Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

The directive officially came into effect on January 1, 2024, bringing a broader range of companies into its scope and introducing more stringent reporting obligations.

In February 2025, the European Commission introduced the Omnibus I simplification package, which reshapes key aspects of CSRD implementation from 2026 onwards. These changes significantly narrow company eligibility, simplify ESRS reporting requirements, and delay reporting timelines for certain businesses - with the aim of reducing administrative burden while maintaining the core objectives of the CSRD.

What exactly is the CSRD? Who does it concern? What changes can be expected? And what impact does the Omnibus proposal have?

The Corporate Sustainability Reporting Directive (CSRD) was introduced by the European Commission in April 2021 and formally adopted on December 16, 2022.

It came into effect on January 1, 2024, replacing the Non-Financial Reporting Directive (NFRD), which was considered too limited in scope and ambition.

The directive is a key pillar of the European Green Deal, which aims for carbon neutrality by 2050, and it aligns with the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy to promote transparency and accountability in sustainable finance."

As financial markets place increasing pressure on companies for reliable ESG data, sustainability reporting is becoming a critical part of corporate decision-making. Investors and financial institutions are now subject to their own reporting obligations, further driving the demand for clear, consistent, and comparable non-financial disclosures.

Unlike financial reporting, the CSRD requires companies to assess and disclose their sustainability performance across three key areas:

With the CSRD now in effect, companies across Europe and beyond are adjusting to the new reporting requirements, alongside the Omnibus I simplification measures that have narrowed scope, reduced data points, and revised reporting timelines for many organisations.

One of the biggest challenges in corporate sustainability reporting has been the lack of a unified framework.

Until now, companies followed different reporting methods, making it difficult to compare sustainability performance across industries and countries. The CSRD changes this by establishing a clear, harmonised standard for ESG disclosures.

This directive doesn’t exist in isolation. It works alongside the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR), forming part of a broader push to align financial markets with Europe’s climate goals. By improving transparency, the CSRD helps direct investment toward businesses that are actively working to reduce their environmental and social impact.

At the heart of the CSRD is the principle of double materiality. This means companies must report not only on how sustainability issues affect their business but also on how their operations impact the environment and society. It’s not just about risk management, it’s about accountability.

To make sustainability data more accessible, the European Commission has set up the European Single Access Point (ESAP), a centralised platform where corporate financial and sustainability reports will be publicly available. This will make it easier for investors and other stakeholders to assess corporate sustainability performance without sifting through scattered reports or vague ESG claims.

With sustainability becoming a key factor in investment and consumer choices, companies have faced growing pressure to present themselves as environmentally and socially responsible.

The problem? Many have made broad claims about their ESG efforts without backing them up with concrete data - otherwise known as greenwashing.

The CSRD introduces stricter requirements and third-party assurance to ensure that sustainability reports are accurate, verifiable, and free from misleading claims. By holding companies accountable for what they report, the directive aims to rebuild trust in corporate sustainability commitments.

Following the Omnibus I simplification package, the scope of the CSRD has been significantly narrowed. The directive now applies to approximately 15,000 large EU and non-EU companies, focusing reporting obligations on the largest organisations with the greatest sustainability impact.

Large enterprises are subject to the CSRD if they meet the following conditions:

| Company type | CSRD status (post–Omnibus I) | Conditions | ||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

EU companies

|

In scope |

At least 1,000 employees (mandatory) and either:

|

||||||||||||||||||||||||||||||||||||||

|

Non-EU companies

|

In scope |

€450+ million EU turnover for two consecutive years and either:

|

||||||||||||||||||||||||||||||||||||||

|

Companies under 1,000 employees

|

Out of scope |

Classified as Protected Undertakings No mandatory CSRD reporting May report voluntarily using the VSME |

||||||||||||||||||||||||||||||||||||||

|

Listed SMEs

|

Out of scope |

| Date | Applicability (post–Omnibus I) |

|---|---|

|

Jan. 1, 2025 (based on FY 2024) |

Companies previously subject to the NFRD

Applies to EU and non-EU companies that were already required to report under the Non-Financial Reporting Directive.

|

|

Jan. 1, 2028 (based on FY 2027) |

Large EU companies (≥ 1,000 employees)

Applies to listed and unlisted EU companies meeting the post–Omnibus I CSRD eligibility thresholds.

|

|

Jan. 1, 2029 (based on FY 2028) |

Non-EU parent companies with significant EU activity

Applies to non-EU groups exceeding €450 million in EU turnover and meeting the EU presence criteria under the Omnibus I rules.

|

Companies with fewer than 1,000 employees are now classified as Protected Undertakings and are exempt from mandatory CSRD reporting.

Under 1,000 employeesListed SMEs are no longer required to report under the CSRD.

No mandatory reportingNon-EU companies fall within scope only if they exceed €450 million in EU turnover and have a significant EU subsidiary or branch, as defined under the Omnibus I rules.

€450M EU turnover + EU presenceWhile the Omnibus package delays reporting for many companies, it does not change the overall direction of travel. Sustainability reporting requirements remain firmly embedded in EU law, and companies approaching future reporting waves should use this additional time to prepare robust data collection and governance processes.

The Corporate Sustainability Reporting Directive (CSRD) replaces and significantly expands upon the Non-Financial Reporting Directive (NFRD), which was adopted in 2014 to establish a common framework for non-financial disclosures.

While the NFRD was an initial step toward harmonised sustainability reporting, it was widely considered insufficient due to its limited scope and lack of standardised reporting requirements.

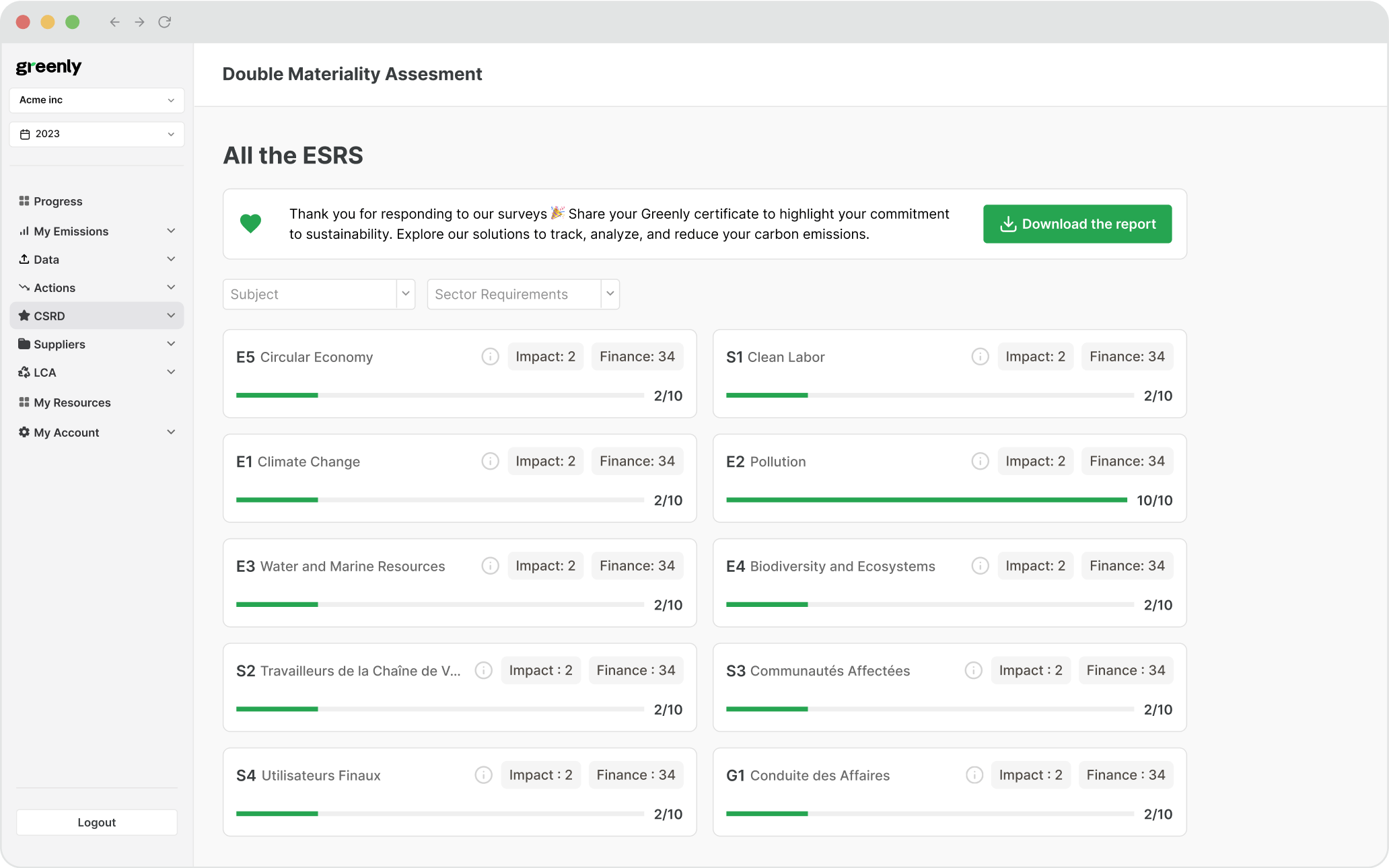

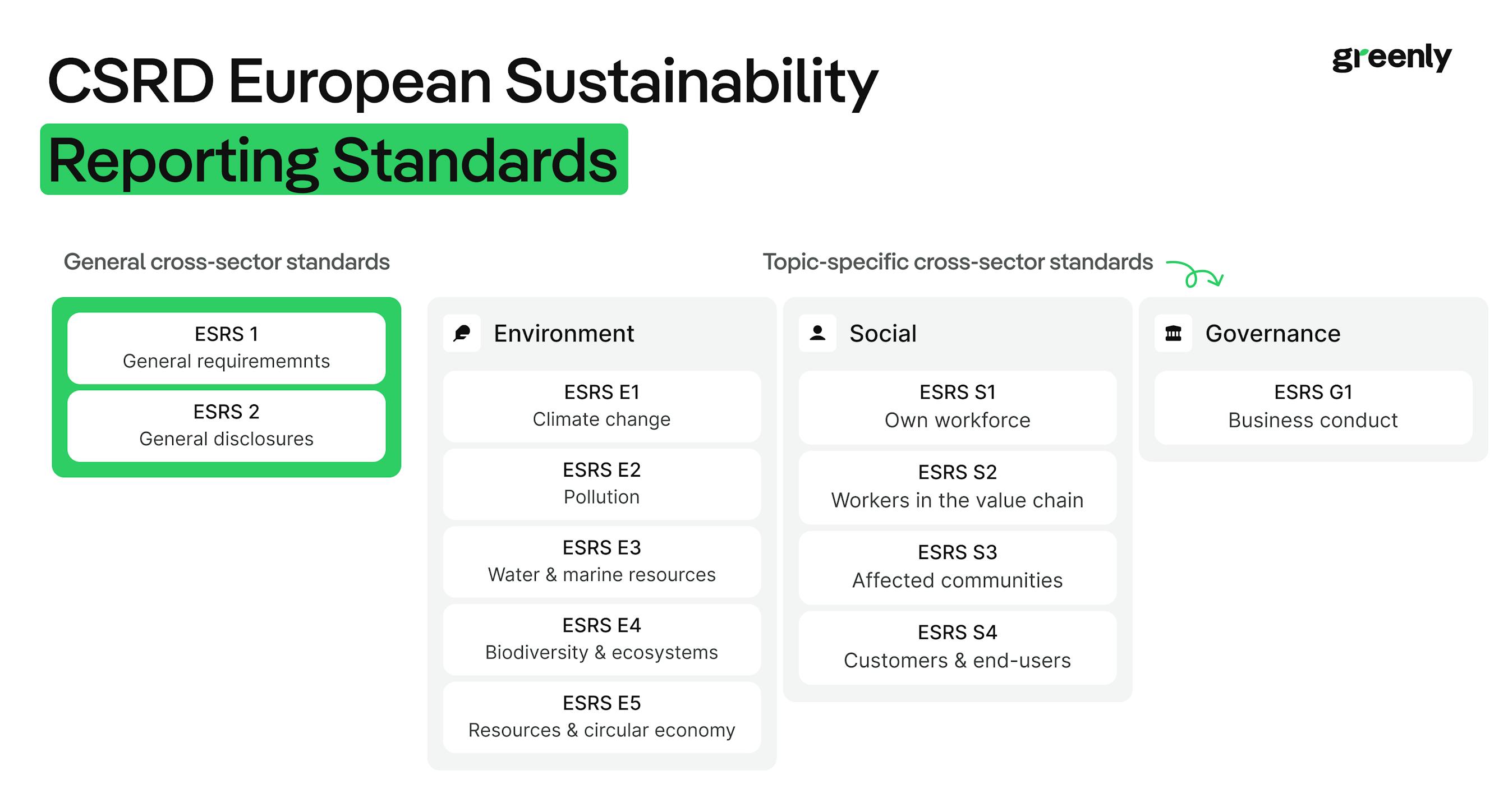

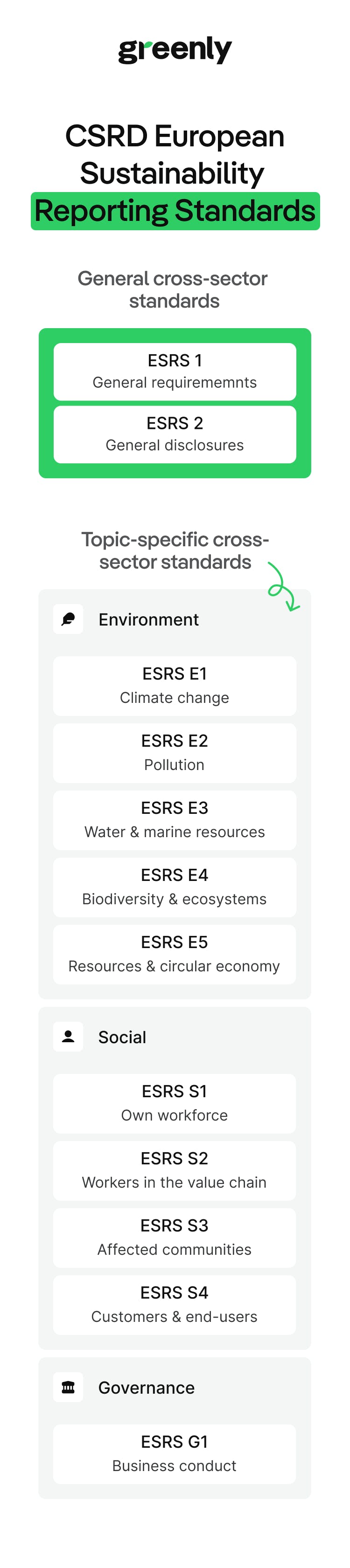

The CSRD requires companies to report in accordance with the European Sustainability Reporting Standards (ESRS), which aim to standardise and enhance the quality of corporate sustainability disclosures.

These standards define how companies must report on their environmental, social, and governance (ESG) impacts, ensuring consistency and comparability across industries.

The first set of ESRS standards was developed by the European Financial Reporting Advisory Group (EFRAG) and formally adopted by the European Commission on July 31, 2023. These standards apply to companies within the CSRD scope. Under the Omnibus I simplification, the ESRS have also been subject to simplification work, including “quick-fix” amendments adopted in 2025 and further simplified ESRS developed by EFRAG.

| Category | ESRS Standard | Overview |

|---|---|---|

|

General Principles

|

ESRS 1: General Requirements | Defines key principles for sustainability reporting, including governance, materiality, and strategic alignment. |

| ESRS 2: General Disclosures | Outlines key disclosures such as governance roles, due diligence, and performance metrics. | |

|

Environmental Standards

|

ESRS E1: Climate Change | Requires reporting on climate mitigation efforts, adaptation strategies, and Scope 1, 2, and 3 emissions, with alignment to frameworks such as TCFD. |

| ESRS E2: Pollution | Covers pollution control measures, reduction strategies, and impacts of pollutants on air, water, soil, and noise. | |

| ESRS E3: Water and Marine Resources | Addresses water management, including withdrawal, consumption, recycling, wastewater treatment, and marine ecosystem conservation. | |

| ESRS E4: Biodiversity and Ecosystems | Requires reporting on biodiversity conservation, habitat restoration, and ecosystem impact management. | |

| ESRS E5: Resource Use and Circular Economy | Focuses on sustainable resource management, waste reduction, life-cycle assessment, and circular economy initiatives. | |

| ESRS S1: Own Workforce | Covers employee-related policies, including diversity, inclusion, health and safety, and working conditions. | |

| ESRS S2: Workers in the Value Chain | Addresses fair wages, labour rights, and supply chain working conditions, ensuring alignment with international labour standards. | |

| ESRS S3: Affected Communities | Requires companies to assess their impact on communities, including cultural heritage, relocation, and socio-economic effects. | |

| ESRS S4: Consumers and End-Users | Focuses on consumer protection, product safety, data privacy, and ethical considerations in product and service delivery. | |

|

Governance Standards

|

ESRS G1: Business Conduct | Covers corporate governance, anti-corruption measures, lobbying activities, and supplier risk management. |

Under the Omnibus I simplification package, the European Commission adopted a set of targeted ESRS amendments - often referred to as “quick-fix” changes - to ease the first years of CSRD implementation. These amendments do not change the structure of the ESRS, but reduce immediate reporting pressure for companies newly in scope.

In practice, the quick-fix measures:

These changes are designed to make ESRS reporting more proportionate, without weakening the core principles of double materiality, comparability, or transparency. Companies should therefore continue to align their systems with the full ESRS framework, while applying the simplified requirements where permitted during the transition.

A core principle of the CSRD is double materiality, which requires companies to report on both financial materiality (how sustainability factors impact a company’s financial performance) and impact materiality (how a company’s operations affect people and the environment).

Companies that fail to comply with the CSRD will face penalties, which are determined at the national level by each EU member state.

While enforcement mechanisms may vary, the directive sets out minimum sanctions that authorities can impose on non-compliant businesses.

According to Article 1 of the CSRD, penalties may include:

These measures are designed to ensure that sustainability reporting is taken as seriously as financial disclosures, reinforcing accountability and preventing companies from avoiding their reporting obligations.

In practice, the Omnibus package signals a recalibration rather than a retreat. The CSRD remains one of the most ambitious sustainability reporting frameworks globally, but its implementation is now more proportionate, prioritising feasibility and clarity while maintaining comparability and regulatory credibility.

With the first wave of CSRD reporting underway and the Omnibus I simplification package now clarifying scope, timelines, and reporting expectations, companies can move from regulatory uncertainty to practical implementation. The priority in 2026 is no longer guessing what may change, but understanding where your organisation sits, and acting accordingly.

The Omnibus package has significantly narrowed the number of companies subject to mandatory CSRD reporting. The first step is to confirm whether your organisation falls within scope under the revised criteria, and which reporting year applies.

What to do now:

For companies required to report under the CSRD, attention should shift from exhaustive data collection to robust, decision-useful disclosures aligned with the simplified ESRS requirements.

What to do now:

CSRD sustainability information is subject to assurance requirements, making auditability a central consideration from day one.

What to do now:

Even where CSRD reporting is no longer mandatory, sustainability data remains a commercial and strategic issue, particularly for companies operating in European value chains.

What to do now:

Whether reporting is mandatory or voluntary, the CSRD has set a new baseline for how sustainability data is structured, governed, and used.

Companies that invest early in scalable systems and internal alignment will be better positioned to:

Although the CSRD is an EU directive, some UK companies will still be required to comply based on the scale of their activities in the European Union. UK-based groups with significant EU operations - through subsidiaries, branches, or substantial EU turnover - should assess whether they fall within the CSRD’s revised scope following the Omnibus I simplification.

Under the updated rules for non-EU parent companies, a UK-based group is required to report under the CSRD if it:

UK parent companies meeting these criteria will be required to publish CSRD-compliant sustainability reports from 2029, based on their 2028 financial year.

Note: where CSRD reporting applies, UK companies must disclose sustainability information covering their entire global operations, not only their EU activities.

As companies navigate the complexities of the Corporate Sustainability Reporting Directive (CSRD), Greenly provides a comprehensive, AI-powered platform to streamline compliance, automate reporting, and turn sustainability data into a strategic advantage.

Automated compliance and AI-powered data collection

Effortless CSRD reporting with xHTML & XBRL

Expert guidance and real-time audit support

Because CSRD is one of the most comprehensive sustainability frameworks globally, implementing it with Greenly provides a robust foundation for wider ESG reporting needs - from investor requests and tenders to voluntary CSR reporting and future regulations.

Once CSRD is in place, companies can activate additional frameworks (eg. IFRS, GRI, Ecovadis, California disclosures, or custom indicators) without redoing core data collection, significantly reducing long-term reporting costs compared to traditional consulting-led approaches.

Learn more about Greenly's CSRD solution here.