The Carbon Border Adjustment Mechanism (CBAM)

In this article, we break down what the EU CBAM is, how it works, and what businesses need to do to comply.

ESG / CSR

Industries

As businesses face increasing scrutiny over their environmental impact, compliance with the UK's Streamlined Energy and Carbon Reporting (SECR) regulation has become essential. SECR aims to enhance climate transparency and drive energy efficiency improvements, positioning UK companies to address both legal requirements and stakeholder expectations. While this is a UK-specific regulation, understanding these requirements is valuable for US companies with UK operations or subsidiaries.

Streamlined Energy and Carbon Reporting (SECR) is a mandatory UK regulation requiring qualifying companies to disclose their energy use and greenhouse gas emissions.

This guide explains what SECR is, who needs to comply, and how to report accurately.

This article explains what the SECR is, why it was introduced, who it applies to, and what it means for companies operating in the UK.

The UK's Streamlined Energy and Carbon Reporting (SECR) policy was introduced on April 1st 2019 as a major step forward in enhancing corporate accountability for energy use and carbon emissions. Designed to simplify reporting requirements while expanding their scope, SECR replaced the Carbon Reduction Commitment (CRC) Energy Efficiency Scheme and brought many more businesses under its purview.

Unlike the CRC, which applied to fewer organizations, SECR mandates that approximately 11,900 large UK-based companies now disclose their annual energy use, carbon emissions, and any energy-efficiency measures they’ve implemented. This broader scope ensures greater transparency and incentivizes action across a wider range of industries.

SECR also aligns closely with the UK’s ambitious climate goals, including achieving net zero emissions by 2050. By requiring companies to report on their energy efficiency efforts, SECR supports the national transition to a low-carbon economy and provides investors with critical data to guide sustainable decision-making. This approach parallels the growing ESG disclosure momentum in the US, where investors are increasingly demanding similar transparency.

It’s important to note that SECR operates alongside, rather than replacing, other emissions reporting requirements, including:

By modernizing and unifying reporting requirements, SECR makes it easier for businesses to integrate emissions tracking into their sustainability strategies, helping the UK move closer to its climate commitments.

Although the SECR is a UK-based regulation, it still apples and can even be pivotal for US companies.

While SECR is a UK-specific regulation, its approach to emissions reporting illustrates the ongoing global trend toward greater corporate climate transparency.

US companies should monitor these developments closely, as it can help them to better understand how similar requirements may unfold – such as with new SEC proposals and state-level regulations.

Furthermore, US businesses with UK operations must make an effort to understand SECR compliance as it is essential to transparency and success.

By adopting comprehensive emissions tracking now, such as by drawing inspiration from oversees efforts such as the SECR – US companies can prepare for evolving regulatory landscapes while demonstrating environmental leadership to increasingly climate-conscious investors and consumers.

The urgency is clear: climate change not only threatens the environment but poses a significant economic risk. Swiss Re, a leading reinsurance firm, projects that without decisive action, global GDP could shrink by up to 18% by 2050. For UK businesses, this makes transparency in energy use and carbon emissions not just a regulatory obligation but a competitive advantage. US businesses face similar concerns, with climate risk increasingly affecting investment decisions and corporate valuations.

Since its introduction in 2019, SECR has transformed how companies report on energy consumption and emissions. By expanding the scope of carbon accounting and modernising disclosure rules, it equips investors with the high-quality data they need to align financial and environmental considerations in their decisions. To find out if you are in compliance with the regulations, try our Legislation Checker. This is imperative for US companies with UK operations, as understanding these requirements is crucial for global compliance.

Overall, carbon reporting under SECR is important because as it can help to boost transparency and accountability around corporate energy use and emissions – allowing businesses to identify inefficiencies while supporting the UK’s broader climate goals.

The drop down sections below will explain additional reasons why SECR is important for U.S. based companies with operations in the United Kingdom:

The SECR is beneficial as it creates a bridge between fiscal performance and environmental responsibility. By tracking energy use and carbon emissions, companies can reduce costs, improve operational efficiency, and demonstrate transparency to regulators and stakeholders. In turn, this helps companies curtail their greenhouse gas emissions and combat the repercussions of climate change by endorsing energy-efficient practices.

Furthermore, beyond compliance, the SECR increases awareness regarding the implications of climate change and the intricacies of energy expenditure within organizations. It not highlights the monetary aspect of energy, but also enlightens stakeholders about a company's role in climate change. This clarity empowers leadership to make informed decisions and adopt low-carbon strategies.

For investors, SECR data provides reliable, standardized insight into a company’s sustainability efforts – which remain crucial for ESG-focused decision-making in today’s low-carbon economy.

The summary cards below will explain for SECR reporting is good for a business in terms of climate change, finances, and long-term business success:

The SECR impacts an estimated 11,900 companies incorporated in the UK. These businesses fall under three main categories. All companies that meet the following criteria are obligated to report their emissions and energy consumption unless they fall under one of the exemptions:

Remember, for detailed and official guidance, it's important to refer to the UK government’s publication to better under what companies must provide in their reporting framework.

Yes, the SEC has exemptions. While the Streamlined Energy and Carbon Reporting (SECR) framework applies broadly, several key exemptions exist.

Here's a breakdown of the possible exemptions under the SECR:

The table below will break down the reporting obligations and exemptions under the SECR:

| Company Type | Criteria | Reporting Obligations | Exemptions |

|---|---|---|---|

| Quoted Companies | Listed on a UK stock exchange | Must report energy use and efficiency measures globally. | None |

| Unquoted Companies | Meets two of the following: turnover > £36M, balance sheet > £18M, > 250 employees | UK-based energy use and efficiency measures only. | Exempt if energy use is < 40 MWh per year |

| Limited Liability Partnerships (LLPs) | Same as unquoted companies: meets two of the following: turnover > £36M, balance sheet > £18M, > 250 employees | UK-based energy use and efficiency measures only. | Exempt if energy use is < 40 MWh per year |

In some cases, a group-level report is required. In a group-level report, the parent company is typically required to disclose energy use and carbon emissions for the entire group, including all subsidiaries.

However, as previously explained in the exemptions section, if a subsidiary would not independently fall within the scope of SECR (i.e., if it is not considered a “large” company under the Companies Act 2006), its energy and emissions data may be excluded from the group report at the parent company's discretion.

It is important to note that reporting companies must remember that this specific guideline is treated differently than in the Energy Savings Opportunity Scheme (ESOS) and the CRC Energy Efficiency Scheme, where reporting rules for subsidiaries may vary.

Note that when subsidiary companies are within scope of SECR have already reported their energy and carbon information in a parent’s group-level report, they will not be required to file a separate energy and carbon report.

SECR reporting requirements vary depending on the type and size of the business. We've provided a breakdown of what quoted companies — including large unquoted companies and LLPs — are required to report under the SECR framework.

Quoted companies are legally required to report their Scope 1 and Scope 2 worldwide GHG emissions. The emissions should be reported in tonnes of carbon dioxide equivalent (CO2e) covering the seven gases listed in the Kyoto Protocol.

Companies are strongly recommended to report Scope 3 emissions if they are essential to business operations, however, for now reporting on Scope 3 emissions is not mandatory, and is voluntary only.

The report must include emissions of the seven Kyoto Protocol gases:

Scope 3 emissions (all other indirect emissions, such as from supply chains or travel) are optional to include but strongly encouraged in reporting, especially when they represent a large portion of a company’s carbon footprint.

Quoted companies should also report at least one emissions intensity ratio – which refers to a metric that relates emissions to a business activity, such as how many emissions are emitted via tonnes of CO₂e per £m revenue or per m² floor space. These selected emissions intensity ratios must be shared in their director's report for both:

Remember, emissions intensity ratios define GHG emissions in relation to the scale of business operations. Intensity metrics help regulators and stakeholders compare companies’ energy efficiency with counterparts of a similar size. Examples of intensity metrics include tons of CO2e per sales revenue or per square feet of total floor space.

In addition to their emissions, listed companies should report their total global annual energy usage, which includes specifying both:

If the first year of SECR reporting has passed, quoted companies must also provide a comparison between the current and previous reporting years.

SECR requires quoted companies to describe whether or not they implemented measures aimed at reducing carbon emissions throughout the course of the year, or any actions taken during the reporting year to improve energy efficiency. This should include:

If no actions were taken, this must also be explicitly stated in the report to ensure transparency.

The flip cards below (move cursor over cards to flip) will include examples of energy efficiency measures:

Quoted companies should outline the methodology used to calculate their energy use and GHG emissions. While there is no specific recommended methodology, SECR recommends selecting one that is widely used, comprehensive, and transparent, such as:

Quoted companies should report these details and all SECR disclosures in their Director’s Reports. This applies to financial years beginning on or after April 1st 2019.

Here’s a quick SECR reporting checklist for quoted companies:

SECR requires large unlisted companies and large LLPs to report on the following information:

UK energy use (including the UK offshore area) in three categories: electricity, gas, and fuel for transport. Associated GHG emissions from these activities should also be reported, with at least one emissions intensity ratio included.

Note: When reporting transport energy use, businesses should report their direct fuel purchases for company vehicles, but there is no need to report fuel used from a third-party operator. Fuel used in flights, trains, public transport, taxi trips, freight, or shipping for services contracted to a third party is also excluded.

Like quoted companies, large unquoted companies and large LLPs also need to provide a narrative description of their energy efficiency activities taken throughout the reporting year, and details on the methodology they used to help reduce energy usage or carbon emissions. In addition, they must disclose the methodology used to calculate energy consumption and greenhouse gas (GHG) emissions. While SECR does not mandate a specific methodology, it recommends choosing a recognized, consistent, and transparent approach (e.g. DEFRA emissions factors, GHG Protocol, or ISO 14064-1).

Also similar to quoted companies, large unquoted companies should provide the required information in their Directors’ Reports, or Strategy Reports alongside a clear explanation.

Large LLPs should report the information in their Energy and Carbon Report (a new obligation that was brought in with SECR). These reports must be filed for financial years starting on or after April 1st 2019.

Here’s a quick SECR reporting checklist for large unquoted companies and large LLPs:

The SECR guidelines set a foundational benchmark for successful GHG reporting to mitigate the impacts of climate change, but there's room to go beyond the basics. Here's what's recommended in addition to the general requirements:

Full Disclosure: Companies should share details about all significant sources of energy consumption or greenhouse gas emissions, even those not specified in the guidelines. This includes Scope 3 emissions, which are the indirect emissions that occur in a company's value chain.

Science-backed Targets: Companies should aim to align their reporting with science-based goals, such as aiming to keep global warming below 1.5 degrees Celsius by 2100.

Future-focused Analysis: The Task Force on Climate-related Financial Disclosures (TCFD) suggests companies look ahead and analyse how climate change might affect them. This involves:

Risk Assessment: The TCFD encourages companies to evaluate climate risks, both direct (like storms or rising sea levels) and indirect (like changes in policies, markets, technologies, potential lawsuits, or harm to their reputation).

In certain situations, companies might find it challenging to include their energy and carbon emissions data in their annual streamlined reports. Reasons could range from facing exceptional difficulties in gathering the data to concerns that sharing such information might harm the company's interests.

Companies choosing to withhold such data should clearly state their reasons for doing so. However, they're also expected to make efforts to fully comply in subsequent reports.

Failing to comply with SECR reporting requirements can have significant repercussions for businesses, affecting both their financial standing and reputation. Here are the key risks of non-compliance:

Non-compliance with SECR can lead to fines and enforcement actions by the UK Government. While the exact penalty depends on the nature and severity of the breach, companies that fail to submit accurate and timely reports risk facing financial sanctions. This adds an unnecessary expense that could otherwise be avoided with proper compliance.

In today’s business landscape, transparency is critical for maintaining trust among stakeholders. Non-compliance with SECR may signal a lack of commitment to sustainability, damaging a company’s reputation with investors, customers, and employees. This can lead to lost business opportunities and decreased brand loyalty.

SECR compliance often uncovers inefficiencies in energy use that, when addressed, can result in significant cost savings. Failing to report and act on this data means companies miss opportunities to reduce their operational expenses and carbon footprint, leaving them at a competitive disadvantage.

Non-compliance can attract unwanted attention from regulatory authorities, leading to audits or more stringent oversight. Additionally, sustainability-conscious investors may question a company’s reliability and commitment to addressing climate risks.

To avoid these risks, companies should ensure their compliance processes are robust and aligned with SECR requirements. The UK Government’s official SECR guidelines provide detailed instructions on reporting obligations and methodologies, which businesses should follow closely. Companies unsure about their compliance status can seek expert advice to streamline their reporting processes and minimize risks.

For further information and support on SECR compliance, consider exploring the following resources:

SECR Official Guidelines

Government Resources on Energy Efficiency

Greenly’s Services Related to Emissions Reporting

Greenly is the best choice for SECR reporting as we're familiar with international environmental regulations and can provide exceptional expertise with scope 3 emissions.

SECR only mandates Scope 1 and Scope 2 reporting, however, it is strongly recommended that companies also adopt Scope 3 reporting. Let’s take a closer look at the different Scopes and what they encompass below:

The GHG Protocol defines the three emissions reporting Scopes as follows:

Scope 3 emissions data is more challenging for companies to collect, as they aren't created by the company themselves. It includes the supply chain emissions created when manufacturing and shipping products, as well as the emissions caused by the end-users when consuming the products, goods, or services.

In the US, the SEC's proposed climate disclosure rules also address Scope 3 reporting for certain companies, making this an growing standard across the globe.

To find out more about the different scope emissions, read our article on the topic – and if you'd like to learn more about carbon accounting. take a look at our blog.

Working with specialized carbon accounting experts like Greenly can improve the quality of your reporting across all 3 Scopes, so why not get in touch with us today?

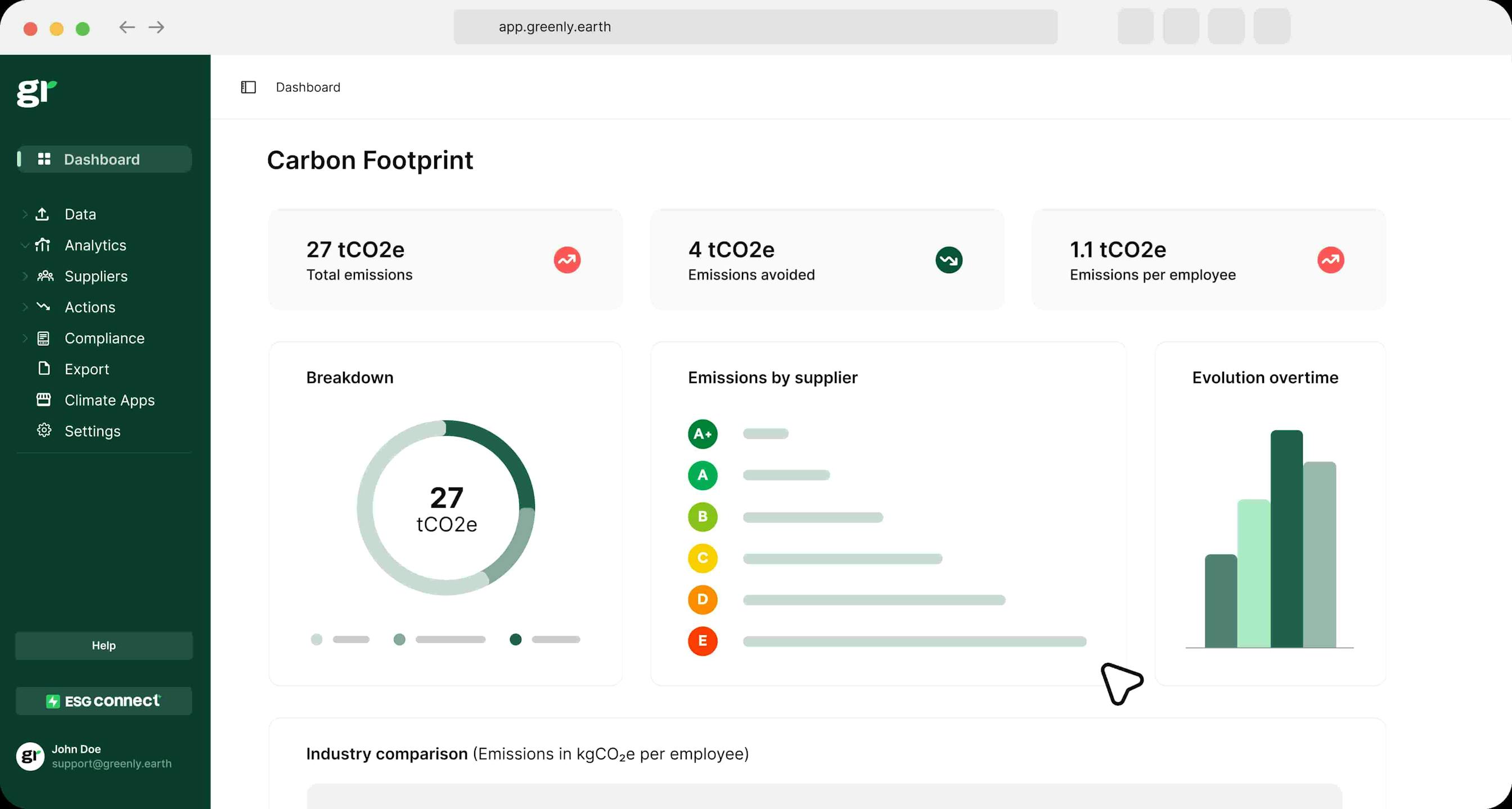

A: Effective carbon reporting tools for SECR compliance include accurate energy usage and emissions calculations, measurement of Scope 1, 2, and 3 emissions, and ease of use for collecting and analyzing data. Greenly possesses all of these features, making it a perfect carbon reporting tool for SECR compliance.

A: Various sustainability platforms such as EcoVadis, Diligent ESG, Sphera, and especially Greenly all serve as excellent compliant platforms for SECR reporting.

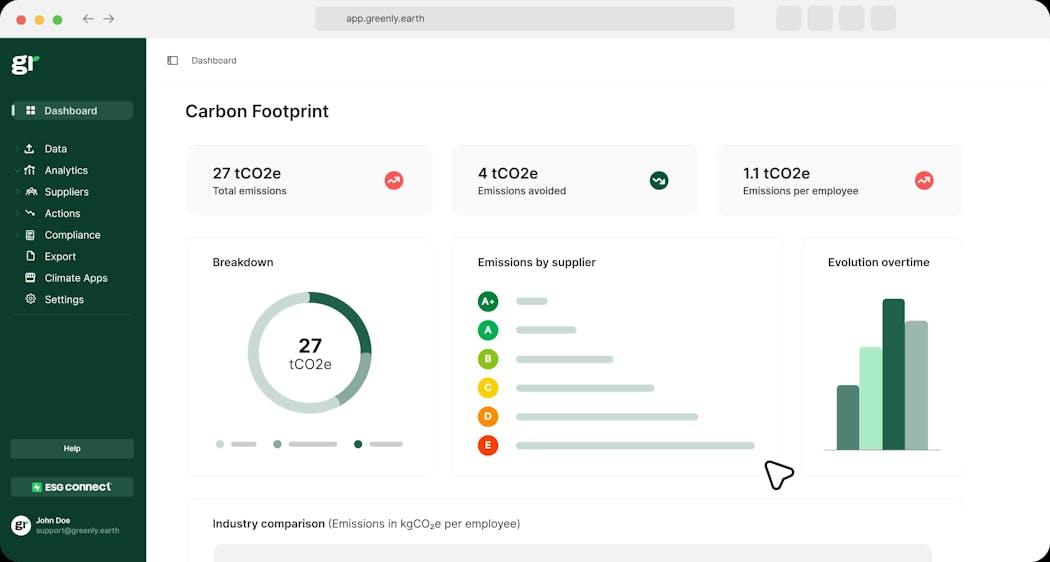

A: Greenly is a strong option for SECR reporting in the UK due to its focus on Scope 3 emissions, user-friendly dashboards, supply chain visibility, streamlined data collection, and tailored decarbonization pathways—all helping to ensure regulatory compliance.

A: Yes, Greenly’s own experience as a startup and its work with both small and large enterprises makes our platform a manageable and effective SECR solution for small UK businesses looking to track and reduce emissions easily.

At Greenly, we specialize in making carbon management accessible and actionable for businesses of all sizes. Our suite of carbon management services is designed to help your company effectively measure, track, and reduce emissions, enabling you to achieve sustainability goals while staying ahead of regulatory requirements like SECR.

Here’s what we offer:

With Greenly, sustainability is not just a goal – it’s an achievable and measurable journey. Our mission is to empower businesses to reduce emissions, improve operational efficiency, and strengthen their commitment to a sustainable future.

Request a demo today to discover how Greenly can help you take the next step in your carbon management journey.