

As free allowances under the EU ETS begin phasing out from 2026 (with a full phase-out by 2034), the cost of carbon is expected to increase. Some projections suggest that allowance prices could double or even triple in the coming years.

This creates a strong financial incentive, not just for importers but for their suppliers, to invest in cleaner supply chains and technologies that reduce carbon emissions.

In February 2025, the European Commission introduced a set of proposed changes to CBAM under the first Omnibus package. These proposed updates aim to streamline the system, reduce red tape, and make compliance more manageable for businesses, particularly smaller importers.

Key proposals include:

While these changes have been welcomed by some for their potential to reduce the administrative burden, they are not yet legally in force. The final legislation and timeline for adoption are still under discussion.

While the Omnibus proposal is expected to bring regulatory simplifications, businesses should not assume major changes will take effect until the final legislation is confirmed.

A formal review of CBAM is planned before the end of 2025, as the transitional period draws to a close. This review will look at how the system is functioning and whether its coverage should be expanded.

Here’s a quick look at the planned timeline:

| Phase | Timing | Application |

|---|---|---|

|

Scope and coverage review

|

End of 2025 | Evaluation of CBAM performance and whether to add new product categories or emissions types. |

|

Gradual expansion of covered goods

|

2026–2030 | Possible inclusion of organic chemicals and additional downstream products. |

|

Full implementation

|

By 2030 | CBAM is expected to cover all sectors included in the EU ETS, including indirect emissions. |

While no official decisions have been made yet, companies operating in sectors that might be brought into scope should start preparing now.

Expanding CBAM’s coverage will bring new compliance obligations, and businesses that stay ahead of these changes will be better placed to adapt smoothly when the time comes.

If you import CBAM-covered goods from outside the EU, such as steel, aluminium, cement, fertilisers, electricity, or hydrogen, then you are already subject to reporting obligations under CBAM’s transitional phase.

From 1 January 2026, financial obligations will follow, including the need to purchase CBAM certificates to account for the embedded emissions in your imports.

Here’s what importers need to know and start doing:

One of the most important and challenging parts of CBAM compliance is gathering accurate emissions data from non-EU manufacturers.

You’ll need to:

From 1 January 2026, importers will need to:

CBAM compliance will require solid recordkeeping. Make sure you:

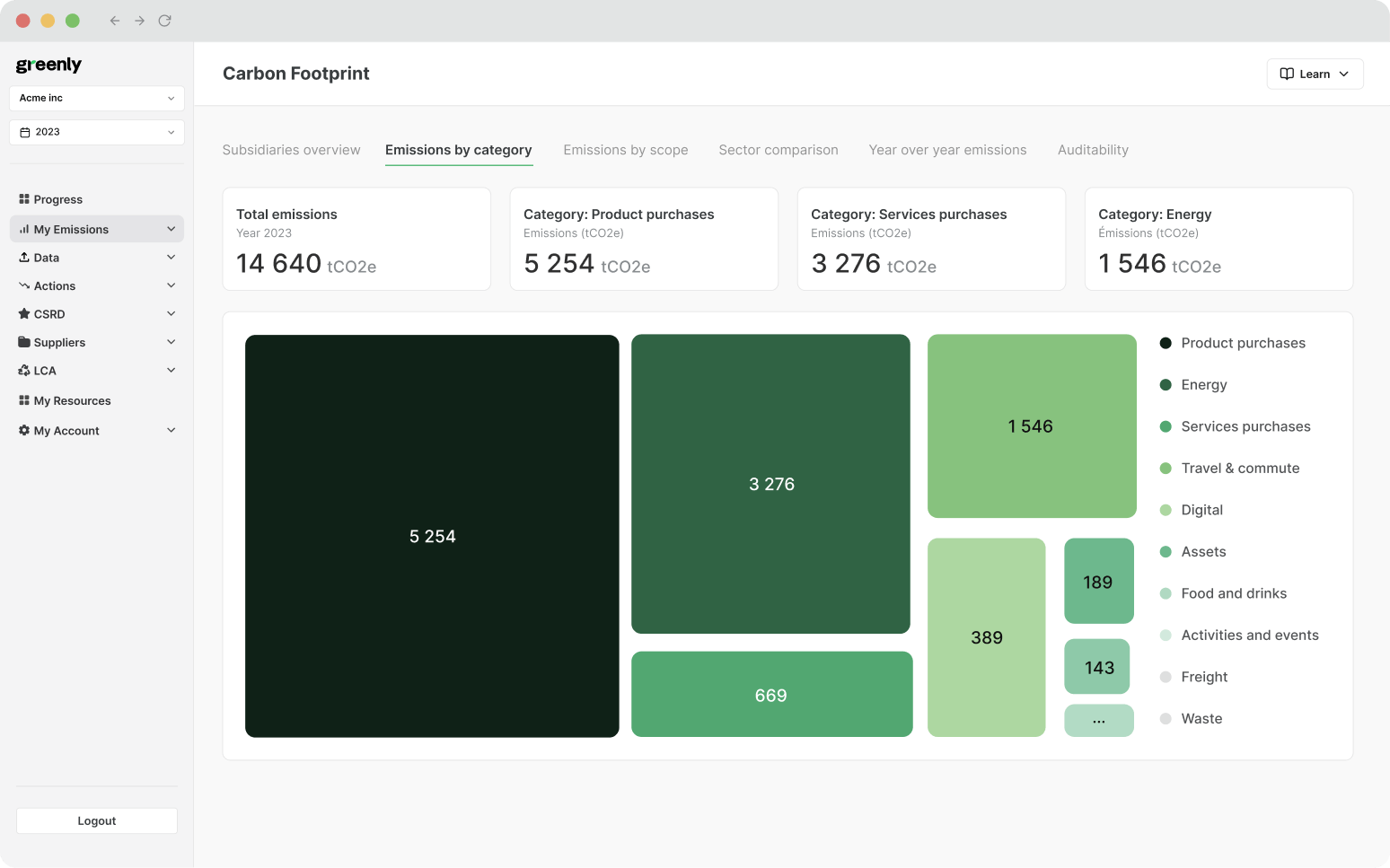

Given the complexity of CBAM and its evolving requirements, many businesses are choosing to work with third-party experts like Greenly to:

Choosing the right platform is key to smoothly navigating the EU’s Carbon Border Adjustment Mechanism (CBAM). The best CBAM-ready software helps businesses calculate embedded emissions, manage carbon pricing, and automate compliance reporting. Below we rank 10 top solutions available in 2025 - including Greenly as the leading option for end-to-end carbon management.

| Rank | Software | What it does | Best for | Available regions |

|---|---|---|---|---|

|

1

|

Greenly | Full carbon management platform covering CBAM reporting, carbon pricing, emissions tracking, and automated compliance workflows. | Importers, manufacturers, and exporters seeking a complete solution with expert guidance. | EU, UK, US |

|

2

|

EcoCarbon | CBAM-specific emissions tracking with integrated reporting templates for EU importers. | Small to medium-sized importers with simple product lines. | EU |

|

3

|

CarbonTrace | Advanced footprint calculations, scenario modeling for CBAM carbon pricing impacts. | Large manufacturers managing complex supply chains. | EU, North America |

|

4

|

EmisTrack | Automation for Scope 1–3 data collection and emissions verification aligned with CBAM requirements. | Multinational enterprises seeking centralised reporting. | Global |

|

5

|

CBAM SmartComply | Lightweight tool for exporters to quickly calculate embedded emissions and prepare declarations. | SMEs exporting to the EU. | EU, APAC |

|

6

|

ClimateBridge | Combines supplier engagement tools with CBAM-compliant footprint calculation. | Companies dependent on global supplier networks. | EU, Asia |

|

7

|

SustainPro | ESG-focused platform with CBAM modules for reporting and carbon pricing dashboards. | ESG teams in mid-to-large corporations. | EU, Americas |

|

8

|

CarbonLedger | Blockchain-based solution for traceable CBAM emissions data across supply chains. | Businesses needing verifiable data for regulators. | Global |

|

9

|

CBAM Assist | Entry-level calculator and reporting templates for quick CBAM compliance. | Small importers just starting CBAM reporting. | EU |

|

10

|

EnviroSoft | Broader sustainability platform offering optional CBAM reporting module. | Companies combining CBAM compliance with wider ESG tracking. | Global |

To comply, companies must calculate the embedded emissions of imported goods, pay corresponding carbon pricing where applicable, and submit verified reports to EU authorities. Many use CBAM-ready tools to automate data collection and reporting.

This is software specifically designed to meet CBAM obligations, including embedded carbon footprint calculations, reporting templates, and automatic alignment with EU regulatory updates.

Yes. Modern platforms like Greenly offer automation for emissions tracking, data verification, and report generation, significantly reducing manual effort and compliance risks.

Most top tools are available across the EU and major exporting regions like the US and Asia. Availability depends on vendor reach and language support.

Consider your company size, supply chain complexity, and reporting needs. Large manufacturers may need advanced calculation and automation tools, while small importers might only require a lightweight calculator. Look for software that supports emissions tracking, carbon pricing analysis, and generates EU-compliant reports.

Importers of goods manufactured outside of the EU, that fall within the CBAM reporting doesn’t need to be a manual, spreadsheet-heavy nightmare.

Greenly’s purpose-built platform streamlines the entire process for both EU importers and their international suppliers.

Here’s how we help:

| How Greenly supports CBAM compliance | What it means |

|---|---|

|

Emissions tracking

|

Greenly’s platform supports data collection across both direct and indirect emissions, helping you meet EU methodology requirements and avoid reporting gaps. |

|

Streamline supplier data collection

|

Use tailored CBAM questionnaires, automated follow-ups, and supplier-specific dashboards to collect accurate emissions data – no spreadsheets required. |

|

Track evolving supply chains

|

As new products or suppliers are added, Greenly automatically triggers new data requests, keeping your reporting up to date without extra admin. |

|

Centralise supplier collaboration

|

Give your suppliers access to their own dedicated portal where they can upload data, access guidance, and contribute directly to your reports. |

|

Improve accuracy, reduce risk

|

Built-in quality checks and real-time insights help you spot issues early, reduce reporting errors, and stay ahead of rising carbon allowance costs. |

|

Automate quarterly reporting

|

Generate compliant XML reports in minutes, ready for direct upload to the EU portal. Our platform detects CBAM goods, flags missing data, and handles formatting automatically. |

Whether you’re an EU declarant or an international supplier, Greenly’s all-in-one CBAM solution is designed to save time, lower costs, and help you reduce emissions while staying compliant.

Now that the UK is no longer part of the EU, it’s treated like any other non-EU country under CBAM. This means that UK exporters of covered goods, including steel, aluminium, cement, fertilisers, electricity, and hydrogen, are subject to the same reporting requirements as other third countries.

From October 2023, UK companies exporting these goods to the EU have had to submit quarterly reports on embedded greenhouse gas emissions. And from 2026, they will also be required to purchase CBAM certificates to cover those emissions.

UK businesses will need to: