ESG / CSR

Industries

5 Best ESG Funds for Responsible Investors in 2024

Many people seek to invest as it can help them to achieve their financial goals quicker without additional effort, and more and more investors have grown interested in the benefits of ESG funds. This is because ESG funds can not only provide a good financial return, but it can help improve society and the current environmental circumstances.

What are ESG funds, why are they piquing the interest of investors, and what are the top five ESG funds to keep on the lookout for in 2024?

In this article, we'll explain the importance of ESG criteria, sustainable investing, mutual funds, passive ESG funds, ESG investors, and the importance of ESG mutual funds in your company's investment strategy.

What are ESG funds?

Compromises are made on a consistent basis for those who are determined to help reduce their environmental impact, but the great thing with ESG investing – is that no sacrifices need to be made.

💡 In fact, ESG funds have grown in popularity in conjunction with raising awareness on the importance of climate change, government interference, and societal problems. ESG funds are not only beneficial to society and the planet, but they have also proven to be a wise investment – with ESG funds set to be worth $53 trillion USD by 2025.

Investment objectives such as ESG funds are derived from the phrase ESG, most often referred to as ESG data. The ‘E’, ‘S’, ‘G’ in ESG represents, “Environmental, Social, and Governance” – which are known as the three crucial components that companies will use to calculate the environmental efforts and sustainability of their business. Just as ESG values are used when determining a company’s ESG data, they are used in ESG funds – where these same principles are applied to investments.

The main goal of investing in ESG funds is for investors to choose investment funds that will personally apply to their environmental, social, and governance values. Ultimately, ESG funds are more emotionally rewarding than typical investment funds – and are good for business, as many investors and companies are growing interested in sustainability.

ESG investing is often used interchangeably with socially responsible investing – but are they the same thing?

Is ESG investing the same as impact or socially responsible investing?

ESG investing has grown to become so popular that investing in ESG funds has grown a whopping 143% in the four years between 2016 and 2020.

💡 In fact, 25% of all sustainable investments incorporate the use of ESG funds into their investment models. Given ESG funds focus on environmental and societal improvement, or ESG principles, over a lucrative financial return, doesn’t that make them interchangeable with socially responsible investing and other corporate governance factors?

Socially responsible investing, also known as SRI – is a type of social investment that aims to represent fair social responsibility, and prioritize this over other financial gains to be had from the investment. SRI stands for, “sustainable, responsible, and impact” investing, which demonstrates the three core values of socially responsible investing.

👉 The main goal of socially responsible investing is to be aware of how investments can have a profound impact on society, as opposed to the ultimate goal being to acquire new monetary resources.

On the other hand, ESG funds are used by those who are determined to make a difference in all ESG factors – even if their ESG fund is focused on improving a singular component in ESG values.

In this sense investors or businesses that make use of ESG funds may appear more well-rounded than those who choose socially responsible investment, even though both present beneficial opportunities outside of the world of finance.

Comparison of ESG, Impact, and Socially Responsible Investing

| Criteria | ESG Investing | Impact Investing | Socially Responsible Investing (SRI) |

|---|---|---|---|

| Definition | Investments focusing on Environmental, Social, and Governance factors to ensure positive impact beyond financial returns. | Investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. | Investments that prioritize social responsibility and aim to have a positive impact on society, often at the expense of higher financial gains. |

| Main Goal | Improve ESG factors and promote sustainable practices. | Create a direct and measurable positive impact on social and environmental issues. | Promote ethical and socially responsible practices, with less emphasis on financial returns. |

| Investment Focus | Broad focus on improving all three ESG components (Environmental, Social, Governance). | Specific focus on achieving measurable impact in targeted areas (e.g., clean energy, poverty reduction). | Emphasis on ethical and responsible investment practices, often avoiding investments in certain industries (e.g., tobacco, firearms). |

| Popularity and Growth | ESG investing has grown 143% between 2016 and 2020, making up 25% of all sustainable investments. | Growing in popularity, especially among investors looking to make a tangible difference. | Established approach with steady growth, particularly among ethically-minded investors. |

| Financial Returns | Focus on long-term sustainability and stability, with potential for competitive financial returns. | Balances financial returns with measurable social/environmental impact. | Often prioritizes social impact over financial gains, which may lead to lower financial returns. |

In short, ESG funds are different from SRI investing as ESG funds can provide a better representation of a company’s environmental, social, and governance values – whereas socially responsible investing solely prioritizes the social aspects and affiliations of the investment project.

👉 Ultimately, both ESG funds and socially responsible investments value benefiting society over a large financial return.

How do ESG funds work?

Environmental

One of the values that an ESG fund can represent is the environment. This can include beneficial impacts such as conserving or protecting the environment, aiding in reducing emissions or improving air quality, improving energy efficiency, encouraging the use of natural resources and the preservation of large bodies of land, and improving waste management and the disposal of hazardous materials.

Social

The social component of ESG funds relates mostly to the relationship that businesses have with their employees, suppliers, and consumers. ESG funds helping to improve societal measures can include helping to improve labor laws, the impact of the business on the surrounding community, the safety of the production of goods, fair employment practices, and the services provided to employees such as health care, education, and accommodation.

Governance

ESG funds which seek to improve the standards for leadership, risk management, or the rights of active shareholders all refer to the governance factor in ESG funds. Projects and ESG funds that could help to improve the governance of a company include financial support towards fair business practices, aiding to acquire voting rights, promoting diversity, creating fair pay, and improving account and tax transparency.

If an investor seeks out an organization to invest in with one of these three principles remaining as the primary motivation for the investment – they are contributing to an ESG fund.

What are the benefits of investing in ESG funds?

It’s easy for many investors to jump to the conclusion that ESG funds won’t yield the same financial return as other investments, but the reality is that as the investment process and strategies with ESG funds continue to develop due to public interest – the more successful ESG funds are bound to be.

💡 Finding success with ESG funds requires investors to closely oversee the operations of their ESG funds to ensure it is the right investment for them.

However, if the selection process is done methodically – it could result in a lucrative long-term investment that benefits that planet and society.

Additional benefits of ESG funds and fixed income investments such as bonds, index funds, mutual funds, exchange traded funds, and more include:

- Improved risk management

- Build resilience to changes in emerging markets

- Better corporate performance for companies involved

- Making the most of your investment dollars to contribute to an improved ESG strategy

Think of ESG investing as being one of the first people to test out the Apple iPhone over a decade ago. Sure, it may have seemed odd to put such trust in a device that wasn’t used by the general public – but those initial users helped to develop the iPhone at the capacity that it exists at today. The same has happened, and will continue to happen, with ESG funds. As more investors become interested in ESG investing, the more research will be done to ensure the effectiveness of ESG funds.

👉 In addition to these benefits, ESG funds can also aid in rectifying energy efficiency, help to reduce emissions, encourage support within the targeted communities, improve transparency, and serve as a representation for fair business practices.

What are the Top 5 ESG funds in 2024?

iShares ESG Aware MSCI USA ETF

Investors interested in representing a peaceful society and seeking ESG funds may find this ESG fund especially personal and demonstrative of their values. iShare ESG Aware, holding large positions alongside Apple, Microsoft, and Tesla – follows the S&P 500 index, and restrains it from funding various firearms and substances such as nuclear weapons, tobacco, civilian firearms, thermal coal, and other various weapons. As iShare ESG Aware continues to perform well financially while protecting society, it remains as a top pick for our top ESG funds of 2024.

Vanguard FTSE Social Index Fund Admiral Shares

The Vanguard index ESG fund prohibits several industries from investing, such as alcohol, tobacco, fossil fuels, weapons, gambling, and nuclear power. In addition to this, companies interested in using this ESG fund must meet certain diversity criteria to apply – further demonstrating their sustainable values, which are very much in line with the Sustainable Development Goals established by the UNGC.

This ESG fund is best suited for those in the tech industry, as popular companies like Apple, Amazon, and Microsoft remain as the largest shareholders.

Calvert International Responsible Index Fund

This ESG fund is dedicated toward investmenting in large-cap companies that were not originally based in the United States. The largest shareholders include Roche and Nestle; as this ESG fund also specializes in limiting exposure to enterprises associated with alcohol, weapons, gambling, and animal testing. As an ESG portfolio with over 800 available stocks – Calvert International Responsible Index Fund makes for a good ESG fund for companies passionate about a cruelty-free world.

Pax Ellevate Global Women's Leadership Fund

Unlike the other ESG funds mentioned before, the Pax Ellevate Global Women’s Leadership Fund supports equal rights for women in the business world. This ESG fund accomplishes this by financially supporting and encouraging a broader board of gender diversity at various workplaces, enhanced leadership, and promoting fair pay, training, and hiring policies.

This makes for a great ESG portfolio for cosmetic companies to demonstrate their support towards equal rights for women – it’s no surprise that Estee Lauder is a top shareholder, in addition to Microsoft and Amazon.

Nuveen ESG Mid-Cap Growth ETF

This ETF is determined on assisting U.S. enterprises with mid-cap growth, and as an ESG fund on the rise with an almost 16% increase over the past five years – this ESG fund specifically focuses on information technology and healthcare. The Inflation Reduction Act of 2022 has revealed that improving healthcare in the U.S. is an important task for many, making this a great ESG fund for investors passionate about providing healthcare for all.

There are dozens more ESG portfolios to choose from – how can companies interested in ESG funds get started with their new sustainable investments?

How can companies invest in ESG funds?

The process for getting started with ESG funds is relatively similar for the processes between impact investing and socially responsible investing – the only difference is the sifting process necessary for ESG funds, as ESG investments should represent the values of the potential investors. This can either be done alone, or through the recruitment of a third-party – more often than not a robo-advisor.

Overall, ESG funds serve as a new, lucrative and simultaneously beneficial tool for investors to demonstrate their ESG values while still thriving in the world of investing. ESG investing can prove to be not only financially rewarding, but also a personal endeavor to rectify some of the environmental, societal, or governance issues currently present in today’s world.

Success is more fruitful when it is derived from intrinsic motivation, and given investors are already determined to see their money make a difference elsewhere beside burning a hole in their own pockets – ESG funds can prove to be an investment worthwhile for all.

What about Greenly?

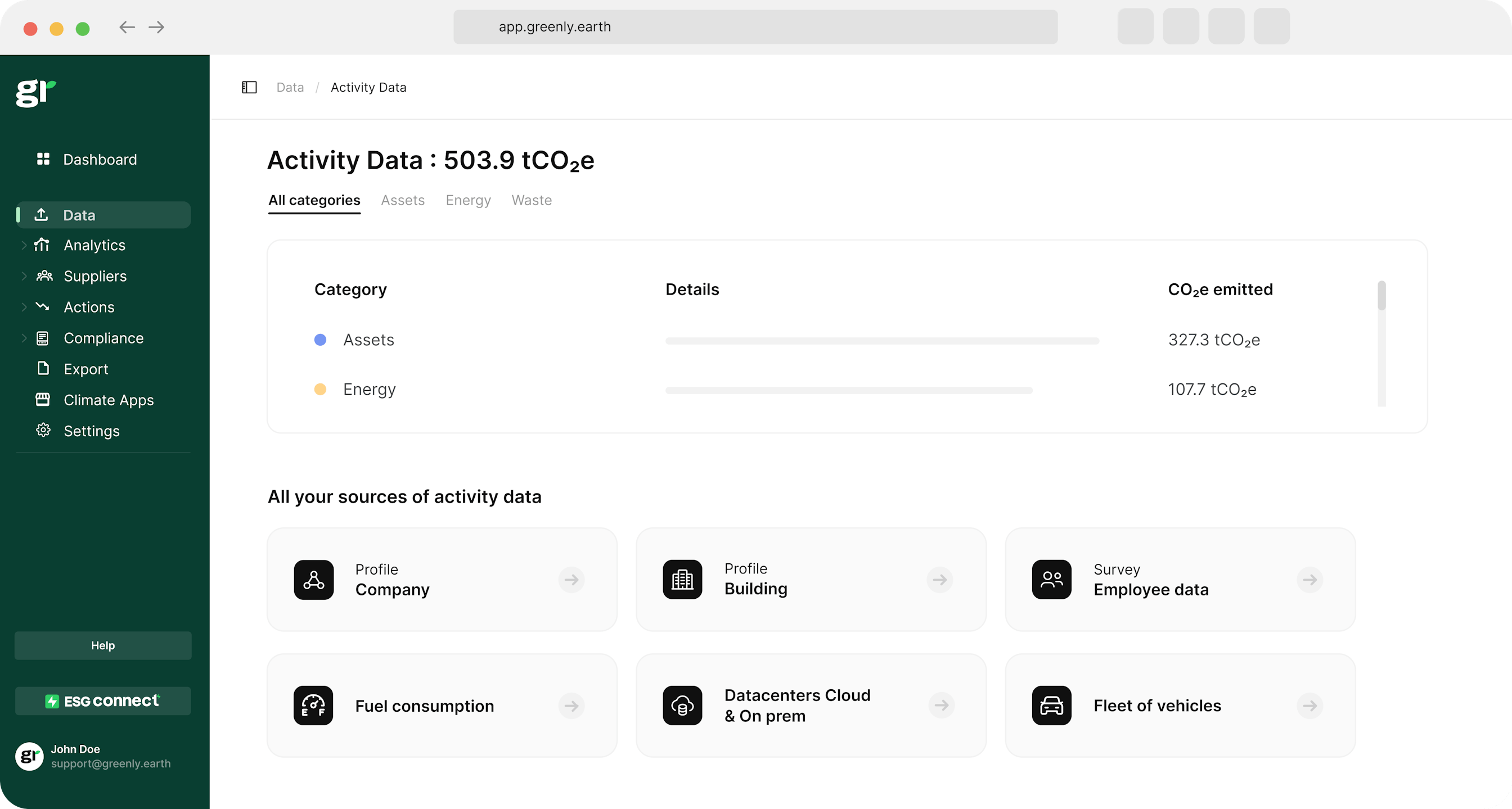

If reading this article about the 5 best ESG funds for responsible investors in 2023 has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.

Take the first step towards reducing your carbon footprint by requesting a free and non-binding demo with one of our experts today and finding the solution that best fits your business needs.