👉 In this article we’ll explore what the TPT framework is, how it will operate, and what companies should do to prepare for its implementation.

ESG / CSR

2024-01-11T00:00:00.000Z

2024-11-05T00:00:00.000Z

en-us

Regulators around the world are increasingly recognising the importance of climate disclosure in the context of the private sector. Public disclosure of greenhouse gas emissions and the risks and opportunities linked to climate change is fast becoming the norm. A natural extension of this is the requirement that companies create and share an accompanying transition plan that outlines how their organization will work towards achieving decarbonization targets.

Globally, there are a number of countries that are already implementing transition plan requirements - or soon will be. Under current or upcoming regulations, companies in the UK, EU, and the US for example must produce transition plans.

To help companies create and disclose effective transition plans in the United Kingdom, the UK Government launched the Transition Plan Taskforce (TPT) to develop a framework. The final version of the framework was published on the 9th of October 2023. It helps companies subject to mandatory disclosure requirements to develop and roll out climate transition plans.

👉 In this article we'll explore what the TPT framework is, how it will operate, and what companies should do to prepare for its implementation.

What is the UK Transition Plan Taskforce (TPT)?

The UK Government recognizes the crucial role that financial institutions and corporations play in achieving the country's ambitious net-zero targets, and within the private sector transition plans are quickly becoming standard. However, these private sector transition plans vary greatly in terms of detail and quality, which restricts their useability and prevents stakeholders from accurately contrasting and comparing their credibility.

This is where the Transition Plan Taskforce comes into play. The UK Government created the taskforce in response to the growing need for standardized, credible climate transition plans in the private sector and tasked it with creating a framework to help companies deliver “gold standard” disclosures.

“The Transition Plan Taskforce (TPT) was launched in April 2022 to develop the gold standard for private sector climate transition plans. Its materials were informed by global engagement with financial institutions, real economy corporates, policymakers, regulators and civil society. - TPT ”

Timeline and creation of the TPT

The history of the TPT is rooted in the broader landscape of the UK's environmental and sustainability policies. Let's take a closer look at how the UK Government moved from the inception of the TPT to the recent release of their finalized framework:

- October 2021 - Greening Finance Roadmap: The UK Government introduced this roadmap to align the financial sector with environmental sustainability, aiming to make the UK a leading hub for green investment.

- November 2021 - COP26 and TPT Formation: The then-Chancellor, Rishi Sunak, announced the creation of the Transition Plan Taskforce (TPT) and committed to mandatory transition plans, framing the UK as a potential leader in climate finance.

- December 2021 - FCA Climate-Related Disclosure Requirements: The FCA’s requirements for climate-related disclosures align with the Task Force on Climate-Related Financial Disclosures (TCFD), with expectations for companies to disclose transition plans on a "comply or explain" basis. This includes listed issuers and FCA-regulated asset managers and owners.

- March 2023 - Green Finance Strategy: The UK Government’s updated strategy discussed expanding the requirements to disclose transition plans to large private companies in addition to listed entities.

- August 2023 - FCA Consultation on Transition Plan Disclosure: The FCA expressed intentions to consult on making transition plan disclosures mandatory for listed companies, aligning these with TPT and ISSB standards.

- October 2023 - TPT Final Framework Release: The TPT published its final Disclosure Framework and supporting guidance to help companies create high-standard climate transition plans.

Purpose and goals of the TPT

The primary goal of the TPT is to help companies to develop comprehensive and effective transition plans. These plans are essential tools for businesses to outline their strategies for reducing greenhouse gas emissions and managing climate-related risks, opportunities, and financial implications. By providing a standardized framework, the TPT aims to reduce the complexity of the task and to make the information provided more clear and comparable for stakeholders.

The TPT's finalized framework focuses on guiding companies to detail their decarbonization pathways, encompassing Scope 1, 2, and 3 emissions. It emphasizes the importance of setting quantifiable targets, implementing robust governance structures, and ensuring regular reporting and accountability.

The TPT guidelines are also designed to be in alignment with global standards, such as those set by the International Sustainability Standards Board (ISSB), helping to reduce the reporting burden on companies and to create a global baseline for transition plans.

💡 Recognising that different industries face unique challenges, the TPT framework also includes sector-specific guidance to ensure that transition plans are both relevant and actionable for companies across diverse sectors. This sector guidance helps companies address industry-specific risks, set realistic goals, and create detailed action plans that align with their operational realities.

Scope of the TPT's Disclosure Framework

As it stands, the TPT Disclosure Framework is voluntary, providing companies with guidance on best practices for climate transition plan disclosures and reducing the complexity of sharing climate-related information. However, the Financial Conduct Authority (FCA) has already signaled plans to expand mandatory climate disclosure requirements, creating a path toward broader alignment with the TPT framework.

In addition, the FCA is expected to release updates on the new Sustainability Disclosure Requirements (SDR) regime, which will standardize sustainability reporting across UK businesses. This SDR regime will likely require companies to incorporate TPT-aligned disclosures as part of their compliance obligations, ensuring that they are meeting both domestic and international expectations. This anticipated development further underscores the importance of the TPT framework, positioning it as an essential tool for companies preparing for future regulatory requirements.

By aligning with the TPT framework now, companies can gain an advantage by staying ahead of potential mandates while building credibility with investors and stakeholders increasingly prioritizing sustainability transparency.

What is the TPT’s final Disclosure Framework?

In October 2023 the TPT final Disclosure Framework was released, setting out a framework for the disclosure of climate transition plans by private sector organisations. This framework is designed to provide a structured approach for companies to develop, articulate, and implement their climate transition plans.

The purpose of the TPT's framework is summed up in three fundamental principles: ambition, action, and accountability:

- Ambition - At its core, the framework encourages companies to set bold and meaningful targets that contribute to the broader economic shift towards net-zero emissions. These targets are expected to encompass not only direct emissions (scope 1 and 2) but also indirect emissions (scope 3), ensuring a more comprehensive approach to decarbonization. The ambition principle also pushes organizations to prioritize substantial CO2 emissions reduction over merely offsetting emissions through carbon credits.

- Action - The framework requires that organizations translate their ambitions into concrete actions. This involves detailing short-term, medium-term, and long-term plans with clear resource allocation, financial planning, and operational strategies. The action component asks firms to set out how they intend to achieve their set targets, including any underlying assumptions, dependencies, or potential uncertainties.

- Accountability - Underpinning the framework is the principle of accountability. It necessitates board-level oversight and robust governance structures to ensure the transition plans are not only developed but are also actively pursued. Companies are required to establish quantifiable metrics and targets with clear deadlines and to integrate these into their annual financial reporting. This level of transparency and accountability is crucial for stakeholders to monitor progress and hold organizations accountable for their environmental commitments.

Key components of the TPT Disclosure Framework

In addition to the three fundamental principles. The TPT's Disclosure Framework is structured around five key categories, each with specific sub-elements:

- Foundation - This category addresses the strategic ambition of the company, its business model, and the value chain implications. It involves assessing the business model for its alignment with the transition plan, considering key milestones, resources needed, and potential impacts on products or services.

- Implementation strategy - Here, firms need to detail their planned activities and strategies to achieve their transition goals. This includes changes in operations, resource allocations, and handling of greenhouse gas or carbon-intensive assets. Firms should also disclose their internal policies that align with their strategic ambitions.

- Engagement strategy - This involves disclosing activities aimed at engaging with stakeholders across the value chain. The focus is on fostering wider industry collaboration and knowledge sharing to collectively address the challenges of transitioning to a low-carbon economy.

- Metrics and targets - Firms must disclose specific metrics and targets used to track progress against their strategic ambitions. This includes both financial and greenhouse gas (GHG) metrics, and, where applicable, the use of carbon credits.

- Governance - The final category requires firms to disclose governance arrangements supporting their transition plans. This encompasses board oversight, senior management responsibilities, policies and procedures to foster the right culture, as well as necessary skills and training to achieve strategic ambitions.

💡 The TPT's Disclosure Framework is designed to be a comprehensive tool, guiding companies in developing and disclosing robust and credible transition plans. This framework not only helps companies articulate their climate strategies but also helps ensure that these strategies are integrated into their core business operations and governance structures.

Does the TPT Disclosure Framework align with other standards?

The Transition Plan Taskforce helps to align UK climate transition planning with global regulatory standards, particularly those established by the International Sustainability Standards Board (ISSB). A key aspect of this alignment is the TPT's integration with the ISSB's IFRS S2 standard, which sets the global benchmark for climate-related disclosures.

Alignment with ISSB Standards

The ISSB's IFRS S2 standard focuses on providing a globally consistent framework for climate-related financial disclosures. The TPT's framework complements this standard by offering detailed guidance on how entities can effectively disclose their transition plan. This alignment ensures that organizations following the TPT guidelines are also in line with international best practices as laid out by the ISSB.

“By aligning with IFRS S2, the TPT framework helps UK organisations integrate their climate-related disclosures into broader financial reporting, ensuring that these disclosures are consistent with international standards. This integration is vital for creating transparency and comparability in how companies around the world report their progress towards decarbonisation.”

Influence on upcoming UK regulations

Within the UK, the TPT framework is set to significantly influence upcoming regulations. The Financial Conduct Authority (FCA), for example, has indicated intentions to update its climate-related disclosure rules to incorporate the TPT's guidelines. This move signifies a shift towards more detailed and standardised reporting requirements for UK companies, ensuring that their disclosures align with both national objectives and international norms.

💡 Globally, the TPT's work is contributing to the creation of a baseline when it comes to sustainability disclosure practices. By setting a high standard for transition plan reporting, the TPT is influencing how other countries and regulatory bodies approach the issue of climate-related disclosures.

Global transition plan regulations

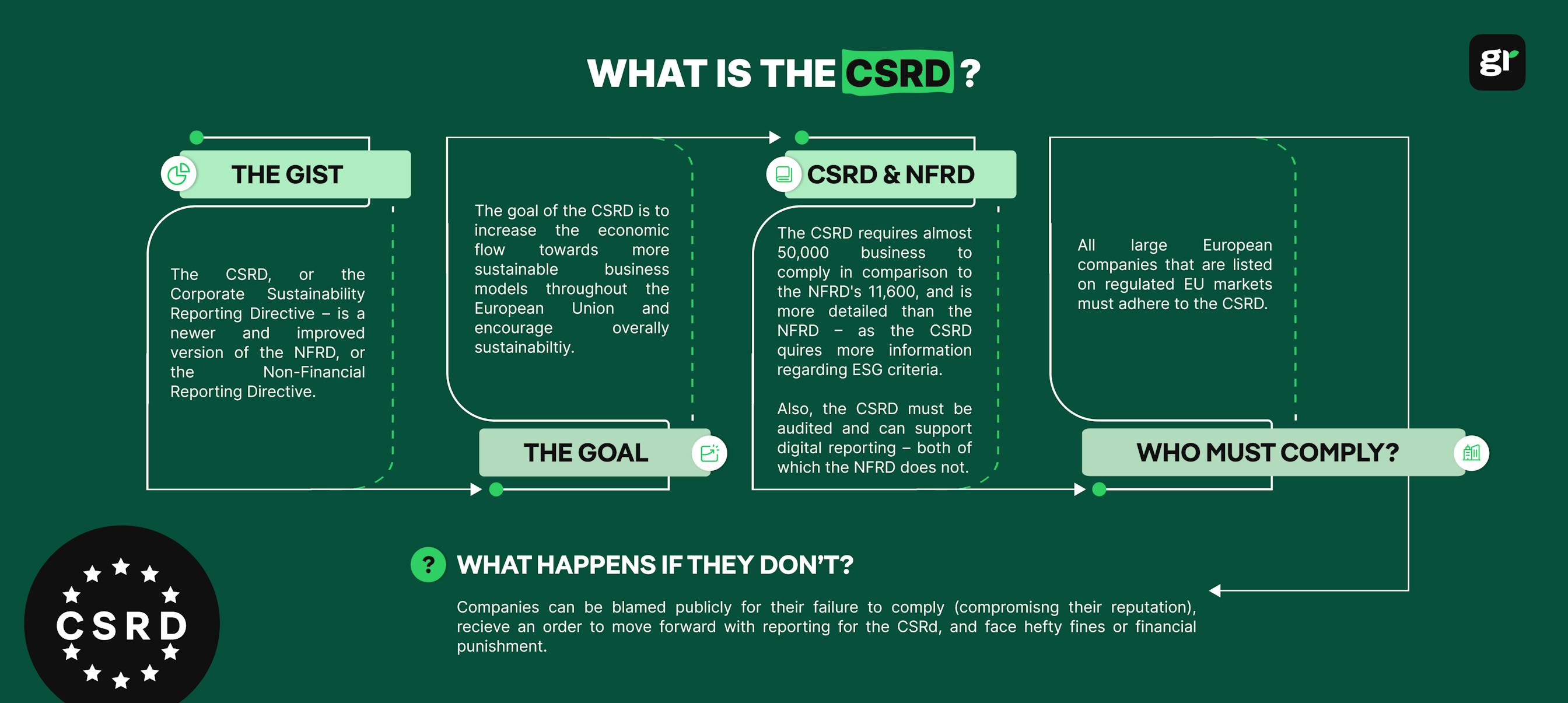

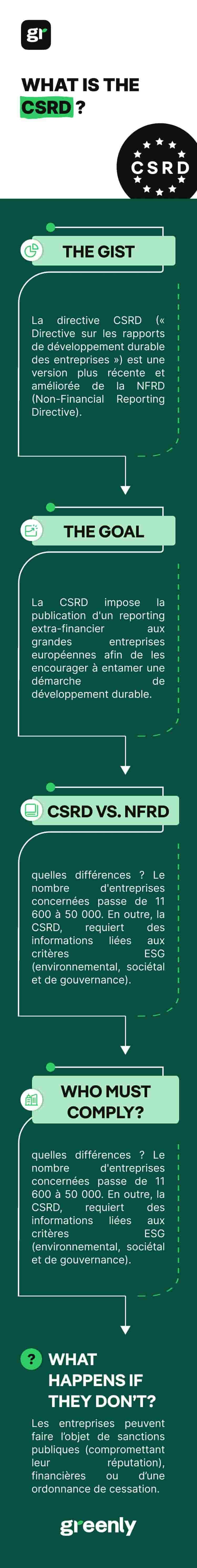

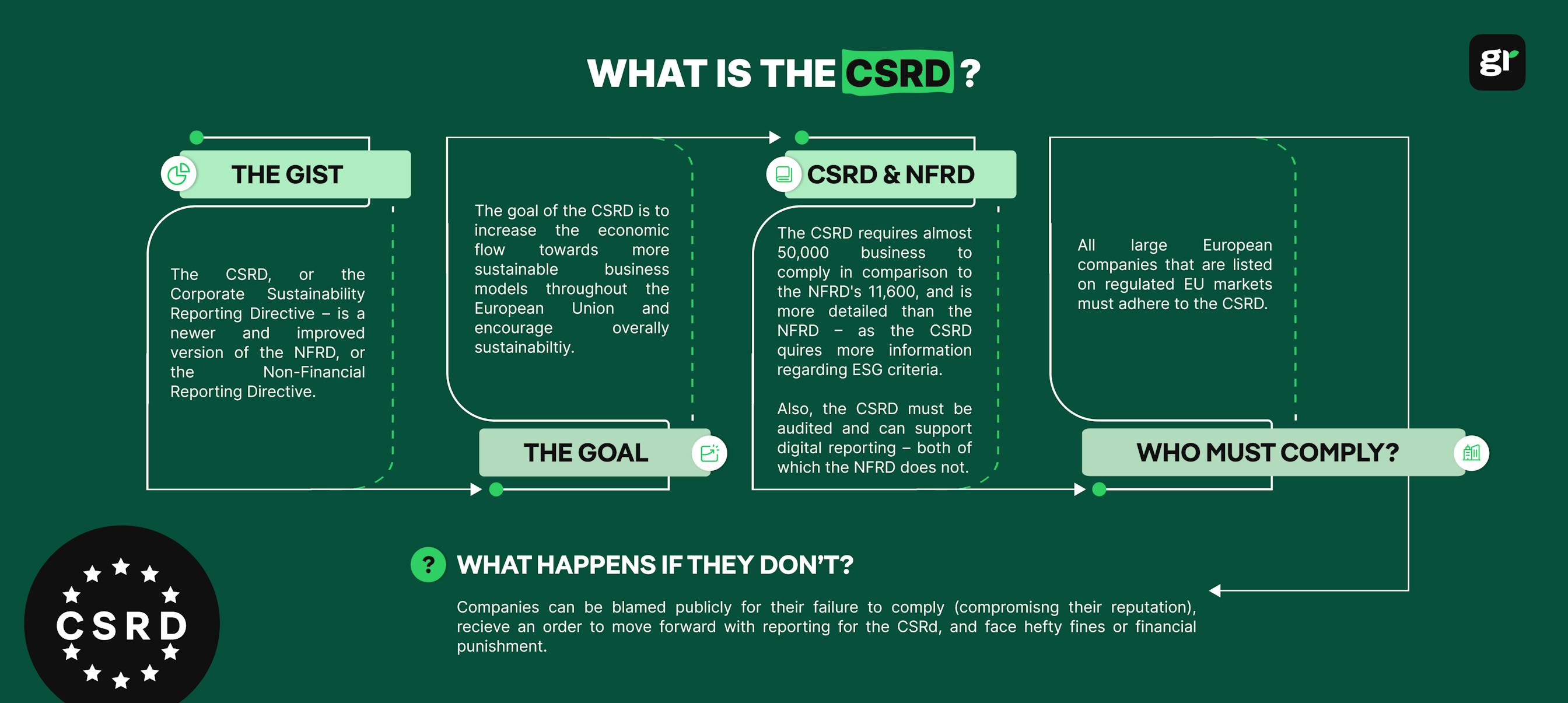

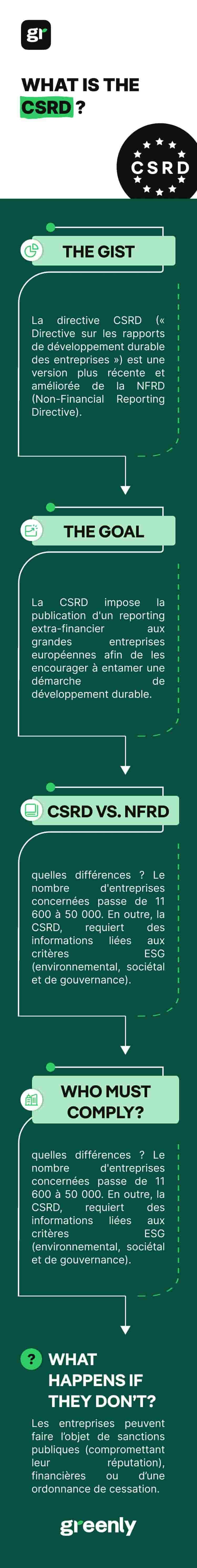

As climate-related disclosures become a central focus worldwide, the UK’s TPT framework is part of a larger movement toward standardized transition planning and transition finance requirements. Transition finance aims to channel funds toward initiatives that support decarbonization and climate resilience, with frameworks like the TPT helping companies attract and allocate funds effectively. Similar frameworks emerging in the EU and the US, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the SEC’s climate disclosure rules, reflect this global trend in aligning financial flows with climate transition goals.

The EU’s CSRD mandates large companies to disclose detailed information on their sustainability risks and impacts, including transition plans, rolling out from 2024 onward. This directive aligns with the EU’s broader goals under the European Green Deal and seeks to provide investors and stakeholders with consistent, comparable information on corporate environmental commitments.

In the United States, the SEC is in the process of finalizing climate disclosure rules that will require publicly traded companies to report their greenhouse gas emissions and share their climate transition strategies. When finalized, these rules would set out clear expectations for US companies regarding climate-related financial risks and commitments, further aligning with international standards.

By aligning with similar global regulations, the TPT framework not only supports UK companies in achieving compliance but also enables them to meet the expectations of international investors and stakeholders looking for credible, high-quality climate transition disclosures.

Why is the TPT relevant to US companies?

Although the UK TPT framework is designed specifically for UK companies, it holds valuable insights for businesses in the United States as well. With the global trend toward climate-related financial disclosures, including recent proposals by the U.S. Securities and Exchange Commission (SEC), companies worldwide are expected to enhance their transparency around climate risks and transition plans. The TPT framework aligns with international standards, such as those from the International Sustainability Standards Board (ISSB), making it a useful reference for US companies aiming to meet emerging disclosure requirements. By following the TPT framework’s structured approach to climate transition planning, US companies can better position themselves to attract sustainability-focused investors, meet stakeholder expectations, and prepare for future regulatory developments both domestically and internationally.

How can companies align with the TPT's Disclosure Framework?

As we've already touched on, the TPT Disclosure Framework is currently voluntary. As it stands, in the UK, only listed issuers and asset managers, and owners falling under the scope of the UK's FCA climate-related disclosure rules are expected to disclose their transition plans.

However, the FCA already has signaled its intention to consider expanding the scope of its regulations to include listed companies as well. Additionally, the FCA will also likely strengthen its requirements for transition plan disclosures, aligning more closely with the TPT Disclosure Framework. This is why it's a good idea for companies to get ahead of the game by familiarising themselves with the TPT Framework now.

So how can companies align with the TPT's gold standard on transition plan disclosures?

| Steps to Align with TPT's Gold Standard on Transition Plan Disclosures |

Description |

| Understand the framework |

Companies should gain a thorough understanding of the TPT framework, including its key principles (ambition, action, and accountability) and the details of its five disclosure categories. |

| Develop a transition plan |

Set ambitious but achievable emissions reduction targets, create actionable plans with clear timelines, and establish governance structures for oversight and accountability. |

| Integrate with the business strategy |

Ensure the transition plan is integrated into the organization’s overall business strategy, making climate action a core business objective. |

| Stakeholder engagement and reporting |

Communicate the transition plan effectively to stakeholders, and include regular monitoring and reporting against set targets as part of the annual reporting process to maintain transparency and accountability. |

| Begin early |

Aligning on a climate-related strategy and developing the final transition plan takes time, so it’s essential to start early. |

| Make use of the TPT Framework and resources |

The TPT Framework and resources offer more than regulatory alignment; they provide a valuable blueprint for developing a comprehensive climate strategy. |

Looking forward

The TPT framework, though voluntary, provides a best practice template in climate-related transition plan disclosures. With the Financial Conduct Authority (FCA) already requiring transition plan disclosures from UK-listed issuers and considering broader mandates, familiarisation with the TPT framework is a proactive step for all organisations.

Companies should take note: aligning with the TPT framework prepares them for upcoming regulatory changes and positions them effectively in a sustainability-focused corporate world. In a rapidly changing environment, where sustainability is gaining prominence, the TPT framework offers a practical tool for companies to demonstrate their commitment to environmental responsibility and adapt to the evolving demands of climate strategy and reporting.

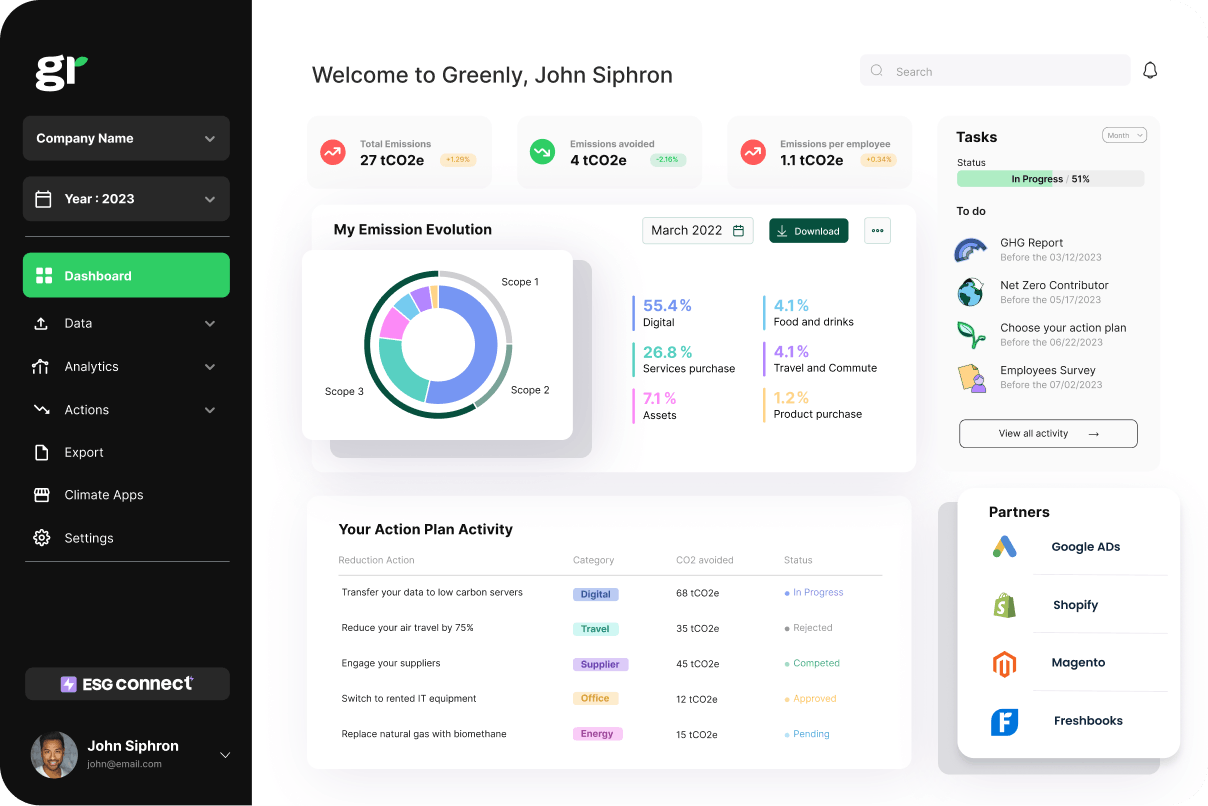

How Greenly Supports Your Company’s Path to Sustainability

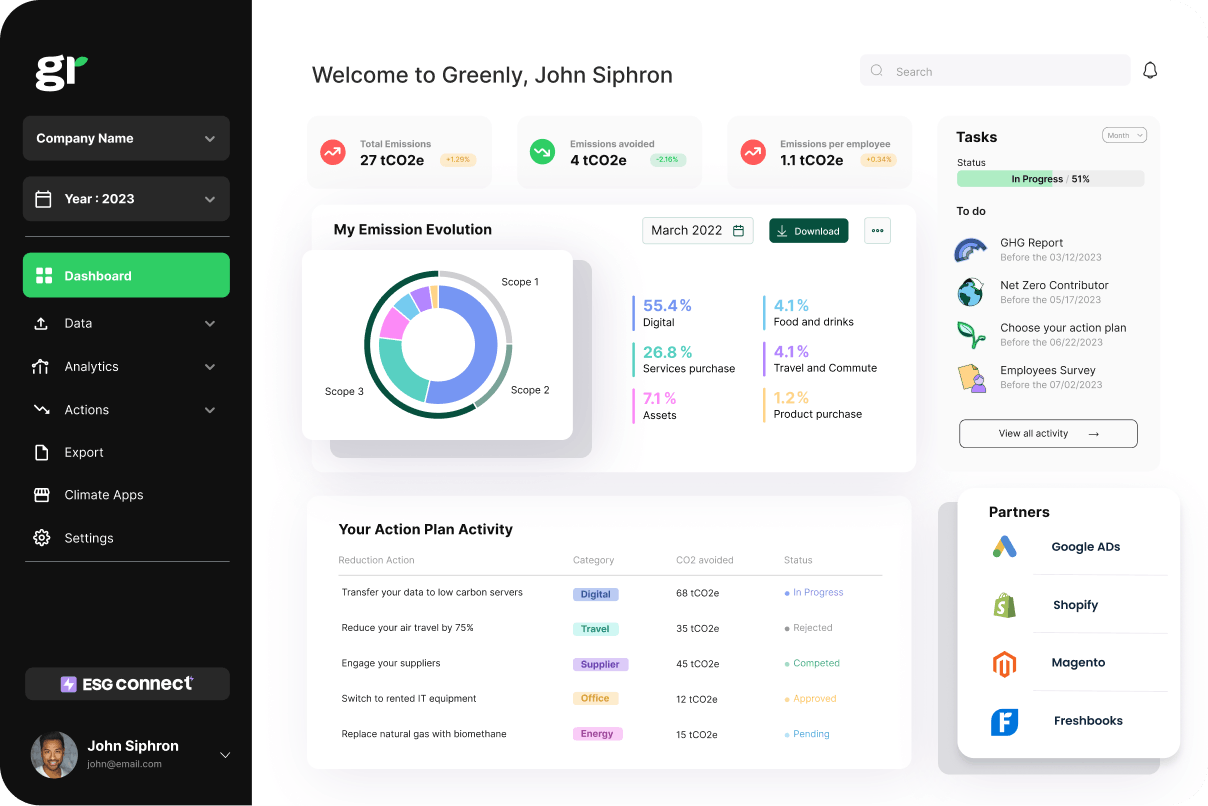

Sustainability has evolved from being optional to essential for businesses across all industries. With increasing global demands to minimize environmental impact and work towards a sustainable future, having effective tools to measure and manage carbon emissions is crucial. Greenly provides a robust suite of sustainability solutions that enable companies to make real progress toward their sustainability objectives.

Sustainability Management with Greenly

At Greenly, we equip businesses with the knowledge and platform needed to streamline their sustainability initiatives. From emissions tracking to developing tailored sustainability strategies, Greenly is there to support your company at each stage of the journey toward sustainability.

Monitoring and Lowering Carbon Emissions

Greenly’s platform enables companies to monitor their Scope 1, 2, and 3 emissions, offering an overview of their environmental footprint. This data serves as a foundation for creating effective strategies to reduce emissions, meet science-based targets, and adhere to regulatory requirements.

Custom Sustainability Strategies

In addition to emissions tracking, Greenly works alongside companies to build tailored sustainability strategies. Our specialists help pinpoint critical areas for improvement and guide businesses through clear, actionable steps to reach their sustainability goals.

Reducing Supply Chain Emissions

Managing Scope 3 emissions from the supply chain can be complex. Greenly’s platform aids companies in identifying high-emission areas within their supply chains and collaborating with suppliers to implement sustainable, impactful changes.

Streamlined Platform for Managing Sustainability

Greenly’s intuitive platform streamlines sustainability efforts, allowing businesses to monitor emissions, track their progress, and embed sustainability into their day-to-day operations. Whether you’re just beginning your sustainability journey or looking to enhance existing initiatives, Greenly helps you effectively manage and reduce environmental impact.

👉 Greenly offers a comprehensive solution for businesses aiming to lead in sustainability. Our end-to-end services (from emissions tracking to actionable strategy development) enable companies to align their environmental goals with global standards. By choosing Greenly, your company can contribute significantly to the fight against climate change, so why not get in touch with us today to start your sustainability journey?