What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

In this article, we’ll explain what a corporate carbon footprint is, why it’s important, how it is measured, and reasons why your company should track it too.

In this article, we’ll explore five of the leading carbon management software platforms available today. Whether you're looking to measure your carbon footprint, create actionable decarbonisation plans, or meet regulatory requirements, these tools can help you build a more sustainable future.

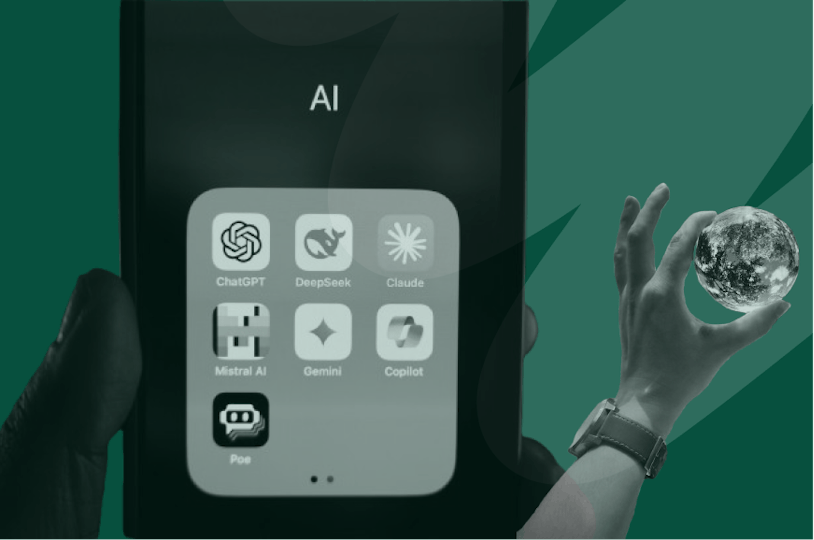

In this data story, we'll respond to Google's most recent report in terms of AI and Gemini.

What is decarbonization, and why is it urgent? Learn practical steps companies can take to support the global move toward net zero emissions.

This data story examines the carbon footprint of major streaming platforms to reveal the global emissions impact of digital entertainment.

Last articles

Learn what the UK Sustainability Reporting Standards (UK SRS) are, who they apply to, and how they will reshape corporate sustainability disclosures from 2027.

A practical guide to New York’s new GHG reporting rules – who must report, what data is required, key deadlines, and how the framework compares to other US regulations.

In this article, we compare the top 10 IFRS tools of 2025, explore their key features, and help you choose the right platform for simplified ESG reporting.

In this article, we compare the top 10 VSME tools of 2025, explore their key features, and help you choose the right platform for simplified ESG reporting.

In this article, we’ll break down what the Clean Industrial Deal is, what it actually promises, and how it could shape the future of European industry.

In this article, we’ll break down what permafrost actually is, why it matters, and what happens when it starts to thaw.

In this article, we’ll explain what short-termism is, the negative impacts of short-termism, and how we can transition away from short-termism.

What is the UNGC, otherwise known as the United Nations Global Compact – and what is their main mission?

In this article, we’ll explain what bioplastic is, its main goal, and five things to know about bioplastic.

In this article, we’ll explain what peak oil is, why it is important, and how we can avoid reaching peak oil.

This article explores the Great Green Wall’s vision, what’s working, what isn’t, and whether this massive undertaking can truly reshape the future of the Sahel.

In this article, we’ll explore 15 reusable products that can help you cut down on waste and build more sustainable habits, one small swap at a time.