Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

Once, financial returns were the sole focus of investment decisions. Now, ESG investing prioritises strategies that deliver both financial performance and positive societal impact, reflecting a growing demand for more responsible and sustainable investment practices.

What exactly is ESG investing? Why has it gained so much momentum? And what makes it such a compelling choice for investors today?

ESG investing refers to an investment strategy that incorporates environmental, social, and governance factors into decision-making processes.

This approach assesses a company's environmental impact, its treatment of employees and communities, and the strength of its leadership and ethics.

The term "ESG" refers to environmental, social, and governance performance - key factors that, alongside profitability, reflect a company’s overall impact on society. ESG investing recognises that businesses must balance these diverse priorities to ensure long-term sustainability and success.

By incorporating ESG factors into their decision-making, investors go beyond traditional financial analysis. They assess a company’s environmental footprint, social responsibility, and governance practices, enabling them to align investments with their personal or organisational values while contributing to meaningful societal change.

The rise of ESG investing has also driven greater corporate transparency and accountability.

To attract ESG-conscious investors, companies are increasingly disclosing detailed information about their environmental impact, social initiatives, and governance structures. This heightened transparency builds trust, encourages responsible practices, and strengthens the relationship between investors and the companies they support.

Often used interchangeably with terms like sustainable investing, impact investing, socially responsible investing, and ethical investing, ESG investing reflects a shared commitment to sustainable development and responsible business practices.

These approaches collectively fall under the broader umbrella of responsible investment, helping investors drive meaningful change while pursuing competitive financial returns.

Unlike short-term profit-focused approaches that often harm the environment or society, ESG investing prioritises long-term value creation. The aim is to help businesses thrive while safeguarding the natural resources and human capital they depend on.

Well-known ESG frameworks include CDP, the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-related Financial Disclosures (TCFD). These frameworks provide guidelines for measuring and reporting ESG performance, while annual corporate social responsibility (CSR) reports help investors compare businesses on key metrics.

To evaluate companies, ESG investors often rely on indices such as the Dow Jones Sustainability Index (DJSI), Morgan Stanley Capital International (MSCI), FTSE4Good, and ISS ESG Solutions, which aggregate and analyse ESG ratings.

Investors can also disclose their own sustainability efforts by aligning with the United Nations’ Principles for Responsible Investing (PRI), introduced in 2006. With over 2,000 signatories worldwide, the PRI offers a recognised set of ethical investment guidelines.

Here is a small summary of ESG frameworks:

| Framework | Focus | Relevance |

|---|---|---|

| CDP | Climate change, water security, deforestation | Helps companies disclose environmental data and track progress |

| SASB | Industry-specific ESG standards | Provides sector-based benchmarks for sustainability performance |

| GRI | Broad ESG reporting | Encourages transparency across all ESG factors, widely adopted globally |

| TCFD | Climate-related financial disclosures | Assists companies in aligning with climate-related risk and opportunity reporting |

In April 2022, the UK introduced mandatory ESG disclosure regulations (The Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022 and The Limited Liability Partnerships (Climate-related Financial Disclosure) Regulations 2022), requiring certain companies to include climate-related financial disclosures in their strategic reports.

These regulations apply to:

These regulations extend beyond major companies and financial institutions to include numerous businesses within their supply chains, emphasising the importance of initiating ESG reporting regardless of direct impact.

In 2024, the UK government published an implementation update on Sustainability Disclosure Requirements (SDR), outlining plans to build on global best practices and leading standards to support the UK's ambition to become the world's first Net Zero Aligned Financial Centre.

The Non-Financial Reporting Directive (NFRD) previously required approximately 11,000 large companies in the EU to disclose ESG information. In January 2023, the Corporate Sustainability Reporting Directive (CSRD) replaced the NFRD, expanding the scope to around 50,000 companies, accounting for approximately 75% of the total turnover of EU companies.

The CSRD modernises and strengthens the rules concerning the social and environmental information that companies must report.

The CSRD entered into force on January 5, 2023, with the first set of companies required to start reporting in 2025 for the financial year 2024. The directive applies to a broader set of large companies and listed SMEs, ensuring that companies identify and address adverse human rights and environmental impacts of their actions inside and outside Europe.

As of December 2024, the United States has made significant strides toward mandatory ESG disclosures at the federal level.

In March 2024, the Securities and Exchange Commission (SEC) adopted rules to enhance and standardise climate-related disclosures for investors. These rules require registrants to provide certain climate-related information in their registration statements and annual reports, including information about climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition.

The final rules will become effective 60 days after publication in the Federal Register, with compliance dates staggered based on the registrant's filer status. However, the implementation of these rules may face challenges due to potential changes in SEC leadership and differing political priorities.

ESG investing has seen explosive growth, rising by an astounding 456 % between 2005 and 2020.

Contrary to the belief that profitability must come at the expense of environmental or social responsibility, studies have consistently shown a strong link between ESG investment performance and financial growth.

For example, a Fidelity study analysing global ESG investments from 1970 to 2014 revealed that half outperformed the broader market, while only 11 % underperformed.

Further supporting this trend, Morningstar’s research found that ESG funds are more stable and deliver positive returns. Over a ten-year period, 77 % of ESG funds remained active, compared to just 46 % of conventional funds, highlighting the resilience and longevity of ESG-focused investments.

The benefits and importance of ESG analysis:

| Benefit/Importance | Explanation |

|---|---|

| Improves financial performance | ESG-focused companies are more likely to deliver long-term, sustainable growth and profitability. |

| Reduces risk | Identifies and mitigates risks related to environmental, social, and governance factors. |

| Enhances reputation | Positions companies as ethical and sustainable, strengthening brand trust and loyalty. |

| Attracts investors | ESG analysis appeals to socially conscious investors, opening access to a broader investor base. |

| Drives consumer preference | Consumers are more likely to support brands that prioritise ESG principles. |

| Encourages cost efficiency | Implementing ESG initiatives can lead to reduced operational costs and improved efficiency. |

| Fosters regulatory compliance | Ensures adherence to growing global ESG reporting requirements, avoiding penalties. |

| Supports employee engagement | Companies with strong ESG values attract and retain top talent who value ethical workplaces. |

| Encourages innovation | Drives creative solutions to address sustainability challenges and future-proof businesses. |

| Promotes stakeholder trust | Transparent ESG practices strengthen relationships with stakeholders, including customers, employees, and investors. |

| Enables access to capital | ESG-focused companies are often favoured by lenders and investors, improving financing options. |

| Aligns with global trends | Positions companies to adapt to increasing demand for sustainable and ethical practices globally. |

In voluntary ESG reporting, businesses have traditionally disclosed performance metrics based on issues relevant to their operations. Various ESG frameworks recommend reporting on specific factors such as greenhouse gas (GHG) emissions.

However, not all factors fit neatly into the categories of "E" (environmental), "S" (social), or "G" (governance), as many have interconnected impacts. For example, reducing GHG emissions directly addresses environmental concerns like climate change, but it also improves community health, which is a social consideration.

Collaborating with organisations that specialise in ESG quantification helps businesses accurately measure and report on these critical factors, ensuring they meet expectations and demonstrate accountability.

ESG factors:

| Category | Factor | Explanation |

|---|---|---|

| Environmental | Greenhouse gas (GHG) emissions | Tracks the company’s contribution to global warming and climate change. |

| Environmental | Energy efficiency | Measures how effectively energy is utilised to reduce consumption and costs. |

| Environmental | Water consumption | Assesses water use to minimise depletion of this critical resource. |

| Environmental | Toxic substances and pollution | Tracks the release of harmful chemicals and pollutants into the environment. |

| Environmental | Biodiversity loss and protection | Evaluates the impact on ecosystems and efforts to preserve biodiversity. |

| Environmental | Deforestation | Examines activities contributing to forest loss and measures to protect natural habitats. |

| Environmental | Waste management | Assesses how waste is minimised, reused, or responsibly disposed of. |

| Environmental | Product life cycle analysis | Reviews the environmental impact of a product from production to disposal. |

| Social | Human rights and child labour | Ensures ethical practices across operations and supply chains. |

| Social | Living wages | Evaluates whether workers are paid wages that meet basic living standards. |

| Social | Worker health and safety | Assesses measures to protect employee health and safety. |

| Social | Diversity, equity, and inclusion | Measures efforts to create equitable workplaces and promote diversity. |

| Social | Data protection and privacy | Tracks policies to safeguard personal and organisational data. |

| Social | Employee and customer satisfaction | Evaluates how well employees and customers are engaged and satisfied. |

| Social | Community relations | Measures the company’s impact on and relationship with local communities. |

| Social | Stakeholder engagement | Tracks efforts to involve and communicate with key stakeholders. |

| Governance | Board composition | Evaluates diversity, expertise, and independence of board members. |

| Governance | Executive compensation | Assesses alignment between executive pay and company performance. |

| Governance | Tax strategy | Measures transparency and fairness in tax practices. |

| Governance | Bribery and corruption | Tracks policies and measures to prevent unethical practices. |

| Governance | Lobbying and political contributions | Evaluates transparency and alignment of political activities with company values. |

| Governance | Transparency and public disclosures | Measures how openly the company communicates its ESG practices. |

| Governance | Codes of conduct | Reviews adherence to ethical standards and corporate policies. |

| Governance | Supply chain management | Tracks efforts to ensure ethical and sustainable practices across the supply chain. |

| Governance | Risk and crisis management | Assesses how prepared the company is to handle risks and crises effectively. |

Key environmental metrics often include greenhouse gas (GHG) emissions, energy efficiency, and water usage. For example, measuring GHG emissions has become increasingly central to ESG reporting due to global climate targets such as the Paris Agreement. Companies may quantify emissions either as absolute emissions (total emissions over a set period) or emissions intensity (emissions relative to units of output or profit).

While absolute figures are crucial for tracking global climate goals, intensity metrics are valuable for assessing performance as businesses grow.

Social metrics vary widely depending on the company’s sector and scope. Common areas include workforce diversity, equity, and inclusion (DEI); employee health and safety; and data protection and privacy. For example, companies in tech may focus heavily on cybersecurity practices, while manufacturing firms often prioritise workplace safety indicators.

Governance metrics are typically centred around board diversity, executive compensation, and risk management frameworks. Transparency is key - companies are expected to disclose tax strategies, anti-corruption efforts, and political contributions to demonstrate ethical governance practices.

Historically, ESG metrics have been voluntary and chosen based on relevance to a company’s industry. However, the regulatory landscape is changing. Recent developments include:

These frameworks aim to simplify ESG reporting by offering clear, comparable metrics across jurisdictions, helping companies respond to stakeholder demands and comply with legal obligations.

Choosing the right metrics often depends on a company’s ability to accurately measure and verify performance. Environmental metrics like GHG emissions often require advanced tracking tools and external verification, while social and governance metrics may be harder to quantify. For example, assessing the impact of stakeholder engagement or workplace culture may require a mix of qualitative and quantitative data.

Ultimately, selecting metrics should be guided by materiality - focusing on the issues that have the most significant impact on the company’s value creation and stakeholder interests.

ESG labelling regulations continue to evolve globally, focusing on improving transparency, enabling easier comparison of ESG funds, and addressing the growing issue of greenwashing.

These frameworks aim to help investors make informed decisions by providing clear and consistent criteria for assessing sustainability credentials.

The UK has recently introduced the Sustainability Disclosure Requirements (SDR), which standardises ESG disclosures and establishes a clear labelling system for investment funds. Key components include:

To ensure a smooth transition, firms have until April 2025 to fully comply with these labelling and disclosure rules (FCA).

The EU’s Sustainable Finance Disclosure Regulation (SFDR) remains a cornerstone of ESG labelling in Europe, with its three-tier fund classification system:

Recent updates include:

The US Securities and Exchange Commission (SEC) has advanced its efforts to strengthen ESG labelling and reporting requirements:

Fund classifications:

The SEC also finalised climate disclosure rules in early 2024, requiring public companies to disclose climate risks and emissions data. However, Scope 3 emissions reporting remains voluntary for most companies.

Environmental, Social, and Governance (ESG) considerations have become integral to business strategies, reflecting a global shift towards sustainable and responsible practices. Several key trends are shaping the ESG landscape:

The urgency to address climate change continues to drive corporate strategies. Companies are setting ambitious net-zero targets and investing in renewable energy to reduce greenhouse gas emissions.

The 2015 Paris Agreement has been a catalyst, with nations and corporations committing to limit global warming. Public opinion also supports climate action; for instance, a Yale poll indicates that a significant majority of Americans believe CO₂ should be regulated and that corporations should do more to address global warming. Investors are increasingly evaluating businesses based on their climate resilience and carbon footprint, making climate-related disclosures a priority.

Regulatory bodies worldwide are implementing stringent ESG reporting requirements to combat greenwashing and ensure transparency.

In the European Union, the Sustainable Finance Disclosure Regulation (SFDR) categorises funds to help investors understand their sustainability focus. Similarly, the U.S. Securities and Exchange Commission (SEC) has proposed amendments to enhance ESG disclosures among funds. These regulations aim to standardise ESG metrics, enabling investors to make informed decisions.

The COVID-19 pandemic and subsequent economic challenges have highlighted social inequalities, prompting companies to prioritise diversity, equity, and inclusion (DEI) initiatives.

Employee mental health and well-being have become focal points, with businesses implementing flexible work arrangements and support systems. Addressing social issues is now seen as essential for maintaining employee morale, enhancing productivity, and safeguarding corporate reputation.

Sustainable investing is experiencing significant growth, with ESG assets projected to reach substantial figures in the coming years.

Investors are increasingly allocating capital to companies demonstrating strong ESG performance, recognising the long-term value and risk mitigation these practices offer. This trend is reshaping capital markets, encouraging businesses to adopt sustainable practices to attract investment.

Artificial Intelligence is playing a pivotal role in enhancing ESG initiatives.

AI aids in data analysis for ESG reporting, monitors supply chain sustainability, and assesses environmental impacts. However, the ethical use of AI itself has become an ESG consideration, with stakeholders scrutinising how companies deploy AI technologies responsibly.

Beyond climate change, there is a growing emphasis on preserving biodiversity and managing natural resources sustainably.

Companies are assessing their impacts on ecosystems and incorporating biodiversity considerations into their ESG strategies. This holistic approach acknowledges the interconnectedness of environmental factors and aims to promote overall ecological balance.

These trends underscore the evolving nature of ESG considerations, highlighting the increasing importance of sustainability in corporate governance and investment decisions.

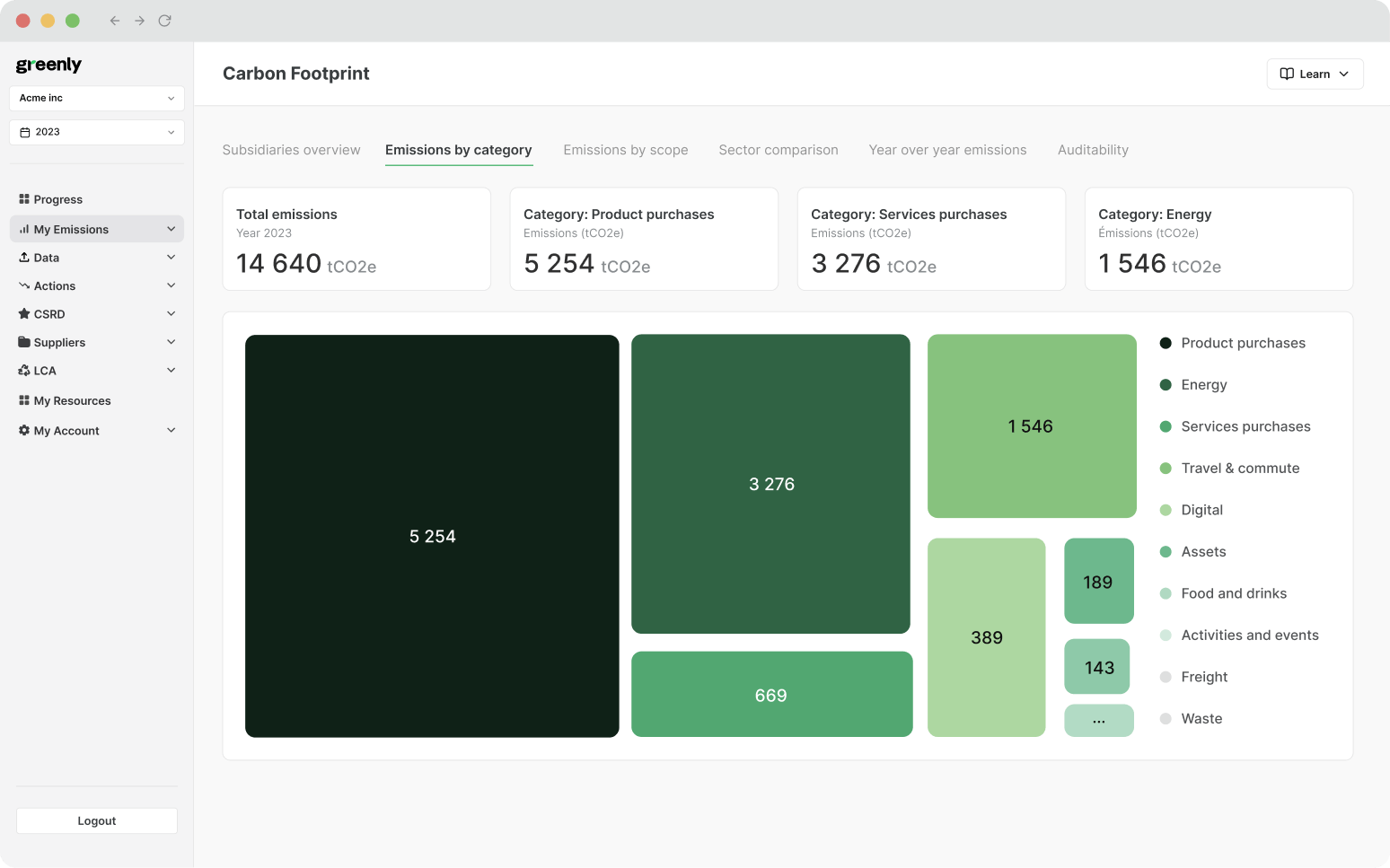

Greenly offers a suite of comprehensive carbon management solutions to help your company reduce its environmental impact and achieve its sustainability goals. Our platform provides the tools and insights you need to take meaningful action while streamlining the complexities of carbon management.

Greenly is here to support your journey toward sustainability, making carbon management both actionable and achievable. From tracking your emissions to creating impactful reduction plans, our platform ensures that your business is prepared to meet its goals while staying ahead of regulatory demands.

Learn more about how Greenly can help your business succeed in sustainability. Contact us today!