Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

At the same time, investors are paying closer attention. ESG factors that were once seen as peripheral are now central to assessing long-term value and financial resilience. The pressure to identify, measure, and report on these issues has never been greater, not just to meet regulatory expectations, but to stay competitive in a fast-changing market.

The concept is rooted in Generally Accepted Accounting Principles (GAAP), which have long guided the disclosure of financially relevant information to investors. As ESG considerations become increasingly linked to financial outcomes, financial materiality now plays a central role in helping companies focus their reporting on the sustainability issues that truly matter to their long-term performance.

In recent years, financial materiality has taken on greater importance as ESG reporting becomes more mainstream. Thousands of publicly listed companies have begun measuring and disclosing ESG-related risks and opportunities, not just for compliance, but to remain competitive and resilient.

This shift has been driven by multiple forces: companies recognising the strategic value of sustainability, growing pressure from stakeholders and regulators, and a marked rise in investor interest. Asset managers and investment funds are now actively incorporating financially material ESG factors into their analysis, using them to inform risk assessments and capital allocation decisions.

Financial materiality and impact materiality are two terms that are often used in the context of ESG reporting, but they refer to very different things. While they’re sometimes confused or used interchangeably, each captures a distinct perspective on what makes an issue “material” to a business.

Here’s how they differ:

Financial materiality centres on factors directly influencing a company's financial performance. These are aspects capable of significantly swaying investors' decisions and financial metrics, such as cash flow, revenue growth, and profitability.

Real-world example: Consider a manufacturing company that drastically cuts energy consumption through sustainable practices and technologies. This leads to substantial cost savings, thereby improving profitability - a clear illustration of financial materiality.

Impact materiality, on the other hand, delves into the broader societal and environmental repercussions of a company's actions. It assesses how a company's operations affect various stakeholders, including communities, ecosystems, and society at large. Impact materiality encompasses the non-financial facets of sustainability.

Real-world example: Take a tech company actively promoting diversity and inclusion in its workforce, creating a more equitable workplace. While this initiative may not immediately impact financial statements, it generates a positive societal effect by fostering inclusivity - an example of impact materiality.

To achieve comprehensive ESG reporting, both dimensions should be considered. Neglecting impact materiality can result in an incomplete understanding of a company's sustainability performance, potentially overlooking vital societal or environmental risks.

On the other hand, dismissing financial materiality can undermine an organisation's ability to attract investors and maintain financial stability. Investors, particularly those integrating ESG criteria into their decisions, place substantial weight on financial materiality.

Recognising the value of both financial and impact materiality is increasingly seen as essential for credible ESG reporting. Rather than viewing them in isolation, many frameworks (such as the EU's CSRD framework) now encourage companies to consider them side by side, leading to the emergence of double materiality as a guiding principle.

Double materiality requires companies to evaluate the materiality of sustainability factors from both perspectives. It entails assessing how sustainability issues may affect the company financially (traditional financial materiality) and how the same issues may have broader societal or systemic implications (impact materiality).

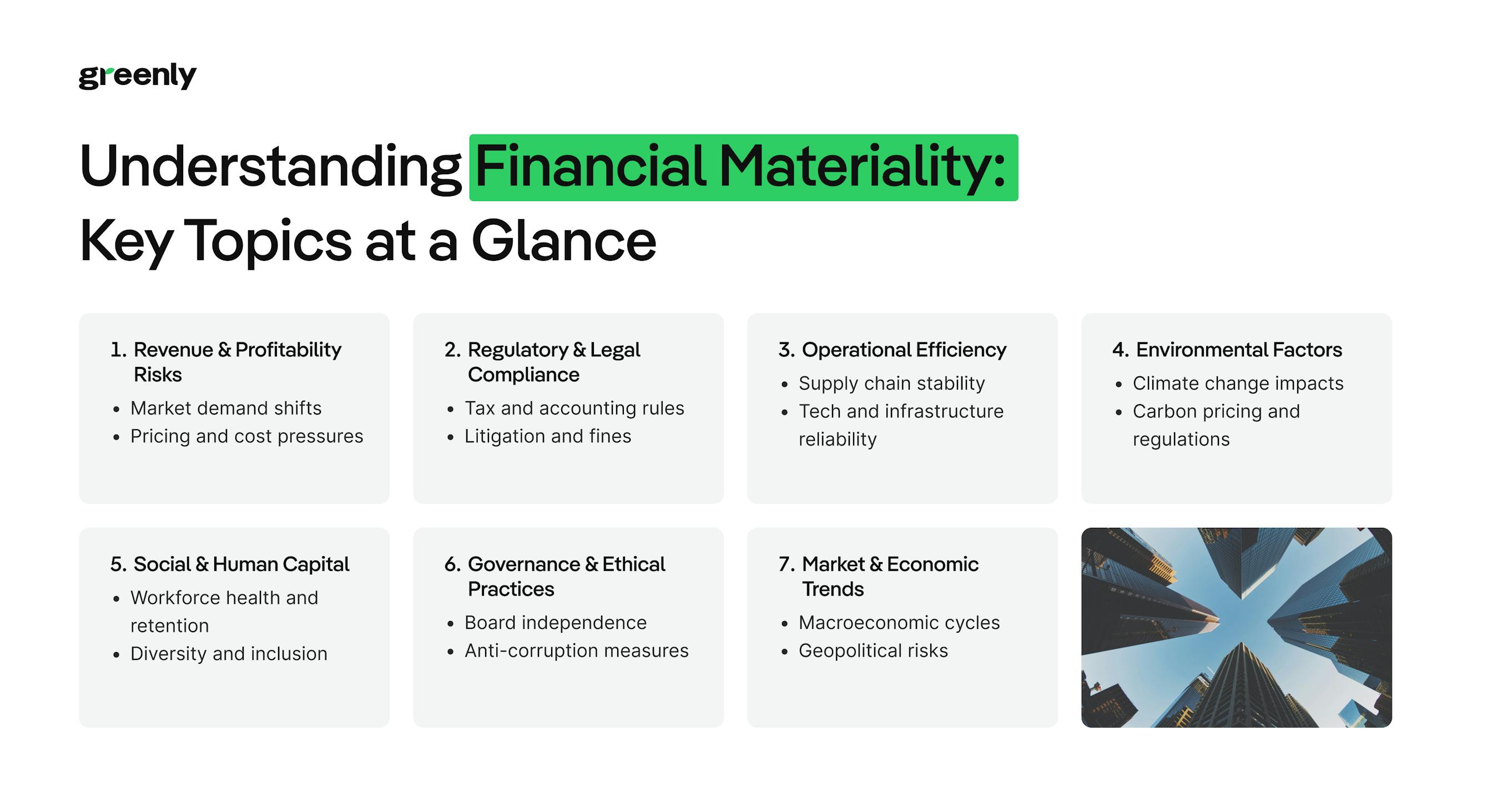

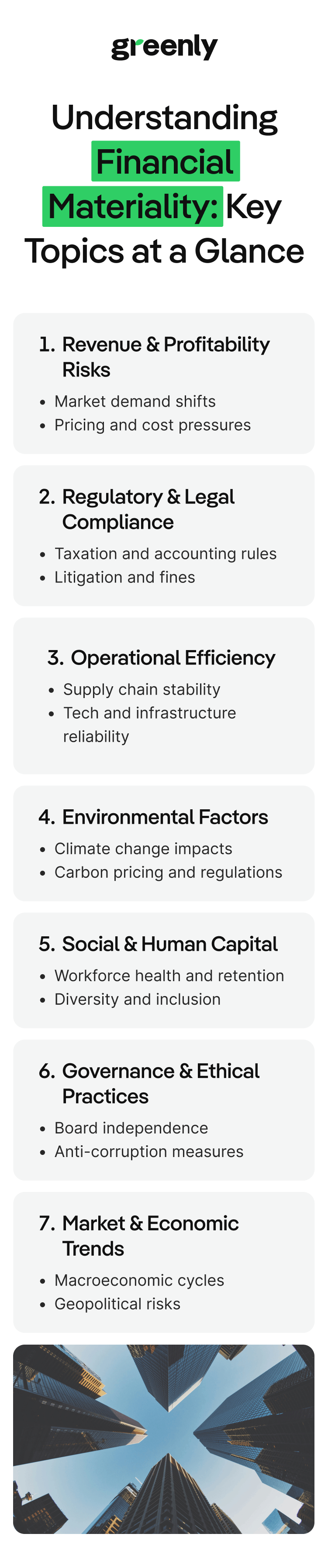

Assessing financial materiality involves evaluating specific factors that are likely to affect a company’s financial outcomes. These assessments typically draw on a combination of financial, strategic, and sector-specific considerations to determine which issues are most relevant.

Below are some of the key criteria companies use when identifying what’s financially material in the context of ESG.

Although financial materiality is often framed in the context of meeting regulatory requirements like the CSRD, its real impact stretches far beyond mere compliance. Financial materiality shapes how companies manage their operations, engage with stakeholders, and make strategic decisions, helping them uncover value, control risk, and build trust across the board.

Here are some of the key advantages of implementing financial materiality assessments:

Influencing investment decisions

Financially material factors shape how institutional investors assess risk and allocate capital. Companies that address these well are more likely to attract investment and secure growth funding.

Enhancing financial resilience

Identifying financially material risks helps companies manage cash flow and profitability. This strategic foresight builds resilience, especially in times of economic uncertainty.

Reputation & confidence

Transparent financial materiality builds trust with stakeholders and investors. Clear disclosure signals strong governance and boosts confidence in long-term performance.

Competitive advantage

Managing financially material issues drives efficiency and strategic focus. This often leads to cost savings, innovation, and stronger market positioning.

Global recognition

Companies that act on financially material ESG factors are seen as credible, forward-thinking, and investment-worthy—especially by sustainable and long-term-focused funds.

Once you’ve understood what financial materiality means and why it matters, the next step is figuring out how to apply it within your organisation. A structured assessment can help you identify which ESG issues are most likely to impact your company’s financial performance and ensure your reporting reflects the risks and opportunities that really count.

Here’s how to approach it:

Of course, financial materiality assessments don’t happen in a vacuum. Most companies are guided, or required, to carry them out in line with ESG reporting standards. Frameworks like the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS) provide structured guidance on how financial materiality should be assessed, disclosed, and used to inform broader sustainability reporting.

Additionally, these standards facilitate comparability among companies within the same sector, aiding investors and stakeholders in evaluating performance.

| Framework | Applies to | Financial Materiality Role | Recent updates (2025) |

|---|---|---|---|

|

CSRD (EU)

|

EU large companies & listed SMEs | Requires both financial and impact materiality (“double materiality”) | Omnibus delay Reporting waves 2–3 delayed to 2027–28 |

|

ESRS (EU)

|

Mandatory under CSRD | Sets detailed guidance on assessing and disclosing financially material sustainability issues | Simplification underway Updates due mid‑2025 |

|

ISSB (IFRS S1/S2)

|

Global — public & private companies | Focused solely on financial materiality for investor decision‑making | Now in force Effective from 1 Jan 2024 |

|

SASB (under ISSB)

|

Sector-specific global guidance | Helps companies identify ESG issues most likely to impact financial performance | Fully integrated into ISSB since Aug 2022 |

|

TCFD / SEC climate rule (US)

|

Climate-focused disclosures | Emphasises financially material climate risks | Referenced globally Forms basis for climate rules in UK, EU, Japan, Singapore & more |

At Greenly, we offer a full sustainability suite designed to help companies track, analyse, and reduce their environmental impact, while meeting evolving stakeholder and regulatory expectations.

Our suite of services includes:

| Our Services | What They Deliver |

|---|---|

|

Carbon accounting

|

Measure Scope 1, 2, and 3 emissions across your operations and supply chain with precision and clarity. |

|

Life Cycle Assessments (LCAs)

|

Understand the environmental impact of your products and services, from raw materials to end-of-life. |

|

Materiality assessments

|

Identify the ESG issues that matter most to your business and stakeholders, using frameworks aligned with leading standards — including double materiality assessments. |

|

Sustainability reporting

|

Build investor- and regulator-ready reports aligned with CSRD, ESRS, ISSB, and other major ESG frameworks. |

|

Decarbonisation strategy

|

Get a tailored action plan to reduce emissions, meet science-based targets, and future-proof your operations. |

Whether you're just getting started or looking to strengthen your sustainability strategy, Greenly's platform and expert support can help you take the next step with confidence. Get in touch today to find out more.