What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

The International Integrated Reporting Council (IIRC) has been at the forefront of evolving how businesses communicate their value creation. Advocating for integrated reporting, the IIRC championed the consolidation of financial, environmental, social, and governance information into a singular, cohesive report. This approach is increasingly vital in a marketplace that demands transparency and accountability.

👉 This article will offer an insight into the IIRC's approach, explore its framework, and discuss its influence on business reporting globally.

The International Integrated Reporting Council (IIRC) was established in 2010 as a response to the growing demand for a more coherent and comprehensive approach to corporate reporting that reflects the wide range of factors affecting corporate value creation.

The IIRC (previously known as the International Integrated Reporting Committee) was formed by a coalition that included the GRI (Global Reporting Initiative), the Prince’s Accounting for Sustainability Project (A4S), and the International Federation of Accountants (IFAC). This collaboration of global leaders sought to address the increasing complexity and interdependence of financial, environmental, social, and governance issues, and the need for a reporting framework that could reflect that interconnectedness.

The objectives were not just to improve communication with investors but also to promote a more sustainable global economy by influencing decision-making and corporate behavior. This was achieved by encouraging a more cohesive and efficient approach to corporate reporting, drawing on different reporting strands, and communicating the full range of factors that materially affect the ability of an organization to create value over time.

💡 As of June 2021, the International Integrated Reporting Council (IIRC) merged with the Sustainability Accounting Standards Board (SASB) to create the Value Reporting Foundation (VRF). Later, in November 2021, it was announced that the IFRS Foundation would further consolidate the VRF and the Climate Disclosure Standards Board into its newly formed International Sustainability Standards Board. This represents a significant consolidation in the world of financial and sustainability reporting, aiming to streamline the standards and practices businesses use to report their sustainability and financial information.

👉 Learn more about the Global Reporting Initiative on our blog. Or why check out our article on the Sustainability Accounting Standards Board.

The IIRC was a diverse group, with stakeholders from various sectors including business, investment, accounting, securities, regulatory, academic, and standard-setting bodies, as well as civil society. Its governance included a Council, Board, and Secretariat. The Council comprised senior representatives from its coalition organizations and was responsible for promoting the adoption of integrated reporting globally, providing strategic guidance to the organization. The Board oversaw the IIRC’s activities and consisted of leaders with diverse international experience in business, investment, and regulation. The Secretariat, led by the CEO, implemented the IIRC's strategy and managed day-to-day operations.

This collaboration between different stakeholders was critical in developing a widely accepted framework. It ensured that the framework was robust, applicable to the broad spectrum of global business, and capable of meeting the needs of the capital markets while also serving the broader public interest.

💡 The International Integrated Reporting Council (IIRC) has undergone a significant governance transformation. The IIRC now operates within the broader governance framework of the IFRS Foundation. This reorganization means that the IIRC's governance, oversight, and operational mechanisms have been integrated into the IFRS Foundation's systems and processes, aligning with their mission to develop a comprehensive global baseline of high-quality sustainability disclosure standards to meet investors' information needs.

👉 Learn more about the IFRS Sustainability Disclosure standards in our article.

The International Integrated Reporting Council's (IIRC) integrated reporting is a process that results in a periodic integrated report by an organization about value creation over time. It includes a comprehensive format that combines financial information with other important elements of value creation, such as environmental, social, and governance (ESG) issues. The aim is to provide a holistic picture of the organization's performance and its sustainable use of resources. This approach encourages companies to consider the interdependencies between their activities and the social and environmental context within which they operate, to make more sustainable decisions.

💡 These principles continue to exist and are being carried forward under the new governance structure within the IFRS Foundation. These principles form the basis of the integrated reporting framework, which organizations around the world use to communicate a comprehensive account of their performance. The consolidation into the IFRS Foundation aims to build upon and enhance the application of these principles in global sustainability standards.

Integrated reporting is founded on a set of seven principles that collectively guide companies in providing a clear, concise, comprehensive, and comparable picture of their business performance. These principles are not mere suggestions but are integral to the framework that the IIRC has established. They serve as a blueprint for companies to communicate their strategy, governance, performance, and prospects in a way that reflects the commercial, social, and environmental context within which they operate. Here's a deeper look into how each principle should be utilized by companies:

By embedding these principles into their reporting, companies align themselves with the IIRC’s mission to enhance the way organizations think about business models and the creation of value in its various forms. These principles are designed to support the IIRC’s overarching vision of evolution in corporate reporting, paving the way for informed decision-making that contributes to financial stability and sustainable development.

💡 Although the IIRC has merged into the Value Reporting Foundation and subsequently into the IFRS Foundation's structure, the Integrated Reporting framework and its principles remain influential in guiding organizations on how to communicate their value creation story comprehensively.

The Integrated Reporting Framework, developed by the International Integrated Reporting Council (IIRC), is a strategic tool that guides organizations in communicating a clear, comprehensive, and multi-dimensional picture of their business performance. The framework is structured around the concept of 'capitals' - financial, manufactured, intellectual, human, social and relationship, and natural capital. Organizations are encouraged to report on how they interact with these capitals and how they are influenced by the organization's activities.

To use the framework, companies need to identify and communicate how they interact with these capitals, which involves disclosing their strategy, governance, performance, and prospects in a way that reflects their capacity to create value in the short, medium, and long term.

💡 This approach encourages not just transparency but a holistic understanding of the company’s impact and value creation in the context of its external environment and stakeholders.

The International Integrated Reporting Council (IIRC) has significantly influenced global business reporting standards by advocating for a more cohesive approach to corporate reporting. This impact is particularly evident in the convergence of IIRC standards with other global reporting frameworks, which has been a catalyst for the movement towards uniformity and comparability in reporting practices.

The IIRC has not worked in isolation but rather in concert with prominent frameworks and standards like the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD). The alignment of the IIRC framework with these standards creates a streamlined reporting process that enables companies to present a unified narrative that covers financial, sustainability, and governance issues. This convergence supports the 'integrated thinking' concept, encouraging companies to consider all aspects of their business and how they interact to create value.

By setting the stage for integrated reporting, the IIRC has urged companies to go beyond the traditional financial statements and include environmental, social, and governance (ESG) factors in their reports. This move towards integrated reporting has encouraged businesses to disclose not just what they do, but also how they do it, and the broader impact their operations have on society and the environment.

The IIRC's framework promotes transparency by encouraging companies to report on their strategy, governance, and performance holistically. This transparency is not just about making more information available; it's about making information more meaningful to investors and other stakeholders. The framework's emphasis on materiality helps businesses focus on issues that are truly significant to their ability to create value over time.

Moreover, the IIRC advocates for long-term value creation, steering businesses away from short-term profit maximization to a more sustainable approach that considers future generations. By integrating the six capitals into their reporting, companies are more accountable for their use of resources and are encouraged to maintain the integrity of these capitals for long-term sustainability.

The influence of the IIRC is evident as regulatory bodies in several countries have begun to integrate aspects of the IIRC's framework into their reporting requirements, thereby reinforcing the IIRC's role as a transformative force in the landscape of global business reporting standards.

👉 If you’d like to read more about ESG and its importance in the modern business landscape, head over to our article.

The Integrated Reporting Framework, now under the IFRS Foundation after the consolidation of the Value Reporting Foundation, continues to be a principles-based, multi-capital framework used worldwide. The IFRS has pledged to develop the Integrated Reporting Framework within the ISSB's scope, aiming to set global standards for sustainability disclosures for capital markets.

The IASB and ISSB, taking on the framework since the merger with the Value Reporting Foundation in August 2022, are committed to evolving a corporate reporting system that integrates the principles of the current Integrated Reporting Framework. This initiative will guide companies in crafting integrated reports that align with both IASB and ISSB requirements, fostering connected and cohesive corporate reporting. During this transition, companies are encouraged to continue to adopt and implement the Integrated Reporting Framework.

If reading this article about the International Integrated Reporting Council has inspired you to consider your company’s own carbon footprint, Greenly can help.

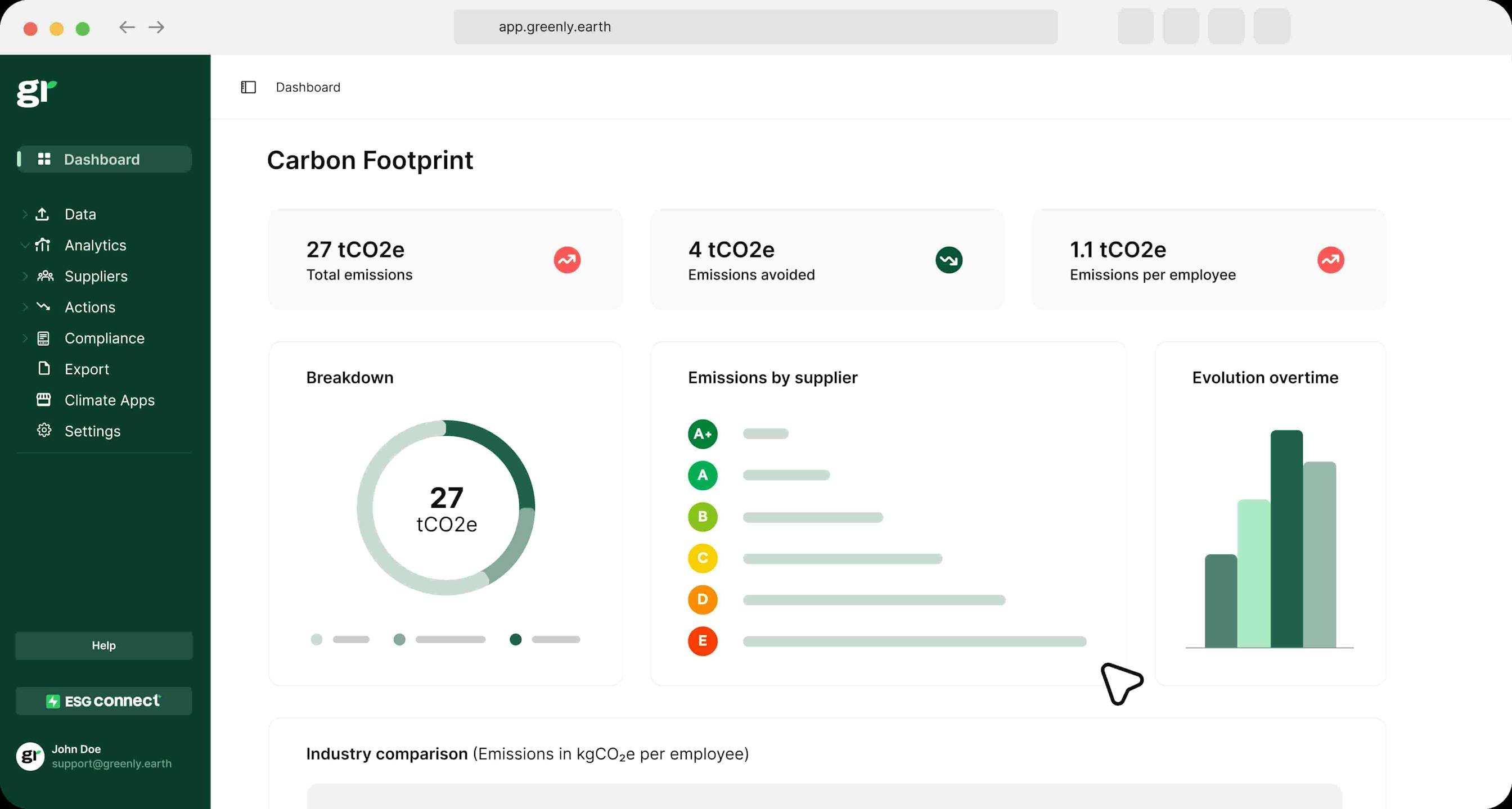

At Greenly, we can help you to assess your company’s carbon footprint, and then give you the tools you need to cut down on emissions. We offer a free demo for you to better understand our platform and all that it has to offer – including assistance with boosting supplier engagement, personalized assistance, and new ways to involve your employees.

Learn more about Greenly’s carbon management platform here.