Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

Several states within the U.S. aren’t waiting on national environmental legislation to battle the current climate emergency, such as New York and California.

California has always been a leader in many ways, for its globally renowned fiscal status landing a spot as the fifth largest economy in the world and in terms of combating climate change – having developed a set of statewide climate legislation before many other states and even countries back in September 2022.

Now, California is back at it again with AB 1305 – a new bill and disclosure aimed at regulating the amount of carbon offsets purchased by companies within the state to avoid trying to compensate for excess emissions.

In this article, we’ll provide an overview of AB 1305, its importance, and how companies can ensure compliance.

AB 1305, a bill and disclosure in California, refers to how companies are regulated in terms of marketing, selling, and purchasing voluntary carbon offsets for businesses within the state.

💡 AB 1305 is commonly referred to as the Voluntary Carbon Market Disclosures Act (VCMDA) just as voluntary carbon offsets are often referred to as VCOs.

Developed for the state of California, AB 1305 requires businesses in the state that engage with the market for voluntary carbon offsets (VCOs) to publicly disclose details regarding their current offset projects.

Under AB 1305, it is imperative that these disclosures are made publicly available on the organisation’s website and that it is updated every year in line with the annual disclosure date for AB 1305 – January 1st.

The main requirements businesses must follow under AB 1305 include:

👉 Overall, AB 1305 is a bill and disclosure in California that is aimed to ensure businesses across the state take accountability for the impact of their activities on the environment and do not loosely rely on or refer to the use of voluntary carbon offsets.

AB 1305 started as a result of newfound concern regarding the voluntary carbon market, and was developed in hopes of helping to regulate much of the activity that has occurred undisclosed thus far.

💡 A good example of this is with Delta, who was accused of selling low-quality carbon credits – confirmed skeptics’ criticism of the voluntary market and how it may allow for some companies to seem more eco-friendly than they actually are.

As a result, greenwashing allegations such as these fueled the need for greater transparency and accountability when it came to companies seeking out the use of carbon credits or carbon offset projects to aid in their emission reduction efforts.

More specifically, California has always paved the way for more stringent climate legislation – having passed the California Climate Accountability Package which includes SB253, SB261, and SB252.

👉 Ultimately, by requiring companies to provide greater detail regarding their involvement with the voluntary carbon market, AB 1305 can help companies from broadcasting false environmental claims and ensure that businesses use the highest-quality offsets possible to support their already-existing emission reduction strategies.

The table below will further explain the the timeline for AB 1305, SB253, and and SB261.

| Legislation | Effective Date | Key Compliance Requirements |

|---|---|---|

| AB 1305 | January 1, 2024 (enforcement begins January 1, 2025) | Requires businesses selling or marketing voluntary carbon offsets to disclose details about their offset projects, including third-party verification and updates on claims like carbon neutrality. |

| SB 253 | January 1, 2026 | Large corporations must publicly report their Scope 1, 2, and 3 greenhouse gas emissions annually, with mandatory assurance and verification starting in 2027. |

| SB 261 | January 1, 2024 | Companies with over $500 million in annual revenue must disclose climate-related financial risk reports starting in 2024, including strategies to mitigate those risks. |

The main goal of AB 1305 is to require companies across California to justify their ecological promises and verify their sustainability claims.

💡 Usually, many people will fall guilty to believing that any company or individual that refers to the voluntary carbon offset market is simply reducing the rest of the emissions they were unable to on their own – but this simply isn’t the case. AB 1305 will help hold companies accountable for their true environmental efforts and decrease dependency on carbon offsets and credits.

A perfect example is with Taylor Swift and her private jet, which garnered unwavering media attention in the midst of her globally successful Eras Tour. Many people presumed that since Swift was reported to have purchased carbon credits to offset the emissions of her tour, it meant the excess emissions from her private jet were compensated for – but in reality, this isn’t the case.

This is because it is often difficult to ensure if the carbon credits or carbon offsets purchased meet the relevant criteria, in this case – Swift’s excessive air travel. AB 1305 will attempt to accomplish the same motif by verifying the extent in which companies engage with the voluntary carbon market.

Here are some other reasons why AB 1305 is important:

👉 Companies subject to report under AB 1305 will need to validate their engagement with the voluntary carbon market, which in turn – will provide indispensable information regarding a company’s environmental integrity and prevent potential greenwashing behavior from being swept under the rug.

Technically, AB 1305 went into effect on January 1, 2024 – but all businesses within the state will be expected to comply one year later on January 1, 2025.

💡 Although AB 1305 already went into effect at the start of 2024, the bill never specified which date the first set of disclosure should be made. This was later clarified by Jesse Gabriel, who served as an assembly member for AB 1305 – who then confirmed the first disclosures should take place on January 1, 2025 and every year after that.

However, it is important to remember that AB 1305 is already in effect – meaning that businesses that fail to comply may face legal fines up to $2,500 per day for non-compliance if they do not take the steps to comply by the time enforcement kicks in at the start of 2025.

👉 Therefore, it is important for companies that have yet to take action to ensure compliance with AB 1305 act sooner than later – as the deadline for the first annual disclosure under AB 1305 is fast approaching.

Businesses in California can start preparing to comply with AB 1305 by taking note of the current carbon credits they have purchased or carbon offsets they have used.

Here are some of the ways that companies in California can make sure they comply with AB 1305:

👉 Overall, AB 1305 is aimed to encourage companies to take a look at their current carbon emission reduction schemes – and make sure those who want to label themselves as a carbon neutral or net-zero company have earned it.

If reading this article about bill AB 1305 has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

Trying to switch your company over to the values of a green business can be overwhelming, but don’t worry – Greenly is here to help. Click here to schedule a demo to see how Greenly can help you find ways to improve energy efficiency and decrease the dependency on fossil fuels in your own company.

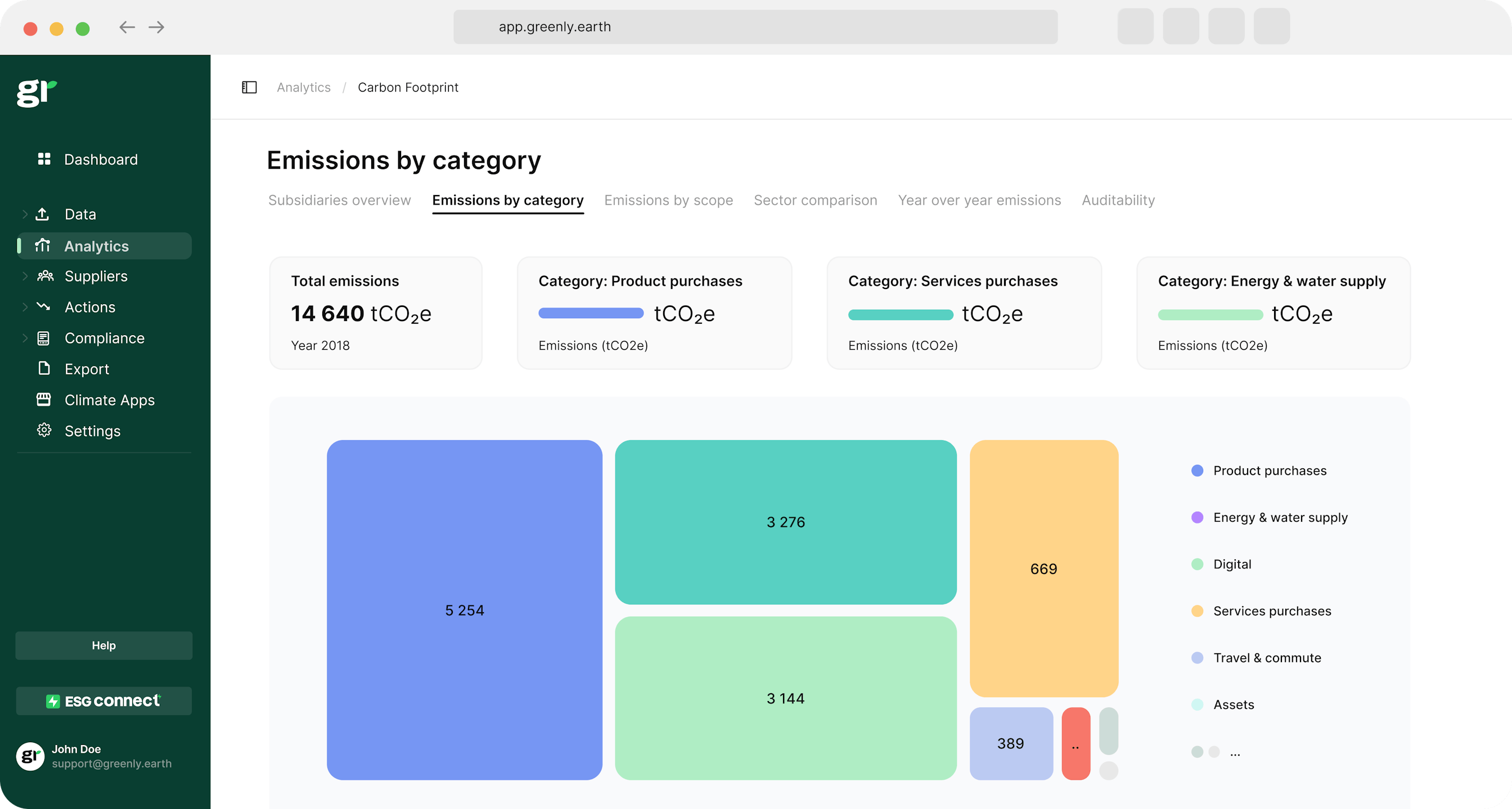

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.