ESG / CSR

Industries

What is the Inflation Reduction Act of 2022?

Inflation is worse than it’s ever been before, and most governments around the world have been too preoccupied with other predicaments to implement something like the Inflation Reduction Act of 2022.

In the U.S., inflation has reached a new high since 2021 and 2022. According to the Bureau of Labor Statistics, consumer prices skyrocketed by 9.1% in June 2022. Although the U.S. has experienced extreme inflation rates in the past, such as in the 1970s and early 1980s when inflation exceeded 10% for extended periods – the inflation Americans are currently experiencing now could be a true threat to the consumerism culture the country is built on.

The Inflation Reduction Act of 2022 represents Biden's effort to control the consequences of inflation, legislative response to recent inflationary pressures. However, it is important to note that the Congressional Budget Office initially estimated for the bill to have a minimal impact on inflation in the short-term.

In this article, we will explain how the Inflation Reduction Act of 2022 could help to stabilise rapidly increasing prices and the economy, prevent prices from skyrocketing more than they already have, and benefit Americans from the additional environmental initiatives expressed in the IRA.

What is the Inflation Reduction Act of 2022?

The Inflation Reduction Act of 2022 is a landmark federal law in the United States signed by President Biden on August 16, 2022 that aims to fight inflation, reduce deficit, lower the price of prescription drugs, reallocate funds to the use of domestic energy production, clean energy, and manufacturing, and simultaneously help to reduce carbon emissions.

This historic law was developed and passed with the intent to achieve the following:

- Allocate $740 billion toward deficit reduction, lowering costs for healthcare, and climate investments over the next decade

- Reduce the federal deficit by an estimated $100 billion to lower prescription drug costs for Medicare beneficiaries

- Invest $370 billion in domestic renewable energy production, clean energy technologies, energy infrastructure, and manufacturing incentives

This new inflation reduction bill will also grant Medicare the ability to negotiate the prices for prescription drugs prices and extend the expanded Affordable Care Act program through 2025.

The timeline below will depict the process from the development of the Inflation Reduction Act of 2022 to when it was officially signed into law by President Biden in August 2022:

July 27, 2022 – Senator Joe Manchin and Senate Majority Leader Chuck Schumer unexpectedly announce a deal on a new reconciliation bill, later known as the Inflation Reduction Act.

August 7, 2022 – The U.S. Senate passes the bill after a marathon voting session, with Vice President Kamala Harris casting the tie-breaking vote in a 51–50 decision.

August 12, 2022 – The U.S. House of Representatives approves the Inflation Reduction Act in a 220–207 vote, following party lines.

August 16, 2022 – President Joe Biden officially signs the Inflation Reduction Act into law, marking the largest climate investment in U.S. history.

Will Trump's Re-Election Impact the Inflation Reduction Act of 2022?

Following Trump's return to the White House, policy analysts and industry experts anticipate the Trump administration to roll-back on several parts of the Inflation Reduction Act of 2022 – particularly its climates-related provisions, such as the development of green technologies or investment tax credit for businesses or individuals purchasing solar panels.

Remember, Biden developed the bill not only to help curb the nation's rising prices, but to help boost the country's climate journey – such as by encouraging infrastructure investment for future projects in clean energy development or by providing tax incentives for businesses or households that purchased Electric Vehicles (EVs) or energy efficient equipment.

In addition to this, an in-depth analysis from the Brookings Institution detailed how the Trump administration plans to re-evaluate existing certain clean energy tax credits and subsidies. As Trump has made it clear he values the reassurance of domestic energy production, increased tax enforcement for fossil fuels or bonus credit for businesses making an effort to reduce emissions is likely to dissipate under the new administration.

Furthermore, a source reported to CNN that Trump is likely to reduce the current offers depicted in the Inflation Reduction Act of 2022, and ironically – inflation could skyrocket as a result of his presidency, costing the average middle-class American family an additional $4,000 a year.

The table below depicts the components of the Inflation Reduction Act of 2022 Trump is likely to eradicate once he returns to office:

| Provision | Description | Potential Reasons for Repeal |

|---|---|---|

| Electric Vehicle (EV) Tax Credits | Offers tax credits for purchasing new and used EVs and incentives for domestic EV production. | Trump's prior focus on reducing dependence on China and anti-EV sentiment might lead to cuts or limitations on these credits. |

| Methane Emission Fees | Imposes fees on methane emissions from oil and gas operations, increasing over time. | Seen as burdensome to energy producers; potential repeal aligns with pro-oil and gas policies. |

| Energy Efficiency Rebates | Provides rebates for energy-efficient appliances and home improvements. | Viewed as costly; could face cuts to reallocate funds or eliminate spending entirely. |

| Clean Energy Tax Credits | Funds for solar, wind, and other clean energy production to reduce reliance on fossil fuels. | May be reduced in favor of traditional energy sources, which are a priority for Republican policymakers. |

| Manufacturing and Job Creation Incentives | Encourages domestic manufacturing of clean technology and supports job creation in the clean energy sector. | Although beneficial to some Republican districts, funding may be redirected to support other tax cuts. |

Energy Infrastructure & Clean Energy Production: Categories Included in the IRA

The Inflation Reduction Act of 2022 encompasses multiple interconnected policy areas designed to address economic pressures through strategic government intervention. Therefore, this law targets key economic vessels, such as by including tax reform through improved Internal Revenue Service offerings, healthcare cost reductions, and domestic energy infrastructure investments that could help to stabilise supply chains.

Unlike traditional free trade agreements, which mainly focus on reducing tariffs – the Inflation Reduction Act of 2022 serves as in incentive to improve domestic production and build supply chain resilience to foster long-term economic stability.

Here's a breakdown of how the Inflation Reduction Act works to benefit each of these areas:

Medicare Benefits

Specifically, the new inflation reduction act plans to accomplish its goal of stabilising prices by expanding medicare benefits such as providing those who qualify for medicare with free vaccines (which started in 2023), offer insulin for only $35 a month, and to cap the prices on out-of-pocket drug costs.

The new inflation reduction act plans to lower overall health care costs by allowing the average prospect to save $800 a year, and also allow for more benefits with medicare. The new inflation act also plans to negotiate prices for more than one hundred drugs throughout the next decade, with an ultimate goal to encourage more companies to increase their rebates on medication.

Climate Change & Energy Consumption

The inflation reduction act also plans to help lower energy bills with the intent to lower utility bills. A report from the Rhodium Group explained how Americans dedicated to improving insulation and switching their current appliances to newer models developed with energy efficiency in mind could save $500 annually.

Furthermore, the U.S. Department of the Treasury reports that households working to improve their insulation and implement the use of renewable energy sources could save a whopping $1,000 to $3,100 every year.

The United States has already revealed their revolutionary climate bill to help reduce climate change, but this law also plans to help benefit the environment with a goal to reduce carbon emissions by nearly 40% by 2030 – ultimately helping to support additional incentives in the U.S. to revolutionise electricity generation, reduce air pollutants, and fight global warming.

Development of New Jobs

The Inflation Reduction Act of 2022 also plans to create more jobs in manufacturing and invest in communities that are suffering by offering to help clean up the effects of pollution and assisting these developing communities to implement plans to reduce the negative environmental impacts they are suffering from.

The Biden-Harris administration deployed additional mechanisms in order to increase the amount of available jobs across the nation while also working toward greater emission reductions – such as with the American Climate Corps Program.

IRA Funding Small Businesses

Finally, the new inflation reduction act aims to prevent the common tax loopholes that the wealthy are known to take advantage of by implementing a 15% minimum tax on corporate, a 1% fee on stock buybacks and also pontificate the importance of enforcement by the IRS.

In addition to mitigating cheat schemes regarding taxes for the wealthy, the inflation reduction act also plans to help families and small businesses that aren’t raking it in. Any family or small business making $400,000 or less annually will be able to benefit from the inflation reduction act.

The Inflation Reduction Act of 2022's multi-faceted approach, which combines direct pay incentives for clean energy projects, calculated efforts to raise revenue through corporate tax reforms, and targeted cost reductions across healthcare and energy sectors – illustrates a comprehensive policy well-designed to address both the negative effects of inflation while building for a better economic future.

Why Is the Inflation Reduction Act of 2022 Necessary?

The cost of living in the United States is already difficult and is becoming more challenging: as healthcare isn’t included for most, even with jobs – and the need for a car is almost always essential for general transportation unless you live in an area with excellent public transportation like New York City.

The Inflation Reduction Act of 2022 doesn’t only seek to reduce the impact of inflation, but to aid those who are in dire need of improved healthcare benefits and overall financial stability. The new inflation reduction act will be able to help those Americans who are not financially equipped to handle periods of inflation, while also providing them with other long-term benefits like extended, improved healthcare.

The flip cards below (move your cursor over to turn the card over) will breakdown these benefits of the Inflation Reduction Act of 2022 for Americans:

What Causes Inflation & How IRA Investment Could Curb It

Inflation is common amongst any product or service like housing, food, medical care, and utilities – but inflation also impacts unnecessary, personal expenditures like cosmetics, cars, and clothing.

Inflation occurs when there is an imbalance in the relationship between supply and demand. When the demand outweighs the supply, prices must increase in order to prevent a shortage in the product in question. Even if there is a perceived shortage of the product, the product immediately becomes more valuable and therefore, the price increases.

Inflation is concerning because it decreases the value of money at any given moment.

The drop down section below will detail how inflation could impact a wide-variety of people:

🧑💼 Small Business Owners

Inflation can increase the cost of raw materials, utilities, and transportation — all while customers may become more price-sensitive. This makes it harder for small businesses to maintain profits or scale up.

💹 International Investors

Currency fluctuations caused by inflation can directly impact international investments. Even profitable assets may see reduced returns due to unfavorable exchange rates.

🌍 Expats Living Abroad

Expatriates earning in one currency but spending in another may see their purchasing power shift overnight as inflation influences exchange rates, making everyday expenses unpredictable.

✈️ Budget Travellers & Event Planners

A traveller from the United States could be saving up for a trip to Europe for a few months. They may be under the impression that they have finally hit their goal and can hop on the next flight across the pond, but in reality – the exchange rate between the dollar and the euro aren’t what they were a few months ago when the traveller in question was planning their flight.

It is important to note that inflation can be influenced by a wide variety of economic factors including production costs, consumer demand fluctuations, and government fiscal policy decisions.

While consumers typically bear the burden of rising prices as a result of increased living expenses, inflation may be beneficial in the short-term for certain individuals – such as equity investors who may see asset values increase or companies that can easily adjust their pricing to be beneficial for their business.

However, it is important to remember that continuous high inflation ultimately hinders a consumer's ability to spend – which creates broader economic instability that affects all market participants

Why is Inflation in the U.S. High in 2025?

The main reason inflation in the U.S. is continuing into 2025 is due to housing, transportation, extreme weather events, and the food industry.

It is important to note that the initial period of inflation that spurred the development of the IRA in the first place was caused by a post-pandemic demand for goods and also due to the situation between Russia and Ukraine.

Remember, inflation isn’t just happening in the United States, but around the world – with countries like Argentina, Turkey, and Zimbabwe also experiencing high rates of inflation.

How Long Will Inflation Last?

While this current spike has been deemed as historical, it isn’t expected to last forever – as the inflation is most certainly a cause of the atypical demand for goods as countries around the world resume normal activities such as shopping, concerts, and travel. After a long time of slow economic activity, there was bound to be a temporary uptick like the one we've experienced in recent years.

Luckily, according to NBC – inflation reports from April 2025 reveal that prices have grown at slower rate comparable to 2021. However, that being said, Trump's current economic policies could mean that these price rates are subject to change.

Regardless, the United States has still made an effort to pull itself out of its inflation woes – having increased the amount of jobs and amount employees are paid in the last year.

How the U.S. is Working to Avoid Future Inflation

In June 2022, the Department of Labor revealed that the U.S. increased the amount of jobs and amount employees were paid – creating 372,000 jobs. Just like life in any big, populous city like San Francisco or New York City isn’t sustainable without a high wage due to the high cost of living, the same goes for all these new employees without newfound higher payrolls.

More recently, the United States Department of Labor created a whopping almost 2 million jobs between 2023 and 2024 alone. This shows continuous growth and effort to address unemployment and potential discrepancies in fair salaries across the nation.

In short, the global demand for goods has surged, and when demand exceeds the available – there is either a shortage in goods or a price increase. Typically, there isn’t a shortage on the majority of the products where prices are going up, therefore – an increase in price is what occurs. This is what we are currently seeing with inflation.

How the U.S. Fought Against Inflation: Lessons from Past Economic Interventions

The United States is no stranger to experiencing inflation, having suffered strong bouts of inflation in the late 1970s – but no bill like the Inflation Reduction Act of 2022 has ever been passed before.

Most governments are often advised that while there are things that they can do to decrease the impact of inflation, that it is often a cause of external locus of control – and that time is really the only thing the country can rely on when it comes to ending inflation.

However, the United States did successfully win the fight against inflation before – such as the 1978 to 1982 period of inflation. This was done when higher interest rates were established, which in turn – preventing people from spending less. In theory, this same approach could be employed now, but it is highly unlikely to occur under the Trump presidency – where consumerism is imperative.

How Can We Avoid Inflation Moving Forward?

Inflation is challenging to avoid and resolve, but there are some ways that a nation can remain in good shape to hopefully mitigate the effects on inflation.

The drop down sections below will share additional ideas to mitigate inflation moving forward:

⛽ Temporarily Lower Prices

Local governments could temporarily reduce taxes on essential goods like gas to soften the blow of inflation. While this won’t solve the core supply-demand imbalance, it can ease immediate financial strain for vulnerable households.

🧾 Provide Targeted Relief Checks

Governments can issue relief payments to low- and middle-income households, helping them cover rising costs for food, transportation, and utilities without placing long-term strain on fiscal budgets.

📦 Invest in Supply Chain Efficiency

By reducing bottlenecks in supply chains, governments and private companies can lower the production and distribution costs that feed inflation. This includes localising production or improving port and transport logistics.

💡 Encourage Energy Efficiency Programs

Inflation is often tied to energy prices. Incentivising energy-saving appliances or home retrofits can help consumers cut costs on their own — reducing dependence on volatile global energy markets.

However, it is important to note that ultimately, there isn’t much a government can do to reduce the impact of inflation. In fact, even the new inflation reduction won't realise its full potential until 2030, and by then – most of the culprits of the current spike in prices will have resolved themselves on their own. Still, the IRA is imperative to help Americans get the healthcare rights they deserve and to establish an effort to mitigate climate change.

Does Inflation Impact the Environment?

Rising inflation doesn’t necessarily impact the environment, but the state of climate change does seem to have an impact on inflation itself – as continuous natural disasters can put a strain on resources, supply and demand, and in turn – inflation.

Although many independent analyses believe that the Inflation Reduction Act of 2022 will help the U.S. achieve their goal of reducing their greenhouse gas emissions to 50% below of the levels of emissions in 2005 by 2030 – it’s important to recognise the power that establishing measures to reduce climate change itself can have a direct, positive impact on the inflation problems the world is suffering from today.

Most will attest the multiple COVID-19 lock downs that forced business owners into foreclosures as the primary reason for the economy’s current state. This is both evident and true as to why so many prices are being driven higher, as it is an effort to compensate for lost time where businesses weren’t able to fully operate.

However, economists such as from the International Monetary Fund's Eye of the Storm: The Impact of Climate Shocks on Inflation and Growth delineate to not negate how extreme weather events due to climate change are also a primary reason behind inflation.

There are many reasons as to why climate change is negatively affecting inflation. Here's a breakdown of how climate change can have a profound impact on inflation:

How Natural Disasters Impact Inflation

Natural disasters have prevented crops from being harvested, deterred the use of energy supplies, and destroyed public transportation lines. These devastating occurrences are only likely to continue as climate change worsens.

The efforts for nations around the world to mitigate climate change and strive to reach net-zero emissions by 2050 is costly in itself, too. Both public and private sectors have and will continue to spend trillions of to make the transition from fossil fuels to renewable energy sources, and new regulations that will increase the cost of goods and services that emit a high rate of carbon dioxide emissions such as in the new Corporate Sustainability Reporting Directive in the European Union – will also drive prices higher than they already are.

In 2024 alone the United States has suffered from almost $3 trillion in damage from 403 natural disasters: such as the Los Angeles wildfires and tornadoes in the Midwest. The economic impact of these natural disasters, often provoked by climate change, is substantial.

Massive storms or wildfires are not only costly to repair in conjunction with the communities and developing countries that suffered from the natural disaster, but these drastic, climate change induced weather patterns impact other sectors that impact the economy, as well. A chemical shortage caused by a natural disaster could spike prices for consumers, out of character cold weather could alter harvest times for crops, and various facilities could have to shut down due to unprecedented weather conditions.

The summary cards below will outline additional reasons why climate change has an impact on inflation:

🌪️ Challenge: Natural Disaster Supply Disruptions

Climate-related events like hurricanes and wildfires can damage crops, disrupt supply chains, and reduce availability of key goods.

✅ Solution:

Invest in climate-resilient infrastructure and diversify sources of supply for critical products.

🏥 Challenge: Stress on Healthcare Systems

Higher temperatures and pollution levels increase respiratory issues and heat-related illnesses, driving up public health costs.

✅ Solution:

Support climate-health initiatives that boost medical preparedness and improve air quality standards.

🚛 Challenge: Transportation & Fuel Costs

Climate disruptions to oil production or road infrastructure can spike fuel prices, which impacts shipping and goods pricing.

✅ Solution:

Invest in clean energy and local supply chains to reduce reliance on volatile fuel markets.

🌾 Challenge: Agricultural Yield Declines

Rising temperatures and irregular rainfall patterns reduce crop yields, driving up food prices globally.

✅ Solution:

Fund climate-smart agriculture and invest in sustainable farming innovation to stabilise food supply.

Therefore, it’s clear that governments must implement stronger policies to mitigate climate change – or the world could see even more economic implications due to inflation.

All in all, the Inflation Reduction Act of 2022 is a great place for the U.S. government to stabilise skyrocketing prices, but it isn’t likely to have an impact on inflation immediately.

This is why in order to implement long-term habits to reduce occurrences like inflation, that the United States, alongside the rest of the world – we shouldn't mitigate the importance of establishing concrete measures to fight against climate change: the ultimate root of the multitude of problems, such as inflation, that the world is battling from today.

What About Greenly?

If reading this article about the inflation reduction act of 2022 emissions has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

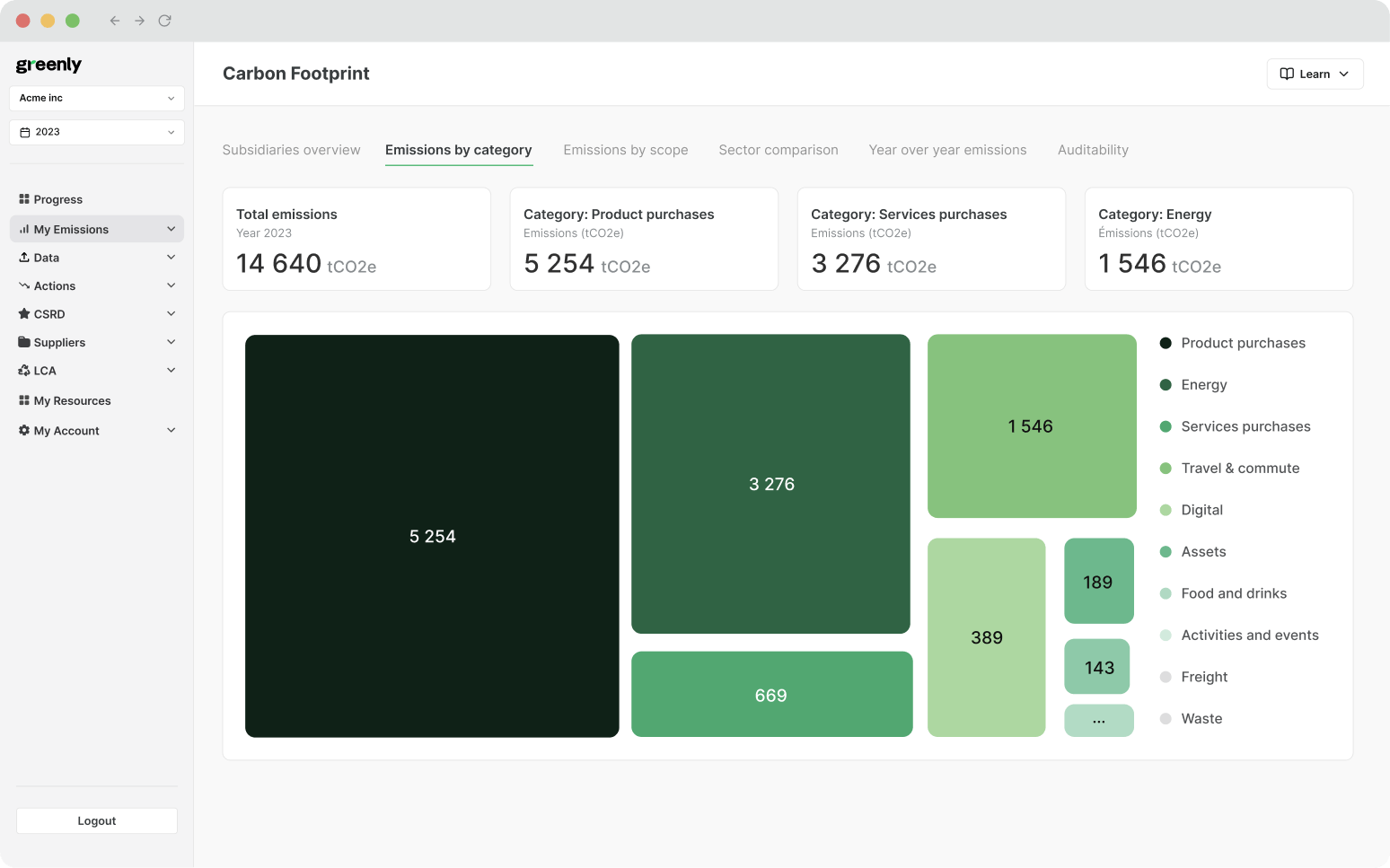

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.