What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

Sustainability regulations in the European Union are complex, overlapping, and, according to many businesses, increasingly difficult to navigate. In response, the European Commission has unveiled an Omnibus Regulation - a proposal aimed at simplifying key corporate sustainability reporting requirements while maintaining the EU’s ambitious environmental and social governance (ESG) goals.

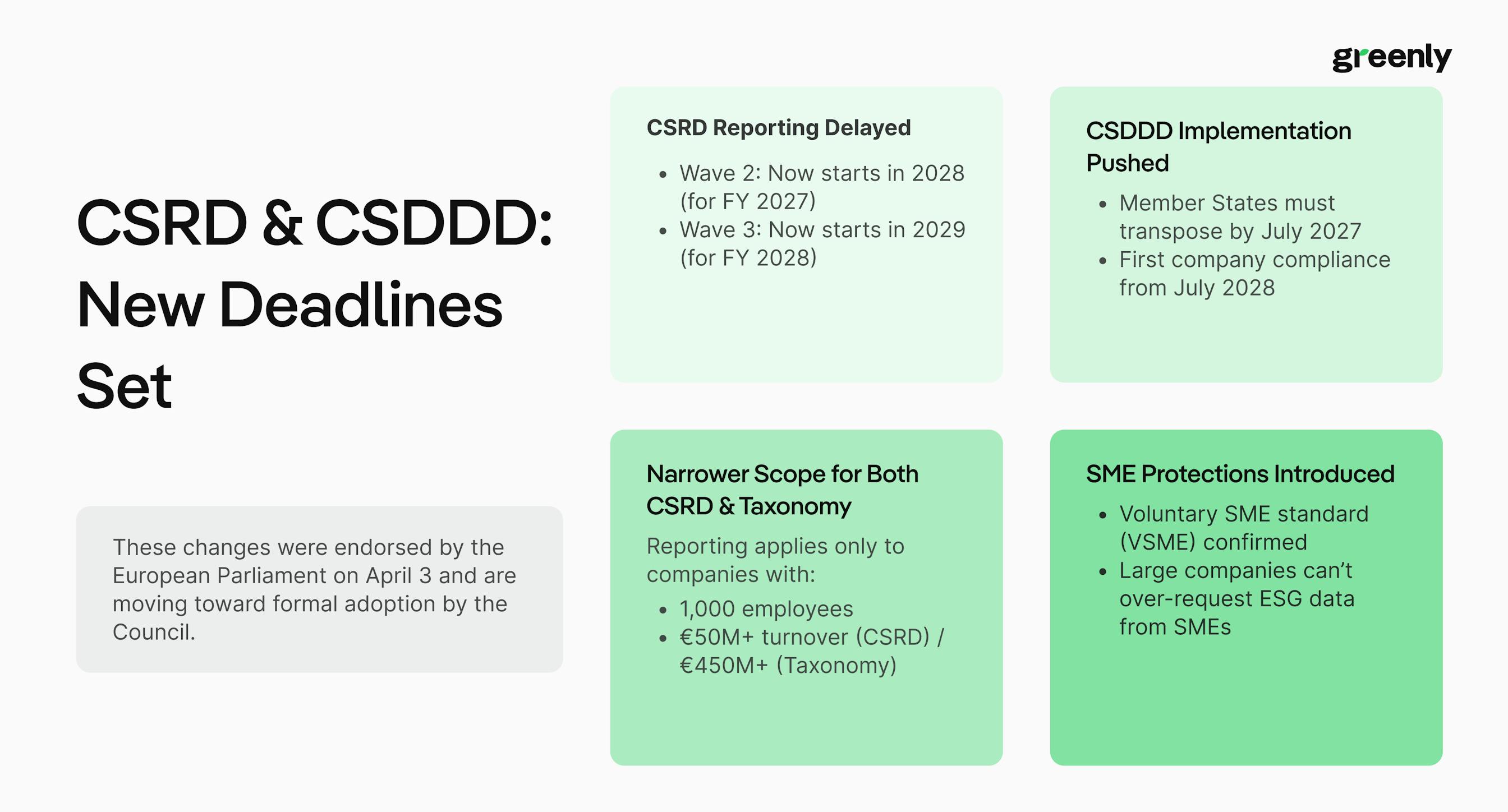

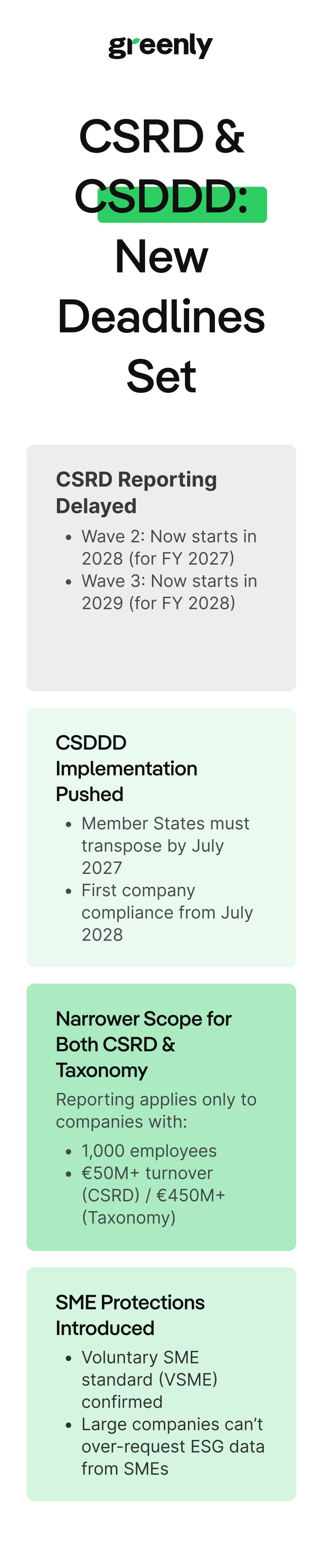

The proposal, released on February 26, 2025, and partially endorsed by the European Parliament on April 3, has been framed as part of the EU’s broader Competitiveness Compass - a strategy designed to enhance Europe’s economic resilience by reducing regulatory burdens.

But while the Commission argues that this will reduce compliance costs for businesses, the proposal has already sparked significant debate. Investors and sustainability advocates fear that cutting back on reporting requirements could weaken corporate transparency, while some businesses warn that changes could create further legal uncertainty just as they’ve started implementing existing regulations.

The package proposes targeted amendments to several cornerstone regulations, including the:

The Omnibus package was introduced under the umbrella of the EU Competitiveness Compass, a broader strategy presented in early 2025 to:

The Commission has explicitly linked the Omnibus to the findings of the Draghi report on EU competitiveness and its own 2023 call for evidence on regulatory burdens. Many businesses and industry groups have argued that existing sustainability rules, while well-intentioned, are overly complex, duplicative, or costly to apply, particularly for companies lower in the value chain.

In response, the Omnibus Regulation proposes:

While some elements, such as the reporting delays under CSRD and CSDDD, have already been approved by the European Parliament, other proposals are still under review by the EU co-legislators. The overall goal is to adopt final changes by mid-to-late 2025.

This change would remove around 80% of companies from the original CSRD scope, allowing smaller companies to focus on their core business while targeting reporting efforts on the largest players with the biggest sustainability impact.

The European Parliament has already approved a two-year extension of the reporting deadlines for companies that have not yet started reporting. This is part of the ‘stop-the-clock’ proposal passed on April 3, 2025, and is awaiting formal adoption by the European Council.

Here’s how the timeline now looks:

The European Commission has committed to making the reporting process easier and less time-consuming. The European Sustainability Reporting Standards (ESRS) will be revised to:

These changes are currently under development. A revised version of the ESRS is expected by October 31, 2025, led by EFRAG (the European Financial Reporting Advisory Group).

This standard is designed to help smaller companies respond to information requests from clients, banks, or investors, without creating excessive admin or compliance costs.

Importantly, companies in the scope of CSRD or CSDDD will only be allowed to request information from SMEs that aligns with this voluntary standard, unless they can justify the need for more.

The EU has pushed back the rollout of the Corporate Sustainability Due Diligence Directive (CSDDD) to give companies and governments more time to prepare.

The deadline for Member States to turn the directive into national law is now July 26, 2027.

The first group of companies will need to start complying from July 2028.

These updated timelines were formally approved by the European Parliament on April 3, 2025, and are now awaiting final adoption by the Council of the EU.

The rules will apply in phases, starting with the largest companies:

They’ll be required to identify, prevent, and address human rights and environmental impacts across their operations and supply chains – but the rules have been softened in key areas under the proposed amendments.

If you're an SME or small mid-cap working with a large company, the updated directive aims to limit the amount of sustainability information you’re asked to provide:

Several proposed requirements have been scaled back:

To ensure a consistent approach across the EU, the directive now includes more harmonized core obligations, reducing the risk of fragmented national rules.

The Omnibus package proposes narrowing the scope of mandatory EU Taxonomy reporting. Under the proposed rules, only companies with:

would be required to report their alignment with the EU Taxonomy.

If adopted, this change would mean that many companies that were previously in scope, including smaller large enterprises, may no longer be legally required to report. However, these companies can still choose to report voluntarily.

Companies that are working toward sustainability goals but aren’t fully Taxonomy-aligned can opt to report partial alignment voluntarily.

This gives businesses the flexibility to demonstrate progress and attract sustainability-minded investors, even if they aren’t 100% aligned yet.

The Commission is also overhauling the Taxonomy Delegated Acts to make reporting more practical and focused. These changes are still at the proposal stage and subject to consultation. The proposed changes include:

As part of the Omnibus simplification package, the European Commission has proposed a new exemption for small importers. Under the draft rules, businesses that import less than 50 tonnes of CBAM-regulated goods per year would be exempt from CBAM obligations.

If adopted, this change would:

For businesses that remain in scope, the EU is also proposing a number of simplifications to make compliance more manageable. These include:

These changes build on feedback gathered during the CBAM transitional phase, which began in October 2023.

Later in 2025, the Commission plans to conduct a full review of the CBAM framework. This could lead to:

As part of the Omnibus I package, the European Commission has proposed amendments to the InvestEU Regulation to streamline administration and encourage more effective use of EU-backed financing, especially for smaller companies.

The European Commission wants to make it easier for businesses to access funding through InvestEU by cutting unnecessary paperwork and speeding up processes.

Here’s what could change:

If approved, the changes could:

| Regulation | Key Changes | Who’s Affected | Timing |

|---|---|---|---|

| CSRD |

• Scope narrowed to companies with >1,000 employees and €50M turnover or €25M assets • Reporting requirements for Wave 2 and 3 delayed by 2 years • Sector-specific standards and reasonable assurance removed • ESRS to be simplified • Voluntary SME standard introduced (VSME) |

Large companies, listed SMEs, SMEs in value chains | Wave 2 starts in 2028, Wave 3 in 2029 |

| CSDDD |

• Transposition deadline delayed by 1 year (to July 2028) • Focus on direct suppliers only, fewer obligations for indirect impacts • Due diligence review cycle extended to 5 years • Civil liability harmonization removed • Cap on SME data requests aligned with VSME standard |

Large companies (6,000+ total), indirect SME suppliers | Application starts in 2028 |

| EU Taxonomy |

• Mandatory reporting only for companies with >1,000 employees and >€450M turnover • Partial alignment reporting allowed • Simplified disclosures: 70% fewer data points, materiality thresholds, simplified DNSH • Revised GAR for banks |

In-scope companies, financial institutions | Public consultation ongoing; changes expected by end of 2025 |

| CBAM |

• New exemption for importers of <50 tonnes annually • Simplified emissions calculations and reporting • Maintain 99% emissions coverage with reduced admin load |

Importers of CBAM goods, especially SMEs | Immediate upon adoption (target: mid-2025) |

| InvestEU |

• Reduced reporting requirements for implementing partners and SMEs • Combined use of legacy funding instruments • €2.5B increase in guarantee expected to mobilise €50B in investments |

Financial intermediaries, SMEs, project developers | Pending adoption |

Specifically, the Parliament voted to:

The proposal passed without amendments, following the Council of the EU’s earlier endorsement of the Commission’s approach. The only remaining step before the ‘stop-the-clock’ provisions can enter into force is formal adoption by the Council, which is expected before the end of June 2025. Once adopted, the changes will be published in the Official Journal of the EU, giving them legal effect.

While this vote provides legal certainty around the upcoming CSRD and CSDDD deadlines, the broader Omnibus package, including changes to reporting scope, content, and thresholds, is still under negotiation.

Debate continues in both Parliament and the Council over how far simplifications should go, and whether they risk diluting the EU’s sustainability framework.

| Directive / Regulation | ✅ Finalized Changes | 🕓 Proposed (Pending Final Adoption) |

|---|---|---|

| CSRD |

• Reporting deadlines for Wave 2 and 3 companies postponed by 2 years (approved by European Parliament, April 2025; awaiting Council confirmation) • Wave 1 reporting begins in 2025 as planned |

• Scope narrowed to companies with >1,000 employees and €50M turnover or €25M assets • Revised ESRS standards to reduce complexity (expected October 2025) |

| CSDDD |

• Transposition deadline delayed to July 26, 2027 • First application pushed to July 2028 (approved by Parliament; awaiting final Council adoption) |

• Applies first to EU/non-EU companies with >5,000 employees and €1.5B turnover • Reduced supplier due diligence requirements • No harmonized civil liability |

| EU Taxonomy | • No changes formally adopted yet |

• Mandatory reporting only for companies with >1,000 employees and >€450M turnover • Voluntary partial alignment reporting • Materiality thresholds and DNSH simplifications under public consultation |

| CBAM | • No changes formally adopted yet |

• Proposed exemption for importers of <50 tonnes of CBAM goods/year • Simplified emissions reporting and authorization process • Full review planned later in 2025 |

Many companies have reported that the current system is difficult to navigate, with overlapping obligations across the CSRD, CSDDD, and EU Taxonomy.

A 2023 PwC survey found that 64% of organizations struggled with the technical complexity of CSRD implementation.

Smaller businesses in particular often lack the resources to manage detailed reporting and due diligence requirements.

By simplifying frameworks and clarifying expectations, the Omnibus aims to ease compliance without diluting core sustainability goals.

The Omnibus forms part of the EU’s Competitiveness Compass, a broader plan to make the EU more attractive for investment and innovation.

The European Commission has committed to cutting regulatory burdens by 25% for large companies and 35% for SMEs.

The Draghi Report on Competitiveness highlighted that excessive administrative demands can drive companies to scale or invest outside the EU.

Supporters believe that reducing unnecessary burdens will free up time, resources, and capital to drive Europe’s green and digital transitions.

Several EU governments, including Germany and France, have called for a pause or recalibration of sustainability rules:

In early 2025, France called for a “massive regulatory pause” to reduce burdens on businesses.

Germany voiced support for the postponement of CSRD obligations and the removal of sector-specific reporting.

The Omnibus helps answer these concerns, providing breathing room without abandoning core climate and ESG commitments.

The proposed scope changes would focus mandatory reporting and due diligence on the largest companies, where the biggest risks and impacts are concentrated.

SMEs would be protected through simplified voluntary standards, reducing trickle-down effects in value chains.

Resources can be targeted more efficiently, while companies outside the scope can still report voluntarily if they choose.

While many welcome the effort to simplify complex sustainability rules, the Omnibus Regulation has sparked strong criticism from parts of the business, investor, and policymaking communities.

Some large companies, including Unilever, Nestlé, Mars, and others, have publicly warned against reopening major sustainability rules. Their concern is that:

Investor groups and sustainability advocates fear that scaling back disclosure requirements could:

Organizations like Eurosif, IIGCC, PRI, and over 200 investors and service providers have signed joint statements urging the EU to maintain the ambition of its sustainable finance framework.

Although the European Parliament approved the ‘stop-the-clock’ proposal in April 2025, many of the broader Omnibus measures are still under negotiation. This creates uncertainty about:

At the heart of the debate is whether the Omnibus is a practical fix or a step back from the EU’s Green Deal goals. While the Commission insists the proposal is about making rules more workable, critics argue that:

This could risk weakening the EU’s leadership on sustainability, just as global momentum around climate and social governance is accelerating.

The European Parliament has approved a two-year delay for CSRD reporting for large non-listed companies (Wave 2) and listed SMEs (Wave 3). But this is not a rollback, it’s a strategic pause to simplify the framework and improve clarity.

Wave 1: Companies (listed firms with over 500 employees) are already reporting in 2025.

Wave 2: Companies will report from 2028 (for FY 2027).

Wave 3: Companies will report from 2029 (for FY 2028).

The proposed Voluntary SME Standard (VSME) will make it easier for smaller companies to respond to requests from clients, banks, or investors, but building internal capacity early will make this transition smoother.

Even if some companies fall out of scope under the Omnibus, reporting expectations in value chains remain. Large groups will continue to request ESG data from subsidiaries and suppliers to meet their own obligations.

The EU may be simplifying rules, but global expectations are still rising:

This global pressure is already translating into new mandatory requirements outside the EU. In the United States, New York State has introduced a mandatory greenhouse gas reporting program, requiring certain facilities, fuel suppliers, waste operators, and power entities to submit annual emissions data starting from 2026. While the programme is currently focused on data collection rather than emissions reduction, it mirrors the same underlying direction seen in Europe: climate reporting is becoming more formalised, standardised, and increasingly unavoidable.

Follow updates from the European Commission, Parliament, and Council on the Omnibus Regulation.

Timelines and requirements may change. Staying updated helps avoid surprises and ensures timely compliance.

Start setting up tools and processes to gather, manage, and report sustainability data.

Even with delays, robust systems take time to develop. Early preparation reduces last-minute pressure.

Check if you fall into Wave 1, 2, or 3 of CSRD — and prepare accordingly.

Understanding your timeline helps you plan realistically and prioritize resources.

Coordinate efforts across subsidiaries and engage with suppliers to ensure ESG data readiness.

Large companies will need data from their supply chains. Early alignment avoids gaps and inconsistencies.

For SMEs, review the Voluntary SME Standard and consider how to apply it in practice.

Helps respond to ESG requests without unnecessary admin burden. Builds future compliance capability.

Monitor developments from ISSB, SEC, and other international frameworks.

EU rules are part of a bigger picture. Staying aligned globally improves competitiveness and transparency.

Use the delay to trial reporting workflows, refine processes, and train teams.

You’ll be more efficient and confident when full reporting becomes mandatory — no scrambling required.

The EU’s Omnibus Regulation — and the wider sustainability rules it modifies — can still apply to US companies, particularly those operating or trading in Europe. Here’s how it could affect you:

A: It’s a legislative package proposed in February 2025 to simplify key sustainability rules, including CSRD, CSDDD, the EU Taxonomy, and CBAM.

A: On April 3rd and April 14th 2025, the European Parliament and Council adopted the “Stop-the-Clock” Directive, delaying CSRD and Taxonomy obligations by two years and CSDDD by one year (source: KPMG).

A: The Directive entered into force on April 16, 2025. Member States must transpose it into national law by December 31, 2025.

A: Key proposals under negotiation for approval include narrower scope thresholds (e.g., > 1,000 employees and €450M turnover), fewer reporting datapoints, simplified DNSH criteria, and changes to due diligence scope under CSDDD.

A: Final votes in the European Parliament are anticipated in October 2025. Negotiations between Parliament, Commission, and Council are expected to conclude with adoption in early to mid-2026.

A: While timelines have been pushed back and some simplification measures are being discussed, the overall direction of EU and global sustainability regulation remains toward broader and more rigorous ESG reporting and due diligence. Businesses should treat this delay as extra preparation time — strengthening data systems, engaging suppliers, and aligning internal processes — rather than assuming requirements will be permanently eased.

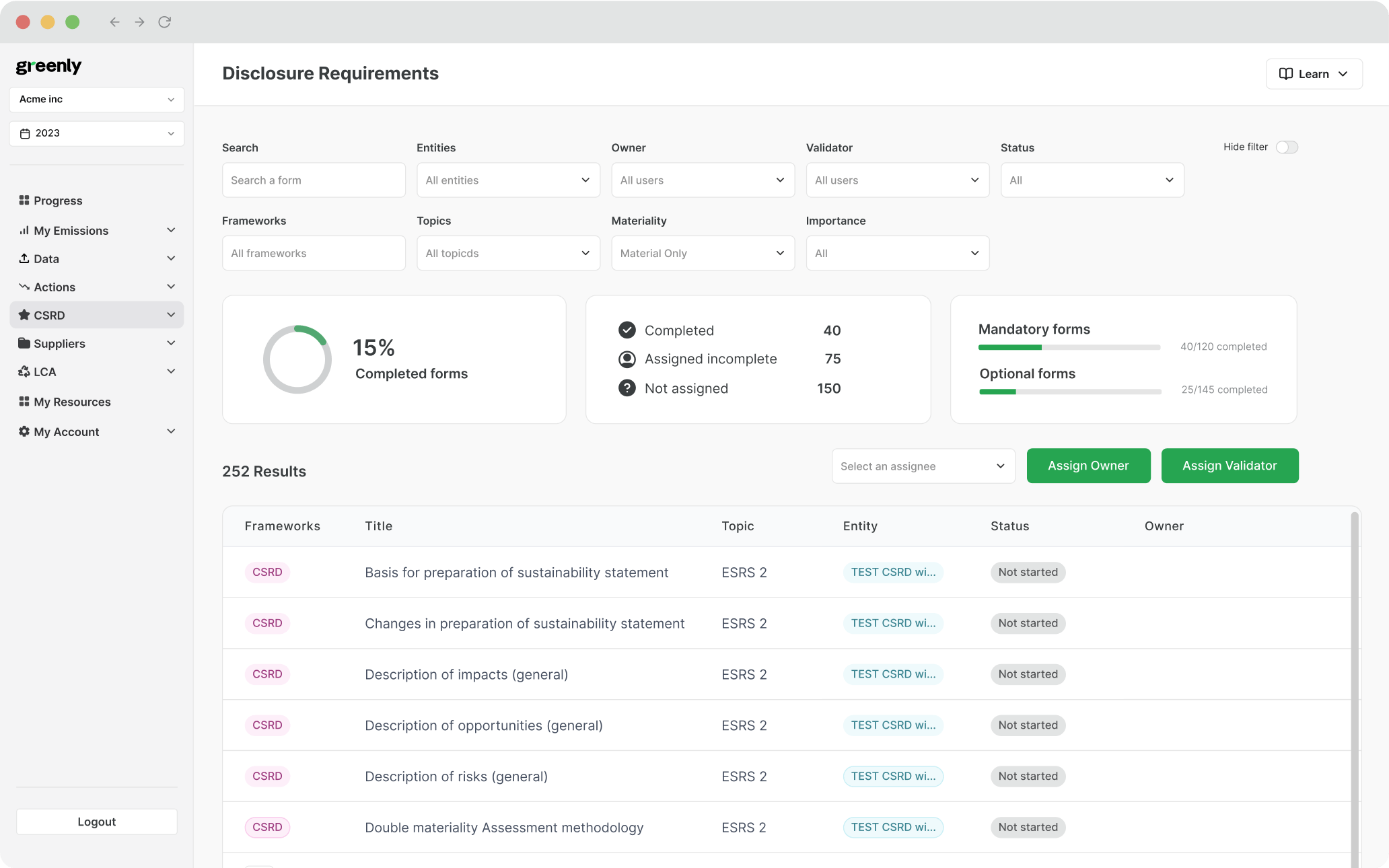

Greenly helps businesses navigate sustainability regulations like CSRD, ensuring compliance while building a stronger sustainability strategy. Regardless of how the Omnibus Regulation unfolds, companies will still need to track emissions, manage supply chain risks, and align with investor expectations, and Greenly provides the tools to do just that.

| Greenly Feature | What It Delivers |

|---|---|

|

Carbon Management & Reporting

|

Easily measure, track, and reduce Scope 1, 2, and 3 emissions while ensuring compliance with evolving sustainability regulations. |

|

Supply Chain & Due Diligence Support

|

Companies still need visibility into supplier emissions and risks. Greenly helps streamline data collection and reporting to meet due diligence requirements. |

|

Global Regulatory Alignment

|

Beyond EU rules, investors and stakeholders expect transparency. Greenly’s platform aligns with ISSB and other leading international frameworks for ESG reporting. |

|

Actionable Sustainability Insights

|

Whether reporting requirements shift or remain unchanged, Greenly helps businesses proactively reduce emissions, improve operational efficiency, and strengthen ESG performance. |

Sustainability isn’t just about compliance - it’s a competitive advantage. Get in touch with Greenly today to find out more.