ESG / CSR

Industries

Applying ESG in Banking

Businesses today have a lot more to deal with than ever before, such as appealing to younger consumers concerned with climate change and aligning their finances to fit the mold of ESG banking and sustainable finance.

The typical business finance model isn’t as simple as it used to be anymore, meaning that companies wishing to grow their business sustainably will need to find ethical investments and apply ESG banking to their financial activities.

In this article, we’ll explain what ESG banking is, why it is important, and how you can apply ESG in banking.

What is ESG in banking?

ESG in banking refers to financial activities that take the environment, society, and governance factors into account – such as by avoiding an investment that would cause excess GHG emissions or would harm a local community.

💡 As opposed to traditional banking, where the main goal is financial growth, ESG in banking will seek to prioritize ESG values being met over profits.

Here’s a breakdown of how ESG in banking works:

Environment

Several big-name banks across the world are still primarily concerned with providing their customers with the best interest rates possible as opposed to protecting the environment – such as with the top 6 banks in the United States having previously helped to finance fossil fuels to the tune of $1.8 trillion.

💡 Luckily, some of these top tier banks, such as Wells Fargo – have since made the effort to address carbon emission, energy usage, and how their projects are financed. For example, Wells Fargo has finally set net-zero by 2050 emission reduction targets for 2030.

Applying the ‘E’ in ESG banking will require:

- Banks to re-evaluate how their investments and financial projects impact climate change, energy usage, and various emissions

- Banks to set targets in line with international agreements such as the Paris Agreement

- Banks to remain aware of current and future environmental impacts as a result of their financial and business activities

Social

Certain banks may address societal issues more consistently than others, such as with Climate First Bank’s effort to help society by donating $100 to non profit organizations to help uninsured residents of Florida gain access to healthcare – a massive struggle in the United States, especially in the midst of the most recent presidential election.

Applying the ‘S’ in ESG banking will require:

- Banks to determine their current impact on local and larger communities, such as by evaluating criteria like ethical labor practices, human rights, and other DEI values

- Banks to partner with non profit organizations, such as Climate First Bank’s efforts, to help support low-income communities during difficult times and to illustrate they care about their societal impact

- Banks to prioritize loans to smaller businesses over big-name corporations to help boost diversity and inclusion

Governance

Often one of the the more overlooked factors of applying ESG in banking, governance refers to how a bank takes accountability for their actions – essentially, striving to be the opposite of the Deutsche Bank scandal.

Applying the ‘G’ in ESG banking will require:

- Banks to determine how and if they can improve their current ethical practices and efforts to comply with environmental regulations

- Banks to develop new anti-corruption policies and ensure diversity

- Banks to take full accountability for any greenwashing scandal or business mishaps that may occur

Popular examples of ESG in banking

Here are some well known examples of ESG in banking:

- Green Financing – This refers to issuing green bonds and loans for renewable energy projects, adhering to the ‘E’ in ESG banking.

ESG Reporting – Working towards clear-cut communication in terms of a bank’s ESG efforts can help them to align with global frameworks like the UN’s Sustainable Development Goals (SDGs) or the Task Force on Climate-related Financial Disclosures (TCFD), adhering to the ‘G’ in ESG banking. - Donating to Non-Profit Organizations – Allowing customers to choose a donation as a result of signing up for a new bank account can help to adhere to the ‘S’ in ESG banking.

- Exclusion Policies – Banks that work to avoid financing industries with significant negative environmental impacts, such as coal mining – can adhere to the ‘E’ in ESG banking.

👉 ESG is becoming a cornerstone of modern banking, shaping how financial institutions operate and contribute to sustainable development.

Why is ESG in banking important?

ESG in baking is important since banks are one of the last industries to get on board with ESG values and sustainability – meaning that their environmental and societal impact remains colossal, and that applying ESG in banking can help them to reduce their current ESG footprint.

💡Unlike fast fashion or travel, which are extracurricular activities and hobbies, next to everyone in the world has a bank account – whether it be for business or to pay your personal bills.

Here are some more reasons why ESG banking is important:

- Comply with Environmental Regulations – Major banks across the world may struggle to comply with ESG mandated compliance requirements, but seeking to apply ESG in banking can help companies to comply with current and future regulations.

- Risk Mitigation – Applying ESG in banking can help banks to determine their current risks associated with ESG factors, and help them to avoid greenwashing or loss of transparency – all of which are paramount to maintain an effective and sustainable business.

- Stakeholder Engagement – Increasingly, stakeholders and investors alike prefer banks that demonstrate strong ESG performance, reflecting a long-term, sustainable strategy.

👉 Furthermore, several banks are not on track to achieve net-zero emissions by 2050 – even if they have committed to emission reduction targets. This demonstrates that consumer incentive to choose truly ethical and ESG-committed banks is essential to reduce emissions in the financial sector.

The table below will share big-name banks and their current efforts to employ ESG:

| Bank | ESG Initiatives |

|---|---|

| Chase (JPMorgan Chase) | Invested $2.5 trillion in sustainable development and climate-related initiatives from 2021 to 2030, including renewable energy and energy efficiency projects. |

| Bank of America | Achieved carbon neutrality in 2019 and committed to $1.5 trillion in sustainable financing by 2030. Implements robust ESG governance and provides extensive ESG disclosures to stakeholders. |

| HSBC | Pledged to provide $1 trillion in sustainable financing by 2030. Set goals to achieve net-zero carbon emissions from its financed portfolio by 2050. |

| Wells Fargo | Launched a 10-year Banking Inclusion Initiative to support underbanked communities. Committed to $500 billion in sustainable finance by 2030 and enhanced community-focused programs. |

| Capital One | Focused on creating environmental impact through green buildings and reducing carbon footprints while supporting financial inclusion and education for underserved communities. |

| BNP Paribas (France) | Strong advocate for renewable energy financing, exiting coal power by 2030 in OECD countries, and by 2040 globally. Provides green bonds and sustainable investment products. |

What are the benefits of applying ESG in banking?

There are numerous benefits for banks that choose to apply ESG in banking, such as by allowing greater access to capital, enhanced customer loyalty, more sustainable business growth, and boosting overall transparency.

💡 Applying ESG in banking can help banks to improve both their business partnerships and customer relationships, allowing for new opportunities to expand business growth.

How can applying ESG in banking help your business to grow?

Here are some of the benefits for banks that choose to apply ESG in their business models:

- Boost Brand Reputation – Banks that make an effort to apply ESG are often viewed as more ethical and desirable amongst customers. As consumers become more concerned with associating themselves with eco-friendly products and services, this means that applying ESG in banking could help a banking business to grow.

- New Access to Capital – Investors are becoming increasingly interested in banks that align with ESG factors, meaning that applying ESG in banking could help financial firms to gain access to new financial opportunities.

- Greater Customer Loyalty – A whopping 77% of consumers want companies to become more cognizant in terms of ESG, meaning that applying ESG in banking could help to attract new customers.

- Reduced Business Risk – Banks that choose to incorporate ESG values into their business models can ensure reduced financial risks for both insurers and investors, making the bank more competitive and attractive to current and potential customers.

- Potential for Partnerships – Choosing to apply ESG in banking can allow for new business relationships to be fostered, such as with various non-profit organizations, investment researchers, or data providers – all of which can help to expand your banking business.

- Encourage Other Businesses to Utilize ESG Practices – ESG banking may encourage small businesses and clients to employ the same ESG practices in their own companies or day-to-day lives, which can help to further reduce our global environmental and social impact.

👉 Ultimately, ESG in banking can help businesses and banking clients alike to reduce their ESG impact and make long-term adjustments to go green in both their personal and professional lives.

How can you apply ESG in banking?

Businesses can apply ESG in baking by implementing sustainable practices across their business interactions, such as in their investment choices and how they interact with customers.

Here are some ways that businesses can employ ESG banking:

Environmental Efforts

- Green Financing – This can allow businesses to fund various projects such as energy efficient buildings or sustainable farming.

- Sustainable Investments – Utilizing green bonds and eco-friendly stocks can help to ensure no investments support fossil fuel usage.

- Reducing Emissions – Any efforts to reduce energy consumption, use renewable energy sources, or cut back on waste can help to employ ESG in banking.

Social Efforts

- Inclusive Banking – Developing financial products and services accessible to all communities or smaller businesses could help to attract customers of all kinds while also adhering to the ‘S’ in ESG banking.

- DEI Policies – Cultivating a workplace that allows all genders and minorities to be represented can make employees, clients, and business partners feel more comfortable and motivated to invest in your bank or company.

- Partnerships – Teaming up with local organizations to support recent natural disasters or local hardships can help foster a greater sense of community.

Governance Efforts

- Publicly Disclose Information – Making a greater effort to be transparent such as by sharing annual ESG or progress reports can help your business to align with global frameworks such as the Global Reporting Initiative (GRI).

- Encourage Ethical Business Practices – Banks that develop stronger anti-corruption policies can ensure compliance and a level of safety and satisfaction from clients and stakeholders alike.

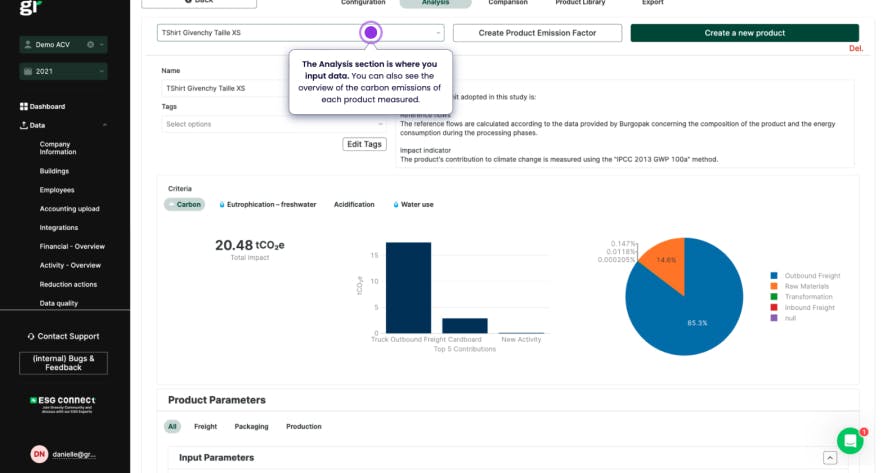

- Use Carbon Accounting to Track New Regulations – Using third party organizations like Greenly can help ensure that your business is up-to-date with all current and future regulations.

Additional ways to employ ESG in banking include:

- Improving the screening process for investments and loans to ensure they align with ESG protocols

- Educating customers with various information to help them make more ESG-friendly investments

- Implementing relevant technology to help measure ESG risks in real-time

- Working with non-profit organizations and government agencies to promote the importance of ESG in banking

👉Alongside this, opting for more eco-friendly banks can help to make applying ESG in banking easier.

Here are some of the most ethical banks to choose from to help kick-start your journey in ESG banking:

- Climate First Bank – Excellent choice for those who value diversity and want to support local communities.

- Amalgamated Bank – Great for customers who want to ensure their investments do not finance fossil fuel related projects.

- Clean Energy Credit Union – Best green bank for those looking for loans to be used for green energy projects.

- Spring Bank – Good choice for those who want a local bank dedicated to offsetting their emissions.

Overall, applying ESG in banking can help to reduce the finance industry's current environmental and social impact – while also inspiring business partners and clients to do the same.

What About Greenly?

If reading this article on applying ESG banking to your business has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

It can be overwhelming to figure out how to effectively reduce your environmental impact in terms of finances, but don’t worry – Greenly is here to help. Click here to schedule a demo to see how Greenly can help you find ways to ensure your company is complying with all current and future environmental regulations.

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.