Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

With ISSA 5000 newly released by the International Auditing and Assurance Standards Board (IAASB), businesses now have a dedicated global standard for sustainability assurance. This standard arrives at a crucial moment, as expectations for transparency around environmental, social, and governance (ESG) commitments are higher than ever. ISSA 5000 aims to bring clarity and rigor to sustainability reporting, helping organisations substantiate their ESG claims with reliable, verified data - a move that builds trust among investors, stakeholders, and the public.

👉 In this article, we’ll explore what ISSA 5000 is all about, why it’s significant, and how it’s set to improve sustainability reporting.

Designed to address the growing demand for credible, transparent ESG reporting, ISSA 5000 provides assurance practitioners with a clear set of principles for assessing sustainability data, ensuring that the information companies disclose is accurate and free from material misstatement.

One of the standout features of ISSA 5000 is its flexibility. Unlike other standards that may be tied to specific frameworks, ISSA 5000 is framework-neutral, meaning it can be applied to sustainability information prepared under a variety of reporting guidelines. Whether a company reports according to global standards like the Global Reporting Initiative (GRI), International Sustainability Standards Board (ISSB), or local regulations, ISSA 5000 offers a way to validate their ESG data, regardless of the framework they choose.

This principles-based approach also makes ISSA 5000 adaptable across different industries and organisational sizes. Rather than a rigid set of procedures, the standard provides assurance practitioners with guidelines focused on achieving high-quality outcomes, allowing them to apply professional judgment in assessing what evidence is necessary to support ESG claims. As a result, ISSA 5000 has quickly been recognised as a critical tool for organisations looking to reinforce their commitment to sustainable practices, building trust and transparency with stakeholders.

In the context of ISSA 5000, sustainability encompasses a broad range of topics that go beyond environmental concerns alone. The standard defines sustainability as covering environmental, social, economic, and even cultural issues that reflect both a company’s impact on the world and the world’s impact on the company. This includes everything from climate change and resource use to labor practices, human rights, community relations, and economic contributions.

ISSA 5000 emphasises a holistic approach to sustainability, where an organisation’s operations, products, and services are considered in terms of both financial and societal impacts. By setting standards for verifying this information, ISSA 5000 ensures that companies report on these diverse areas transparently and with accountability, giving stakeholders a clearer picture of a company’s overall commitment to sustainable practices.

ISSA 5000 was officially approved by the International Auditing and Assurance Standards Board (IAASB) on September 20, 2024, marking a major milestone for global sustainability assurance standards. With the formal publication of the standard set for December 2024, its full guidance will soon be available.

💡 The IAASB has announced plans to release additional guidance and application materials in January 2025, aimed at helping organisations implement the standard effectively. This support will include step-by-step instructions and examples tailored to various types of assurance engagements, making it easier for companies to align with ISSA 5000.

While the exact implementation timeline may vary by region or reporting requirement, the IAASB expects ISSA 5000 to be widely adopted by early 2025. Companies preparing to use ISSA 5000 will benefit from early planning and coordination with assurance providers to ensure their ESG data is ready for the first round of assurance reviews under this new standard.

ISSA 5000 is designed to be broad and inclusive, applying to any organisation seeking assurance on its sustainability information. Unlike some standards that cater only to specific industries or types of disclosures, ISSA 5000 is flexible enough to cover all sustainability topics - from environmental impact and energy use to social practices and governance. This wide scope means it can be used by companies of all sizes and industries, regardless of their specific reporting framework.

Notably, ISSA 5000 allows both accounting and non-accounting professionals (such as environmental experts or scientists) to perform assurance engagements, provided they meet the standard’s ethical and quality requirements. This inclusivity expands access to qualified professionals who can verify ESG data, making it easier for companies to obtain reliable assurance on their sustainability reports.

At its core, ISSA 5000 is all about one thing: helping businesses back up their sustainability claims with trusted, verifiable data. But how does it achieve that? The standard sets out clear objectives and requirements for assurance providers to follow when they’re verifying ESG information, ensuring that the data presented is both accurate and meaningful. Here’s a closer look at the main elements.

The primary goal of ISSA 5000 is to offer either limited or reasonable assurance on sustainability information. What exactly does that mean? When an assurance provider steps in, they’re tasked with checking that the information reported isn’t misleading or materially incorrect. For limited assurance, the process involves a more surface-level review; with reasonable assurance, it goes deeper, requiring more detailed verification and evidence. This layered approach means that organisations can choose the level of scrutiny that best matches their needs.

Before starting any assurance work, the auditor has to establish the “rules of engagement”. This includes understanding exactly what will be audited (the scope), how much information needs verifying (the reporting boundaries), and the level of assurance required. This careful planning ensures that both the auditor and the business are on the same page from the beginning - setting expectations and minimising misunderstandings along the way.

ISSA 5000 introduces a concept known as “double materiality”, which is a big deal for ESG reporting. Here, materiality goes beyond financial impact alone - it also considers the effects a company’s operations have on the environment and society. This two-sided approach means that the auditor looks at sustainability from two perspectives: how these issues could impact the business financially and how the company itself impacts the wider world. It’s a holistic view, designed to give stakeholders a fuller, more balanced picture.

The next step is all about evidence. For assurance to be credible, it has to be backed by solid proof. Auditors gather and document this evidence carefully, which might include checking data sources, reviewing internal reports, or even conducting interviews to confirm the accuracy of what’s being reported. When companies opt for reasonable assurance, this evidence-gathering process is even more thorough, requiring deeper dives into data to ensure nothing’s missed.

Finally, at the end of an assurance engagement, the auditor provides a report summarising their findings. It’s not just about giving a thumbs-up or down, the report explains the level of assurance provided, describes the procedures used, and clarifies any limitations or uncertainties found along the way. This transparency ensures that stakeholders know exactly how reliable the information is and where any potential gaps might lie.

One of the most significant features of ISSA 5000 is its approach to materiality, which goes beyond traditional financial reporting to capture a fuller picture of a company’s impact. In the context of sustainability, materiality isn’t just about what affects the business’s bottom line, it’s also about how the company impacts the world around it. This two-fold approach is known as “double materiality”. It’s already a concept embedded in the EU CSRD and it’s also a key element of ISSA 5000.

So, how does double materiality work? It consists of two aspects:

In practice, ISSA 5000 requires both the entity and the assurance practitioner to apply double materiality when preparing and verifying sustainability reports. This means companies need to think about both financial and non-financial impacts when deciding what information to disclose, while auditors assess these factors to ensure that important data hasn’t been overlooked. For qualitative disclosures (like company policies or community initiatives), this can involve narrative assessments; for quantitative data (like emissions levels or workforce diversity metrics), it might involve more precise thresholds.

By mandating double materiality, ISSA 5000 provides a more complete, balanced view of sustainability data - one that speaks to a wider range of stakeholders and recognises the complex, interconnected nature of today’s ESG concerns.

For companies falling under the scope of the Corporate Sustainability Reporting Directive (CSRD), ISSA 5000 arrives just in time. The CSRD requires that companies disclose their environmental, social, and governance (ESG) information with a level of rigor comparable to financial reporting, which includes verification by independent auditors and the requirement of a double materiality assessment. ISSA 5000 offers a standardised framework that aligns well with the CSRD’s focus on high-quality, credible ESG data.

Under the CSRD’s phased timeline, companies will need to meet a limited assurance requirement initially, with the potential to move toward reasonable assurance in the coming years. ISSA 5000’s dual approach to assurance (limited and reasonable) is well-suited for this phased compliance, providing companies with a structured path to meet and exceed regulatory expectations as standards continue to evolve.

Moreover, ISSA 5000’s compatibility with a variety of reporting frameworks makes it an ideal fit for the CSRD, which allows companies flexibility in choosing reporting standards, such as the European Sustainability Reporting Standards (ESRS). By implementing ISSA 5000, companies can streamline their assurance processes, enhance the credibility of their CSRD reports, and ensure their ESG disclosures meet both current and future regulatory demands.

Implementing ISSA 5000 offers companies a way to enhance the credibility, transparency, and efficiency of their sustainability reporting. By adopting this standard, organisations can better meet the growing expectations of stakeholders who demand verified, accurate ESG information. Here’s a closer look at how ISSA 5000 benefits businesses and their assurance processes:

| Benefit | Description |

|---|---|

| Enhanced Credibility | Provides verified, standardised ESG data, strengthening trust with stakeholders and boosting investor confidence. |

| Improved Transparency | Ensures ESG reports are clear and comprehensive, helping prevent misstatements and reducing the risk of greenwashing. |

| Global Consistency | Offers a unified assurance framework adaptable across industries and regions, supporting international comparability. |

| Streamlined Auditing | Reduces complexities in auditing by setting a consistent approach, allowing for more efficient engagements. |

| Flexibility Across Frameworks | Can be applied to any sustainability reporting framework, making it versatile for companies using different standards. |

| Supports Double Materiality | Integrates financial and impact materiality perspectives, providing a fuller picture of a company’s sustainability performance. |

| Cost-Effective Compliance | Lowers costs by minimising rework and providing a clear pathway for consistent, repeatable audits. |

| Adaptability for All Sectors | Suitable for any organisation size or type, from corporations to non-profits, as long as reporting aligns with sustainability goals. |

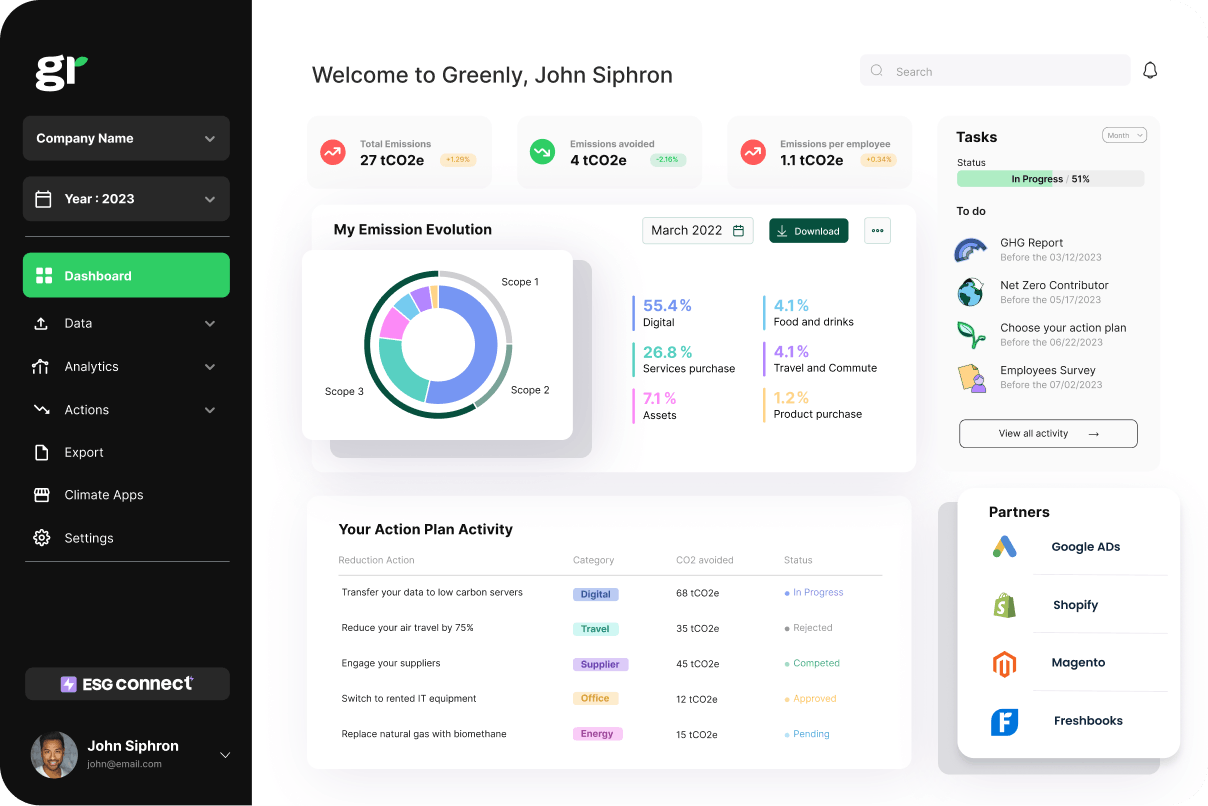

Sustainability is no longer a choice - it's a necessity for businesses across all sectors. As global pressures mount to reduce environmental impact and work towards a more sustainable future, having the right tools to manage and reduce carbon emissions is critical. Greenly offers a full suite of sustainability services that empower businesses to take meaningful action towards their sustainability goals.

At Greenly, we provide businesses with the expertise and tools needed to effectively manage their sustainability efforts. From tracking emissions to developing tailored strategies, Greenly supports companies at every stage of their sustainability journey.

Greenly’s platform allows businesses to track their Scope 1, 2, and 3 emissions, providing a clear overview of their environmental impact. This data is vital for developing targeted strategies to reduce emissions, align with science-based targets, and comply with regulatory standards.

Beyond emissions tracking, Greenly collaborates with companies to develop sustainability strategies. Our experts help identify key areas for improvement and guide businesses through actionable plans to achieve their sustainability ambitions.

Managing Scope 3 emissions - those originating from the supply chain - can be particularly challenging. Greenly’s platform helps companies identify and tackle high-emission areas in their supply chains, working collaboratively with suppliers to implement effective, sustainable changes.

Greenly’s intuitive platform streamlines sustainability management, enabling businesses to track their emissions, measure progress, and integrate sustainability into everyday operations. Whether you're starting your sustainability journey or enhancing your current efforts, Greenly can help you effectively manage and reduce your environmental impact.

Ready to become more sustainable? Let Greenly help your company take the next step towards a greener future.