ESG / CSR

Industries

EU ETS: what you need to know about the EU carbon market

The EU Emission Trading System (EU ETS) is a key component of Europe's environmental strategy, but what exactly is it and how does it function?

This article aims to demystify the EU ETS, offering an overview of its structure, operation, and impact. We'll delve into how this system has become a crucial tool in the EU's efforts to reduce greenhouse gas emissions, discuss its economic implications, and examine the challenges it faces.

👉 In this article, we'll explore the EU Emissions Trading System (EU ETS), a European initiative for reducing greenhouse gases through a cap-and-trade scheme.

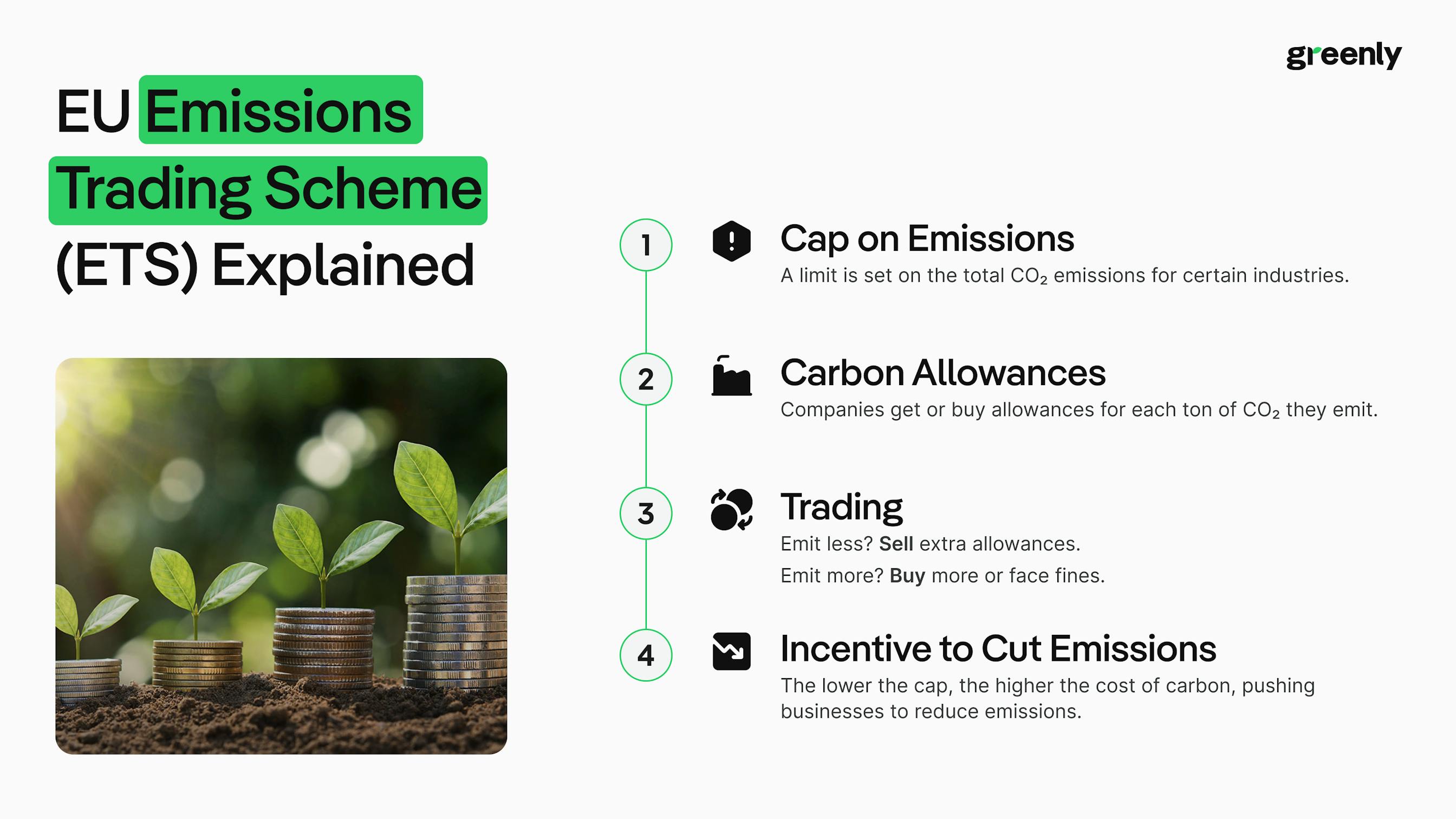

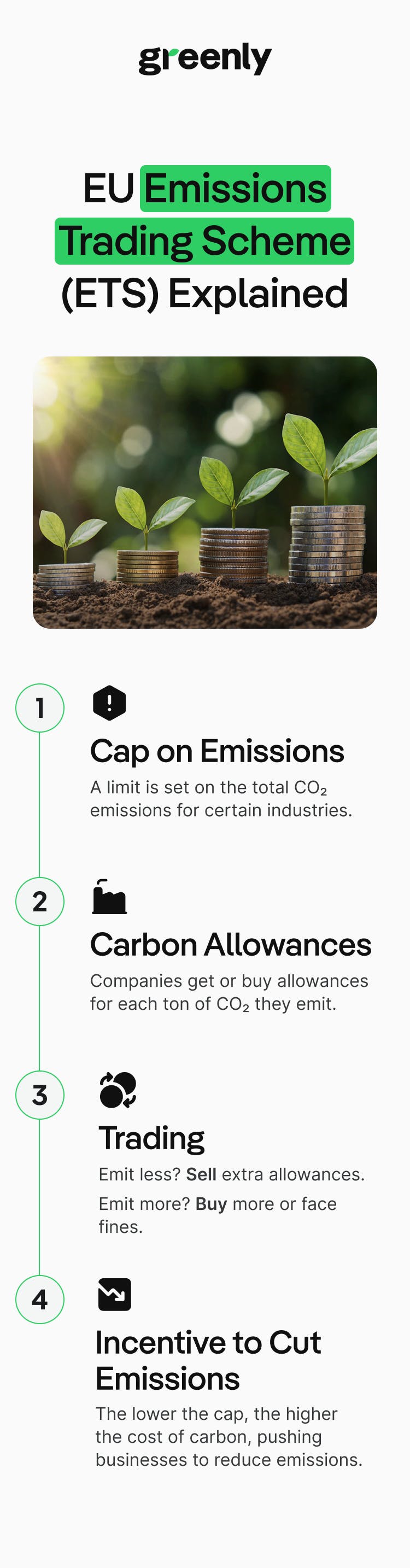

What is the EU ETS?

The European Union Emission Trading System, commonly known as the EU ETS, represents a major step in Europe's commitment to fighting climate change. Established in 2005, it is the world's first and largest international trading system for carbon dioxide emissions, a pioneering model for cap-and-trade schemes globally.

At its core, the EU ETS operates on a straightforward principle: setting a cap on the total amount of certain greenhouse gases that can be emitted by installations covered by the system. The cap is reduced over time, helping the EU to progress towards its emissions reduction target. Within this system, companies receive or buy emission allowances, which they can trade with one another as needed. Each allowance equals one tonne of CO2 or the equivalent amount of another greenhouse gas.

The EU ETS covers over 10,000 power stations and industrial plants across EU member states, Iceland, Norway, and Liechtenstein, as well as airlines operating between these countries - from 2024 the ETS will expand to cover emissions from maritime transport too. It accounts for about 45% of the EU's greenhouse gas emissions, making it a central tool in the Union's policy to combat climate change.

The implementation of this system marked a significant shift in environmental policy, introducing a market-based approach to controlling pollution. By putting a price on carbon emissions, the EU ETS incentivises companies to reduce their carbon footprint, fostering innovation in sustainable practices and technologies.

Moreover, the EU ETS is not static; it has evolved over time through various phases, each addressing different challenges and aiming to improve the system's efficiency and impact. This evolution reflects the EU's ongoing commitment to refining its climate policies and adapting to new scientific findings and economic contexts.

How does the EU ETS work?

The system operates on a 'cap-and-trade' principle, a method that combines regulatory limits with market-based incentives. Let's take a closer look at how this functions:

Setting the cap:

The EU ETS sets an upper limit or ‘cap' on the total amount of certain greenhouse gases that can be emitted by factories, power plants, and other installations that fall under the scope of the system. This cap is reduced over time, aligning with the EU's emissions targets - ie. reducing net greenhouse gas emissions by 55% by 2030 and achieving net zero by 2050.

Allocation of EU allowances:

Within this cap, companies receive or buy emission allowances, which are essentially permits to emit a certain amount of greenhouse gases. One allowance grants the holder the right to emit one tonne of CO2 (or carbon dioxide equivalent, ie. its equivalent in other GHG emissions).

Initially, many allowances were given out for free (referred to as free allocation), but over time, auctioning has increased with new trading periods. For the current phase (phase 4), around 57% of the cap is auctioned, and the rest is provided for free.

Trading in the European carbon market:

The 'trade' aspect comes into play as companies can buy or sell allowances depending on their needs. Firms that manage to reduce their emissions can sell their excess allowances to others who need more. This trading is done at market prices, which are influenced by supply and demand.

Flexibility and incentives:

The system offers flexibility to companies in how they meet their emission targets. They can cut emissions themselves or buy allowances from others who have spares. This creates an economic incentive for companies to reduce emissions, as selling excess allowances can be financially beneficial.

Verified emissions:

The process of verifying emissions under the EU Emissions Trading System (EU ETS) is a crucial element of its annual compliance cycle, encompassing monitoring, reporting, and verification (MRV). Those covered by the EU ETS are mandated to have an approved monitoring plan for tracking and reporting their annual emissions, a requirement that's also part of their operating permit.

Each year, these operators are responsible for submitting a comprehensive emissions report, with the data for a given year needing to be verified by an accredited verifier by March 31st of the following year. After this verification, operators are obliged to surrender a corresponding number of allowances for their emissions by April 30th, thereby ensuring accountability and adherence to the EU's stringent emission reduction targets.

Compliance and penalties:

At the end of each year, companies must surrender enough allowances to cover all their emissions, or they face significant fines. This ensures compliance and adds a strong financial incentive to stay within emission limits.

Monitoring and reporting:

Rigorous monitoring and reporting requirements ensure that the emissions of each installation are accurately measured and reported. This transparency is crucial for the credibility and effectiveness of the system.

Impact of the EU ETS

The European Union Emission Trading System (EU ETS) has had a significant impact on both the environment and the economy since its inception. This section delves into the various effects of the EU ETS, highlighting its successes and the areas where it has faced challenges.

Reduction in emissions

The primary goal of the EU ETS is to reduce greenhouse gas emissions, and it has shown success in this regard - since 2005, the EU ETS has helped to reduce emissions linked to power and industry plants by 37%. By setting a cap on emissions and lowering it over time, the EU ETS has effectively contributed to Europe's overall emissions reduction targets.

Economic impact

The EU ETS has influenced the way businesses operate in Europe. It has encouraged companies to invest in cleaner, more efficient technologies to reduce their carbon footprint. While some industries argue that the cost of purchasing emissions allowances has impacted their competitiveness, others have benefitted from the trading aspect of the system.

Innovation and clean technology

One of the significant positive impacts of the EU ETS has been the stimulation of innovation in clean technologies. The system's market-based mechanism has incentivised companies to develop and adopt new technologies to reduce emissions, leading to advancements in renewable energy, energy efficiency, and other green technologies.

Global influence

The EU ETS has set a precedent for carbon trading worldwide. It has served as a model for similar systems in other countries and regions, thereby contributing to a global effort to address climate change. Its success and challenges have provided valuable lessons for other emissions trading schemes.

Market dynamics and carbon price

The effectiveness of the EU ETS is closely linked to the dynamics of the carbon market, including the price of carbon. There have been periods of volatility, with prices dropping too low to effectively incentivise emission reductions. However, recent reforms, such as the Market Stability Reserve, have been implemented to address these issues and improve the resilience and effectiveness of the EU carbon market.

EU ETS expanding scope

The European Union Emission Trading System (EU ETS) is undergoing significant expansions and revisions to broaden its scope and enhance its impact on reducing emissions across various sectors. This includes new systems for buildings and road transport emissions, as well as revised policies for aviation and maritime transport.

New emissions trading system for buildings and road transport

Starting in 2027, with a potential delay to 2028 depending on oil and gas prices, the EU will implement a separate emissions trading system specifically for buildings and road transport. This system targets emissions from fuel combustion in these sectors that are not currently covered by the existing EU ETS.

Rather than directly involving households and drivers, this new system will regulate fuel distributors. The aim is to facilitate cost-effective emission reductions in these sectors, which are crucial for the EU's goal of achieving climate neutrality by 2050.

To prevent abrupt price shocks for consumers and to support a smooth transition, several safeguards are being established, including the creation of the Social Climate Fund. This fund will use revenues from the new ETS to address social impacts on vulnerable households and micro-enterprises, starting operation in 2026, a year before the new ETS.

Revised EU ETS for the aviation sector

As part of the 2023 reforms, the EU ETS will gradually phase out free allowances for airlines, with a 25% reduction in 2024 and 50% in 2025, moving to full auctioning by 2026. While there was strong debate over expanding the scope to cover international flights departing from within EU member states, this decision was postponed. A final determination will be made in 2026 following an evaluation of ICAO's CORSIA scheme. If progress is deemed insufficient, the scope could be expanded starting in 2027.

EU ETS extension to maritime transport

In January 2024, the EU ETS directive was revised to extend its scope to cover large ships (of 5,000 gross tonnage and above) entering EU ports, regardless of their country of origin. The system includes 50% of emissions from voyages starting or ending outside of the EU and 100% of emissions for intra-EU voyages and activities within EU ports.

Starting in 2026, it will also cover methane and nitrous oxide emissions. This extension aims to generate revenues for green transition in the shipping industry and incentivise low-carbon solutions.

A phase-in period will allow shipping companies to gradually adjust, starting with surrendering allowances for 40% of their emissions in 2025, increasing to 70% in 2026, and reaching 100% in 2027.

These expansions and revisions of the EU ETS represent a comprehensive approach to tackling emissions in sectors that have been challenging to regulate. By broadening the scope and enhancing the mechanisms of the EU ETS, the European Union is taking significant steps toward its ambitious climate goals.

EU ETS challenges

While the European Union Emission Trading System (EU ETS) has made notable strides in reducing greenhouse gas emissions, it has not been without its challenges and criticisms.

Carbon price volatility:

One of the primary challenges has been the volatility in carbon prices within the EU ETS. There have been periods where the price of carbon was too low to effectively incentivise reductions in emissions. This volatility can undermine the system's goal of providing a stable economic incentive for companies to invest in low-carbon technologies.

Allocation of allowances:

The initial phase of the EU ETS faced criticism over the way emission allowances were allocated. Many allowances were given for free, which led to windfall profits for some companies without significant reductions in emissions. The system has since moved towards more auctioning of allowances, but the transition has been complex and contentious.

Scope and coverage:

Although the EU ETS covers a significant portion of the EU's emissions, there are sectors like agriculture and certain parts of transportation and building sectors that are not fully covered. Expanding the scope of the system to include these sectors remains a challenge.

Linkage with other systems:

While the EU ETS has inspired similar systems globally, creating effective linkages between different carbon markets remains a complex challenge. Such linkages are essential for a more integrated and global approach to carbon pricing.

Global competitiveness:

There are concerns about the impact of the EU ETS on the global competitiveness of European industries. The costs associated with buying emissions allowances can put these industries at a disadvantage compared to their counterparts in regions without similar carbon pricing mechanisms.

Carbon leakage:

Carbon leakage is a concern where companies might relocate production to countries with more relaxed emission constraints to avoid the costs associated with buying allowances. This not only undermines the EU's emission reduction efforts but also impacts the competitiveness of businesses within the EU. To counteract these issues, the EU recently introduced the Carbon Border Adjustment Mechanism (CBAM), we'll explore this in more detail in the next section.

The introduction of CBAM

Following the challenges and criticisms of the EU Emissions Trading System (EU ETS), a significant development has been the introduction of the Carbon Border Adjustment Mechanism (CBAM), adopted by the European Commission on August 17th, 2023. This mechanism is designed to complement the EU ETS by addressing carbon leakage and reinforcing the EU's climate objectives.

Purpose and need for CBAM

The CBAM is an innovative approach aimed at preventing carbon leakage – a scenario where companies relocate production to countries with less stringent emissions regulations, undermining the effectiveness of the EU ETS. With the EU's ambitious target of reducing emissions by at least 55% by 2030 and achieving climate neutrality by 2050, CBAM serves as a critical tool. It ensures that the cost of carbon is equitably applied not just within EU countries but also on carbon-intensive products imported into the EU. This mechanism is essential to maintain the competitiveness of European industries while advancing global efforts in industrial decarbonisation.

Operational mechanism of CBAM

The transitional phase of CBAM began in October 2023, introducing greenhouse gas reporting requirements for importers of specific carbon-intensive goods, such as iron, steel, cement, aluminium, fertilisers, and electricity. While financial adjustments are not required during this transitional phase, they prepare businesses for the full implementation of CBAM starting January 1st, 2026. From then, importers will need to purchase CBAM certificates, mirroring the costs they would have incurred if the goods were produced under the EU's carbon pricing policies. This system aligns the carbon costs of imports with those of domestic products, thereby upholding the EU's climate goals.

Impact and future developments

The CBAM is expected to significantly bolster the effectiveness of the EU ETS by mitigating the risk of carbon leakage and promoting cleaner production practices globally. CBAM initially targets certain energy-intensive industries however, the European Commission plans to review CBAM before the end of its transitional period to possibly expand its scope to other product groups.

By 2030, it is anticipated that all goods covered by the EU ETS will also be included in the CBAM, potentially extending to both direct and indirect emissions. Importers are advised to familiarise themselves with CBAM obligations, ensuring compliance and contributing to the broader goal of global emission reduction.

💡 This integration of CBAM into the EU ETS framework represents a proactive step by the EU in addressing the complexities of global carbon emissions management and signifies a move towards more comprehensive and globally aligned climate policies.

The impact of the EU ETS on UK companies

With the UK’s departure from the European Union, British companies are no longer directly regulated by the EU Emissions Trading System (EU ETS). However, the EU ETS continues to have a significant impact on UK companies that trade with the EU or have operations within EU jurisdictions.

UK Emissions Trading System (ETS)

Following Brexit, the UK launched its own Emissions Trading System (UK ETS) in January 2021, which operates similarly to the EU ETS, aiming to reduce greenhouse gas emissions through a cap-and-trade mechanism. For many companies, this shift has been relatively seamless due to the UK ETS's initial alignment with the EU’s system, but there are key differences that could affect business operations moving forward. Challenges that companies may encounter include:

| Issue | Impact |

|---|---|

| Cost and Market Dynamics | The difference in carbon prices between the UK ETS and EU ETS could lead to complexities in financial planning and carbon management for businesses with cross-border operations. |

| Regulatory Divergence | Regulatory changes could increase administrative burdens for UK companies that need to comply with both the UK ETS and EU ETS. |

| Exporting to the EU | UK companies exporting to the EU may face additional costs due to the Carbon Border Adjustment Mechanism (CBAM), affecting the competitiveness of high-carbon products. |

| Competitive Pressure | UK companies may face competitive disadvantages if there is significant divergence in carbon prices between the UK ETS and EU ETS, leading to potential carbon leakage or underinvestment. |

The issue of carbon pricing

Carbon pricing has long been a central element of the EU’s decarbonisation efforts, with the EU Emissions Trading System (EU ETS) serving as a key driver. However, fluctuating carbon prices, most recently marked by a sharp drop to a low of €52 per tonne in early 2024, have reignited concerns about the system’s effectiveness in incentivising industrial decarbonisation.

One of the ongoing challenges facing the EU ETS is the issue of oversupply, which dampens the impact of carbon pricing. While the introduction of the Market Stability Reserve in 2018 helped to remove excess allowances, recent decisions to release additional permits as part of the REPowerEU initiative have led to a renewed glut in supply. This, combined with demand stagnation and factors like lower fossil gas prices and the growth of renewables, has caused carbon prices to drop significantly.

Lower carbon prices threaten to undermine both industrial investment in cleaner technologies and national funding for climate action. Carbon pricing serves as a crucial investment signal, and when prices fall, the incentive for industries to reduce their emissions weakens. This is further complicated by the continued free allocation of allowances, which shields many industries from the full impact of carbon pricing.

Moreover, decreased carbon prices reduce the auctioning revenues that fund essential EU-level schemes like the Innovation Fund and the Modernisation Fund, both of which are vital for supporting the green transition across Europe.

To maintain the effectiveness of the EU ETS, policymakers will need to address the issue of oversupply and explore measures such as implementing a floor price for carbon. A steadily increasing carbon price is essential to provide the long-term certainty needed to drive the deep emissions cuts required to meet the EU’s climate targets.

Looking ahead: The future of EU ETS

Continuous improvement and expansion

The EU ETS is expected to undergo continuous refinement to enhance its effectiveness. This includes adjusting the cap on emissions, improving the allocation of allowances, and expanding the system to cover more sectors. The integration of the CBAM is a significant step in this direction, aiming to mitigate carbon leakage and ensure a level playing field for EU industries. Future expansions might also include incorporating more greenhouse gases and extending the system to additional sectors like agriculture and transportation.

Global climate leadership

The EU ETS, being the first and largest international carbon trading system, sets a precedent for global climate initiatives. Its success, challenges, and adaptations provide valuable insights for other countries and regions looking to implement similar emissions trading systems. The EU's commitment to reducing emissions and achieving climate neutrality by 2050 positions it as a leader in global climate action, encouraging other nations to strengthen their climate policies.

International collaboration and linkage

A key aspect of the EU ETS's future will be its ability to link with other carbon markets globally. Such linkages can create a more cohesive and efficient global carbon market, driving down emissions worldwide. International collaboration in climate policy, technology transfer, and shared knowledge will be crucial for the success of global efforts to combat climate change.

Technological innovation and economic transformation

The EU ETS is not just a regulatory tool - it's a catalyst for innovation and economic transformation. As the system evolves, it is expected to continue driving investment in clean technologies and sustainable practices. This shift will play a significant role in the transition to a low-carbon economy, creating new opportunities in green industries and jobs.

Addressing social and economic impacts

A forward-looking EU ETS will need to balance environmental goals with social and economic considerations. Ensuring a just transition for affected industries, workers, and communities is vital. This includes addressing the distributional impacts of carbon pricing and using revenues from systems like the EU ETS and CBAM to fund social and environmental programs.

Enhanced transparency and stakeholder engagement

The future success of the EU ETS will also depend on enhanced transparency in its operations and active engagement with a wide range of stakeholders, including industries, consumers, and environmental groups. This approach will help in building broad support and ensuring that the system is fair, effective, and adaptable to changing circumstances.

The EU ETS, bolstered by mechanisms like the CBAM, is poised to play a pivotal role in Europe's and potentially the global fight against climate change. Its continuous evolution, coupled with international cooperation and technological advancement, will be key in shaping a sustainable and climate-resilient future. The journey ahead is complex but essential for achieving long-term environmental goals and ensuring a sustainable future for all.

How Greenly can help your company

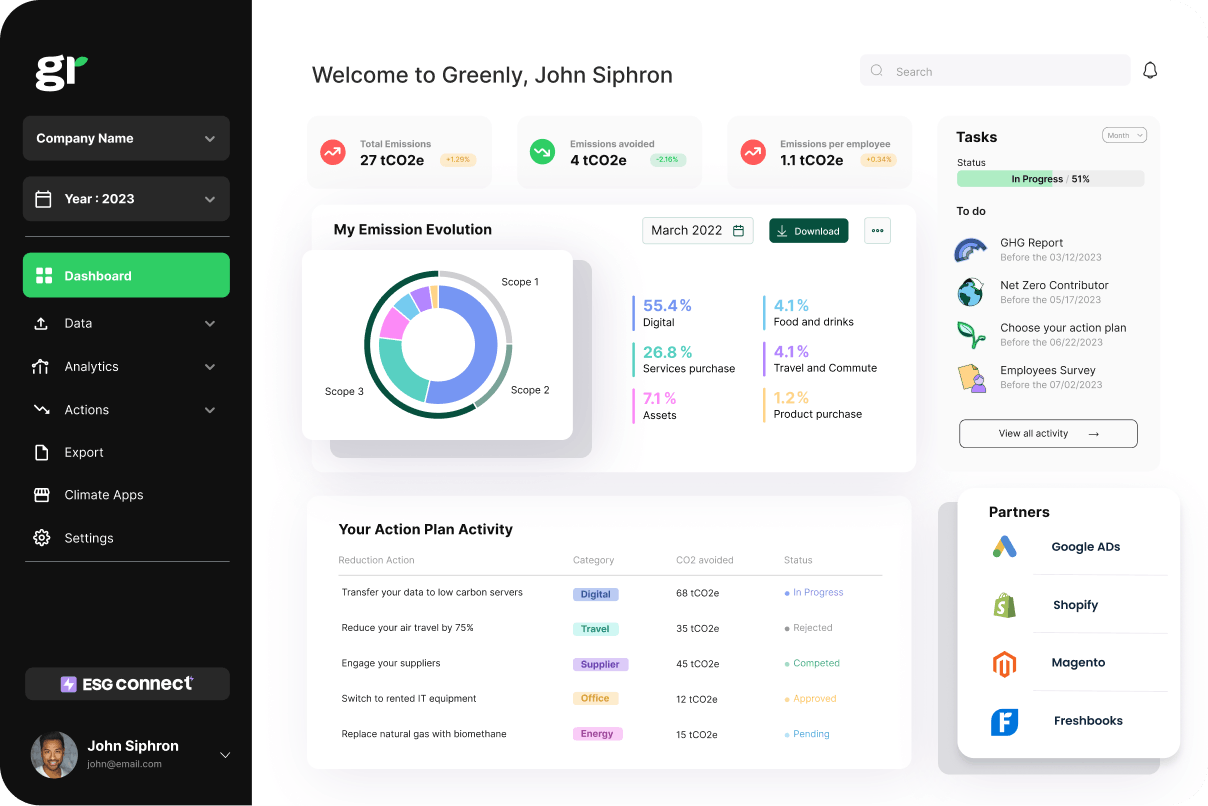

Greenly is committed to guiding your business through the journey towards sustainability, offering a suite of carbon management solutions to minimise your environmental impact:

Carbon Management with Greenly

Monitor your GHG emissions: Leverage advanced technology to track your Scope 1, 2, and 3 emissions, providing a detailed view of your business’s carbon footprint.

Customised action plans: Work closely with Greenly’s climate specialists to design strategies that focus on key areas for improvement, enabling you to implement impactful measures that reduce emissions and foster sustainable growth.

Decarbonising Your Supply Chain

Tackling Scope 3 emissions from your supply chain is often one of the most challenging aspects of carbon reduction, but it’s essential for achieving net-zero targets. Greenly helps you engage with suppliers, shift to low-carbon alternatives, and establish more sustainable partnerships. Our solutions enhance transparency and help you reduce emissions across your entire supply chain.

User-Friendly Platform

Our intuitive platform helps you with the task of tracking and managing your carbon footprint. With Greenly, you can monitor your environmental impact, measure progress towards ESG goals, and integrate sustainability into all areas of your business.

Why Partner with Greenly?

Greenly provides comprehensive support throughout your sustainability journey - from carbon measurement and personalised action plans to supply chain decarbonisation and seamless platform integration. By partnering with Greenly, you’ll not only reduce your environmental footprint but also position your business as a leader in sustainability.

Start your path to net zero with Greenly today and contribute to a more sustainable and cooler future for everyone.