What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

Today, ESG scores are shaping investment decisions, influencing how companies are perceived by customers and employees, and increasingly determining access to capital. But despite their growing importance, ESG scores are often misunderstood - even by the companies being rated!

What does a “good” ESG score actually mean? Who decides it? And how much weight should businesses and investors really give these ratings?

What an ESG score is and what it actually measures

Who uses ESG scores, and how they influence real business and investment decisions

Who provides ESG scores, and why methodologies differ so widely

How ESG scores are calculated, including the role of data, weighting, and materiality

The limitations and criticisms of third-party ESG ratings

How ESG rating regulation is evolving in the UK, EU, and US - and what this means for companies

An ESG score (sometimes called an ESG rating) is a way of turning a company’s environmental, social, and governance performance into a single, comparable signal. Depending on the provider, that signal might be a number, a letter grade, or a risk category.

Most ESG scores are produced by third-party rating agencies using a mix of company disclosures, public filings, regulatory data, and media analysis. But while the inputs may look similar on paper, the way they’re weighted and interpreted varies widely – which is why the same company can receive very different scores from different providers.

One of the most important things to understand is this: ESG scores are usually about risk, not impact.

Rather than measuring a company’s absolute environmental footprint, most ESG ratings assess how well a business manages ESG-related risks that could affect its financial performance. These assessments are typically made relative to industry peers, not against a universal sustainability benchmark.

This explains some of the counterintuitive results people often notice. A high-emissions company can score well if it has strong governance, clear policies, and robust risk management, while a lower-impact business may score poorly if its ESG practices are weak or poorly disclosed.

In short, an ESG score isn’t a verdict on whether a company is “good” or “bad”. It’s a snapshot of how well that company is managing ESG risks – according to a specific methodology, at a specific point in time.

At a glance, an ESG score looks like a simple summary of a company’s environmental, social, and governance performance. In reality, it’s a much more specific and narrower signal.

ESG reporting is what a company discloses; an ESG score is how that information is interpreted, weighted, and judged by a third party.

Reporting is descriptive. Scoring is evaluative. One feeds into the other, but they are not the same thing.

Most mainstream ESG scores are risk-based, not impact-based – and this is where confusion often creeps in.

Risk-based scores assess how exposed a company is to ESG-related risks, and how well it manages them. Impact-based approaches, by contrast, look at the real-world effects a company has on the environment and society.

ESG scores show up in more places than many companies realise. They’re used to inform investment decisions, influence lending and insurance terms, and increasingly play a role in how suppliers and partners are assessed.

Different audiences look at the same score in very different ways. What matters to an investor isn’t necessarily what matters to a bank or a procurement team.

The cards below break down who uses ESG scores and what they’re typically used for in practice.

What they’re looking for: a comparable signal of long-term risk and resilience.

How it’s used: screening, peer comparison, portfolio weighting, and engagement priorities.

Typical outcome: invest, divest, reweight, or push for stronger disclosure and governance.

What they’re looking for: exposure to operational, regulatory, and climate-related risk.

How it’s used: informing credit decisions, pricing, covenants, and insurance eligibility.

Typical outcome: adjusted loan terms, higher/lower premiums, or additional conditions.

What they’re looking for: a benchmark against peers, and a reality-check on external perception.

How it’s used: identifying gaps in data, governance, and policies – then prioritizing improvements.

Typical outcome: clearer ESG roadmap, stronger disclosures, and better investor readiness.

What they’re looking for: supplier risk – from labour practices to environmental compliance.

How it’s used: onboarding decisions, preferred supplier lists, and contract requirements.

Typical outcome: supplier selection, corrective action plans, or tighter reporting expectations.

Most ESG scores are produced by third-party rating agencies that specialize in analyzing companies’ environmental, social, and governance performance. These organizations collect data from public disclosures, regulatory filings, media sources, and proprietary research, then apply their own methodologies to generate ESG ratings or risk scores.

Alongside these external ratings, some companies also develop internal ESG scoring systems. These are typically based on recognised frameworks and used for internal benchmarking, risk management, or strategy-setting rather than public comparison. Internal scores can be useful, but they don’t carry the same weight as an external rating used by investors or lenders.

It’s important to be clear about what ESG rating agencies are – and what they are not.

ESG rating agencies are NOT regulators. They don’t set legal requirements, and they don’t certify compliance. Instead, they act as independent data providers, each applying its own view of what matters, how risks should be weighted, and how performance should be assessed.

While the market includes dozens of players, a small group of providers are most commonly referenced by investors, financial institutions, and large corporates, these include:

Each of these providers uses its own methodology and focuses on slightly different aspects of ESG risk and performance, which is why the same company can receive very different scores depending on who is doing the assessment.

ESG scores are built by collecting large amounts of ESG-related data and translating it into a single assessment using a provider’s own methedology. While the details vary from one agency to another, the process usually follows the same broad steps.

Even when providers rely on similar data, ESG scores can vary widely because:

In other words, ESG scores are not purely objective measurements. They are structured assessments shaped by judgement calls at every stage – which is exactly why understanding the methodology matters.

An ESG score is a useful signal, but it isn’t a verdict on a company’s overall sustainability performance. It reflects how a specific rating provider assesses ESG risks and disclosures at a given moment in time, using its own methodology.

The score is most useful when it’s used for like-for-like benchmarking. Comparing against direct peers within the same sector – and using the same provider – helps companies understand how they’re positioned and where they may be falling behind. Cross-sector comparisons or mixing scores from different providers can quickly become misleading.

Rather than treating ESG scores as targets to optimize, the most effective companies use them as a diagnostic tool. Looking beneath the headline score helps identify gaps in data, governance, or risk management that can then be addressed through concrete actions.

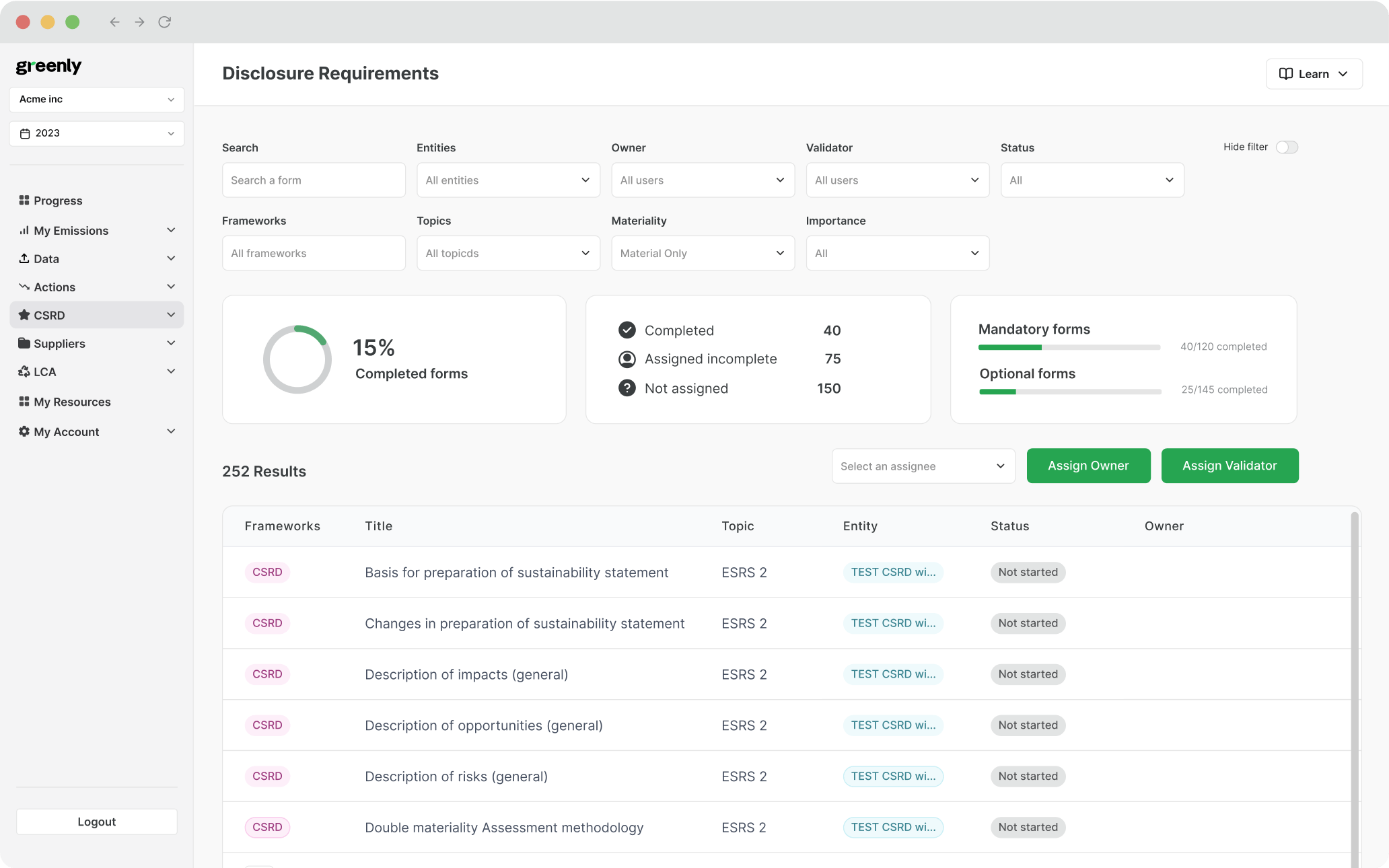

This is where expert support matters. Working with a partner - like Greenly - that understands both ESG requirements and scoring methodologies allows companies to focus on improving underlying practices and data quality – not simply chasing a higher rating.

While third-party ESG ratings can be genuinely useful: they help investors and companies compare organizations, spot potential red flags, and bring structure to complex ESG information. But they’re not a perfect measuring stick. The issues below are the main reasons ESG scores can feel confusing, and why two providers can look at the same company and reach different conclusions.

The same company can receive very different ESG scores.

This doesn’t always mean one score is “wrong.” Different assumptions, weightings, and definitions of materiality mean outcomes depend on the lens being applied.

It’s often unclear how final scores are produced.

Providers usually explain their approach at a high level, but the underlying scoring models are proprietary - making it hard to trace results back to specific assumptions.

Reporting quality can influence scores as much as performance.

Companies with strong reporting processes may score better than peers with similar impacts but weaker disclosure - especially where external data is limited.

Chasing ratings can reward optics over substance.

When scores become the goal, companies may prioritize policies and documentation that “score well”, rather than tackling deeper, long-term sustainability challenges.

None of this makes ESG ratings meaningless. It just means they work best as one input among many.

ESG ratings now play a meaningful role in investment decisions and capital allocation, which has pushed regulators to look more closely at how they’re produced.

However, the regulatory picture is very much dependent on the country or location, with different oversight in the UK, US, and EU:

No. There is currently no requirement for companies to obtain an ESG score. However, many companies are assessed by ESG rating agencies regardless, using publicly available information. In practice, ESG scores often influence investors, lenders, and insurers even when companies haven’t actively sought a rating.

Yes. Companies are often rated by multiple ESG providers at the same time, and those scores can differ significantly. Each provider uses its own methodology, data sources, and weighting models, which is why there is no single “official” ESG score.

Not directly. Most ESG scores are risk-based, meaning they focus on how well a company manages ESG-related risks that could affect financial performance. They do not usually measure a company’s absolute environmental or social impact.

ESG scores are often used alongside traditional financial metrics when assessing investment risk, loan terms, insurance coverage, or eligibility for sustainability-linked products. They rarely act alone, but they can influence conditions and pricing.

Not necessarily. A higher score indicates stronger ESG risk management according to a specific provider’s methodology, but it doesn’t mean a company is low-impact or fully sustainable. Context – including sector, geography, and scoring model – always matters.

Companies can improve how they are assessed by strengthening governance, addressing material risks, improving data quality, and making disclosures clearer and more consistent. That said, chasing a score without improving underlying practices can be counterproductive.

ESG scores are useful indicators, but they are not definitive or fully objective. They reflect judgement calls around data, materiality, and weighting. This is why they work best as one input among many, rather than as a standalone decision-making tool.

ESG scores assess risk and management practices, usually from an investor perspective. Certifications and labels, by contrast, often verify compliance with specific standards or performance thresholds. They serve different purposes and aren’t directly interchangeable.