What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

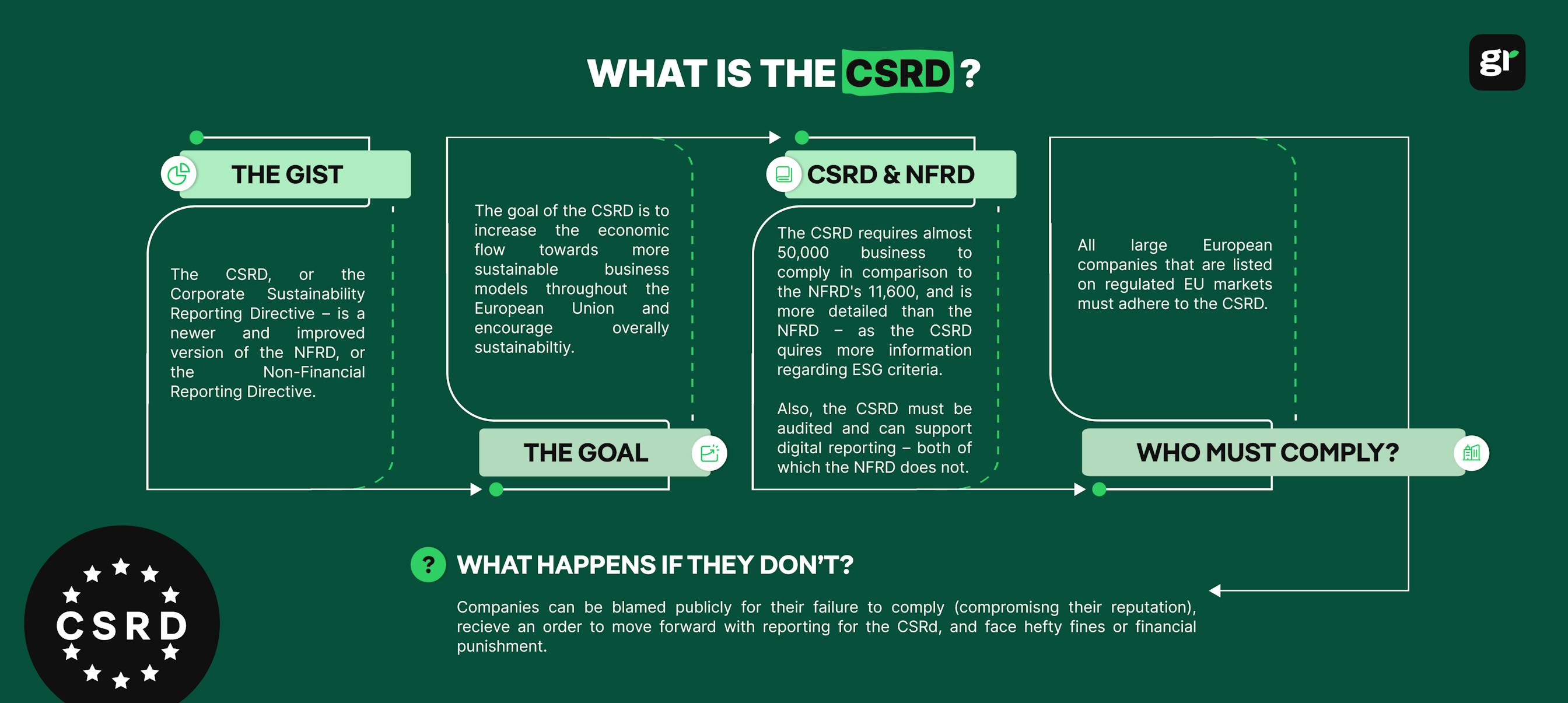

The Corporate Sustainability Reporting Directive (CSRD) introduces new requirements for how companies assess and disclose sustainability issues. A key element of this is Impacts, Risks, and Opportunities (IROs) - a framework that ensures businesses report not just on their sustainability impacts but also on the risks and opportunities that come with them.

IROs play a crucial role in determining what’s material for a company’s sustainability report. By identifying where the business has an impact, where sustainability issues pose risks, and where opportunities for growth exist, companies can prioritise what needs to be disclosed under the European Sustainability Reporting Standards (ESRS).

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

For more information and advice on CSRD compliance, see our IFAC case study.

The Impacts, Risks, and Opportunities (IROs) framework is a key part of sustainability reporting under the Corporate Sustainability Reporting Directive (CSRD). It requires companies to assess and disclose how sustainability issues affect both their business and the wider world.

Under the European Sustainability Reporting Standards (ESRS), IROs are classified into three categories:

IROs help companies identify and prioritise sustainability topics that matter most for reporting, ensuring that disclosures focus on what is truly significant.

Under CSRD, companies must assess which sustainability topics are material through a double materiality assessment. This ensures that reporting captures both:

IROs connect these two perspectives, acting as the foundation of materiality assessments. Because material sustainability topics are identified through the assessment of Impacts, Risks, and Opportunities, IROs play a critical role in determining which ESRS disclosure requirements apply and how those disclosures are structured. In other words, by identifying where the company has an impact, where sustainability issues create financial risks, and where opportunities exist, businesses can determine not only which topics must be disclosed but also how these disclosures are structured within the ESRS framework.

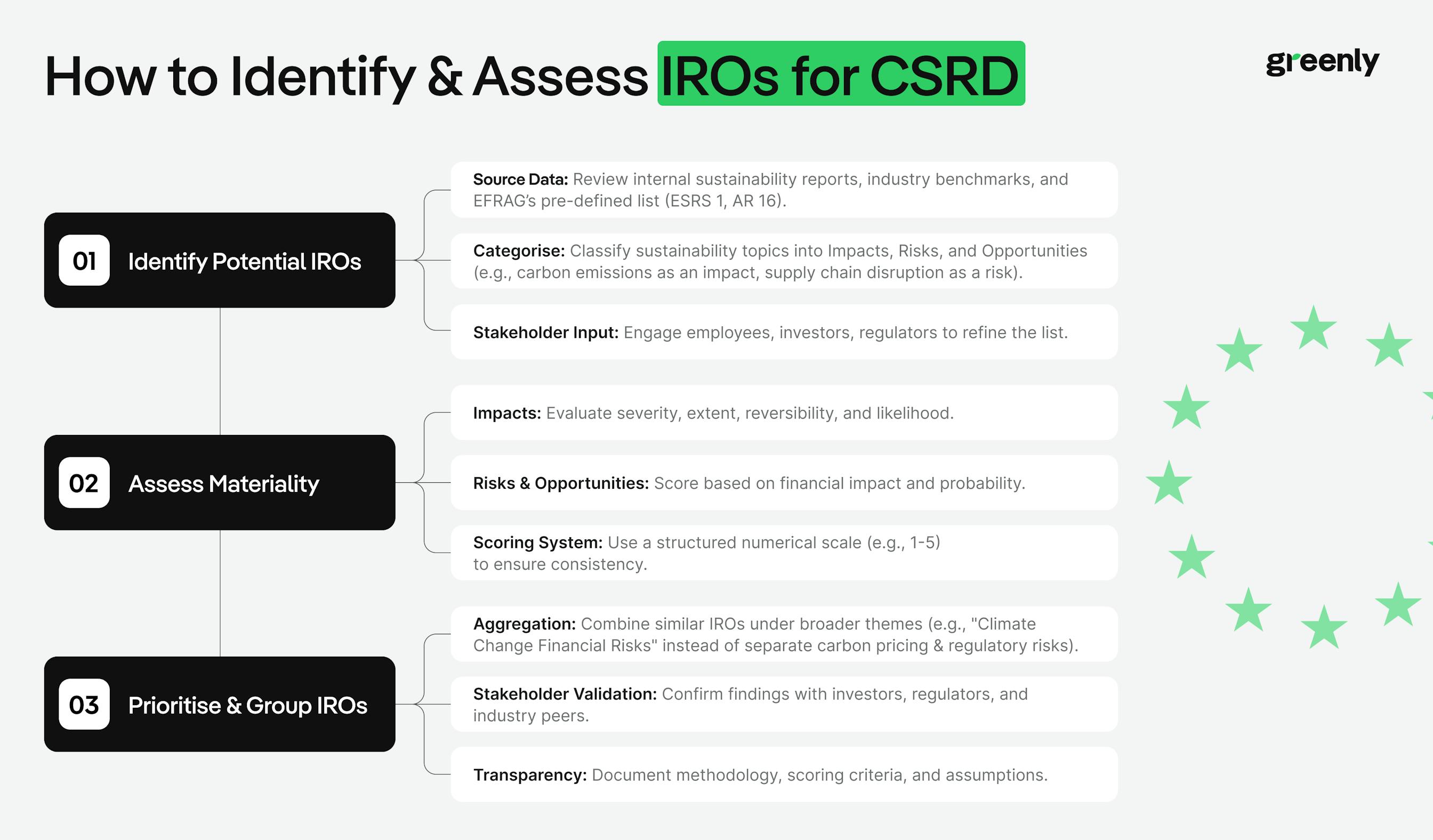

Identifying Impacts, Risks, and Opportunities (IROs) is the first step in CSRD reporting. This process ensures that companies focus on the most relevant sustainability topics for their business.

| Step | Key Actions |

|---|---|

| 1. Start with a Broad List of Potential IROs |

- Review ESRS guidance on ESG topics - Analyse internal data and sustainability reports - Benchmark against industry peers - Engage with stakeholders |

| 2. Categorise IROs into Impacts, Risks, and Opportunities |

- Classify sustainability issues into: * Impacts: Effects on people & planet * Risks: Financial threats from sustainability factors * Opportunities: Business benefits from sustainability trends |

| 3. Assess IROs Across the Value Chain |

- Consider sustainability impacts across: * Upstream (suppliers, raw materials) * Direct operations (factories, employees) * Downstream (products, customers) |

Companies should begin by mapping out all potential sustainability issues that could be relevant to their operations. This can be done by:

Once companies have a longlist, they should classify each item into one of the three IRO categories:

A company’s sustainability footprint extends beyond its own operations. IRO assessments should consider:

Once IROs are identified and categorised, the next step is to assess which ones are material.

For impacts, materiality is assessed based on the scale, extent, reversibility, and likelihood of an issue. This helps companies determine which sustainability impacts - whether positive or negative - are significant enough to be reported under CSRD.

Each impact is evaluated using the following criteria:

Scale: How severe is the impact?

Extent: How widespread is the impact?

Reversibility: Can the impact be mitigated or undone?

Likelihood: How probable is the impact?

ESRS does not prescribe a specific scoring methodology, but companies must apply a structured approach and justify their chosen methodology. Many businesses use a numerical scale (eg. 1-5) to evaluate each criterion and establish materiality thresholds. Setting clear thresholds ensures consistency and comparability across sustainability reports.

Unlike impacts, which focus on how a company affects the environment and society, risks and opportunities look at how sustainability issues can financially affect the company itself.

To determine materiality, businesses need to evaluate two key factors:

Again, to ensure a structured approach, companies typically use a scoring system - for example, rating each IRO on a 1-5 scale based on severity and likelihood. Higher-scoring risks and opportunities are considered material and require disclosure, while lower-scoring ones may be excluded.

To improve accuracy, businesses may also:

Although ESRS does not mandate stakeholder engagement, it is strongly recommended as part of the materiality assessment process. Engaging with investors, regulators, and industry peers can help validate findings, align with market expectations, and enhance reporting credibility. Companies should document any stakeholder input used in their materiality assessments.

Once a company has assessed the materiality of its Impacts, Risks, and Opportunities (IROs), the next step is to refine and organise the findings for CSRD reporting. This ensures that reporting is structured, relevant, and transparent.

To finalise the list of material IROs, companies should:

While not explicitly required under ESRS, consolidating similar IROs under key sustainability themes is a best practice that can enhance clarity and reduce redundancy in reporting.

This approach helps streamline CSRD reports, making them more digestible for stakeholders while ensuring key sustainability topics remain prominent.

Although ESRS does not mandate stakeholder engagement, it is widely recommended as part of the materiality assessment process. By consulting key stakeholders, companies can validate their assessment, address potential blind spots, and align with evolving market expectations.

External stakeholders (eg. investors, regulators, industry experts) can provide insights into whether the company’s assessment aligns with broader market expectations.

Companies must explain how material IROs were determined, including:

This level of transparency helps stakeholders understand the company’s reporting decisions and ensures compliance with CSRD requirements.

By following these steps, companies can streamline their sustainability reporting, making it both comprehensive and accessible.

Once Impacts, Risks, and Opportunities (IROs) have been identified and assessed, companies must ensure they are properly disclosed in their sustainability reports. Under the European Sustainability Reporting Standards (ESRS), two key disclosure requirements apply:

These disclosures ensure transparency and provide stakeholders with a clear view of how a company identifies, assesses, and prioritises sustainability matters.

Companies must explain the methodology used to assess IROs, detailing how they determine which sustainability issues are material. This includes:

Providing this level of detail reinforces credibility and helps investors and regulators understand how sustainability risks and opportunities are managed.

Once material IROs have been assessed, companies must publish a structured list of sustainability topics in their CSRD report. This includes:

By following these disclosure requirements, companies can demonstrate compliance with CSRD, enhance investor confidence, and provide stakeholders with a clear and structured overview of their sustainability priorities.

Effectively managing Impacts, Risks, and Opportunities (IROs) is critical for CSRD compliance, but it presents several challenges. Companies must assess sustainability issues holistically, ensuring that reporting is accurate, relevant, and aligned with stakeholder expectations. However, data complexity, stakeholder engagement, and the lack of standardised assessment methods often create obstacles.

Key challenges include:

| Challenge | Explanation |

|---|---|

| Complexity of data collection | IRO assessments require integrating diverse financial, operational, and sustainability data from multiple sources. Aligning impact data with financial risks and opportunities is challenging, especially for Scope 3 emissions or global supply chain impacts. |

| Stakeholder engagement | Balancing the expectations of investors, regulators, employees, and customers is difficult. Stakeholders may prioritise different sustainability topics, making it challenging to determine what is material for reporting. |

| Lack of standardised thresholds | ESRS provides guidelines but no fixed scoring system for determining materiality. Companies must develop their own criteria for evaluating impacts, risks, and opportunities—leading to inconsistencies across industries. |

| Regulatory complexity | CSRD requirements overlap with other reporting frameworks (e.g., GRI, SASB, TCFD), requiring companies to navigate multiple compliance expectations. |

| Dynamic sustainability risks | Sustainability challenges evolve due to regulatory updates, climate change developments, and shifting consumer demands, requiring frequent reassessments of IROs. |

To address these challenges, companies can implement structured approaches to improve IRO assessments and reporting clarity:

| Best Practice | Why It Matters |

|---|---|

| Use software tools to streamline IRO assessments | Automated platforms help collect, analyse, and document IROs, reducing manual effort and ensuring consistent materiality assessments. |

| Incorporate cross-functional teams | ESG, finance, risk, and compliance teams should collaborate to ensure IROs are assessed holistically, aligning sustainability impacts with financial risks. |

| Develop clear materiality thresholds | Establishing internal scoring systems (e.g., rating impacts from 1-5) ensures consistency and comparability in IRO evaluations. |

| Engage stakeholders proactively | Consulting investors, customers, and regulators ensures material IROs align with market expectations and enhances credibility. |

| Regularly update materiality assessments | Companies should review IROs annually or in response to regulatory changes to reflect evolving sustainability risks and opportunities. |

Greenly provides end-to-end support for companies navigating CSRD reporting, helping to streamline compliance. Our platform offers materiality assessments, structured data collection, and expert-led guidance to help businesses meet ESRS requirements with ease.

With Greenly, companies can move beyond one-off compliance and build a scalable sustainability reporting foundation aligned with CSRD and future reporting frameworks. Get in touch with us today to find out more.