Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

Sustainability reporting has become a critical part of corporate transparency, with businesses facing increasing pressure from regulators, investors, and stakeholders to disclose their environmental and social impacts. In the EU, the Corporate Sustainability Reporting Directive (CSRD) has introduced a new framework to standardise sustainability disclosures, requiring companies to report under the European Sustainability Reporting Standards (ESRS).

At the heart of this framework is ESRS 1, which lays down the fundamental principles that govern all sustainability disclosures under the CSRD. Unlike sector-specific or topical standards, ESRS 1 establishes overarching guidelines for companies, ensuring consistency, reliability, and comparability in sustainability reporting. From double materiality to value chain disclosures, ESRS 1 defines how businesses should assess, structure, and communicate their sustainability-related information.

👉 In this article, we’ll break down what ESRS 1 covers, why it matters, and the key steps businesses need to take to align with its requirements.

The European Sustainability Reporting Standards (ESRS) are the EU’s framework for corporate sustainability reporting under the Corporate Sustainability Reporting Directive (CSRD). These standards aim to bring clarity, consistency, and comparability to how companies disclose their sustainability performance.

ESRS 1 covers general requirements, it serves as the foundation for all ESRS standards, establishing the core principles that companies must follow when preparing their sustainability reports. Unlike the sector-specific or topic-specific ESRS standards (such as those focused on climate change, biodiversity, or social issues), ESRS 1 does not introduce new disclosure requirements. Instead, it provides structural guidance on how companies should approach their reporting obligations, ensuring that all disclosures are comparable, relevant, and meaningful for stakeholders.

ESRS 1 lays out general principles that companies must apply across all aspects of their sustainability reporting. These include:

The CSRD expands the scope and depth of sustainability reporting for EU companies, replacing the Non-Financial Reporting Directive (NFRD). Under the CSRD, thousands more companies - including large, listed, and non-EU firms operating in the EU - are now subject to mandatory sustainability disclosures.

Within this framework, ESRS 1 acts as the universal foundation that applies to all companies, regardless of their industry or specific sustainability focus. Other topical standards (such as ESRS E1 for climate change) and sector-specific standards build upon ESRS 1’s general principles, providing additional guidance for different industries and ESG topics.

By establishing clear and standardised reporting principles, ESRS 1 ensures that sustainability disclosures across companies are consistent, comparable, and useful for investors, regulators, and other stakeholders.

As sustainability reporting becomes a core requirement for businesses operating in the EU, ESRS 1 plays a critical role in ensuring transparency, consistency, and reliability in corporate sustainability disclosures. But why does this standard matter, and what impact does it have on companies and stakeholders?

ESRS 1 establishes clear and structured guidelines for sustainability disclosures, preventing companies from selectively reporting on ESG issues. By setting universal reporting principles, it ensures that businesses cannot engage in greenwashing - misrepresenting their sustainability efforts or omitting material impacts.

For investors and stakeholders, this transparency is essential. It allows them to compare companies on a like-for-like basis, assess sustainability risks, and make informed decisions about which businesses align with their financial and ethical priorities.

Under the Corporate Sustainability Reporting Directive (CSRD), thousands of companies - including non-EU firms with significant operations in the EU - are required to disclose sustainability data in accordance with ESRS.

ESRS 1 ensures that all reporting entities follow a standardised framework, making sustainability disclosures comparable across industries and markets. Companies that fail to align with ESRS 1 risk non-compliance, reputational damage, and potential penalties.

The EU’s ESRS framework does not exist in isolation - it is designed to align with other major sustainability reporting standards, such as:

By aligning with these international frameworks, ESRS 1 helps businesses streamline their sustainability reporting and reduce the reporting burden, particularly for multinational corporations that must comply with multiple regulatory regimes.

Investors are increasingly integrating ESG factors into their decision-making processes, with many requiring companies to demonstrate measurable progress on sustainability goals. ESRS 1 provides investors with a clear, structured framework to assess how sustainability issues impact financial performance, helping them allocate capital more effectively.

Beyond investors, banks, insurers, and other financial institutions also use sustainability disclosures to assess climate-related financial risks when determining lending and investment policies. Companies that align with ESRS 1 can benefit from better financing opportunities and lower capital costs.

Sustainability is no longer just about compliance - it is a strategic necessity for businesses looking to future-proof their operations. Companies that integrate ESRS 1 principles into their sustainability strategies can:

By adopting a proactive approach to sustainability reporting, businesses can stay ahead of regulatory changes while also improving their long-term financial and environmental performance.

ESRS 1 outlines the general principles and guidelines that companies must follow when preparing their sustainability reports under the Corporate Sustainability Reporting Directive. While it does not introduce specific disclosure obligations, it establishes the fundamental reporting concepts that apply across all ESRS standards. Below are the core ESRS 1 requirements that businesses need to understand and implement.

One of the most significant principles in ESRS 1 is double materiality, which requires companies to assess and disclose sustainability information from two perspectives:

This means companies must report on ESG factors even if they do not pose a direct financial risk - as long as they have a significant impact on people or the environment.

“ESRS 1 requires businesses to conduct a materiality assessment, identifying which sustainability issues are relevant based on both financial and impact perspectives. This approach ensures comprehensive and meaningful reporting, helping stakeholders understand a company’s true sustainability footprint.”

ESRS 1 requires companies to assess and disclose sustainability impacts across their entire value chain, not just their own operations. This means businesses must report on both upstream and downstream activities, including:

This requirement poses significant challenges, as companies often lack full visibility into their supply chains. However, ESRS 1 emphasises that businesses must make reasonable efforts to gather data and disclose any limitations transparently.

To ensure consistency, ESRS 1 aligns sustainability reporting with financial reporting boundaries. This means companies must:

By following these principles, ESRS 1 ensures that sustainability disclosures are integrated into corporate reporting, making it easier for investors and regulators to assess ESG risks.

Unlike traditional financial reporting, sustainability reporting requires companies to consider long-term risks and opportunities. ESRS 1 mandates that businesses:

This ensures that sustainability commitments are credible and measurable, rather than vague long-term aspirations.

One of the key objectives of ESRS 1 is to bridge the gap between financial and sustainability reporting. This means that companies must:

If a company discloses climate-related risks under ESRS E1 (Climate Change), those risks should also be reflected in financial statements (eg. asset impairments due to extreme weather events). By enforcing this connectivity, ESRS 1 ensures that sustainability reporting is not just a PR exercise, but a core part of corporate risk management and financial decision-making.

To maintain trust and credibility, ESRS 1 requires companies to ensure data quality and reliability in their sustainability reports. This includes:

Companies are also encouraged to use external assurance for their sustainability disclosures, similar to financial audits, to enhance stakeholder confidence. By setting high standards for data accuracy and transparency, ESRS 1 strengthens the credibility and usefulness of sustainability reporting.

Key principles of ESRS 1:

| Requirement | Description | Why it matters |

|---|---|---|

| Double materiality | Assess and disclose both financial materiality (impact on financial performance) and impact materiality (effects on society/environment). | Ensures comprehensive reporting, capturing all significant ESG issues. |

| Value chain reporting | Report on upstream and downstream impacts, including suppliers, logistics, product use, and end-of-life disposal. | Encourages transparency beyond direct operations, highlighting full ESG impact. |

| Connectivity with financial reporting | Integrate ESG data with financial statements to show clear links between sustainability risks/opportunities and financial health. | Bridges sustainability and financial strategies for holistic reporting. |

| Forward-looking disclosures | Provide historical data, future targets, and scenario analysis for sustainability risks and opportunities. | Helps stakeholders assess long-term plans and credibility of commitments. |

| Data quality and reliability | Ensure ESG data is verifiable, neutral, and aligned with high-quality reporting standards, similar to financial statements. | Builds trust and credibility among investors and stakeholders. |

| Reporting boundaries | Align ESG reporting with financial boundaries, including subsidiaries and joint ventures. | Ensures consistency and comparability across all corporate disclosures. |

While ESRS 1 provides a clear framework for sustainability reporting, many companies face significant challenges when it comes to practical implementation. From navigating complex data collection to aligning with regulatory requirements, compliance with ESRS 1 can be resource-intensive, especially for businesses with global supply chains and diverse operational footprints.

Here are some of the key challenges companies encounter when implementing ESRS 1.

One of the most complex requirements under ESRS 1 is the double materiality assessment, which requires companies to evaluate both:

Failing to properly conduct a double materiality assessment could result in incomplete or non-compliant reports, or even regulatory scrutiny.

ESRS 1 requires companies to report on their entire value chain, meaning businesses must track sustainability impacts beyond their direct operations. This includes:

To overcome this challenge, companies need to establish supplier ESG reporting requirements and invest in technology that enhances value chain visibility.

Unlike financial reporting, which follows well-established accounting rules, sustainability reporting under ESRS 1 requires companies to collect and verify ESG data, which is often unstructured, scattered, or estimated.

To address this, businesses can implement robust ESG data management systems and consider third-party audits to enhance credibility.

ESRS 1 emphasises connectivity between sustainability and financial reporting, requiring companies to ensure that ESG factors are linked to financial risks, costs, and strategic decisions.

Businesses should bridge the gap between finance and sustainability teams by implementing cross-functional ESG reporting processes.

For many companies, particularly small and mid-sized enterprises (SMEs), implementing ESRS 1 comes with significant costs. These may include:

To manage these challenges, businesses should leverage ESG reporting platforms and explore partnerships with sustainability experts to streamline compliance. Companies like Greenly can help streamline the process.

Although ESRS 1 provides a structured framework, the broader regulatory landscape is still evolving. The EU is working on additional sector-specific ESRS standards, and companies will need to adjust their reporting practices accordingly.

To stay ahead, businesses should build flexible ESG reporting systems that can adapt to future regulatory changes.

Despite these hurdles, companies that proactively implement ESRS 1 can gain a competitive advantage by:

By taking a strategic and proactive approach, businesses can streamline compliance with ESRS 1 while also leveraging sustainability reporting as a tool for growth and value creation.

Complying with ESRS 1 requires businesses to adopt a structured, proactive approach to sustainability reporting. Given the complexities involved, such as double materiality assessments, value chain transparency, and data verification, companies should begin preparing well in advance to ensure smooth implementation.

Here are some steps businesses can take to align with ESRS 1 requirements.

Since ESRS 1 mandates a double materiality approach, companies must identify and prioritise both financial and impact materiality factors relevant to their operations.

How to prepare:

To meet ESRS 1’s value chain reporting requirements, companies must map their supply chains and gather reliable ESG data from suppliers.

How to prepare:

ESRS 1 requires sustainability data to be integrated into financial statements. This means companies must harmonise financial and non-financial disclosures.

How to prepare:

Sustainability reporting under ESRS 1 is not just a compliance exercise, it requires company-wide engagement.

How to prepare:

As the EU introduces mandatory sustainability audits, companies should prepare for external verification of ESG data.

How to prepare:

Ensuring data accuracy and reliability is a major challenge under ESRS 1. Companies must establish robust data collection processes to generate verifiable, high-quality ESG disclosures. Without a structured approach, businesses risk inconsistent data, compliance issues, and stakeholder distrust.

How to prepare:

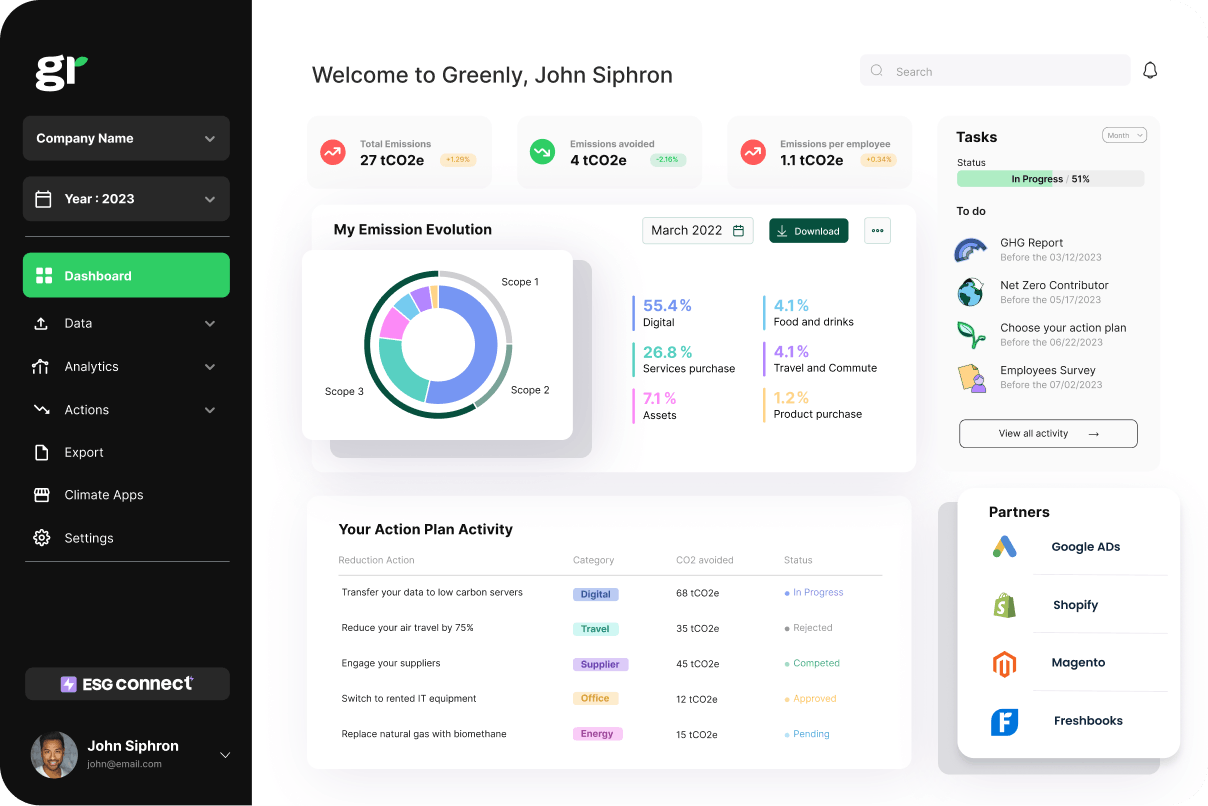

💡 How Greenly can help: Greenly provides a comprehensive ESG reporting platform that enables companies to track, analyse, and verify their emissions data in alignment with ESRS 1 requirements. By leveraging automated data collection and expert insights, businesses can streamline compliance and ensure audit-ready sustainability disclosures.

Complying with ESRS 1 is a complex but necessary step for companies operating in the EU. By taking a proactive approach - investing in data management, value chain transparency, and stakeholder engagement - businesses can not only meet regulatory requirements but also gain a competitive advantage through enhanced sustainability performance.

For businesses navigating ESRS 1 compliance under the Corporate Sustainability Reporting Directive (CSRD), Greenly provides a dedicated CSRD platform designed to simplify reporting, automate data collection, and ensure audit readiness. With a combination of cutting-edge technology and expert guidance, Greenly streamlines the CSRD reporting process, from double materiality assessments to regulatory-compliant report generation.

Discover a Dedicated CSRD Reporting Platform:

With Greenly’s specialised CSRD tools, businesses can streamline their ESRS compliance and enhance the credibility of their sustainability disclosures. Get in touch with us today to find out more.