The Carbon Border Adjustment Mechanism (CBAM)

In this article, we break down what the EU CBAM is, how it works, and what businesses need to do to comply.

ESG / CSR

Industries

The directive officially came into effect on January 1, 2024, bringing a broader range of companies into its scope and introducing more stringent reporting obligations.

In February 2025, the European Commission introduced the Omnibus I simplification package to revise aspects of the CSRD framework. The revised rules were formally adopted by the EU in February 2026, narrowing company eligibility, simplifying ESRS reporting requirements, and delaying reporting timelines for certain businesses while maintaining the directive’s core sustainability reporting objectives.

What exactly is the CSRD? Who does it concern? What changes can be expected? And what impact does the Omnibus proposal have?

What the CSRD is and why it was introduced

Which companies are in scope and when reporting begins

Key CSRD requirements, including ESRS and double materiality

How the CSRD differs from the NFRD

The impact of the EU Omnibus simplification package

The Corporate Sustainability Reporting Directive (CSRD) was introduced by the European Commission in April 2021 and formally adopted on December 16, 2022.

It came into effect on January 1, 2024, replacing the Non-Financial Reporting Directive (NFRD), which was considered too limited in scope and ambition.

The directive is a key pillar of the European Green Deal, which aims for carbon neutrality by 2050, and it aligns with the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy to promote transparency and accountability in sustainable finance."

As financial markets place increasing pressure on companies for reliable ESG data, sustainability reporting is becoming a critical part of corporate decision-making. Investors and financial institutions are now subject to their own reporting obligations, further driving the demand for clear, consistent, and comparable non-financial disclosures.

Unlike financial reporting, the CSRD requires companies to assess and disclose their sustainability performance across three key areas:

With the CSRD now in effect, companies across Europe and beyond are adjusting to the new reporting requirements, alongside the Omnibus I simplification measures that have narrowed scope, reduced data points, and revised reporting timelines for many organisations.

The Corporate Sustainability Reporting Directive (CSRD) was introduced to create a standardised framework for corporate sustainability disclosures, aligning financial and non-financial reporting across the European Union. Its primary goal is to improve the quality, consistency, and accessibility of sustainability information, ensuring that companies provide transparent and comparable data on their environmental and social impacts.

One of the biggest challenges in corporate sustainability reporting has been the lack of a unified framework.

Until now, companies have followed different reporting methods, making it difficult to compare sustainability performance across industries and countries. The CSRD changes this by establishing a clear, harmonised standard for ESG disclosures.

This directive doesn’t exist in isolation. It works alongside the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR), forming part of a broader push to align financial markets with Europe’s climate goals. By improving transparency, the CSRD helps direct investment toward businesses that are actively working to reduce their environmental and social impact.

At the heart of the CSRD is the principle of double materiality. This means companies must report not only on how sustainability issues affect their business but also on how their operations impact the environment and society. It’s not just about risk management, it’s about accountability.

To make sustainability data more accessible, the European Commission is establishing the European Single Access Point (ESAP) - a centralised platform where corporate financial and sustainability reports will gradually become available as the system is rolled out across the EU from 2026 onwards.

This will make it easier for investors and other stakeholders to assess corporate sustainability performance without sifting through scattered reports or vague ESG claims.

With sustainability becoming a key factor in investment and consumer choices, companies have faced growing pressure to present themselves as environmentally and socially responsible.

The problem? Many have made broad claims about their ESG efforts without backing them up with concrete data - otherwise known as greenwashing.

The CSRD introduces stricter requirements and third-party assurance to ensure that sustainability reports are accurate, verifiable, and free from misleading claims. By holding companies accountable for what they report, the directive aims to rebuild trust in corporate sustainability commitments.

Following the EU’s 2026 adoption of the Omnibus simplification measures, the scope of the CSRD has been significantly narrowed. The revised framework focuses mandatory reporting on the largest EU and non-EU companies, prioritising organisations with the most significant environmental and social impact.

Large enterprises are subject to the CSRD if they meet the following conditions:

| Company type | CSRD status (post–Omnibus) | Conditions |

|---|---|---|

|

EU companies

|

In scope |

More than 1,000 employees and €450+ million net annual turnover First report in 2028, based on FY 2027 |

|

Non-EU companies

|

In scope |

€450+ million EU turnover for two consecutive years and either:

|

|

Companies under 1,000 employees

|

Out of scope |

Classified as Protected Undertakings No mandatory CSRD reporting May report voluntarily using the VSME |

|

Listed SMEs

|

Out of scope |

Listed SMEs are no longer required to report under the CSRD May use the VSME voluntary reporting framework |

In addition to EU-based companies meeting the CSRD eligibility thresholds outlined above, certain non-EU parent companies may also fall within scope. This applies where a non-EU group generates more than €450 million in EU turnover for two consecutive years and has a significant operational presence in the EU through a large subsidiary or branch.

Where a non-EU parent prepares a consolidated sustainability report at the group level, some EU subsidiaries may be exempt from standalone reporting. However, entity-level disclosures can still apply in specific cases, and certain companies - including large listed entities - cannot benefit from this exemption.

Under the Omnibus I simplification package, listed small and medium-sized enterprises (SMEs) are no longer subject to mandatory CSRD reporting.

Companies with fewer than 1,000 employees are now classified as Protected Undertakings. While they are exempt from CSRD reporting obligations, they may still be asked to provide sustainability information by larger companies within their value chain.

To address this, the European Financial Reporting Advisory Group (EFRAG) has introduced the Voluntary Sustainability Reporting Standard for SMEs (VSME) - a simplified, proportionate framework designed specifically for smaller companies.

The VSME enables SMEs to:

Importantly, companies subject to the CSRD or the Corporate Sustainability Due Diligence Directive (CSDDD) are only permitted to request sustainability information from SMEs that aligns with the VSME, unless they can clearly justify the need for additional data.

The Corporate Sustainability Reporting Directive (CSRD) was formally adopted in December 2022 and entered into force on January 1, 2024. However, the Omnibus I simplification package has significantly revised the CSRD implementation timeline by narrowing company eligibility and delaying reporting obligations for certain groups.

Under the current post–Omnibus I framework, CSRD reporting applies according to the following timelines:

| Date | Applicability (post–Omnibus) |

|---|---|

|

Jan. 1, 2025 (based on FY 2024) |

Companies previously subject to the NFRD

Applies to EU and non-EU companies that were already required to report under the Non-Financial Reporting Directive.However, following the EU’s 2025–2026 “stop-the-clock” amendments, Member States may allow certain companies to postpone additional CSRD reporting requirements for financial years 2025 and 2026 during the transition period. |

|

Jan. 1, 2028 (based on FY 2027) |

Large EU companies (> 1,000 employees)

Applies to listed and unlisted EU companies meeting the post–Omnibus CSRD eligibility thresholds.

|

|

Jan. 1, 2029 (based on FY 2028) |

Non-EU parent companies with significant EU activity

Applies to non-EU groups exceeding €450 million in EU turnover and meeting the EU presence criteria under the Omnibus rules.

|

Companies with fewer than 1,000 employees are now classified as Protected Undertakings and are exempt from mandatory CSRD reporting.

Under 1,000 employeesListed SMEs are no longer required to report under the CSRD.

No mandatory reportingNon-EU companies fall within scope only if they exceed €450 million in EU turnover and have a significant EU subsidiary or branch, as defined under the Omnibus I rules.

€450M EU turnover + EU presenceWhile the Omnibus package delays reporting for many companies, it does not change the overall direction of travel. Sustainability reporting requirements remain firmly embedded in EU law, and companies approaching future reporting waves should use this additional time to prepare robust data collection and governance processes.

The Corporate Sustainability Reporting Directive (CSRD) replaces and significantly expands upon the Non-Financial Reporting Directive (NFRD), which was adopted in 2014 to establish a common framework for non-financial disclosures.

While the NFRD was an initial step toward harmonised sustainability reporting, it was widely considered insufficient due to its limited scope and lack of standardised reporting requirements.

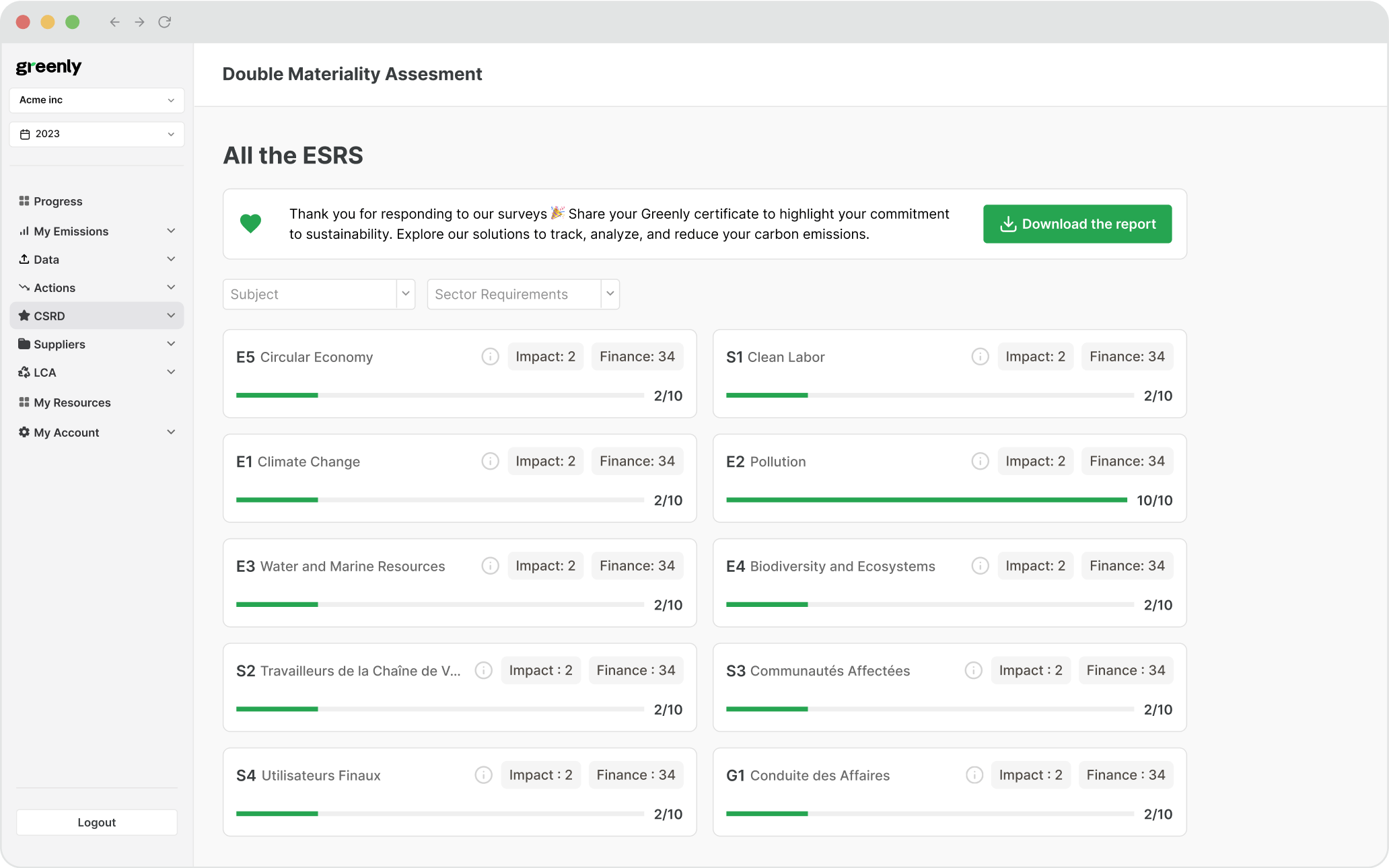

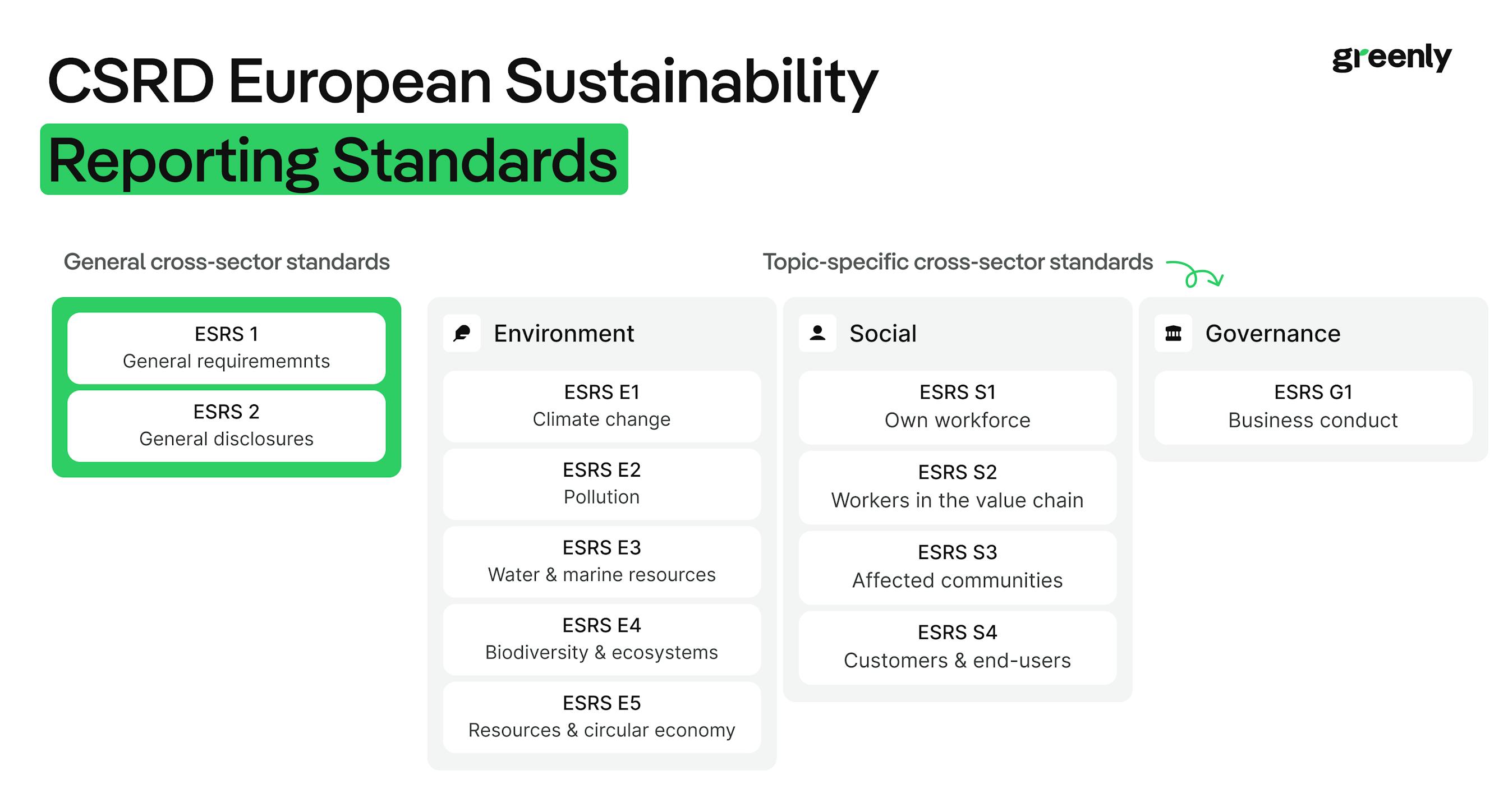

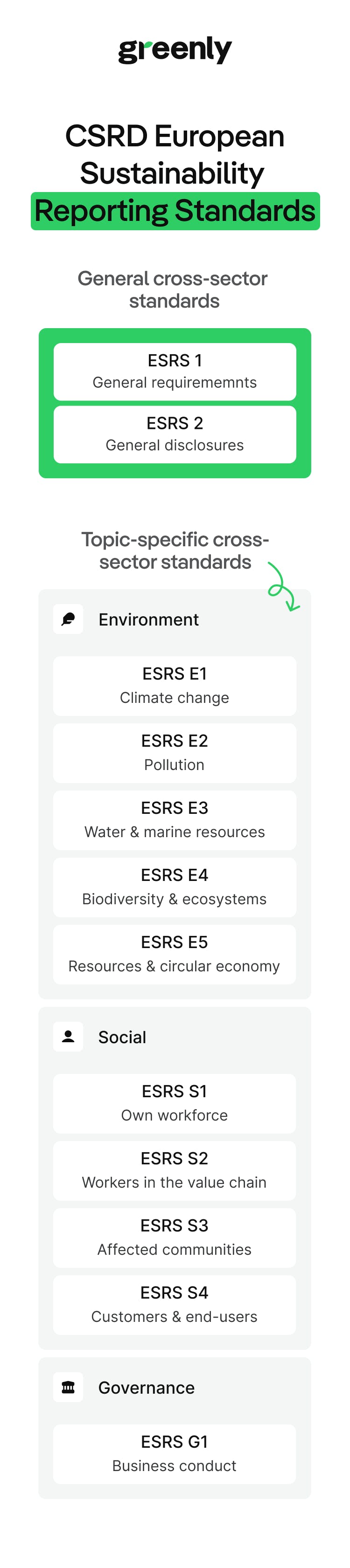

The CSRD requires companies to report in accordance with the European Sustainability Reporting Standards (ESRS), which aim to standardise and enhance the quality of corporate sustainability disclosures.

These standards define how companies must report on their environmental, social, and governance (ESG) impacts, ensuring consistency and comparability across industries.

The first set of ESRS standards was developed by the European Financial Reporting Advisory Group (EFRAG) and formally adopted by the European Commission on July 31, 2023. These standards apply to companies within the CSRD scope. Under the Omnibus I simplification, the ESRS have also been subject to simplification work, including “quick-fix” amendments adopted in 2025 and further simplified ESRS developed by EFRAG.

| Category | ESRS Standard | Overview |

|---|---|---|

|

General Principles

|

ESRS 1: General Requirements | Defines key principles for sustainability reporting, including governance, materiality, and strategic alignment. |

| ESRS 2: General Disclosures | Outlines key disclosures such as governance roles, due diligence, and performance metrics. | |

|

Environmental Standards

|

ESRS E1: Climate Change | Requires reporting on climate mitigation efforts, adaptation strategies, and Scope 1, 2, and 3 emissions, with alignment to frameworks such as TCFD. |

| ESRS E2: Pollution | Covers pollution control measures, reduction strategies, and impacts of pollutants on air, water, soil, and noise. | |

| ESRS E3: Water and Marine Resources | Addresses water management, including withdrawal, consumption, recycling, wastewater treatment, and marine ecosystem conservation. | |

| ESRS E4: Biodiversity and Ecosystems | Requires reporting on biodiversity conservation, habitat restoration, and ecosystem impact management. | |

| ESRS E5: Resource Use and Circular Economy | Focuses on sustainable resource management, waste reduction, life-cycle assessment, and circular economy initiatives. | |

| ESRS S1: Own Workforce | Covers employee-related policies, including diversity, inclusion, health and safety, and working conditions. | |

| ESRS S2: Workers in the Value Chain | Addresses fair wages, labour rights, and supply chain working conditions, ensuring alignment with international labour standards. | |

| ESRS S3: Affected Communities | Requires companies to assess their impact on communities, including cultural heritage, relocation, and socio-economic effects. | |

| ESRS S4: Consumers and End-Users | Focuses on consumer protection, product safety, data privacy, and ethical considerations in product and service delivery. | |

|

Governance Standards

|

ESRS G1: Business Conduct | Covers corporate governance, anti-corruption measures, lobbying activities, and supplier risk management. |

Under the EU’s CSRD simplification reforms, the European Commission adopted a set of targeted ESRS amendments - often referred to as “quick-fix” measures in July 2025 - to ease the first years of CSRD implementation. These amendments do not change the structure of the ESRS, but reduce immediate reporting pressure for companies newly in scope.

Postpone or make optional certain data points for early reporting years, particularly where data is complex or not yet readily available

Clarify ambiguities and overlaps in ESRS wording to improve consistency and auditability

Limit mandatory disclosures to those most material in the initial reporting phase

Reduce the overall number of required data points, following technical work led by EFRAG

These changes are designed to make ESRS reporting more proportionate, without weakening the core principles of double materiality, comparability, or transparency. Companies should therefore continue to align their systems with the full ESRS framework, while applying the simplified requirements where permitted during the transition.

A core principle of the CSRD is double materiality, which requires companies to report on both financial materiality (how sustainability factors impact a company’s financial performance) and impact materiality (how a company’s operations affect people and the environment).

Financial materiality considers how climate risks, regulatory changes, and market shifts influence a company’s revenue, costs, and valuation. For example, a company exposed to extreme weather events may face increased insurance costs, while firms in high-emission industries may encounter stricter regulations impacting profitability.

Impact materiality assesses how a company's business activities contribute to environmental and social issues. This includes measuring carbon emissions, water consumption, human rights practices in supply chains, and biodiversity impacts.

By requiring companies to disclose not only the risks they face from climate change, but also their own impacts, double materiality ensures that sustainability encapsulates a company’s broader responsibility toward society and the environment. This principle aligns with the EU’s commitment to corporate accountability and sustainable finance.

Companies that fail to comply with the CSRD will face penalties, which are determined at the national level by each EU member state.

While enforcement mechanisms may vary, the directive sets out minimum sanctions that authorities can impose on non-compliant businesses.

According to Article 1 of the CSRD, penalties may include:

These measures are designed to ensure that sustainability reporting is taken as seriously as financial disclosures, reinforcing accountability and preventing companies from avoiding their reporting obligations.

Narrower scope

Mandatory CSRD reporting now targets the largest EU and non-EU companies, significantly reducing the number of in-scope entities compared to the original CSRD design.

Adjusted timelines

Later reporting waves benefit from delayed start dates, giving companies additional preparation time without cancelling reporting altogether.

Lighter reporting burden

Through ESRS “quick-fix” amendments and simplification work, the initial reporting load has been reduced, particularly for complex or low-materiality data points.

Greater protection for smaller companies

SMEs and companies below the 1,000-employee threshold are shielded from mandatory CSRD reporting, with voluntary standards like the VSME intended to limit spillover pressure from large value-chain partners.

In practice, the Omnibus package signals a recalibration rather than a retreat. The CSRD remains one of the most ambitious sustainability reporting frameworks globally, but its implementation is now more proportionate, prioritising feasibility and clarity while maintaining comparability and regulatory credibility.

With the first wave of CSRD reporting underway and the Omnibus I simplification package now clarifying scope, timelines, and reporting expectations, companies can move from regulatory uncertainty to practical implementation. The priority in 2026 is no longer guessing what may change, but understanding where your organisation sits, and acting accordingly.

The Omnibus package has significantly narrowed the number of companies subject to mandatory CSRD reporting. The first step is to confirm whether your organisation falls within scope under the revised criteria, and which reporting year applies.

Verify employee thresholds and financial criteria at the group level

Identify your reporting wave and first applicable financial year

Clarify whether you qualify as a Protected Undertaking or fall under voluntary standards such as the VSME

For companies required to report under the CSRD, attention should shift from exhaustive data collection to robust, decision-useful disclosures aligned with the simplified ESRS requirements.

Prioritise double materiality assessments to identify truly material topics

Build reliable processes for high-impact data, particularly climate and supply-chain metrics

CSRD sustainability information is subject to assurance requirements, making auditability a central consideration from day one.

Document methodologies, assumptions, and data sources clearly

Align sustainability and finance teams early to avoid late-stage corrections

Engage with auditors or assurance providers well ahead of reporting deadlines

Even where CSRD reporting is no longer mandatory, sustainability data remains a commercial and strategic issue, particularly for companies operating in European value chains.

Anticipate ESG data requests from clients, investors, and lenders

Use proportionate frameworks such as the VSME to respond efficiently

Maintain internal visibility on key sustainability metrics to support tenders, financing, and partnerships

Whether reporting is mandatory or voluntary, the CSRD has set a new baseline for how sustainability data is structured, governed, and used.

Respond to future regulatory developments

Meet investor and partner expectations

Turn sustainability reporting into a strategic asset rather than a compliance burden

Although the CSRD is an EU directive, some UK companies will still be required to comply based on the scale of their activities in the European Union. UK-based groups with significant EU operations - through subsidiaries, branches, or substantial EU turnover - should assess whether they fall within the CSRD’s revised scope following the Omnibus I simplification.

Under the updated rules for non-EU parent companies, a UK-based group is required to report under the CSRD if it:

Generated for two consecutive financial years.

UK parent companies meeting these criteria will be required to publish CSRD-compliant sustainability reports from 2029, based on their 2028 financial year.

Note: where CSRD reporting applies, UK companies must disclose sustainability information covering their entire global operations, not only their EU activities.

Confirm whether your EU turnover and organisational structure meet the revised non-EU thresholds

If in scope, begin aligning sustainability data and governance processes with ESRS requirements

If out of scope, prepare for ESG data requests from EU-based clients, investors, and lenders, using proportionate frameworks such as the VSME where relevant

As companies navigate the complexities of the Corporate Sustainability Reporting Directive (CSRD), Greenly provides a comprehensive, AI-powered platform to streamline compliance, automate reporting, and turn sustainability data into a strategic advantage.

Because CSRD is one of the most comprehensive sustainability frameworks globally, implementing it with Greenly provides a robust foundation for wider ESG reporting needs - from investor requests and tenders to voluntary CSR reporting and future regulations.

Once CSRD is in place, companies can activate additional frameworks (eg. IFRS, GRI, Ecovadis, California disclosures, or custom indicators) without redoing core data collection, significantly reducing long-term reporting costs compared to traditional consulting-led approaches.

Learn more about Greenly's CSRD solution here.