ESG / CSR

Industries

What is the Partnership for Carbon Accounting Financials (PCAF)?

Investments are always going to be a big part of the financial market, but how investments are made and maintained is changing due to climate change.

Climate related financial disclosures are becoming more important not only to help mitigate climate related risks, but to help the financial sector adjust itself to a new world where global GHG accounting and measuring financed emissions is the new norm.

More and more investors are growing aware of the importance of green financing, such as impact investing or socially responsible investing.

However, as much as investors are becoming more interested in investment opportunities that don’t cause environmental harm, or even do some good for society – it can be difficult to sort through the options and ensure that their potential investments are aligned with the measures necessary to combat climate change.

👉 How does the PCAF, or the Partnership for Carbon Accounting Financials, work to provide investors with the security that their investments are transparent and trustworthy?

What is the PCAF?

Carbon Accounting Financials (PCAF) is a series of financial institutions that serve to seamlessly disclose all greenhouse gas (GHG) emissions that are produced or created in turn with any loans or investments.

The approach of the PCAF helps provide a baseline for investment enterprises to implement science-based targets to ensure that their investment portfolio is in line with the values of the Paris Climate Agreement.

👉 In other words, the PCAF helps to make sure that future investments do not produce excessive emissions and pertain to the ideals of green financing.

What is the background behind PCAF?

The PCAF wasn’t always in existence.

Back in 2015, the PCAF began when several Dutch financial institutions created the PCAF with the help of the ASN Bank.

💡 The PCAF was initially announced at the Paris Climate Summit as an attempt to transition to a low carbon economy by disclosing to the public the emissions impact of their financial activities – like loans and investments.

The Start of Financial Institutions Factoring Greenhouse Gas Emissions Data

Since then, more financial institutions across the Netherlands began establishing the methods necessary to measure the greenhouse emissions of all various financial portfolios. Once 2018 came around, the PCAF spread to North America – where twelve more financial institutions adhered to the measures of the PCAF to enhance greenhouse gas accounting.

By March of 2019, 28 leaders of banks part of the Global Alliance for Banking on Values, or GABV for short – implemented the PCAF method and began to measure and share the greenhouse gas emissions produced by their investments to the public.

What are the main goals of the PCAF?

The PCAF doesn’t want to just improve greenhouse gas emissions disclosures for the sake of transparent financing, but as an effort to protect the future of the planet.

Reduce Global GHG Emissions

It isn’t enough for businesses and individuals to adjust their business models or daily efforts to combat climate change. Every sector in the world needs to make a sustainable change to reach net-zero emissions by 2050, and the PCAF is a compilation of that realisation – that if the financial industry can alter their activities to adhere to the values of the Paris Climate Agreement, it’s possible that the world can collectively reduce emissions and fight climate change together.

For example, the PCAF may encourage evolving standards for financed emissions such as with insurance associated emissions – which refer to emissions existent in our current global economy.

💡 Therefore, companies would not only be required to disclose greenhouse gas emissions, but to understand how and why disclosing financed emissions could lead to an industry led initiative to encourage others to calculate financed emissions data quality as well.

Encourage Transparency Through Climate Related Financial Disclosures

Therefore, the PCAF values transparency in disclosing greenhouse gas emissions throughout the industry across the globe – and is determined to make it compulsory for all engaging in investment portfolios, loans, or various financial activities.

👉 Ultimately, the main mission of the PCAF is to make greenhouse gas accounting the new norm throughout the financial industry – so that all investors and stakeholders can be sure that their investment portfolios don’t cause environmental harm or produce excessive emissions that pollute the Earth.

How does the PCAF work?

Before helping financial institutions, the PCAF works by ensuring that the proper metrics and targets have been set for each individual financial institution. This helps to verify that all climate related financial risks, asset classes, and global climate goals are considered before a company begins to incorporate finance to manage climate related risks.

💡Think of it like placing someone in a foreign language class. It’s first essential to test the current student’s language skills before placing them in a class, because their current level of language will determine how successful they can be in the next course. If a student is placed in a course too difficult, they will be overwhelmed and won’t succeed. It works the other way around, too – if you place someone in a course too easy for them, they won’t try hard enough.

✅ The PCAF defines the correct targets for financial institutions with the help of the Science Based Targets Initiative, or SBTi for short.

By following the goals presented in the Paris Climate Agreement, the PCAF helps financial institutions establish a baseline before they fully commit to the greenhouse gas accounting measures the Partnership for Carbon Accounting Financials strives to implement throughout the industry as a whole.

Since the PCAF is dedicated to making greenhouse gas accounting the new normal throughout the entire financial industry, they welcome any financial institution that wants to alter their financial models and portfolios to be more transparent.

💡 In fact, the PCAF looks to other organisations and institutions to develop their methodology, such as by referring to the Sustainable Finance Disclosure Regulation (SFDR) to create an approachable perspective towards scope 1, 2, and 3 emissions activity for those looking to assess climate related risks.

👉 This is precisely why the PCAF teams up with the SBTi to develop personalised approaches for each financial institution so that every financial organisation looking to implement the values of the PCAF can succeed.

Any financial endeavor from equity, bonds, business loans, mortgages, vehicle loans, or finances coordinated to real estate can seek the expertise and guidance of the PCAF.

The best part about the PCAF is that it is user friendly – its flexible interface has the resources necessary to help financial institutions who have no idea where to start to get started with disclosing their emissions and overall greenhouse gas accounting.

Why is the PCAF important?

You may be wondering how financial institutions could help the world solve global warming. Well, the main reason is simple – money rules the planet and makes the world go round.

💡 The PCAF is important as banks and other financial institutions are extremely influential on the rest of human activity – which studies have revealed is the newfound and most exponential cause for the drastic increase in global surface temperature.

Encouraging environmentally friendly investments and transparency in a sector that everyone must deal with at some point regardless of their individual sector can help to influence the worldwide change necessary to combat excessive emissions and allegations like greenwashing.

👉 The PCAF understands that investors play a massive role in the future of the financial ecosystem, and therefore – view it as their responsibility to steer investors down the right path to help the world transition to the low-carbon economy it so desperately needs.

| Reason | Description |

|---|---|

| Influence of Financial Institutions | Banks and other financial institutions have significant influence over human activities, which are major contributors to the rise in global surface temperatures. Their role in shaping economic activities makes them crucial in addressing global warming. |

| Control Over Capital Activity | Financial institutions control vast amounts of capital, which gives them the power to direct investments towards more sustainable and transparent practices. This control can drive the transition towards global greenhouse gas accounting and transparency. |

| Encouraging Environmentally Friendly Investments | By promoting investments that are environmentally friendly, financial institutions can lead the charge in reducing emissions and combating practices like greenwashing. Their influence can encourage widespread adoption of sustainable practices. |

| Responsibility to Investors | The PCAF recognises the significant role investors play in the financial ecosystem and sees it as their responsibility to guide these investors towards contributing to a low-carbon economy, which is essential for combating climate change. |

Who is partnered with the PCAF?

The PCAF doesn’t accomplish their goals of normalising greenhouse gas accounting and disclosures across the financial industry alone – but with the help of their several partners and collaborators.

Carbon Accounting Financials (PCAF) Partnerships

The PCAF enlists the help of several institutions to help achieve their missions of creating a more climate-transparent financial market, but here are just a few of the partners teamed up with the Partnership for Carbon Accounting Financials.

Science Based Targets Initiative (SBTi)

The SBTi, otherwise known as the Science-Based Targets Initiative, is partnered with the PCAF in order to encourage financial institutions to adjust their investment portfolios to adhere to the values of the Paris Climate Agreement. The SBTi helps the PCAF to achieve their goals by providing financial institutions with the scientific information necessary to help them establish their respective emission reduction targets.

Paris Aligned Investment Initiative

The Paris Aligned Investment Initiative helps the PCAF achieve their goals of creating a more climate-transparent financial market by helping to develop a method for the PCAF to implement greenhouse gas accounting measures in banks all around the world.

The Green Climate Fund

The PCAF is partnered with the Green Climate Fund so that they can monitor how GHG accounting and reporting continues to develop to improve the greenhouse gas accounting measures across the industry over time to ensure continued progress. This is accomplished by the PCAF reporting to the Green Climate Fund, and then giving them the option to provide feedback on ways to improve the greenhouse gas accounting standards.

Joint Impact Model

The Joint Impact Model, otherwise known as JIM for short, helps the PCAF to calculate their financed emissions in financial institutions in developing countries where the greenhouse gas estimates are more difficult to measure. JIM can help to ensure that the greenhouse gas emissions data is more accurate, so that the PCAF can continue to adjust accordingly.

The Carbon Disclosure Project (CDP)

The CDP, a non-profit organisation that strives to implement global disclosure – is a partner of the PCAF in order to help them monitor the environmental impact of certain financial institution’s investment portfolios so that adjustments can be made accordingly to fight against climate change.

The PCAF has several more partners that help them to achieve their missions of making transparent financial activities the new norm throughout the industry. However, everyone can make financial decisions that impact the environment – even if they don’t work for a financial institution or one of the many partners associated with the PCAF.

How else can you adhere to the values of the PCAF?

You don’t have to be the CEO of a bank a part of the PCAF to feel like your financial habits are making an environmental difference.

💡 While the PCAF is working hard to implement greater transparency throughout the financial industry as a whole, there are things you can do with your own financial habits to help decrease your environmental impact.

Different Ways to Align Your Financial Habits with Sustainability

For instance, if you want to make an investment of some sort – seek investment portfolios that pertain to the values of either impact investing or socially responsible investing.

Impact investing is a method of investing where the project or organisation the investor is contributing to is creating some sort of positive impact on society or the environment.

Socially responsible investing is when the investors seek to filter the potential investment portfolios according to various environmental credentials, such as through a good ESG score or a companies that have obtained an ISO certification.

👉 Both socially responsible investing and impact investing are examples of transparency in the financial industry, as they do not contribute to excessive greenhouse gas emissions or further environmental damage by financially contributing to measures that can help to mitigate climate change and benefit society overall.

However, until the market is as transparent as the PCAF is working hard for it to become one day, it’s important to understand how your financial habits and investments impact greenhouse gas emissions – and make the changes necessary so that both your wallet and the world can succeed.

What about Greenly?

If reading this article about the Partnership for Carbon Accounting Financials, or PCAF, has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

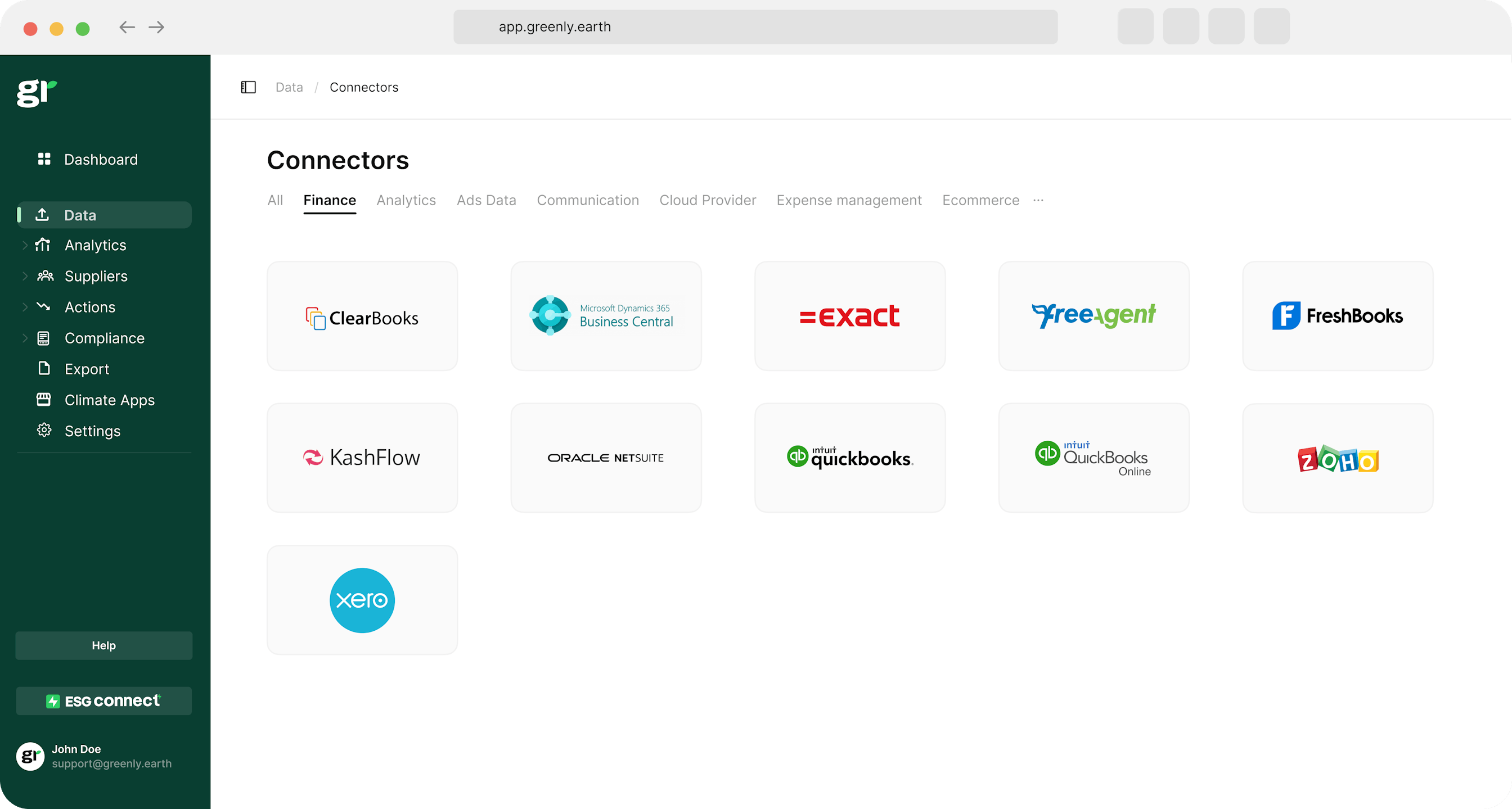

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.