ESG / CSR

Industries

Socially Responsible Investing (SRI): All you Need to Know

In an era where global warming is impacting every region, company, and person on the planet – it’s inevitable that climate change would impact finances, as well.

Socially Responsible Investing, otherwise known as SRI – is an innovative, careful method of investing that is attracting individuals, businesses, and global leaders alike for its sustainable social and environmental values.

But why should an individual investor or company choose socially responsible investing over other types of investments?

👉 In this article, we'll explain what socially responsible investing (SRI) is, why socially responsible investors will benefit from SRI, and if a socially responsible investment strategy is right for your business.

What is Socially Responsible Investing?

Socially responsible investing, otherwise known as SRI – is a type of social investment that pertains to social responsibility as the companies or individuals that choose socially responsible investing usually have other goals besides finances in mind.

The acronym for socially responsible investing, SRI – stands for, “sustainable, responsible and impact” investing, which illustrates the core values that socially responsible investing strives to encourage investors to accomplish.

Socially responsible investments are done by individuals or companies that seek social justice and equality in their investments. SRI strives to implement the principles of positive social effects on society in one’s investment patterns, and it has been growing in popularity ever since climate change has grown as a global cause for concern.

👉 While SRI’s are aimed to help society, investors should remain aware that socially responsible investments are ultimately, still a financial activity – and should remember to weigh the pros and cons of the potential investment for their future financial returns.

How does Socially Responsible Investing work?

Socially responsible investments work by weeding out the companies that manufacture, market, or condone selling harmful substances or activities such as alcohol, gambling, and smoking cigarettes. Through this sifting process, companies interested in making an investment portfolio can determine which businesses, projects, and organizations are committed to social equality and sustaining the environment.

As socially responsible investing has been growing in popularity, threatening the existence of traditional investments, there are many new funding opportunities available for retail investors. For instance, mutual funds and exchange traded funds, otherwise known as ETFs – allow investors to have exposure to multiple companies at once with a single investment. Therefore, this allows the investor to be a stakeholder in multiple projects or companies at once whilst also helping multiple social causes.

💡 Socially responsible investments are usually made through socially responsible mutual funds or exchange traded funds managed by fund managers.

What are the two main goals of socially responsible investing?

The two main goals of socially responsible investing are to have a positive social impact and to create a lucrative financial return. However, it isn’t compulsory that a socially responsible investment provides the investor with a good financial return – as the financial aspect is not the primary mission of socially responsible investing in the first place. It is ultimately the investor’s decision to partake in the socially responsible investment, realizing that it may slightly deter their financial success in exchange for benefiting the environment or society.

There are many ways to commit to socially responsible investing. For example, community investing is a method of investing where the community’s potential societal impact is prioritised over the fiscal monetary return on the investors end.

💡 In short, any type of investment that seeks to place social importance over potentially, financially lucrative goals – can be considered a socially responsible investment.

What are the pros and cons of Socially Responsible Investing?

There are numerous pros and cons to socially responsible funds and ethical investing, with the pros being that an investor can feel good knowing that their investment decisions are helping socially responsible companies or projects that are clearly committed to achieving their environmental and socially sustainable goals. However, SRI funds also require time and processing such as negative screening, positive screening, and other changes to a company's current investment strategies.

💡 Sustainable funds and the SRI investment process can benefit society and the environment, and strive to mitigate any further social and environmental harm all while improving financial performance. However, regardless of these benefits for socially concerned investors, that doesn’t mean that there aren’t downsides or difficulties to socially responsible investing.

Pros of Socially Responsible Investing:

- Align Your Business Practices with Ethical Values – Encouraging investment managers to look into ethical investments as opposed to traditional investing can help to ensure that your company's environmental mission statement is aligned with your investing strategies.

- Values-Based Investing – Seeking the use of SRI investors and committing to other socially responsible activities can not only benefit your company's bank account, but help to demonstrate good business ethics.

- Benefit Those in Your Investment Universe – A more sustainable investing strategy can make a significant difference in addressing environmental concerns, boosting, community involvement, ameliorating corporate governance practices, aiding developing countries to fund their own environmental sustainability projects, and create an overall positive impact.

- Improved Financial Performance – An ethical investment isn't only good for the planet, but an SRI portfolio or SRI mutual funds could actually improve investment performance as a result of improved risk management.

- Adhere to Stakeholder & Market Expectations – There is increasing demand for SRI from investors, especially amongst younger generations – where 44% of respondents say they are ready to invest more than one third of their savings in their own SRI portfolio. In addition to this, those who seek to align their financial practices with those of a socially responsible investor may have an easier time complying with new environmental regulations.

Cons of Socially Responsible Investing:

- Less Investment Choices – Traditional investments often allow for a wider variety of individual investors, private equity, pension funds, and more. Therefore, more sustainable and responsible practices such as positive investing may not be the best for those more concerned with fund performance over sustainable funds and investment decisions.

- Concerns with Financial Performance – While socially responsible investing (SRI) is the better choice in terms of seeking ethical funds and prioritizing the environment and society, there are concerns that SRI funds may be more susceptible to volatile market fluctuations and not provide the same financial returns due to the fact SRIs don't support the use of typical high-performing investments such tobacco and fossil fuels.

- Lack of Standardization – Since SRI funds and their potential financial returns are relatively new, not enough research or consistency has been established to create a universal standard for what can be considered a "socially responsible" mutual funds or investments.

- Higher Start-up Costs – An SRI fund often requires greater investment analysis in comparison to traditional funds, meaning that businesses may need to seek an investment adviser or fund manager to ensure their chosen SRI is in line with ESG criteria and corporate governance.

💡 Remember, socially responsible investments work by pertaining to the current social and political climate at the time the investment is made. Therefore, it is crucial that investors understand the risk of socially responsible investments. Since SRIs prioritise social improvement over financial gain, the investor could prevent themselves from achieving their financial goals if the social value they invested in at the time loses potency in the present day.

This can be considered a con of socially responsible investing, as it is often necessary to recruit the help of a third party to properly delineate what can qualify as a socially responsible investment. Professionals seek to clarify this through a company’s environmental, social, and governance factors – otherwise known their ESG data.

👉 Ultimately, an investor must be dedicated to the non-financial aspects of socially responsible investments and socially conscious investing.

Here is a table further depicting the pros and cons to sustainable investing:

Pros and Cons of Socially Responsible Investing

| Pros | Cons |

|---|---|

|

|

Do SRIs result in a lucrative financial return?

Many investors could be wary of socially responsible investments, as they are known to prioritise social just over lucrative fiscal return. However, socially responsible investments do not automatically mean that the financial return won’t be as good as one from a typical investment would be.

💡 In fact, socially responsible investments can produce just as satisfactory financial returns as a standard investment can. According to Arabesque Partners in 2020, research showed that the majority of sustainable efforts, including socially responsible investments, can provoke lucrative financial performance as well.

This can be due to the fact that as customers, employees, and investors around the world grow aware of the impacts of climate change – that more money is being invested into companies and projects that seek to aid in the fight against global warming and to protect the citizens of the world against inequality.

Will SRI funds provide good financial in the future?

In short, the more popular sustainability grows as a whole, the more successful socially responsible investments could prove financially valuable. Since sustainability practices seek balance, socially responsible investments also have the tendency to be less volatile than traditional funds. Therefore, they may not make as much money as quickly – but they also won’t be subject to drastic changes the way that traditional funds can be.

👉 As more companies strive for sustainability, it’s clear that socially responsible investments have the potential to not only do good for the world – but for your wallet, too.

What is the difference between impact investing and socially responsible investing?

Socially responsible investing refers to a method of investing where a company or individual chooses or doesn’t choose a potential investment opportunity according to the project’s motivation, or lack of incentive, to improve the stance of the environment. These can be confirmed through environmental accreditation such as an ESG score or a company obtaining an ISO 14001.

The main goal of impact investing, on the other hand – is for a business or organization to benefit society and environmental causes while simultaneously creating a financial return to fiscally improve the company.

For example, an investment can be considered an impact investment as long as it does some sort of beneficial act for society or the environment, even if the company the investor chooses to invest in isn’t completely sustainable or aims to reduce their carbon footprint 100% of the time. Socially responsible investments, on the other hand – often require that the company the investors chooses to not purposefully engage in any activities or substances that could be harmful to the environment or society.

💡 Both socially responsible investing and impact investing are selective and aim to create a particular portfolio that doesn’t strive solely for economic growth, but with the mindset to yield beneficial improvements across other sectors – such as social issues and environmental difficulties, like global warming.

Can Socially Responsible Investing help mitigate climate change?

The act of socially responsible investing alone does not mitigate climate change directly. However, encouraging other investors to participate in socially responsible investing can encourage more companies to establish environmentally friendly goals that will reduce emissions and can aid in the fight against global warming.

Basically, if more and more investors become adamant about socially responsible investing, companies will have no choice but to alter their business model to be more environmentally friendly in order to meet the credentials required of socially responsible investing.

💡 If more companies change their industrial habits to reduce emissions because they are more likely to receive funding if they do, then in a way – social responsible investing will help to mitigate climate change.

Is Socially Responsible Investing good for the future of your business?

Socially responsible investing is extremely beneficial for any business.

SRI’s not only help an ulterior social or environmental cause, but it is helping various social and environmental projects while also financially aiding your own business. Socially responsible investing can also serve as an incentive for your company to obtain well-known environmental credentials – like ESG score or an ISO 14001.

It’s easy to get started with socially responsible investing. It begins with deciding which environmental and social causes are most important to you. After that, you can consider how much effort you’d like to put into the investment – choosing to use ETFs or seeking third party assistance that can help you create the perfect portfolio for your socially responsible investment.

👉 Ultimately, socially responsible investing is long-term investment for a better future for everyone involved. Future investors, customers, and employees are more likely to contribute to a business or project that seeks to qualify as a socially responsible investment – and as climate change continues to infiltrate our daily lives, sustainable finance is more important than ever before.

How can your company get started with SRI?

If your company is looking to get started with socially responsible investing (SRI), there are several steps that your business will need to remain mindful of when seeking to employ this new but worthwhile investment strategy.

Here's a guide to help your company embark on this journey:

1. Determine Your SRI Criteria

Every business is bound to consider a different mutual fund as "socially responsible". This means your company will need to re-evaluate the ESG factors most imperative to your company's mission statement.

This could include:

- Environmental impact (such as your company's emissions or renewable energy use)

- Social Impact (such as labor practices and community engagement)

- Governance Impact (such as DEI policies and use of investment dollars)

2. Draft Your SRI Policy

This step will require writing an SRI policy that matches both your company's financial investment goals alongside your ESG criteria and desired corporate management processes. In this phase of developing your company's plans with SRI, it's important to consider your company's values, and to determine how you will screen your investments.

Negative screening vs. Positive screening

- Negative screening – Less restrictive than positive screen, this type of screening refers to excluding any investments in companies that don't work alongside your business values – such as with unfair labor policies, international bribery or corruption, or a lack of sustainable procurement.

- Positive screening – This type of screening refers to the process of finding companies with high ESG scores to then be chosen for your own SRI portfolio.

3. Engage Stakeholders

It is imperative to involve key stakeholders such as your employees, investors, and board members while developing your SRI strategy. This may include conducting anonymous surveys and seeking to boost communication efforts to ensure you have the support of your stakeholders.

4. Choose Your SRI Investment Strategy

There are several SRI investment strategies to choose an appropriate investment strategy based on your defined criteria.

Here are some of the different strategies to choose from:

- Negative Screening – which excludes companies that do not incorporate ESG standards into their financial portfolios.

- Positive Screening – which seeks to invest in companies that meet various ESG criteria

- ESG Integration – which works to employ ESG principles into traditional financial analysis.

- Thematic Investing – which focuses on incorporating specific aspects into your SRI strategy such as by investing in climate smart farming or even gender equality.

5. Research Potential SRI Investments

It is crucial to conduct ample research before choosing your SRI investment portfolio. This can be done by using SRI databases, ESG ratings, and by reading sustainability reports. If this sounds like too much work, you can always consult a third party such as an asset manager or a financial advisor specializing in an SRI portfolio.

6.Continue to Manage & Monitor Your SRI Performance

Once you've chosen your sustainable mutual fund or responsible investors to work with, it may seem like the hard part is over – but in truth, SRI requires consistent upkeep to ensure that your investment remains beneficial for both the planet and your business.

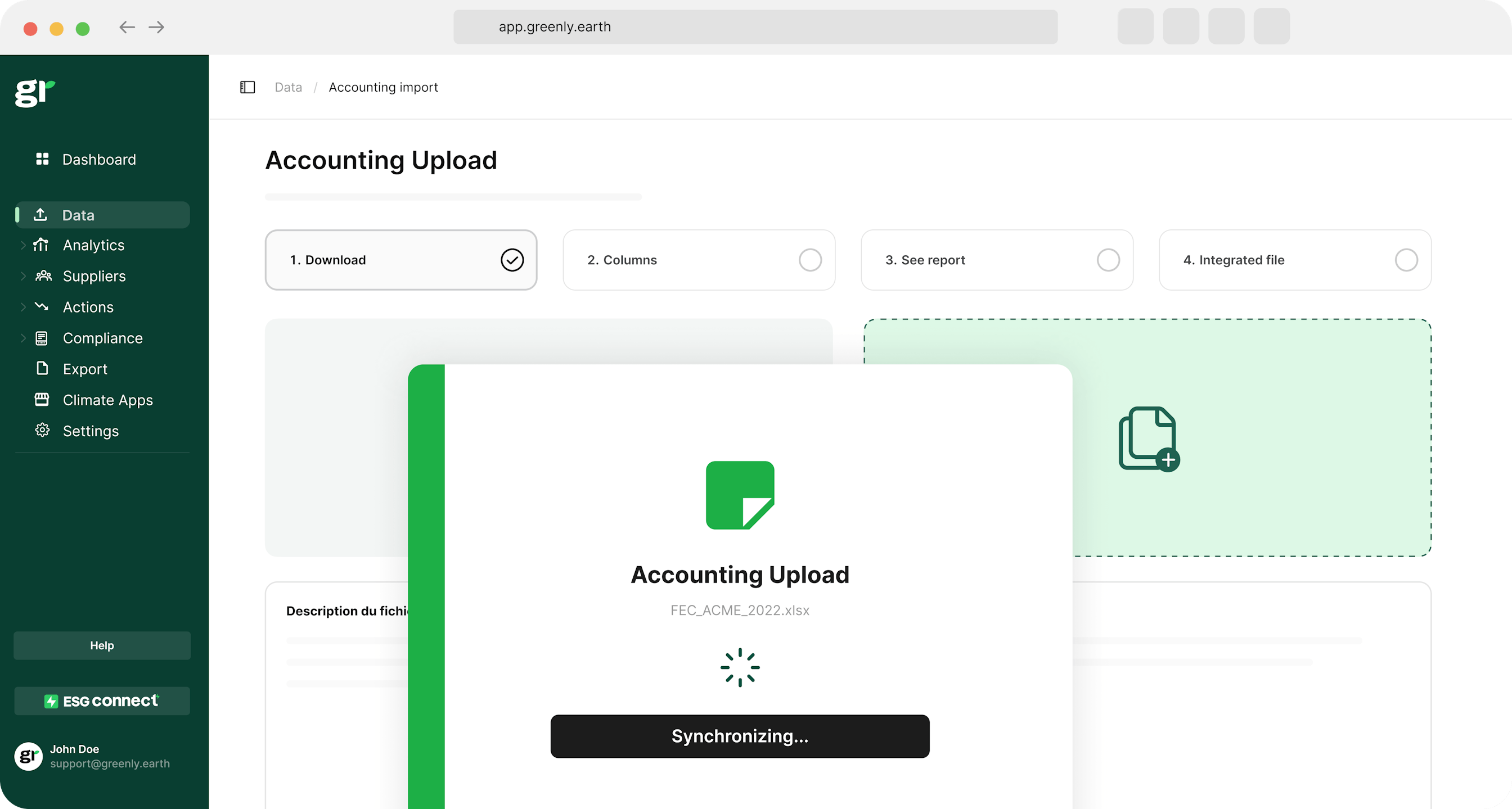

Luckily, you can easily set up this process with the help of Greenly to improve your stakeholder communication and manage your ESG performance with ease.

7. Adjust Your SRI Strategy As Needed

As goals and circumstances evolve, it is normal to make amendments to your strategy as you go. In order to ensure all of the best adjustments are being made, it's important to stay up-to-date and all the latest ESG trends and practices. In addition to this, it's important to stay in communication with your stakeholders to implement their feedback as necessary.

👉 All in all, SRI can help your company to demonstrate an extended effort to environmental reform while also helping to benefit the planet, surrounding communities, and your business growth.

What about Greenly?

If reading this article about socially responsible investing, otherwise known as SRI – has made you interested in reducing your carbon emission to further fight against climate change – Greenly can help you!

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.