What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

California’s Climate Corporate Accountability Act (CCAA - Senate Bill 260) is a landmark bill for carbon accounting that aims at exposing the contribution of corporations to climate change. Through greater transparency, the bill aims to spark stronger efforts by companies to mitigate climate change.

If passed, the climate corporate accountability act (CCAA) would improve the amount of data available for corporate contributions to climate change across the world. The reason is it applies to any large private and public companies operating in California to report their greenhouse gas (GHG) emissions across their entire global value chains.

This comprehensive approach to carbon accounting is aimed at improving the public’s awareness of corporations’ contributions to climate change. It impacts a large number of businesses, as it applies to all businesses operating in California as well as their suppliers.

👉 In this article, we'll break down the new health and safety code in SB 260, how it will help adopt regulations in California, and how it can intertwine with existing state law to further reduce emissions.

The Climate Corporate Accountability Act (CCAA), Senate Bill 260, would require certain companies to disclose their full value chain GHG emissions. It impacts companies earning over $1 billion in annual revenue to report.

💡 Most of the largest corporations in the United States have operations in California, including Amazon, Facebook, Google, Apple, Walmart, Exxon, and FedEx. These major corporations and others would all be impacted by the bill.

The bill marks a shift from voluntary reporting to mandatory reporting, and it would extend the scope of their reported CO2 emissions to include Scope 3, value chain emissions.

Firms seeking to report would need to verify their GHG emissions inventory with a third-party California Air Resources (CARB) approved auditor. CARB will be responsible for assessing the data and producing a report the Secretary of State will make available to the public online.

👉 As a whole, Senate Bill 260 works to ensure that large corporations will take accountability for their carbon footprint – as the existing law requires starting in 2025, the regulations adopted pursuant to subdivision e must both annually and publicly disclose their emissions to the emissions registry no later than 180 days after the initial deadline in regards to their scope 1, 2, and 3 emissions.

Senate Bill 260 is important as it will help the state of California, home to almost 40 million people, to battle the recurrent consequences of climate change – such as recently seen with the 2025 Los Angeles wildfires.

💡 Besides its size and population, California has also remained more progressive than the rest of the United States in terms of its environmental actions. Like Europe, it has a compliance carbon market for emissions cap and trade, making it a leader in renewable energy generation in the United States.

Recently, California is also the site of some of the worst climate change impacts in the United States due to its long-lasting drought and major wildfires.

The pending bill is not the only one of its kind awaiting response. A related rule proposed by the US Securities and Exchange Commission (SEC) would require publicly listed companies to report similar information on GHG emissions as well as additional climate-related risks and business strategies.

👉 In fact, California legislators are likely to move ahead in spite of any other rulings, as they have a more broad reaching goal in mind with the new bill.

Senate Bill 260 (SB 260) has made several adjustments to its Health and Safety Code, such as by focusing on how certain intertwined components of healthcare and environmental accountability.

Remember, SB 260 applies to healthcare plans providing individual or group health care coverage – it does not cover Medi-Cal plans, as this does not adhere to the purposes of this section of SB 260.

👉 Ultimately, the main goal of amending Section 38523 of SB 260 is to further promote transprency, environmental accountability, and health and safety – all while enhancing accessibility to reduced cost coverage for healthcare.

California’s Climate Corporate Accountability Act resembles a similar Securities and Exchange Commission (SEC) rule proposed in March of 2022 after ending its period of public comment at the end of 2021.

The SEC’s proposed rule would require publicly listed companies of all sizes to report their Scope 1 (direct emissions from operations) and Scope 2 (indirect emissions from purchased energy) GHG emissions and climate-related risks annually.

👉 Unlike California’s proposed bill, Scope 3 emissions reporting would only be required under the SEC’s rule if it is material to the company or if the company has established Scope 3 emissions targets.

Climate related risks would include those that materially impact organizations through direct weather – and nature-related impacts, and through indirect transition risks such as policy changes, reputational damage, litigation, market shifts, and technological innovations.

The SEC would require these risks to be reported for short, medium, and long-term periods. Companies would also need to describe their business strategy for addressing the material risks and opportunities related to climate change.

Finally, they would need to disclose their method of assessing and managing climate risk within their organization.

The primary goal of both bills is to improve the transparency, availability, and reliability of GHG emissions data. While a large number of corporations voluntarily report these details, the quality of the reported data varies significantly.

This prevents adequate assurance in companies’ readiness for the many global risks and impacts associated with climate change. Investors increasingly seek clarity on the ability of companies to withstand these risks.

Investor demand, especially from institutional investors with a long-term investment time horizon, has spurred the need for better corporate climate change data.

The SEC’s proposed rule largely aligns with two existing frameworks: the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas Protocol (GHG Protocol).

Unlike many other ESG frameworks, TCFD considers how climate risks impact companies’ assets and revenues to improve credit ratings, insurance, and business investment decisions. TCFD reporting sheds light on the long-term, unpredictable, and costly impacts of climate change within the financial sector.

TCFD recommendations have gained broad support from the G7 Finance Ministers and Central Banks to foster visibility and accountability for climate change related governance, strategy, risk management and metrics and targets.

The GHG Protocol resulted from a collaborative effort by the World Resources Institute and the World Business Council for Sustainable Development. It’s the most widely adopted standard for reporting the greenhouse gases listed in the Kyoto protocol.

The GHG Protocol is most well-known for its emissions Scopes 1, 2, and 3. They are defined as direct operational or owned emissions, indirect emissions from purchased energy and electricity, and indirect value chain emissions resulting from the production or use of a companies’ products or services.

Reporting scope 3 emissions remains a challenge for large organizations, as they are difficult to measure and account for, as they fall outside the company’s direct influence.

👉 However, they also represent the majority of emissions for many organizations, so investors seek stronger data on these emissions.

With both the proposed California Corporate Accountability Act and the SEC’s proposed climate risk reporting rule, there is an ever-greater likelihood that companies will need to improve their processes for disclosing climate change information.

The table below will further explain how SB 260 intersects or supports the SEC, TCFD, and GHG Protocol:

| Regulation/Framework | Intersection with SB 260 | Support Provided by SB 260 |

|---|---|---|

| SEC Climate Disclosure Rule | SB 260 aligns with the SEC's proposed climate-related disclosure requirements by emphasizing mandatory emissions reporting for companies operating in California. | SB 260 can help companies establish standardized emissions reporting practices that comply with both state and federal regulations. |

| Task Force on Climate-related Financial Disclosures (TCFD) | SB 260 supports the TCFD framework by requiring businesses to report climate risks and emissions data, enhancing transparency in financial disclosures. | Companies using TCFD recommendations can leverage SB 260 compliance efforts to enhance their risk management and disclosure strategies. |

| GHG Protocol | SB 260 mandates emissions reporting that aligns with the GHG Protocol, ensuring consistency in tracking Scope 1, 2, and 3 emissions. | Businesses can use SB 260 reporting data to improve their GHG accounting practices and align with global best practices in emissions management. |

The growth of voluntary ESG reporting has improved a heightened public awareness of companies environmental and social impacts. However, it remains difficult for investors and other stakeholders to compare and validate corporate ESG performance with a lack of standards for data.

💡 For California lawmakers who support the CCAA bill, it is in the public interest of California residents to know the carbon footprint of the large corporations operating in their state. The data quality also enhances the ability of investors and consumers to choose companies with a lower climate impact.

Under a voluntary ESG regime, not all companies provide the same level of information in their reports. They can obscure or omit data. Worse still, they can present their performance as though it is green when it is anything but.

Greenwashing is a way for companies to appeal to consumers’ interest in sustainability through attractive PR claims without backing up their data according to industry-wide benchmarks or other relevant reference points for comparison.

The CCAA (SB 260) aims to improve the level of GHG emissions reporting with the use of CARB-auditors. This will prevent organizations from fabricating their impact or leaving details unavailable.

👉 Given the value customers and investors place on climate change data, mandatory reporting could potentially spark a wave of environmental improvements to satisfy demand.

The CCAA Senate Bill 260 requires private and public companies doing business in California and with $1 billion in annual revenues to:

The law would affect all partnerships, corporations, and limited liability companies with a high enough revenue to report. Notably, companies don’t have to have their headquarters in California for the law to apply. They would only need to have business transactions in the state.

The SB 260 defines Scope 1 and 2 emissions as follows:

💡 The bill’s Scope 3 emissions requirement is the most far-reaching aspect of the proposed law, as requiring Scope 3 emissions reporting could impact small businesses worldwide who participate in the supply chains of large companies with business transactions in California.

This is because scope 3 emissions includes emissions from purchased goods and services, commuting, travel, waste, consumer product use, shipping and delivery transport, investments, and any leased assets and franchises, regardless of where the activities occur.

The introduction of an independent auditing organization is another aspect of CCAA that extends beyond the requirements of the SEC’s proposed rule.

👉 By January 1, 2024, the CARB would be charged with implementing regulations with the first reports on data collected over 2024 expected to be published in 2025.

To house the data, the Secretary of State is responsible for creating a digital platform where the public can access the reports from the business entities.

The California economy is responsible for over 14% of the United States GDP, making its proposed bill an important step towards a cleaner economy around the world. Companies should keep an eye on the bill, as it could have a significant influence on the future of carbon accounting reporting worldwide.

To encourage companies to comply with the law, it states that violations of the reporting requirements could lead to civil penalties.

This contrasts with the SEC’s proposed rule, which contains a safe harbor clause for legal liabilities regarding Scope 3 emissions reporting. California’s Assembly General, however, could take civil legal action in California state courts to uphold its requirements.

According to Senator Scott Wiener, the total number of companies affected by the proposed law is roughly 5,500 to 6,000 companies – and he also pointed out that many corporations already have systems in place to effectively report their GHG emissions.

The law would eliminate the lack of data for companies that either don’t report at all or only partially report their GHG emissions.

In order for the law to pass, the California State Assembly must pass it. Bills are generally not reviewed by the Assembly for 30 days after they have been introduced.

If passed, California would need to take several steps to establish the administrative structure for the law’s requirements. The Secretary of State must first create its digital platform where the public can access the reports.

💡 In addition to this, CARB should also prepare its first report once the first disclosures are made and audited by its administrators.

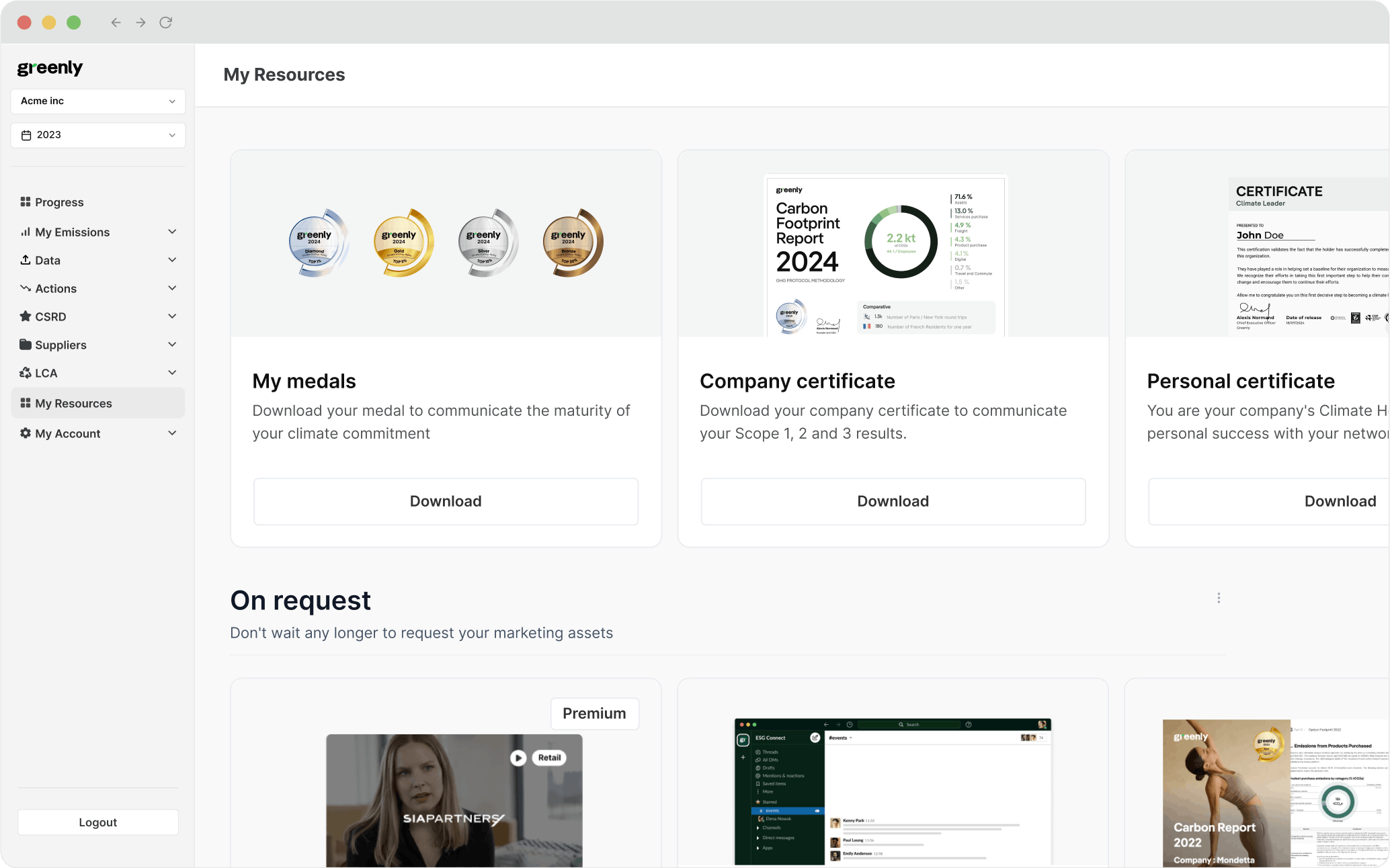

If reading this article about the Climate Corporate Accountability Act, or Senate Bill 260, has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

The expectations for companies to adhere to the necessary measures to fight against climate change can be difficult to understand and abide to, but don’t worry – Greenly is here to help. Click here to schedule a demo to see how Greenly can help you find ways to improve energy efficiency, decrease the dependency on fossil fuels in your own company, and adhere to environmental regulations such as the climate corporate accountability act.

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.