Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

As the EU ramps up efforts to reduce GHG emissions, the Taxonomy provides a classification system for determining which economic activities can be considered environmentally sustainable. By offering clear criteria, it helps investors and businesses align their financial activities with sustainability targets, reducing greenwashing and promoting genuine progress toward a low-carbon economy.

In this article, we'll break down what the EU Taxonomy is, how it works, the criteria for sustainable activities, and its broader impact on businesses and financial markets.

The EU Taxonomy is a classification framework designed to identify and promote environmentally sustainable economic activities. It was introduced as part of the EU's sustainable finance strategy to ensure that capital flows are directed towards projects and businesses that contribute to the EU's climate and environmental objectives.

In early 2025, the European Commission adopted the Omnibus Simplification Regulation to make the framework more practical, streamlining reporting requirements, clarifying scope thresholds, and better aligning disclosures with other EU regulations like the CSRD. The Taxonomy remains legally binding for large companies and financial market participants, making it a key tool in driving corporate transparency and accountability in sustainability efforts.

The EU Taxonomy was developed to:

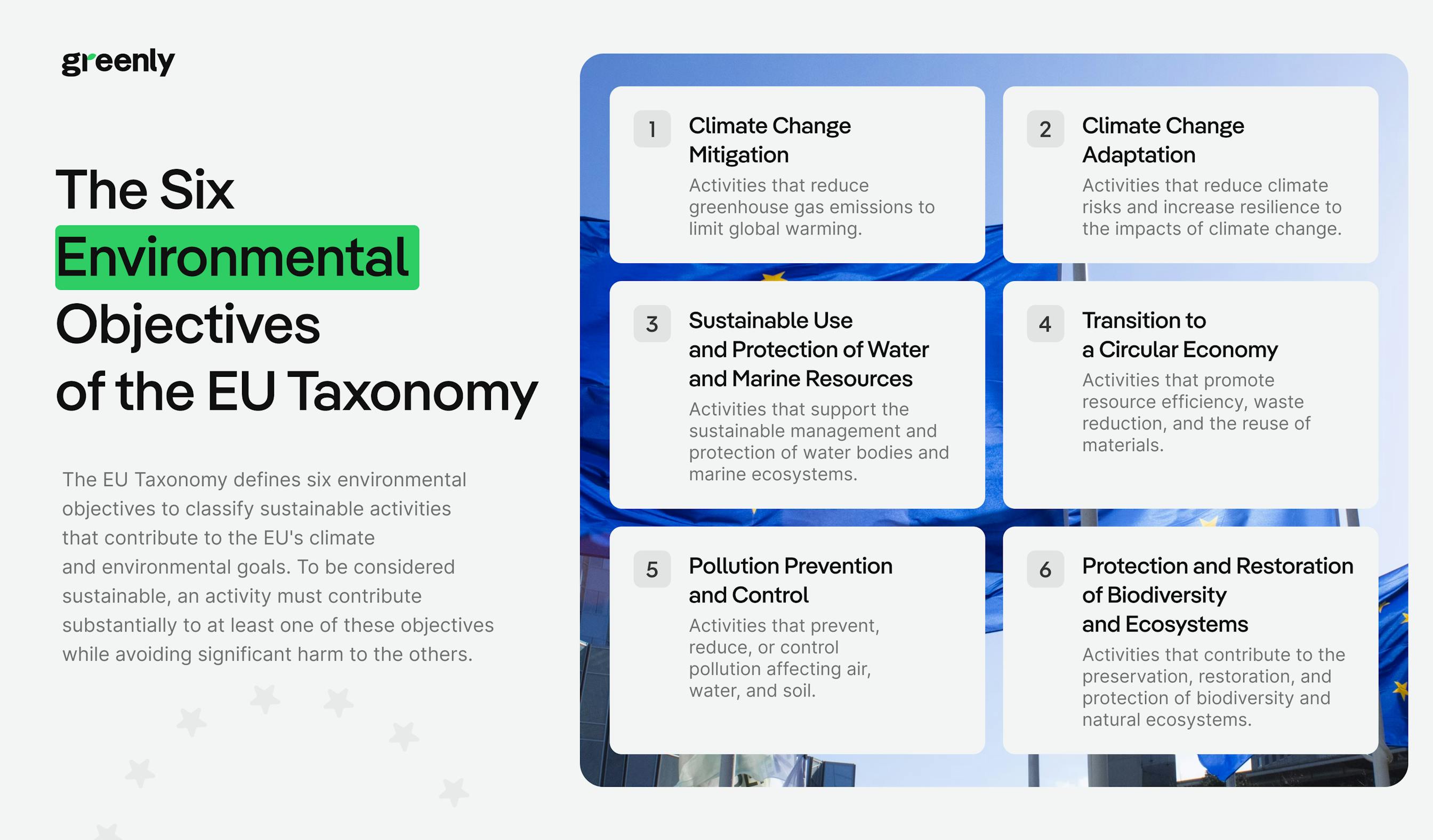

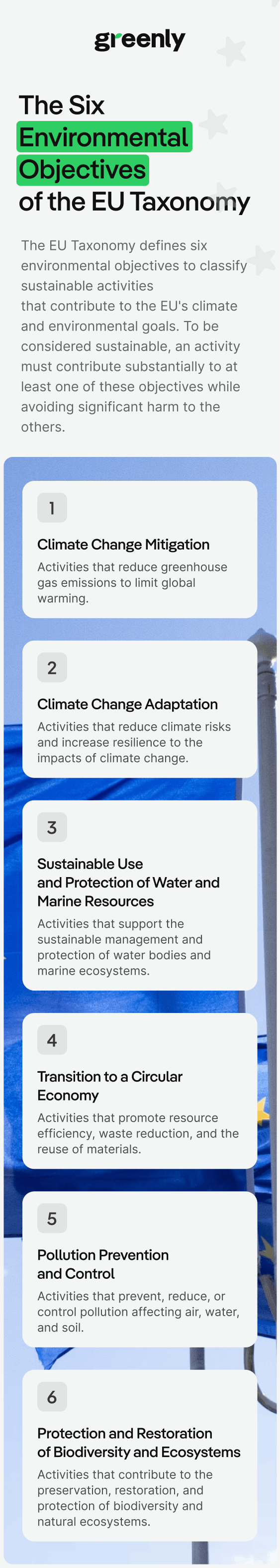

The EU Taxonomy is structured around six key environmental objectives, designed to cover the full spectrum of sustainability challenges:

For an activity to be considered sustainable under the EU Taxonomy, it must contribute substantially to at least one of these objectives while complying with strict environmental criteria.

To determine whether an economic activity can be classified as sustainable under the EU Taxonomy, it must meet a set of four rigorous technical criteria.

These criteria ensure that activities contribute meaningfully to the EU's environmental goals while avoiding harm in other areas. The framework is designed to prevent greenwashing by providing a clear, science-based standard for sustainability.

The four criteria are:

An activity must make a substantial contribution to at least one of the six environmental objectives outlined in the EU Taxonomy. This means the activity should significantly advance climate or environmental goals, such as:

The technical screening criteria specify thresholds for each objective, ensuring that the activity provides a measurable, positive environmental impact.

While contributing positively to one objective, the activity must also do no significant harm to the other five objectives. This requirement ensures that sustainability efforts in one area don't come at the expense of other environmental priorities.

For example:

As of 2025, the DNSH criteria have been simplified to reduce the reporting burden on companies. The European Commission, in response to stakeholder feedback, streamlined the indicators and removed overly complex or redundant requirements, particularly those difficult to assess or verify in practice.

These updates aim to maintain a holistic approach to sustainability while improving usability, consistency, and comparability across sectors.

In addition to environmental criteria, the EU Taxonomy requires compliance with minimum social and governance safeguards. These align with international standards like the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

Key requirements include:

An activity must also comply with the applicable technical screening criteria (TSC), which set science-based thresholds and performance metrics for each environmental objective. These criteria ensure activities meet measurable sustainability standards and avoid greenwashing.

For example:

In 2025, the EU launched a major review of the TSC to improve clarity, consistency, and usability across sectors. Updates include simplified metrics, clearer definitions, and streamlined DNSH indicators. The revision also introduced greater flexibility for partial alignment disclosures and a proposed materiality threshold, allowing companies to focus reporting on activities representing at least 10% of turnover, CapEx, or OpEx.

These criteria ensure a high standard of sustainability that goes beyond superficial environmental claims. They help to:

The EU Taxonomy has been introduced through a phased approach, with gradual implementation to ensure businesses and financial institutions have time to adapt to the regulatory requirements. The focus has been on increasing transparency and standardising sustainability disclosures to prevent greenwashing while directing capital towards genuinely sustainable activities.

The EU Taxonomy's rollout has followed a structured timeline since its adoption:

June 2020: The EU Taxonomy Regulation was formally adopted as part of the European Green Deal and Sustainable Finance Action Plan.

January 2022: Reporting requirements for the first two environmental objectives — climate change mitigation and climate change adaptation — came into effect for large companies and financial market participants.

January 2024: Reporting obligations expanded to cover the remaining four environmental objectives (water, circular economy, pollution prevention, biodiversity).

January 2025: Full compliance expected for companies in scope, with enhanced disclosure requirements now subject to simplification measures under the 2025 Omnibus Regulation. Voluntary reporting options and partial alignment disclosures have been introduced to ease the transition.

The EU Taxonomy primarily applies to companies and financial institutions in the scope of the Corporate Sustainability Reporting Directive (CSRD). However, the 2025 Omnibus Simplification Regulation introduced important clarifications and voluntary options:

Taxonomy reporting is mandatory for companies subject to the CSRD, which includes large undertakings meeting at least two of the following thresholds:

Under the Omnibus Regulation, mandatory Taxonomy disclosures now only apply to those with more than 1,000 employees, although companies below this threshold are encouraged to report voluntarily.

Investors and asset managers marketing financial products in the EU must disclose the extent to which their portfolios align with EU Taxonomy criteria — particularly under the SFDR (Sustainable Finance Disclosure Regulation).

Listed small and medium-sized enterprises will be phased into CSRD reporting obligations starting in 2026, with simplified sustainability disclosure standards.

Taxonomy reporting will remain voluntary for these entities during the initial phase.

Companies not currently in scope may choose to disclose partial alignment if the economic activity accounts for at least 10% of turnover, CapEx, or OpEx.

Companies subject to the EU Taxonomy must disclose how their activities align with the regulation using specific Key Performance Indicators (KPIs):

In 2025, the European Commission introduced simplified reporting templates, reducing the number of required data points by up to 70%. These revised templates are designed to better align with CSRD disclosure formats and ease the reporting burden.

Failure to comply with the EU Taxonomy reporting requirements can lead to:

The EU Taxonomy continues to evolve, with recent updates reflecting both the expansion of criteria and growing efforts to simplify reporting obligations. The latest changes aim to balance scientific rigour with practical implementation, political considerations, and stakeholder feedback from companies, investors, and regulators.

Initially, the EU Taxonomy focused on the first two objectives: climate change mitigation and climate change adaptation. However, as of January 2024, the Taxonomy now covers all six environmental objectives:

This expansion requires businesses to assess their activities against more comprehensive sustainability criteria, broadening the scope of the regulation and increasing the complexity of compliance.

In a controversial move, the EU officially included nuclear energy and natural gas as Taxonomy-aligned activities under specific conditions starting in 2023. These additions sparked debate due to their environmental impact and the potential for misuse of the framework for greenwashing.

Key conditions for inclusion:

While these additions aim to support Europe's energy transition, critics argue they weaken the Taxonomy's credibility by classifying transitional fuels as sustainable.

In 2025, the European Commission launched a comprehensive review of the Technical Screening Criteria to address complexity and improve clarity. These updates were developed in collaboration with the Platform on Sustainable Finance and include:

The goal is to make the TSC easier to apply in practice while maintaining a high bar for environmental performance.

A key development in early 2025 was the adoption of the EU Omnibus Simplification Regulation, which introduced a range of reforms to make the Taxonomy more accessible, usable, and aligned with broader EU sustainability reporting rules.

Key changes include:

These updates aim to maintain the robustness of the framework while addressing widespread concerns about complexity and cost.

The EU Taxonomy's influence continues to grow, with financial institutions increasingly using it to screen investment portfolios and design green financial products. However, many companies still face challenges in interpreting the complex technical requirements, especially in sectors without fully defined screening criteria.

Looking ahead, the European Commission plans to:

Refine definitions and thresholds for transitional and enabling activities. Clearer guidance will help businesses identify and report these activities more accurately under the Taxonomy framework.

Explore expanding the Taxonomy to include social sustainability factors. These may cover areas such as labour rights, supply chain due diligence, and local community impact — helping build a more holistic sustainability framework.

Roll out additional digital tools and platforms to streamline reporting and automate data inputs. The goal is to reduce administrative burden, increase data accuracy, and support scalable compliance across companies.

Continue aligning the Taxonomy with other EU sustainability regulations. Ongoing efforts will further integrate the Taxonomy with frameworks like the CSRD and CSDDD, creating a more coherent EU sustainability reporting landscape.

While the EU Taxonomy is widely regarded as a landmark initiative for sustainable finance, its implementation has not been without challenges and criticism. Some of the key concerns relate to its complexity, political influence, and the practical difficulties faced by businesses trying to comply.

| Challenge | Description |

|---|---|

|

Complexity and Interpretation

|

The technical screening criteria are highly detailed and complex, making it difficult for companies, especially SMEs, to interpret and apply them consistently. This complexity often results in discrepancies in how businesses classify and report their sustainability efforts. |

|

Data Availability and Verification

|

Accurate sustainability reporting requires access to granular environmental performance data, which many companies struggle to collect. Smaller businesses often lack the resources to meet data demands, and there are limited standardised datasets available, increasing the risk of inconsistent reporting. |

|

Inclusion of Nuclear and Gas Energy

|

The inclusion of nuclear and natural gas under strict conditions has sparked significant criticism. While nuclear energy is low-carbon, concerns around radioactive waste management persist. Natural gas, although less polluting than coal, still emits substantial carbon, leading critics to argue its inclusion weakens the framework's climate integrity. |

|

Greenwashing Risks

|

Despite its rigorous criteria, the Taxonomy still leaves room for greenwashing. Companies may claim partial alignment even when only a small portion of their activities meet the sustainability requirements. The allowance for gas as a transitional fuel has also raised concerns that high-emission industries could continue under a “green” label. |

|

Global Alignment and Interoperability

|

While the EU Taxonomy sets a global benchmark, other regions (like the UK and China) are developing their own versions with varying thresholds and metrics. This fragmentation complicates cross-border investments and makes it harder for multinational corporations to ensure consistent sustainability reporting across regions. |

Following the adoption of the Omnibus Simplification Regulation in early 2025, the EU is now moving into the next phase of refining and operationalising its sustainable finance framework. The regulation brought in major simplifications to EU Taxonomy reporting - streamlined templates, clearer scope thresholds, and alignment with CSRD formats - all designed to reduce reporting burdens while preserving rigour.

These changes form part of a wider EU effort to simplify sustainability reporting across regulations, including the EU Taxonomy, CSRD, and CSDDD. This consolidation agenda was formally announced by Commission President Ursula von der Leyen in late 2024, responding to the Budapest Declaration's call to cut ESG reporting burdens by 25% by mid-2025.

Looking forward, the EU is expected to focus on:

The focus has shifted from drafting new obligations to ensuring that the framework is workable at scale, coherent across regulations, and practical for businesses of all sizes.

A: The EU Taxonomy is a classification system developed by the European Union that defines which economic activities can be considered as environmentally sustainable. The main goal of the EU Taxonomy is to guide investments towards activities that support the EU’s climate and environmental objectives.

A: The EU taxonomy is important as this common framework for sustainable finance helping investors, companies, and policymakers identify green activities. By standardizing definitions, the EU Taxonomy reduces “greenwashing” and ensures greater transparency in sustainability reporting.

A: Large companies already subject to the Non-Financial Reporting Directive (NFRD), and soon the Corporate Sustainability Reporting Directive (CSRD), must disclose how their activities align with the EU Taxonomy. In addition to this, financial market participants offering sustainable investment products are also required to comply.

A: Companies must disclose the share of their turnover, capital expenditures (CapEx), and operating expenditures (OpEx) that are associated with environmentally sustainable activities, as defined by the EU Taxonomy.

A: Greenly’s platform simplifies the process of reporting to the EU Taxonomy, such as by automating emissions and generating audit-ready disclosures. Furthermore, our experts also provide guidance to ensure compliance with both the EU Taxonomy and related frameworks like the CSRD.

Greenly offers expert support to help businesses navigate sustainability challenges, including compliance with the EU Taxonomy and other regulatory frameworks. Our carbon management solutions are designed to streamline sustainability reporting and drive meaningful progress toward emissions reduction.

Our Services Include:

By partnering with Greenly, companies can gain valuable insights into their sustainability performance, reduce emissions, and make informed decisions that contribute to a greener future. Get in touch with us today.