In this article, we’ll explore what internal carbon pricing is, the different types of ICP, and how businesses can use it to reduce emissions and manage climate-related risks.

ESG / CSR

2024-10-15T00:00:00.000Z

2024-10-15T00:00:00.000Z

en-gb

Internal carbon pricing (ICP) is a powerful tool that companies are using to advance their sustainability efforts. By placing a monetary value on each ton of carbon they emit, businesses can make more informed decisions about where to invest, how to reduce emissions, and how to mitigate future risks. Whether through shadow pricing, internal carbon fees, or implicit pricing, ICP helps organisations embed the true cost of carbon into their financial and operational strategies.

👉 In this article, we’ll explore what internal carbon pricing is, the different types of ICP, and how businesses can use it to reduce emissions and manage climate-related risks.

What is Internal Carbon Pricing?

Internal carbon pricing (ICP) is the practice of assigning a monetary value to the carbon emissions a company produces. By doing so, businesses can incorporate the cost of their greenhouse gas (GHG) emissions into their financial decision-making, helping to drive investment in low-carbon technologies and more sustainable projects.

Internal carbon pricing allows companies to manage climate-related risks and prepare for future regulations. By setting a price on carbon emissions, businesses can integrate the environmental impact of their operations into strategic decisions, ensuring that carbon emissions are considered in everything from operational activities to long-term investments. This proactive approach encourages carbon-conscious decision-making and supports a company's broader sustainability goals.

Companies adopt internal carbon pricing for various reasons, such as incentivising emissions reduction, preparing for the possibility of future carbon taxes or emissions trading schemes, and supporting investments that align with their sustainability commitments.

Different Types of Internal Carbon Pricing

There are several approaches that companies can take when implementing internal carbon pricing, each serving different purposes depending on the organisation's goals. The three most common methods are shadow pricing, internal carbon fees, and implicit pricing:

- Shadow Pricing: Shadow pricing refers to a theoretical carbon price that is assigned to greenhouse gas emissions for the purpose of evaluating business decisions. No actual money is exchanged, but this approach allows companies to simulate how carbon costs would impact their financial performance. Shadow pricing is typically used to assess the financial feasibility of new projects or strategies, ensuring that potential carbon risks are taken into account before any investment is made.

- Internal Carbon Fee: In this approach, companies impose a fee on their own emissions, charging business units for each ton of CO2 they produce. The money collected from these fees is often reinvested into sustainability initiatives, such as energy efficiency improvements or renewable energy projects. This method creates a direct financial incentive for departments to reduce their carbon emissions, as lowering emissions also lowers costs.

- Implicit Pricing: Implicit pricing is calculated retrospectively, based on how much a company spends on carbon reduction initiatives, such as abatement measures or renewable energy investments. This type of internal carbon pricing allows businesses to measure the true cost of reducing emissions and to evaluate the effectiveness of their sustainability efforts over time.

Many companies use these models for different purposes. For example, a business may use shadow pricing to assess the financial viability of mergers and acquisitions, while an internal carbon fee might be applied to fund green projects within the organisation. Implicit pricing can help businesses better understand the financial impact of their decarbonisation efforts and make adjustments where necessary.

Benefits of Implementing Internal Carbon Pricing

Internal carbon pricing offers a range of benefits that go beyond compliance with environmental regulations. By placing a monetary value on carbon emissions, companies can drive internal change, manage risks, and seize new opportunities in the transition to a low-carbon economy.

| Benefit |

Description |

| Risk Management |

Internal carbon pricing helps companies mitigate risks related to future carbon regulations. Businesses can prepare for carbon taxes, emissions trading schemes, or stricter climate policies, reducing the risk of financial shocks or penalties. |

| Encouraging Sustainable Innovation |

Internal carbon pricing incentivises departments to develop and adopt low-carbon technologies, motivating companies to invest in energy efficiency and renewable projects. These innovations reduce emissions and create long-term savings. |

| Financial Insights |

Internal carbon pricing provides businesses with a clearer understanding of the true cost of carbon, enabling more informed financial decisions. It helps integrate sustainability into financial planning and improve the viability of low-carbon projects. |

| Supporting Decarbonisation Goals |

Internal carbon pricing supports companies in achieving net-zero targets. By assigning a cost to emissions, businesses can financially structure their decarbonisation strategies, ensuring emissions reductions are central to long-term growth. |

How to Calculate Internal Carbon Pricing

Calculating an internal carbon price requires a structured approach, tailored to the company's goals, emissions profile, and sustainability strategy. Whether businesses use shadow pricing, an internal carbon fee, or implicit pricing, each method requires planning and data collection.

- Shadow Pricing: To calculate a shadow price, companies typically benchmark against external market prices, such as the carbon price in emissions trading systems (like the EU Emissions Trading System) or the cost of carbon offsets. This ensures the internal carbon price reflects real-world risks. Shadow pricing doesn’t involve financial transactions but helps businesses factor carbon costs into investment decisions by simulating how carbon pricing impacts profitability.

- Internal Carbon Fee Calculation: For companies using an internal carbon fee, the price is often based on emissions volume and sustainability targets. Businesses calculate how much they emit (typically in tonnes of CO₂e) and assign a fee for each ton. These fees are usually pooled and reinvested into emissions reduction projects. The internal carbon fee should be reviewed regularly to ensure it drives continuous improvements in sustainability and accurately reflects the company’s carbon footprint.

- Implicit Pricing: Implicit pricing is calculated retrospectively, based on how much a company spends to reduce emissions. Businesses assess the costs of their abatement efforts, such as investments in renewable energy or energy efficiency projects, and divide that by the amount of CO₂e reduced. This helps companies understand the cost-effectiveness of their decarbonisation strategies and adjust their efforts as needed.

❗️ Review and Adjust Regularly: It’s essential for companies to continuously monitor and adjust their internal carbon pricing. Carbon markets, regulations, and external economic factors are constantly evolving, and internal carbon prices need to reflect these changes. Regularly updating the internal carbon price ensures it remains a useful tool for driving decarbonisation and sustainable investments.

Challenges of Implementing Internal Carbon Pricing

While internal carbon pricing offers significant advantages, it also presents challenges, particularly for companies just starting to adopt this strategy. Successfully implementing internal carbon pricing requires overcoming several obstacles, including:

- Data Collection: Gathering accurate data on emissions is one of the most challenging aspects of implementing internal carbon pricing. Companies need to assess their emissions across Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (emissions throughout the supply chain). Scope 3 emissions, in particular, can be difficult to measure, as they require collaboration with suppliers and partners. Without comprehensive emissions data, setting an effective internal carbon price can be difficult.

- Company-Wide Buy-In: Ensuring that all departments understand and commit to internal carbon pricing can be a challenge, particularly in large or global organisations. Different departments may have varying levels of emissions, and some may resist the financial impact of internal carbon fees. To be effective, internal carbon pricing must be integrated into the company’s broader strategy, with senior leadership playing a key role in driving this cultural shift.

- Setting the Right Price: Without a global standard for internal carbon pricing, companies often struggle to determine the right price that will drive meaningful change. If the internal carbon price is set too low, it may not create enough incentive to reduce emissions. Conversely, setting the price too high could disrupt operations or investments. Striking the right balance is essential for ensuring that internal carbon pricing delivers both environmental and financial benefits.

- Regulatory Uncertainty: While internal carbon pricing helps companies prepare for future carbon regulations, the uncertainty surrounding the timing and scope of these regulations can complicate decision-making. Businesses may hesitate to set an internal carbon price if they are unsure of how external policies will evolve. Staying informed about emerging carbon pricing regulations and market trends is crucial for adapting internal pricing models to future requirements.

Best Practices for Successful Internal Carbon Pricing Adoption

Successfully implementing internal carbon pricing requires more than just setting a price. To ensure long-term success, companies need to follow best practices that help integrate carbon pricing into their overall business strategy and operations.

- Align with External Carbon Pricing Mechanisms: One of the most effective ways to ensure that internal carbon pricing reflects real-world costs is by aligning it with external carbon pricing mechanisms, such as carbon taxes or emissions trading schemes. By benchmarking the internal price against market prices, businesses can ensure their carbon pricing is both competitive and realistic. This also helps companies prepare for future regulatory changes, where external carbon prices may rise.

- Engage Stakeholders Across the Organisation: To embed internal carbon pricing successfully, it’s crucial to engage stakeholders at all levels of the company. From senior leadership to individual departments, everyone needs to understand the role of internal carbon pricing in achieving sustainability goals. Transparent communication about how the pricing system works and its impact on business decisions helps build buy-in and ensures consistent application across the organisation.

- Integrate Carbon Pricing into Strategic Planning: Internal carbon pricing should not be an isolated initiative - it must be woven into the company’s overall strategy. This means factoring carbon costs into financial planning, investment decisions, and long-term business development. For example, companies should include carbon pricing when evaluating new projects, mergers, or acquisitions to ensure they align with sustainability goals.

- Monitor and Adjust Regularly: Carbon pricing is not something that can be implemented and then forgotten about. It needs to be monitored and adjusted regularly to reflect changes in market conditions, emissions data, and regulatory environments. By reviewing the internal carbon price periodically, companies can ensure that it remains effective in driving emissions reduction and supports the company’s evolving sustainability strategy.

- Integrate Scope 3 Emissions: For many companies, Scope 3 emissions represent the largest portion of their carbon footprint. To maximise the effectiveness of internal carbon pricing, businesses should ensure that their pricing strategy covers these indirect emissions. This involves working closely with suppliers, partners, and customers to measure and reduce emissions across the entire value chain.

“💡 By following these best practices, companies can ensure that internal carbon pricing becomes a key driver of their sustainability efforts, helping them reduce emissions, meet regulatory requirements, and achieve long-term business success. ”

Looking Forward

Internal carbon pricing is fast becoming an essential tool for companies aiming to decarbonise their operations and prepare for the challenges of a low-carbon economy. By assigning a monetary value to their carbon emissions, businesses can better manage climate-related risks, incentivise sustainable practices, and align their strategies with long-term environmental goals.

Whether through shadow pricing, internal carbon fees, or implicit pricing, internal carbon pricing helps companies make more informed decisions about where to invest, how to reduce emissions, and how to future-proof their operations against evolving climate regulations. The benefits - ranging from risk management to driving innovation - make internal carbon pricing a key pillar in achieving sustainability targets, particularly in the pursuit of net-zero emissions.

As more companies adopt this approach, those that integrate internal carbon pricing effectively will gain a competitive advantage, ensuring they are well-positioned in a rapidly changing regulatory landscape. Now is the time for businesses to take proactive steps and implement internal carbon pricing as part of their broader sustainability strategy.

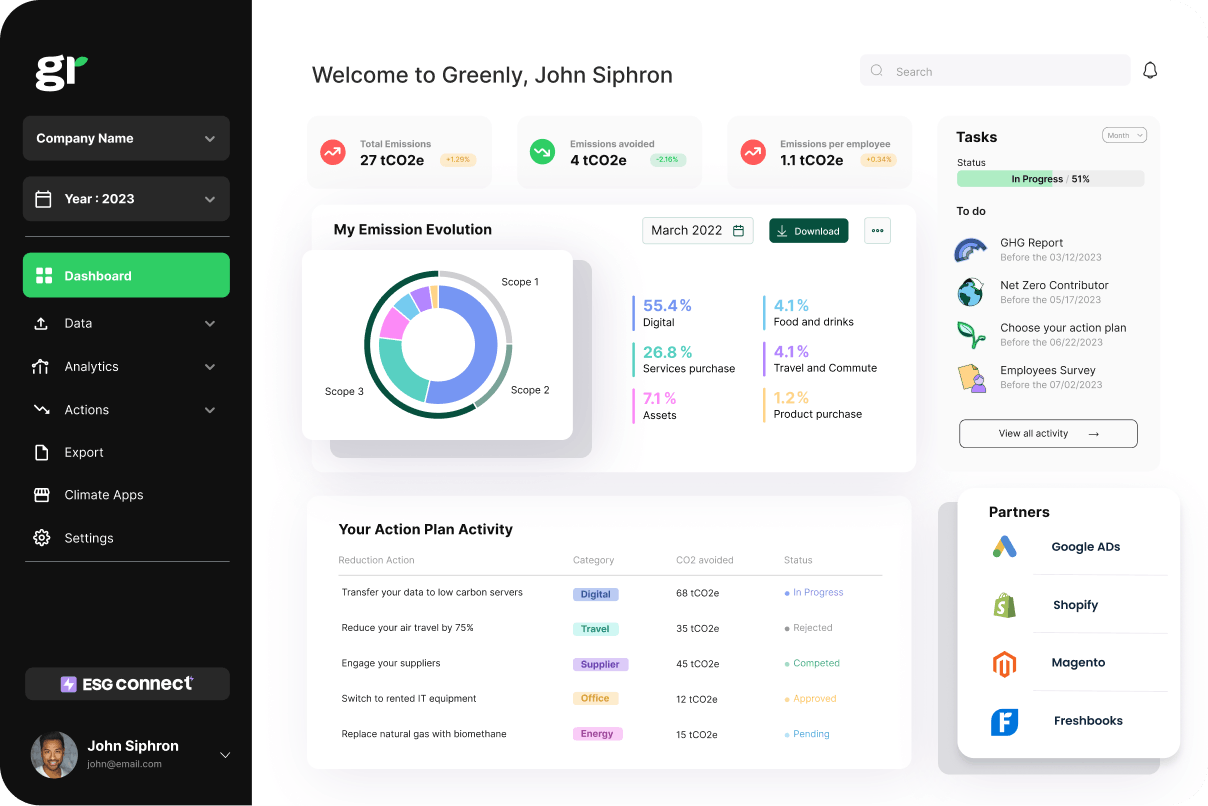

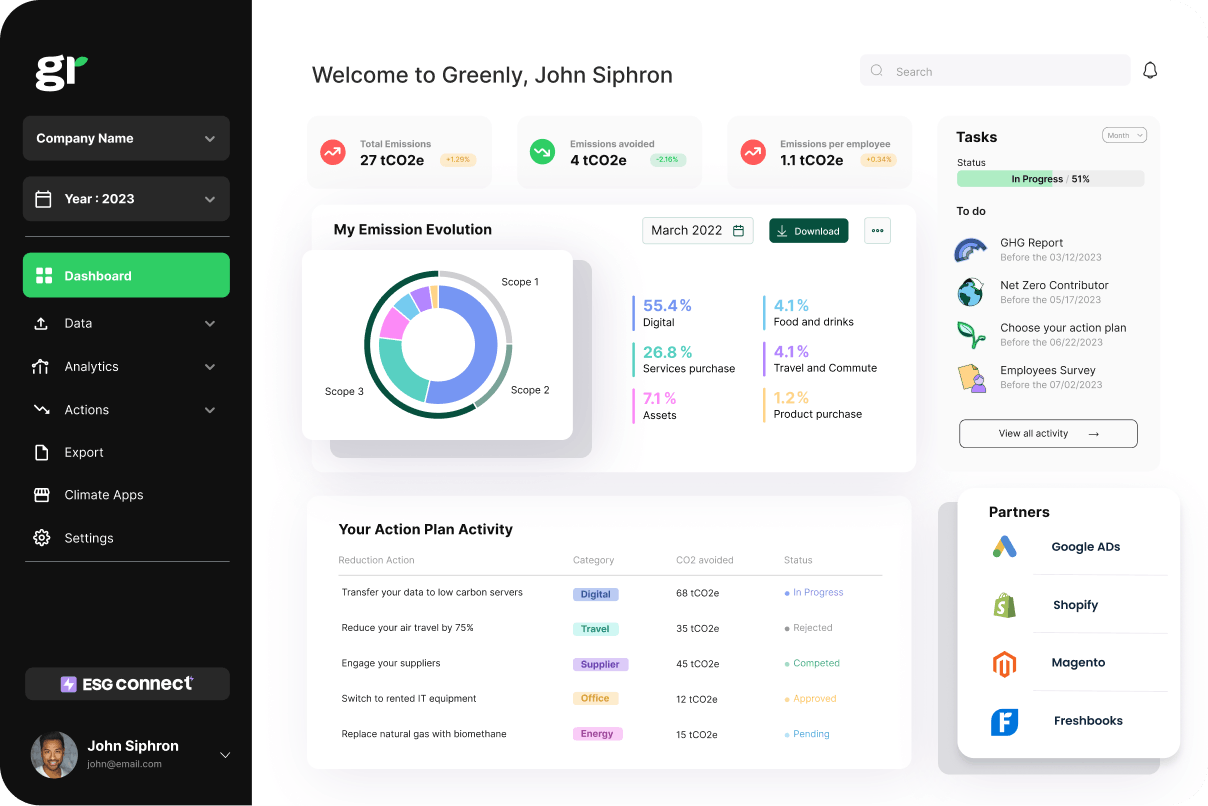

How Greenly can help your company

Implementing internal carbon pricing effectively requires businesses to not only calculate their emissions but also develop and execute strategies to reduce them. Greenly provides a comprehensive suite of carbon management services to help companies measure, track, and reduce their greenhouse gas emissions, making it easier to establish internal carbon pricing and achieve broader sustainability goals.

Carbon Management Solutions with Greenly

At Greenly, we offer businesses the tools and expertise needed to manage every aspect of their carbon emissions. From calculating your carbon footprint to developing actionable decarbonisation strategies, Greenly supports businesses throughout their sustainability journey.

- Monitoring GHG Emissions: Greenly’s platform enables businesses to track Scope 1, 2, and 3 emissions. This data is crucial for setting an effective internal carbon price and ensuring all areas of the business are contributing to emissions reduction efforts.

- Tailored Decarbonisation Plans: Beyond emissions tracking, Greenly works with businesses to create bespoke decarbonisation plans. Our team of climate experts helps companies identify key areas for carbon reduction and develop strategies to meet their net-zero targets, making internal carbon pricing a driving force behind company-wide sustainability efforts.

Supporting Supply Chain Emissions Reduction

Reducing Scope 3 emissions - those from the supply chain - is often one of the biggest challenges for businesses. Greenly helps companies engage their suppliers, identify high-emission areas, and implement sustainable changes that contribute to both emissions reduction and the success of their internal carbon pricing initiatives.

User-Friendly Carbon Management Platform

Greenly’s intuitive platform integrates emissions tracking and decarbonisation efforts into a user-friendly system. Whether calculating your carbon footprint or monitoring progress against goals, Greenly’s platform makes sustainability an integral part of business operations.

Why Choose Greenly?

Greenly offers end-to-end carbon management services, from emissions tracking to decarbonisation strategies. We help businesses align their internal carbon pricing with broader sustainability goals, ensuring they are well-positioned to meet future regulatory requirements while reducing their environmental impact. By partnering with Greenly, your company can become a sustainability leader, driving meaningful change toward a low-carbon future, so why not get in touch with us today?