ESG / CSR

Industries

Impact Investing: All You Need to Know in 2025

The life we live today is expensive, and as inflation continues to rise faster than salaries can catch up – more and more people are learning the importance of investing, such as impact investing, particularly in the rapidly growing impact investing industry.

Impact investing represents a revolutionary approach to investing that has captured the attention of individuals, businesses, and global leaders alike for its unique dual-purpose strategy that allows for both financial returns and positive social and environmental benefits.

The impact investing market has experienced remarkable growth, with impact investing having reached a staggering 29% annual growth rate since 2020. Ultimately, impact investors actively seeking opportunities to align their portfolios with their values while achieving competitive returns. How can impact investing serve as a wise financial move for individuals, businesses, and institutional investors alike?

In this article, we will explore the impact investing industry, examine the measurable environmental benefits, analyze current trends in the impact investing market, and understand how impact investors actively seek opportunities that create positive change while simultaneously securing lucrative venture capital funds, equity investments, and more.

What is Impact Investing?

Impact investing, refers to a type of investment made across multiple asset classes, sectors, and regions. As stated by the Global Impact Investing Network, impacting investing can help to encourage positive environmental impact alongside ensuring investment capital gain.

Impact investments are investments made in attempts to create a quantifiable social and environmental impact in coordination with good financial return. Impact investments can be made in both developing and established markets, and focus on increasing the range of returns from below market to meet the current market rate. However, it is important to note that these potential returns with impact investment are contingent on the investors financial goals.

The flip cards below (move your cursor over to flip) will reveal just a few examples of impact investing:

As impact investments grow in popularity across the market, a newfound sense of capital is being extended to face global predicaments across multiple sectors – such as sustainable agriculture, sourcing renewable energy, overall conservation of value resources, healthcare, education, and providing basic resources and housing for developing countries and communities.

What is the Main Goal of the Impact Investing Market?

It’s clear that impact investing has a positive impact on a multitude of social and environmental issues, but what is the ultimate goal of impact investing?

The main goal of impact investing is to create both tangible, financially lucrative return while also benefiting social and environmental sectors.

Here's a breakdown of some of the main goals of impact investing in action:

- Mission Related Investment: Impact investing aims to generate financial returns while also delivering social and environmental benefits. Therefore, impact investing demonstrate how investors don't have to choose between profit and purpose, and that generating financial returns can go hand-in-hand with meaningful societal change.

- Address Social Injustices: As impact investing works to tackle critical social challenges through strategic capital deployment, asset owners are increasingly directing funds toward solving pressing issues such as affordable housing shortages, healthcare access gaps, and educational inequities in lower income communities for beneficial social purposes.

- Boost Emerging Markets: Impact investing is growing rapidly and unlocking economic opportunities in emerging markets, which can allow capital to create significant momentum in development impact while accessing high-growth investment opportunities that traditional markets may overlook – such as with clean energy, social enterprises, or private funds for renewable energy development.

- Promote Sustainable Business Practices: As impact assets and investing prioritize organizations seeking to improve achieve various social and environmental goals, such as with small businesses or private foundations which may be overlooked by traditional investors – impact investing allows businesses the chance to contribute to long-term environmental change while maintaining a competitive edge.

- Inclusive & Diverse Economic Systems: Asset owners committed to impact investing are dedicated to finding new opportunities to promote economic inclusion, support minority-owned businesses, and create pathways to expand opportunity via sustainable finance.

How Does Impact Investing Work?

Impact investing works based on several core values, missions, and principles: such as intentionality, strong management skills, and seeking to aid development finance institutions for overall growth of the impact investment industry.

This is a primary key component of impact investing, seeing as if there is no extrinsic, beneficial intention behind the investment – it ultimately cannot be constituted as an impact investment as it won’t have an “impact” on any other sector beside the economic one.

Here's a breakdown of the steps involved in impact investing:

- Intentions Behind the Investment: Prior to choosing between mutual funds, exchange traded funds, or hedge funds – it is first paramount for the the investor to define their intentions behind their desire to create a positive social or environmental change through their investments.

- Define Expectations on Financial Return: Next, the investor should set realistic expectations on financial return. Similar to all other investments, impact investments are able to generate a reasonable financial return – often, at least at minimum, a return of capital. An investor interested in impact investing should decide their range of return expectations and asset classes. In other words, anyone using impact investments should be prepared to make risk-adjusted moves for financial gain when necessary – and consider fixed income, venture capital, and private equity before and while using impact investments.

- Determine Effective Measurement & Management: Lastly, it’s imperative that the owner of the impact investment is committed to measuring the data and sharing these numerical reports with others on the environmental or social progress that their investment is creating. This is another quintessential part of impact investing, which aligns with other ESG values such as transparency.

Individual and Institutional Investors: The Importance of Following These Steps

It is important for anyone interested in impact investing to share the social and environmental improvements made through impact investing, as this helps to establish transparency and responsibility in investing. This allows us to create, promote, and maintain sustainable and socially ethical business practices.

Remember, an investor’s method to measure their social or environmental impact is contingent on their goals and capabilities.

However, most impact investing measurements should include:

- creating and monitoring the social and environmental objectives related to the investor of the impact fund;

- allowing for performance goals related to the original motives of the impact investment to strive for improvement whenever possible;

- the continuous managing and adjusting of the performance of the impact investment;

- and to report the social and environmental performance to other stakeholders involved in the impact investment.

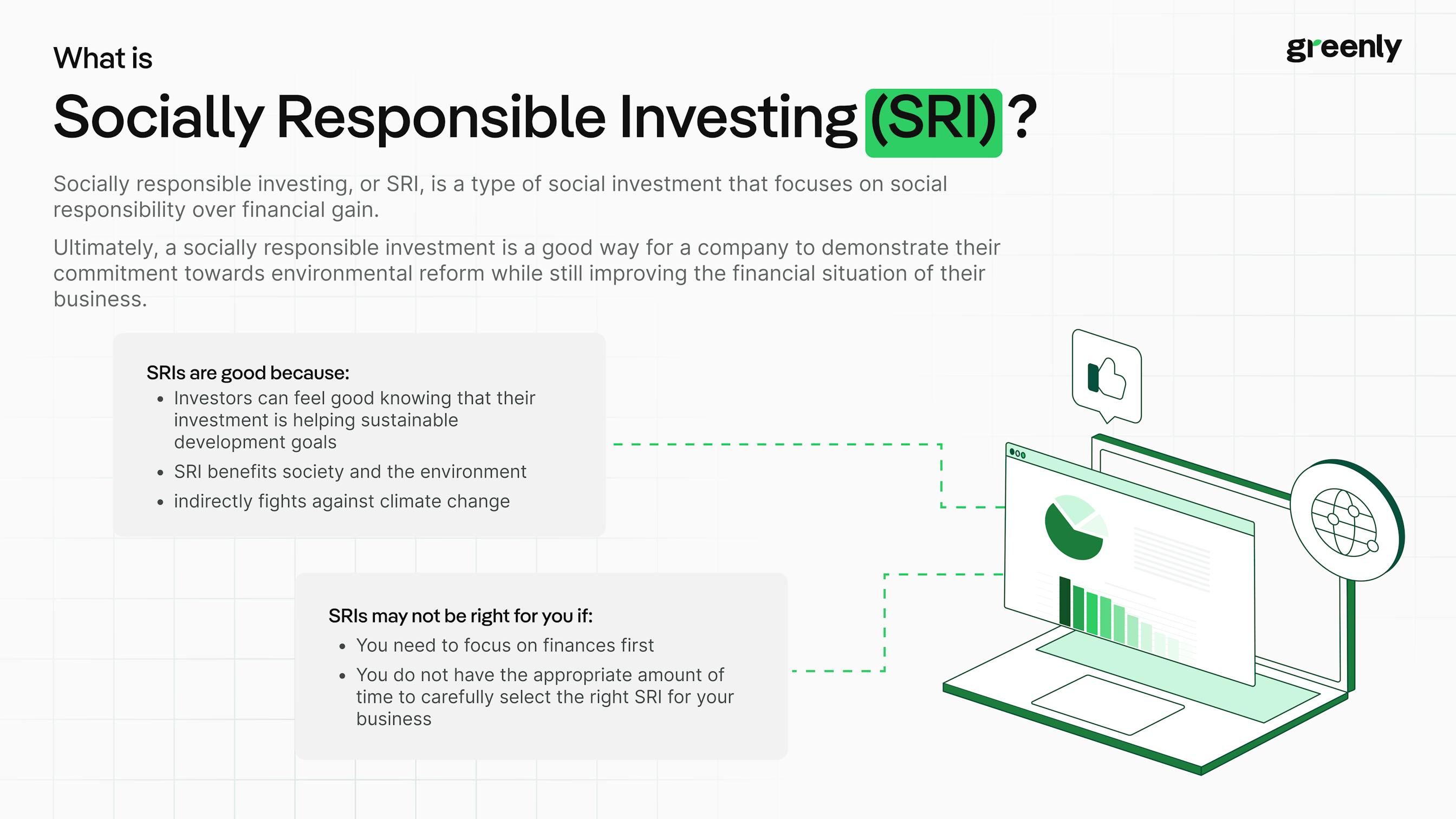

What is the Difference Between Impact Investing and Socially Responsible Investing?

Socially responsible investing refers to a method of investing where a company or individual chooses or discounts a potential investment through environmental credentials, such as an ESG score or a company obtaining an ISO 14001.

Impact investing, on the other hand – is when a business or organization seeks to contribute to a social cause through their investments.

Both socially responsible investing and impact investing are selective and strive to carefully create a portfolio that does not only pertain to economic gain, with the ideal to yield positive results across other sectors – such as social issues and environmental difficulties, like climate change.

The battle cards below will further depict the differences between impact investing and socially responsible investing:

Why Choose Impact Investing?

Impact investing gives new and improved meaning to philanthropy – by demonstrating that it is possible to benefit both social and environmental issues whilst still contributing to personal, financial gain.

Traditional philanthropy implies that projects that provoke substantial change to social and environmental sectors can only be made by superstars or millionaires that have superfluous cash laying around.

Conventional investment strategies typically prioritize the values of achieving measurable financial returns and financial gain above all else, but impact investing defies both paradigms.

Impact Investing: A Method Gaining Value in 2025

According to the Global Impact Investing Network (GIIN), the impact investing market reached over $1.164 trillion in assets under management as of 2022, demonstrating significant institutional confidence in this dual-purpose approach.

The market of impact investing provides a wide variety of viable opportunities for investors to contribute to social and environmental issues through investments whilst simultaneously working towards a financial return.

The drop down sections below will share some of the ways investors may struggle to balance the need for social and environmental reform with investing, and how impact investing could serve as a viable solution:

💸 Ethical vs. Profitable Dilemma

Investors often worry that doing good means sacrificing returns. Impact investing proves this isn’t always the case, offering market-rate or even above-market returns in sectors like clean energy or inclusive fintech.

📊 Lack of Measurable Impact

Many traditional ESG funds don’t show clear results. Impact investing, by contrast, requires measurable social or environmental outcomes using frameworks like IRIS+ or GIIN metrics.

📉 Greenwashing Concerns

Some funds are labeled "sustainable" without accountability. Impact investing ensures transparency and accountability, with rigorous standards and vetting of where the money actually goes.

⚖️ Aligning Values with Financial Tools

It can be hard to find investments that reflect personal values. Impact investing gives individuals and institutions more control to support causes that truly matter to them—while still growing their portfolio.

Recent Studies in Impact Investing

Research shows that more and more investors are growing interested in the benefits of impact investments. Leading institutional investors including banks, pension funds, and other various financial institutions and asset managers are increasingly able to offer investment opportunities to individuals and businesses alike seeking to align their portfolios with environmental or social causes.

Studies by McKinsey & Company, such as in A Closer Look at Impact Investing, indicate that impact investments have historically delivered competitive financial returns while generating measurable positive outcomes, which paints impact investing in a positive light as we move toward the future – where investors may continue to struggle to align their investment strategies with global environmental goals.

Furthermore, impact investments allow the business or individual to support more assets that benefit other causes whilst still improving their own finances. Government investors would also appreciate impact investments, as it is a way for a company to delineate their commitment towards sustainability and improving the environment.

In fact, an article from Apiro demonstrate how ESG investments can allow for new opportunities for U.S. companies to work directly with the Department of Defense, which reveals the growing interest in ESG factors in federal procurement decisions practices. Therefore, the government would be more likely to invest or provide future funding to the business or organization currently using impact investing.

Are Impact Investments Financially Lucrative?

Impact investments are good for social and environmental issues, but if you're wondering if impact investments are good for generating a noticeable profit – the answer is yes.

According to the Global Impact Investing Network’s 2020 Annual Impact Investor survey in 2019, 68% of people partaking in impact investments said that their impact investments helped them meet their financial goals – and 20% reported that their impact investments helped them exceed their financial goals.

These performance metrics demonstrate that impact investing can provide competitive returns while simultaneously working to achieve impact related to its core mission of positive social and environmental change.

What Are the Challenges of Impact Investing?

However, just like any investment strategy – impact investing does carry inherent risks that investors must carefully consider.

Research indicates that sustainable investments sustainable investments usually offer lower risk than traditional investments. While this stability is generally good across all ESG sectors, it can mean that the potential for immediate and exceptional short-term financial returns may be lower than traditional "high-risk, high-reward" investments.

However, given the numerous documented advantages impact investing, such as implementing a proven sustainable business practices while also benefiting social and environmental causes in conjunction with financial gain – it’s hard to see a reason to not remain interested in impact investing. the long-term value proposition makes it more appealing or most investors to remain interested in impact investing.

The chart below will demonstrate some of the challenges of impact investing and how to overcome these obstacles:

📉 Challenge: Lack of Measurable Outcomes

Investors often struggle to assess whether their money is truly making a difference.

✅ Solution:Use standardized frameworks like IRIS+ or GIIRS to track and verify real impact results.

⚠️ Challenge: Greenwashing & Mislabeling

Some funds market themselves as sustainable without meeting rigorous standards.

✅ Solution:Work with verified impact funds or third-party-certified investment platforms.

💲 Challenge: Perceived Return Trade-Off

Investors may believe that values-based investing means lower financial returns.

✅ Solution:Explore funds that offer both impact and competitive returns—particularly in renewable energy, health tech, and microfinance.

🔍 Challenge: Limited Transparency

It's not always clear how investments are used or who ultimately benefits.

✅ Solution:Choose investments with public reporting and detailed disclosure policies.

Does Impact Investing Help the Environment?

Impact investing isn’t just financially beneficial to your company’s economic performance, but it also serves as strategic and measurable way to help the environment.

Because impact investments are designed to improve a company’s contribution to environmental, social and corporate governance (ESG) metrics, impact investments provide quantifiable path to address social issues created by climate change without doing any additional work. This is because impact investing allows for targeted capital allocation rather than requiring separate sustainability initiatives, in a sense, "killing two birds with one stone".

The dual-beneficial structure of impact investing ultimately promotes more sustainable business habits, improves operational efficiencies, and generates positive environmental outcomes– making it an investment approach which maximizes both financial and environmental returns.

The drop down section below will reveal some of the ways impact investing helps the environment:

🌿 Funds Clean Energy Projects

Impact investing channels capital into solar, wind, and battery storage—reducing reliance on fossil fuels and lowering greenhouse gas emissions.

🌎 Supports Conservation Efforts

Investments in biodiversity, reforestation, and sustainable land use protect natural ecosystems and improve global carbon sinks.

🏭 Reduces Industrial Pollution

By backing green tech and low-impact manufacturing, investors help reduce emissions and toxic waste in industrial sectors.

🚰 Promotes Sustainable Resource Use

From water-saving agriculture to waste-reduction startups, impact capital fuels innovation that protects the planet’s most vital resources.

Impact Investing: How It Can Promote Business Growth

Impact investing is extremely good for the future of your business. This is because impact investing not only directly aids a worthy social or environmental cause, but it does so while also financially benefiting your own business or company.

Long story short – impact investing is a win-win situation for everyone involved. Future investors, customers, and employees alike will be glad to contribute to a product or service that seeks to help other sectors. As climate change continues to worsen the state of our planet, businesses that seek nothing more than financial gain are slowly going out of style.

Examples of Impact Investing

There are quite a few examples of impact investments from well known companies and organizations that you may not have known of otherwise.

The Rockefeller Foundation

For instance, The Rockefeller Foundation not only provides grants – but invests in projects seeking social improvement. The Rockefeller Foundation has invested in the Disability Opportunity Fund, which aids financial projects that seek to provide housing, education and job training for anyone with disabilities. This serves as an example of impact investing as the Rockefeller Foundation is financially benefiting from the investment while also aiding positive social change.

Big-Time U.S. Banks

In addition to this, popular banks in the United States like Bank of America, Capital One, and Wells Fargo have invested in Craft3 – which is a non-profit organization that lends money to other non-profits or start-up businesses to help them get their feet off the ground.

These well known American banks investing in future businesses is not only financially beneficial for themselves, but helps other companies establish themselves at the same time – as this can inspire individual investors to incorporate measurable social and environmental impacts into their investment strategies.

Individual Impact Investing

If you're an individual interested in impact investing, you can recruit a robo-advisor that specializes in ESG investing for personalized financial guidance, or research ESG-friendly investments on your own through reputable online platforms.

Impact investing for individuals comes in many forms, including ESG funds, social impact bonds, and new projects focused on gender equality and clean energy initiatives.

Many platforms now offer recoverable grants and blended finance options, helping mitigate the negative effects of market volatility while ensuring your investment creates positive outcomes. If you're looking for a simple starting point, established ESG mutual funds provides a simple entry point before exploring more direct investment opportunities.

How Can You Start Impact Investing?

You don’t have to be a part of a big organization or CEO of an already financially lucrative business to take part in impact investing.

If you’re interested in getting started with impact investing, here are a few ways to get the ball rolling.

Assess Your Company's Most Important Values

The paramount question to pose any organization interest in impact investing is this: what are the issues you care about?

If you’re passionate about sustainable energy, you’ll want to ensure you invest in assets that cater to that. If community or faith is a shared value in your organization, maybe faith based investors are the right choice.

Deciding where you want to create an impact can help you narrow down your investment choices later.

Decide If You Need Third-Party Assistance

Impact investments can be done alone, but sometimes they can yield more success if you seek third-party assistance. It’s easy, too – because you can ask for help with impact investments with robot-advisors. However, keep in mind the potential risks of utilizing robo-advisors on the environment and give they do not have the same experience as real-life fund managers.

Robot-advisors can help create personalized portfolios for impact investing, so you or your company can find solace in positively contributing to the social or environmental areas most meaningful to you.

If you choose to work with a robot-advisor, no other steps will be necessary. However, if you choose to continue on your own – it will be necessary to open a brokerage account, so that you can buy and sell various assets to be a part of your impact investing portfolio.

Seek Potential Impact Investments

It is important to seek investments or financial partnerships with entities that have excellent ESG scores. From here, it is important to strive to gradually increase your impact on each investment to ensure both continued financial growth, and improvement in the desired social or environmental sector.

Overall, there are many types of investing that strive to promote sustainable growth – but it is clear that impact investing is one of the most beneficial methods of investing an individual or business could choose to implement more sustainable business measures and simultaneously promote the importance of ESG values.

What About Greenly?

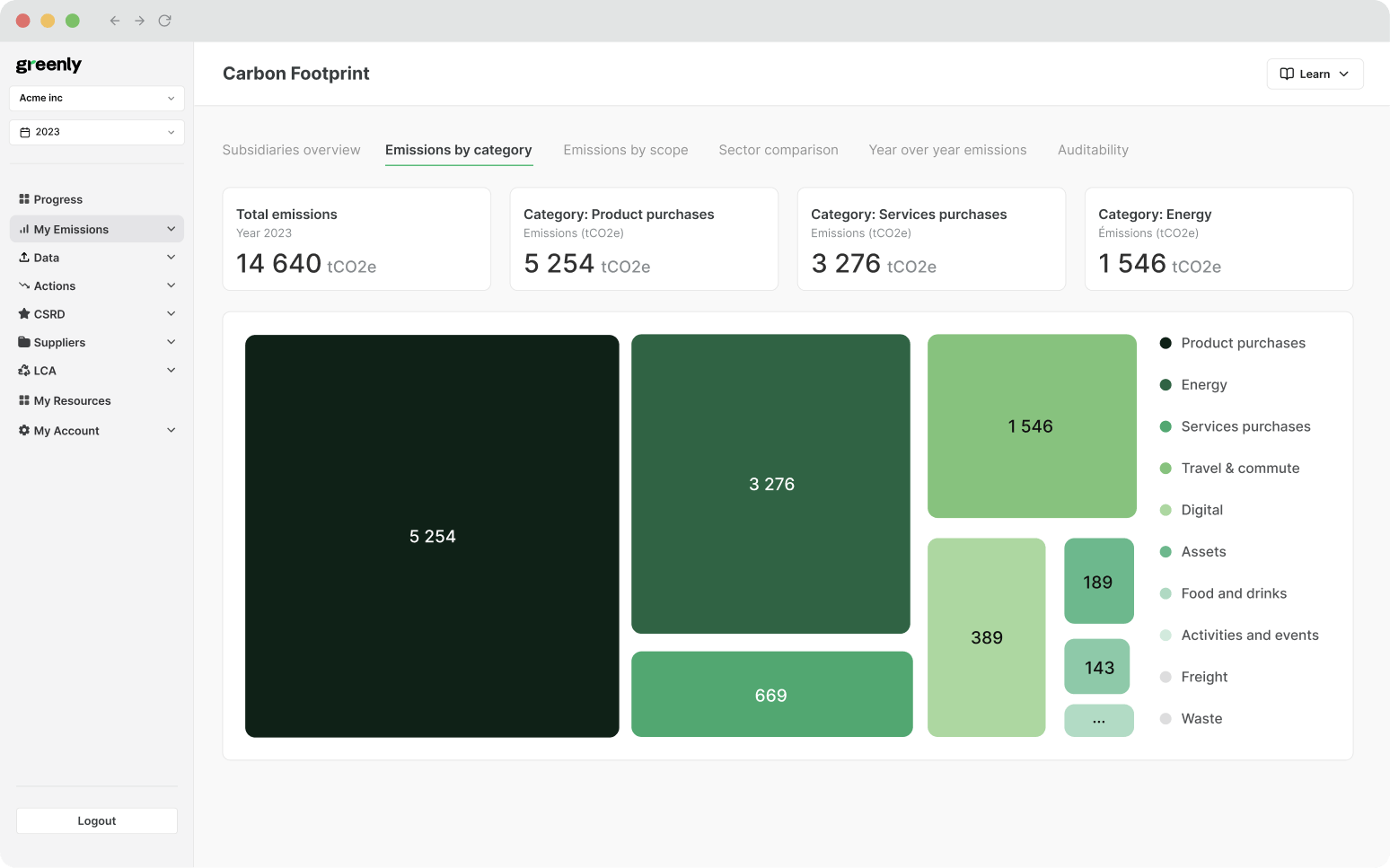

If reading this article about impact investing in 2025 has made you interested in reducing your carbon emission to further fight against climate change – Greenly can help you!

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.