Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

Since leaving the E.U., the United Kingdon has been working to ensure companies comply with sustainability initiatives, such as via the Ten Point Plan – but how do European Sustainability Reporting Standards (ESRS) seek to ensure as many companies are required to comply and be transparent regarding their environmental impact?

Incentives such as the Corporate Sustainability Reporting Directive implore companies to report under the European Sustainability Reporting Standards – as these detailed reporting requirements require business to follow detailed disclosure requirements, adhere to reporting obligations, provide quantitative metrics, and take corporate accountability.

What is the ESRS, or European Sustainability Reporting Standards, how does it work, why is it important, and how can the U.S. take note of the ESRS to improve upon their own sustainability reporting standards?

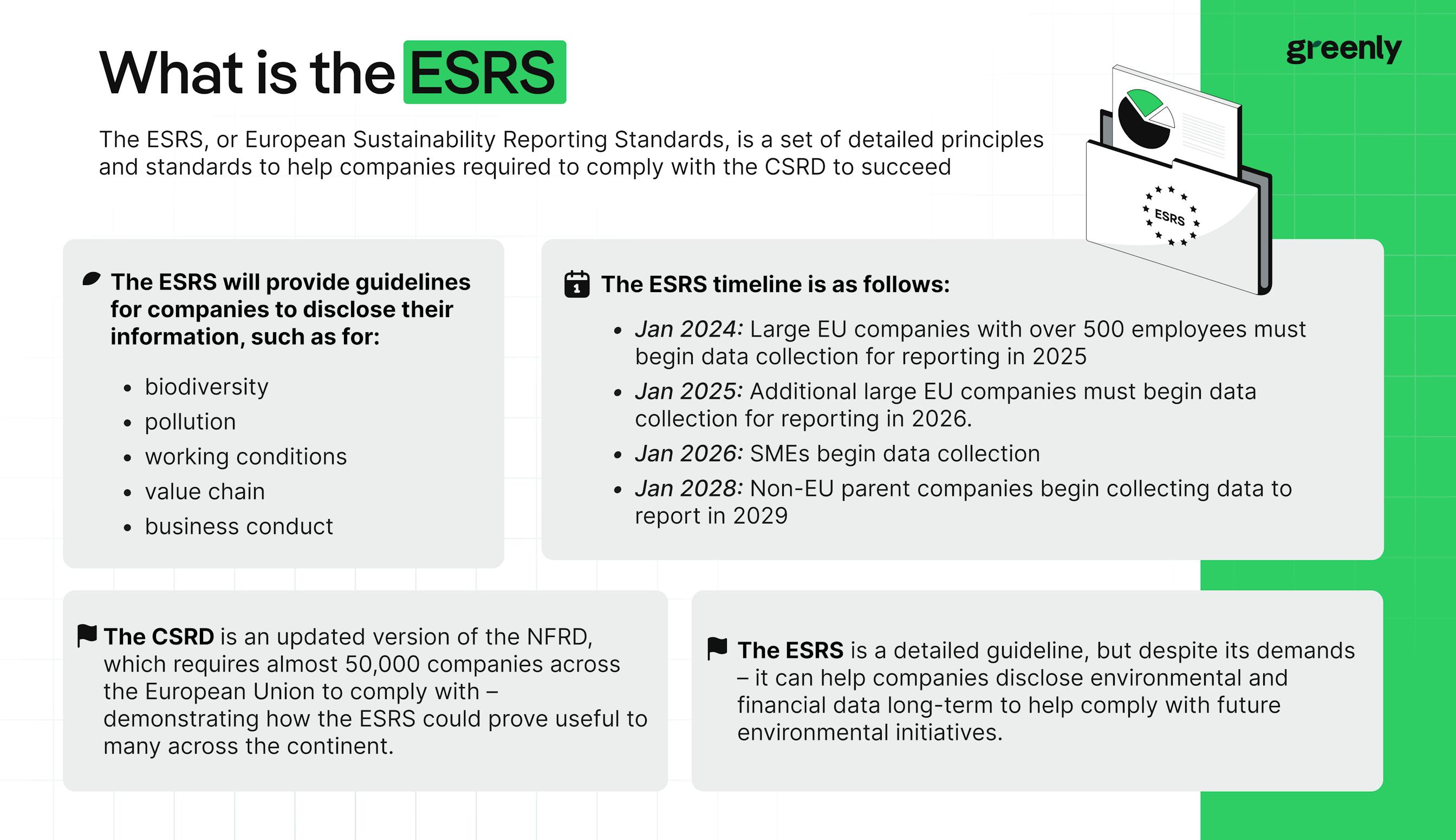

The acronym "ESRS", otherwise known as European Sustainability Reporting Standards, is a pivotal component in CSRD – as they help to standardise reporting across the European Union.

Ultimately, the ESRS provides a set of principles to help companies required to comply with the Corporate Sustainability Reporting Directive. This aligns with the new, imperative goal the EU has set for itself in the midst of global warming and in attempts to curb emissions.

ESRS was approved by the European Financial Reporting Advisory Group last year in 2022, and has provided a list of requirements which pertain to numerous ESG principles – including the environment, social matters, and governance.

Remember, the European Financial Reporting Advisory Group, or EFRAG, is an independent body bringing together various different stakeholders.

Across the EU, companies with more than 250 employees will be required to report under the ESRS – starting anywhere between 2024 and 2026 depending on company size and sector specific standards. ESRS will demand companies to report their environmental and societal impact, and also require them to clarify how their impact on sustainability impacts their business financially.

Remember that while the CSRD and the ESRS are interconnected, the two aren't one in the same – as the CSRD encourages reporting requirements and the ESRS provides a framework for companies required to proceed with reporting to use.

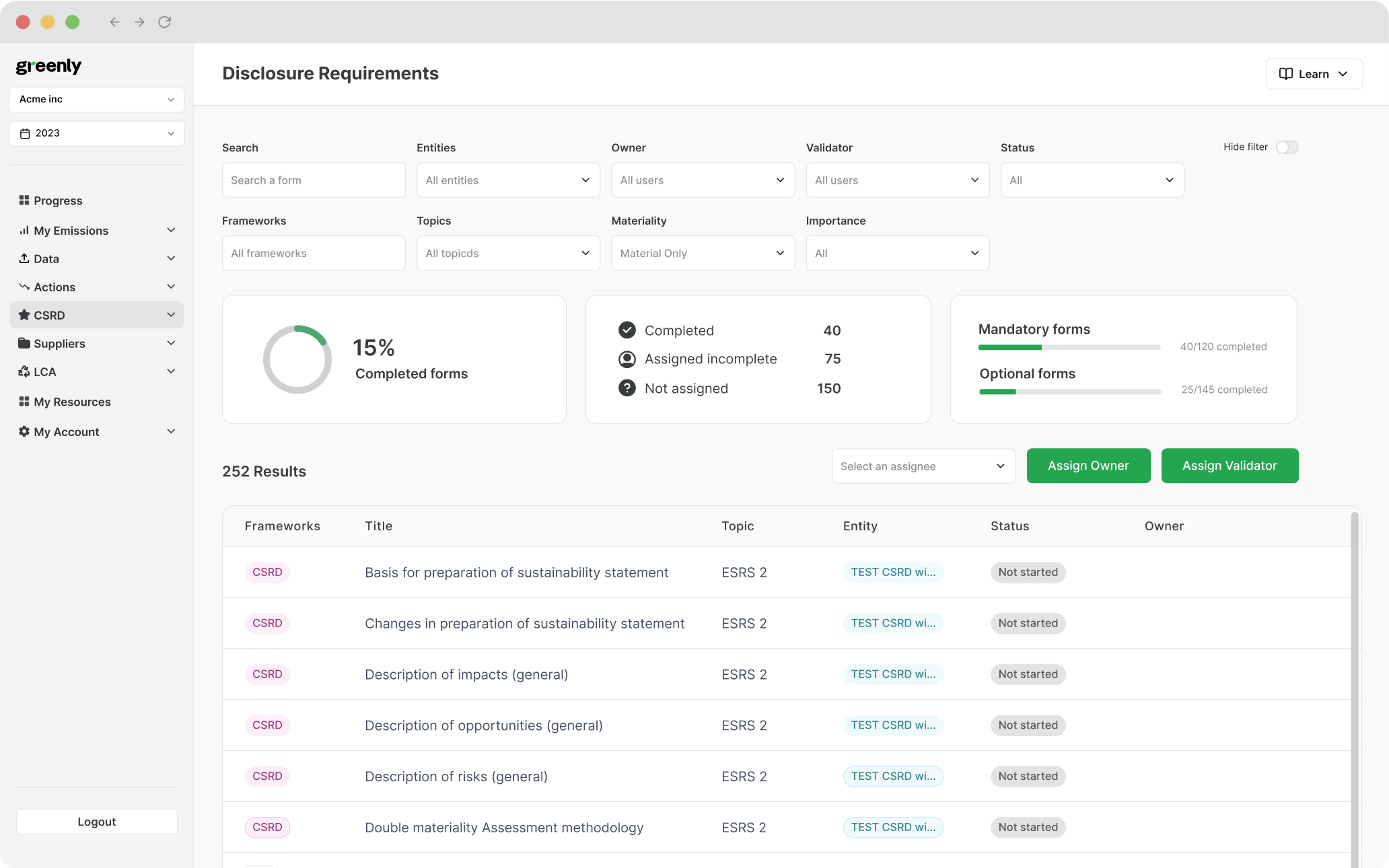

The updated timeline of the CSRD under the guidance of ESRS is as follows:

| Date | Requirement |

|---|---|

| January 2024 | Large EU companies with over 500 employees must begin data collection for reporting in 2025. |

| January 2025 | Other large EU companies must begin data collection for reporting in 2026. |

| UPDATE – February 14, 2024 | The CSRD was amended; extending the release of new sector-specific ESRSs (i.e., reporting standards) and reporting timelines for some large EU companies for two years. |

| January 2026 – 2028 | SMEs can begin data collection in January 2026, however, they have the option to opt out of reporting for two years (exemptions apply). |

| January 2028 | Non-EU parent companies must begin data collection for reporting in 2029. |

The European Commission adopted the final delegated act of the European Sustainability Reporting Standards (ESRS) on July 31st, 2023. This means that companies that are already obligated to comply with the NFRD must begin reporting under the ESRS as soon as the 2024 reporting period.

It's worth noting that in October 2023, the ESRS narrowly escaped being discarded after a majority vote in the European Parliament prevented the standards from being scrapped. The proposal to get rid of the standards stemmed from criticism that the ESRS is lacking in overlap with other disclosure requirements.

Global standard setting initiatives such as ESRS will require companies to consider financial risks, sustainable finance, financial materiality, various material sustainability topics, and even to conduct a materiality assessment or a double materiality assessment.

The overview cards below will reveal how these requirements under the ESRS will benefit companies in the long run:

Helps companies prioritise what matters most to stakeholders and financial performance.

Encourages firms to assess how both sustainability impacts their business and the world.

Improves access to ESG-focused investors and green financing opportunities.

Boosts long-term resilience by identifying climate and sustainability-related risks early.

Transparent reporting builds credibility with consumers, investors, and regulators.

Integrates sustainability goals into business strategy for long-term value creation.

In this sense, ESRS draws inspiration from both the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI) to create rigorous reporting requirements and ensure interoperability, incorporating mandatory cross-cutting standards.

The ESRS can prove beneficial for companies, as it is becoming increasingly important to present yourself as an eco-friendly corporation in order to appeal to customers, employees, and stakeholders alike.

As a whole, ESRS requirements will not only help the EU's commitment to fight against the effects of global warming – but help different companies and even smaller companies take advantage of the opportunities arising from sharing their social and environmental challenges.

At Greenly, we offer companies exceptional guidance on how to comply with various sustainability reporting standards such as the ESRS, CSRD, and more – book a demo today to learn how we can help!

Remember, the ESRS will implore companies to consider:

The interactive flip cards below (move cursor over card to flip) will reveal specifically how the ESRS can benefit businesses in the EU long-term:

ESRS is important because a sustainability statement is not only key to identifying how to reduce environmental impact, but crucial to building a financially successful and reputable business. Evaluating ESG is becoming more pivotal than ever, and the ESRS will enforce this new business necessity.

The main goal of ESRS is to encourage companies within the E.U. to reassess their current sustainability efforts and to support implementation of new sustainable initiatives.

Actions to work towards the main purpose of the ESRS can include:

Actions to work towards the main purpose of the ESRS can include:

ESRS reporting requirements are aligned with international standards such as the Task Force on Climate-Related Financial Disclosures (TCFD) to ensure that the double materiality concept and other sector specific ESRS standards are aligned with other global standard setting initiatives.

ESRS allows companies in Europe to improve the organisation of their own workforce, adhere to other stakeholders, and improve their sustainability, public consultation, and data points to the greatest extent possible for current future EU legislation.

In fact, the ESRS serves as an effort to help Europe establish a capital markets union to make the E.U. more attractive for investors, promote access to financial support for SMEs, and ensure that national markets remain relevant.

The ESRS works by requiring companies to provide detailed reporting for each ESG category: environmental, social, and governance. This allows companies to get a well-rounded view of their business, and how their impact on global warming and sustainability affects different facets of their business.

The data to be collected and reported for the ESRS is both qualitative and quantitative, and allows companies subject to ESRS to understand their impact for short, medium, and long-term improvement.

The summary cards below will breakdown the importance of each ESG factor in ESRS:

Central to climate targets, biodiversity, pollution, and circular economy goals, this pillar is the most data-intensive part of the ESRS. It plays a vital role in assessing sustainability risks and aligning with global investor expectations.

This section includes workers, affected communities, and value chain stakeholders. It highlights issues like DEI, labor rights, and social protections — increasingly prioritised by EU regulations and civil society.

Governance disclosures are required for all companies under ESRS 2. They cover policies, oversight, roles, and accountability measures that help ensure ethical conduct and integration of ESG strategy into operations.

ESRS includes two cross cutting standards and ten topical standards, all of which work to ensure ESRS compliance and top-tier data collection.

Here is a breakdown of some of the ESRS reporting requirements from each ESG category in ESRS:

Social and environmental issues are cross cutting standards are pivotal part of the ESRS framework and to encourage companies to provide a detailed explanation and include overarching disclosure requirements. Corporate reporting often focuses on a the impact a company creates from a financial perspective, but the ESRS redirects the necessary emphasis we need on sustainability issues.

Overall, ESRS ensures an in-depth reporting process to allow companies to improve their transparency, sustainability performance, reporting processes, and do a deep-dive in how each ESG area can be impacted by the actions of their company.

The difference between the ESRS, CSRD, and NFRD can be difficult to keep track of – bearing in mind they are all sustainability reporting initiatives or are related to sustainability, they still aren’t all the same thing.

Ultimately, the ESRS serves as a guidelines while the CSRD and NFRD are compulsory sustainability reports.

The three-way battle cards below will break down the differences between the CSRD, NFRD, and ESRS:

The ESRS is not an actual reporting directive like the CSRD or the NFRD – but rather a supplement to help support companies required to report to the CSRD. Think of the ESRS as a comprehensive study guide for an exam: preparing you for the worst so you are more likely to succeed

The CSRD, built off of the values and serving as a detailed extension of the NFRD, is viewed as the new and improved version of the NFRD. This is because the CSRD applies to a larger scope of companies, requiring nearly 50,000 businesses in the European Union to comply.

The CSRD is also more detailed than the NFRD, while in addition to the already existing requirements to report their efforts, those required to report to the CSRD compliance means further demonstrating how a business can impact ESG factors.

The drop down sections below will reveal additional requirements and incentives under the CSRD as opposed to the NFRD include:

Other key differences between the CSRD and the NFRD include that CSRD must be audited by a third part, and that CSRD accommodates digital reporting whereas the NFRD does not.

As the United Kingdom is no longer part of the European Union, the lines have blurred whether or not U.K. based companies will need to comply with ESRS reporting – but regardless of the company origin, if a U.K. business has roots in the EU, they will still be expected to share their impact materiality, digital taxonomy, and more under the CSRD.

Sustainability reporting practices continue to vary across the world, but the benefit of the European Union over Europe is that multiple countries can insinuate action and inspire others to do the same.

U.K. based businesses will be expected to comply with the CSRD and ESRS reporting if:

U.K. companies listed on any regulated market within the European Union will be expected to comply with the CSRD and ESRS — even if they are not headquartered in the EU.

U.K.-based businesses generating more than €150 million in annual revenue from within the EU must comply with CSRD and submit ESRS-aligned sustainability reports.

Companies with a branch in the European Union that earns more than €40 million in net revenue must also meet CSRD reporting obligations, regardless of U.K. headquarters.

If a U.K. company meets at least two of the following — €900K+ turnover, €450K+ in assets, or 10+ employees — it may fall under CSRD scope depending on EU business presence.

Even if ESRS reveals that Europeans and Brits view climate change differently, it can still prove to be a useful guideline for any company looking to adhere to future sustainable initiatives.

Even if U.K. based companies or other non EU companies hold no ties to the EU and doesn't meet the requirements to report to the CSRD, ESRS is still a framework in line with ISSB standards, sector agnostic standards, and even EFRAG (European Financial Reporting Advisory Group) – all of which can help both the first companies required to comply with ESRS reporting and those after to meet the the newfound high degree of expectations of financial institutions, local governments, and more.

There are several benefits to abiding by the guidelines depicted by ESRS, such as helping to support informed decision making, boosted transparency, and the ability to attract newfound investors.

However, ESRS requires more detailed reporting, and while this can prove beneficial for companies looking to adhere to ESG values more seriously, reducing emissions, and improving upon their sustainability – it can be overwhelming for companies to follow.

In addition to the benefits of ESRS, there are a multitude of challenges for those who seek to follow the guidelines provided by the ESRS. For instance, subscribing to the notion of the ESRS is a time consuming and demanding process – one which may be too difficult for companies to allocate their resources to.

The timeline below will depict the process of adhering to the ESRS and highlight the pros and cons each step of the way:

Companies begin by familiarising themselves with the scope and purpose of the ESRS — a critical framework for ESG compliance in the EU.

Firms must gather detailed environmental, social, and governance data, which can support transparency and informed decision-making — but can also be time-consuming and complex.

This core requirement helps identify what matters both financially and from a sustainability impact perspective. It’s useful but demands cross-functional alignment and deep analysis.

Each data point must align with ESRS-specific disclosure requirements — improving consistency, but adding layers of reporting burden.

Companies consolidate findings into a standardised sustainability report — which increases credibility with stakeholders and investors but requires strong internal systems.

Reports must be externally reviewed, improving reliability and accountability — yet adding cost and operational complexity.

When done effectively, ESRS reporting helps reduce emissions, attract investors, and strengthen ESG values. But for many, it’s a long journey requiring sustained resources and strategy.

Also, the ESRS may create a conflict of interest: as some companies may be wary to be transparent about their areas where improvement can be made.

However, that being said, the ESRS can provide indispensable benefits for companies that follow the detailed guideline. For example, the ESRS can help companies to understand in depth the ESG impacts and better comply with CSRD requirements. This can ultimately help companies to attract new investors and business opportunities, as adhering to ESG data can help companies seem more worthy of being awarded financial resources.

Lastly, the ESRS can help companies acquire new information on CSRD immediately – allowing them to adjust their business models accordingly without time pressure.

Additional benefits of ESRS include:

Improved brand reputation

Better risk management

New sustainable innovation

Lower operational costs

More strategic planning

Stronger long-term growth

Ultimately, the ESRS can help companies to better identify potential risks and business inefficiencies for greater improvement – both in terms of sustainability and financial success.

Overall, it's worth looking into learning more about the guidelines depicted by ESRS even if your company is required to comply – as following these standards could help your company to prepare for the day it's finally expected to comply with environmental legislation.

If reading this article about European Sustainability Standards, or ESRS, has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

At Greenly we can help you to assess your company’s carbon footprint, and then give you the tools you need to cut down on emissions. We offer a free demo for you to better understand our platform and all that it has to offer – including assistance with boosting supplier engagement, personalised assistance, and new ways to involve your employees.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.