Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

The Sustainability Accounting Standards Board (SASB), a non-profit organisation focused on creating sustainability accounting guidelines for diverse industries, offers a blueprint for disclosing sustainability data of financial significance to investors.

In August 2022 the SASB was incorporated into the International Sustainability Standards Board (ISSB), which has since taken on the role of refining and advancing the SASB Standards.

👉 In this article we’ll explore what the SASB is, and what its future looks like under the ISSB.

The Sustainability Accounting Standards Board (SASB) was a non-profit organisation established in 2011 to develop sustainability accounting standards. Its primary aim was to help businesses around the world report on the sustainability topics that matter most to their investors and that are likely to impact their ability to create long-term shareholder value. By doing so, the SASB sought to improve the effectiveness and comparability of corporate disclosure on environmental, social, and governance (ESG) topics.

You’ll notice the use of past tense here - this is because, in August 2022, the International Sustainability Standards Board (ISSB) assumed responsibility for the SASB Standards. The ISSB is now responsible for maintaining, enhancing, and evolving the SASB Standards.

The ISSB has commenced an initial phase of enhancements to the SASB Standards. Updates to the climate-related SASB Standards were released in June 2023, and the updates to the rest of the SASB Standards are expected in December 2023.

The SASB Standards will eventually transition into the IFRS Sustainability Disclosure Standards which are being created by the ISSB. The SASB Standards are still highly valuable to companies in the meantime however as they allow companies to identify their sustainability risks and opportunities. The SASB Standards will also inform the IFRS Sustainability Disclosure Standards, which is why companies who adopt the SASB Standards now will be better placed to meet reporting requirements under the IFRS Sustainability Disclosure Standards.

The ISSB has already published two IFRS Sustainability Disclosure Standards:

However, the ISSB has stated that “industry-specific disclosures are required and, in the absence of specific IFRS Sustainability Disclosure Standards, companies must consider the SASB Standards to identify sustainability-related risks, opportunities, and appropriate metrics.”

👉 To learn more about ESG criteria, why not head over to our article on the topic.

The SASB was created in response to the growing recognition that sustainability factors can have a significant impact on a company's long-term value and performance. Traditional financial reporting, while comprehensive in its coverage of financial data, often lacks standardised information on environmental, social, and governance (ESG) aspects, which are increasingly important to investors and other stakeholders. As the investment community began to acknowledge the financial materiality of ESG issues, there emerged a clear need for a structured and consistent framework to report on these topics.

👉 To find out why ESG reporting is invaluable to companies, take a look at our article.

The SASB Standards consist of 77 distinct industry-focused disclosure guidelines. This is because while some ESG concerns are universal across industries, others are specific to particular sectors or might manifest differently from one industry to another. The SASB guidelines identify material sustainability topics and the corresponding metrics relevant to companies within a particular industry.

The SASB structured its standards around five primary sustainability dimensions. These dimensions encompass a broad spectrum of environmental, social, and governance (ESG) factors, tailoring them to specific industries to capture the most materially relevant issues. Let’s take a closer look at each of these dimensions:

Each of these dimensions offers a comprehensive lens to understand and assess a company's sustainability profile. By categorising issues within these dimensions, the SASB adopted a holistic approach to sustainability reporting, capturing both broad and industry-specific concerns.

The principle of materiality is centred on the idea that not all sustainability topics are equally relevant or significant to every industry. By focusing on financial materiality, the SASB standards ensure that companies disclose information on sustainability issues that are most likely to have a substantive impact on their financial condition, operating performance, or risk profile.

The SASB Materiality Map® is a visual tool that was developed by the Sustainability Accounting Standards Board (SASB) to showcase the sustainability topics that are most relevant to different industries. It categorises sectors and highlights specific environmental, social, and governance (ESG) issues that are considered materially important for companies within those sectors. Given the varied nature of ESG concerns across industries, the Materiality Map offers a tailored view, assisting companies in their sustainability reporting and aiding investors in analysing ESG risks and opportunities.

The SASB standards are not mandatory. They were developed to provide a voluntary framework for companies to disclose material sustainability information in a consistent and comparable manner. The adoption of SASB standards largely depends on the company's discretion, its regulatory environment, and stakeholder demands. However, with the increasing emphasis on sustainability and ESG factors in the global investment community, there is growing recognition of the value of standardised reporting, which has led many organisations to voluntarily adopt the SASB standards or integrate them into their existing reporting processes.

The SASB standards differ from other ESG (Environmental, Social, and Governance) frameworks in several distinctive ways:

In June 2021, the Value Reporting Foundation (VRF) was established from a merger between the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) to simplify the complex sustainability disclosure landscape.

This was followed by the decision to establish the International Sustainability Standards Board (ISSB) to create a “comprehensive global baseline of high-quality sustainability disclosure standards to meet investors' information needs.” The VRF - and therefore the SASB - was consolidated into the IFRS Foundation in August 2022.

The ISSB is now responsible for maintaining and enhancing the SASB Standards. It has stated that it will build on and consolidate the work of reporting initiatives including the SASB Standards, as well as the Integrated Reporting Framework (IR Framework), the Task Force for Climate-related Financial Disclosure Recommendations (TCFD Recommendations), and the Climate Disclosure Standards Board Framework (CDSB Framework).

Since formally taking on this responsibility in August 2022, the ISSB has been working to update the SASB standards. In June 2023 they released updates to the climate-related standards and updates to the non-climate-related standards are expected by the end of the year.

The SASB Standards are precursors to the IFRS Sustainability Disclosure Standards being developed by the ISSB. These standards remain essential for companies to assess sustainability challenges and opportunities. By adopting SASB now, companies will be better prepared for future IFRS requirements. The ISSB has introduced two standards: IFRS S1 and IFRS S2, pertaining to general sustainability reporting and climate-related disclosures. However, in the absence of specific IFRS standards, the ISSB advises companies to reference the SASB Standards for industry-specific sustainability insights.

👉 To learn more about the advantages of sustainability reporting head over to our article.

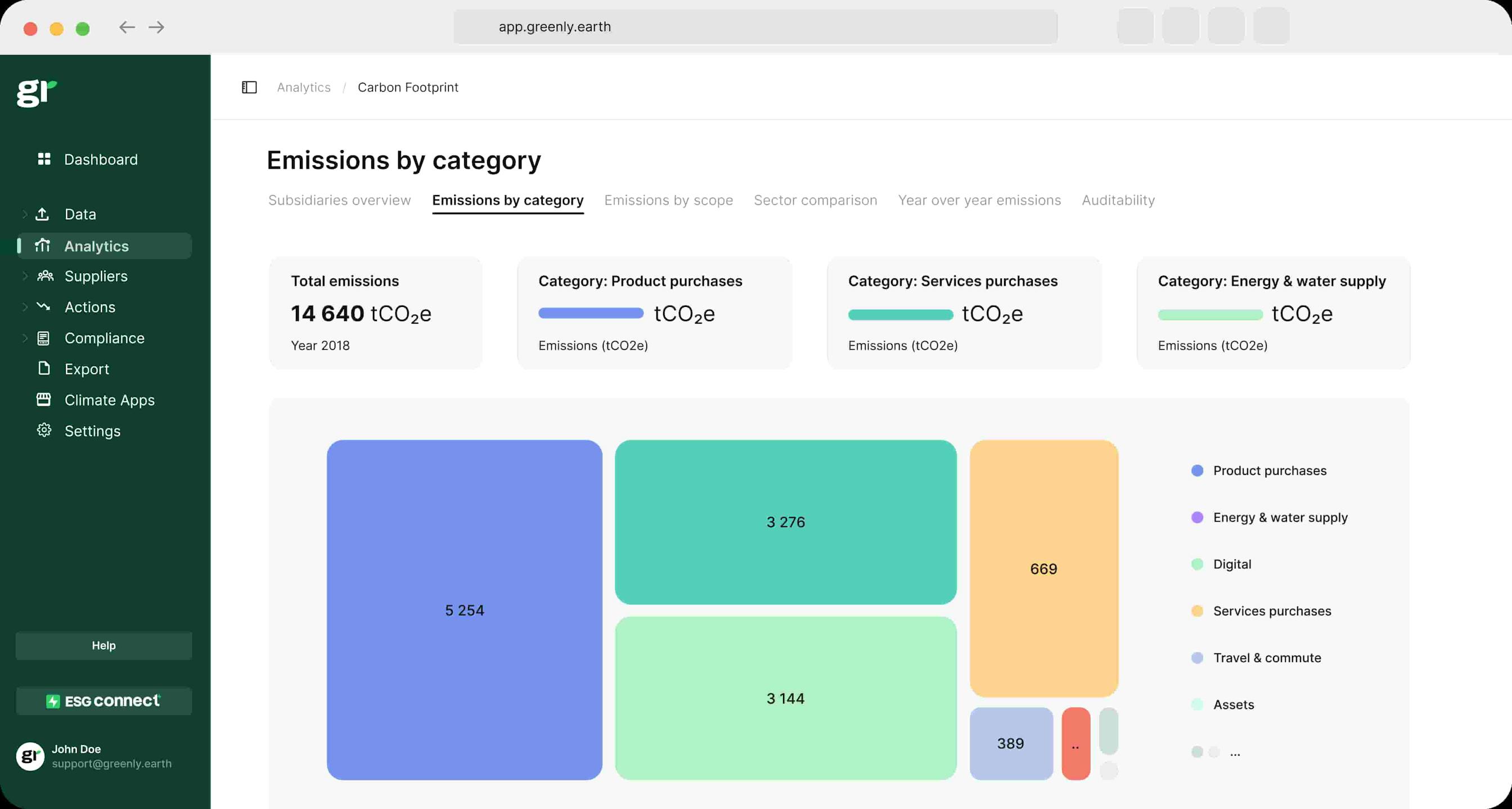

At Greenly we can help you to assess your company’s carbon footprint, and then give you the tools you need to cut down on emissions. Why not request a free demo with one of our experts - no obligation or commitment required, with our personal advice guaranteed.

If reading this article has inspired you to consider your company’s own carbon footprint, Greenly can help. Learn more about Greenly’s carbon management platform here.