Turn ESG Compliance

Into a Competitive EdgeTurn ESG

Compliance

Into a Competitive Edge

Greenly unifies carbon accounting and ESG reporting so you can

align with frameworks, reduce risk, and accelerate impact.

3,500+ happy clients

3,500+ happy clients

Trusted by over 3,500 Ambitious Climate Leaders worldwide.

Minimize effort while meeting stakeholder

expectations for over 15 frameworks

Save time, simplify reporting and stay ahead of sustainability regulations with Greenly’s

scalable platform & supportive expert consultants

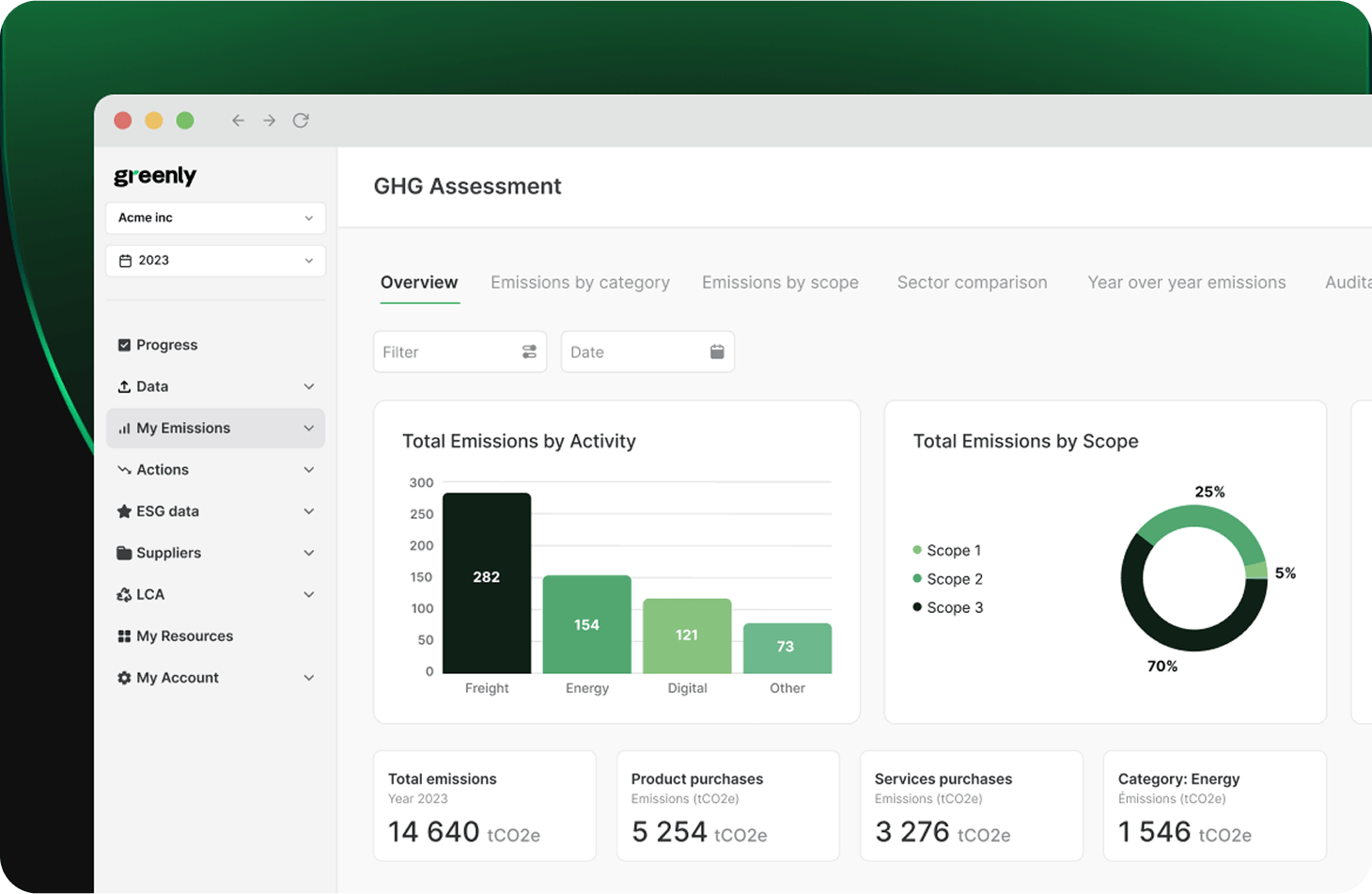

Transform GHG Expertise into ESG

Compliance

- Automate data collection across all functions and suppliers using built-in APIs.

- Generate accurate emissions reporting for Scopes 1, 2, and 3.

- Set SBTi-aligned targets and build a data-driven Net Zero roadmap.

- Cleanse, map and categorize raw data automatically using AI.

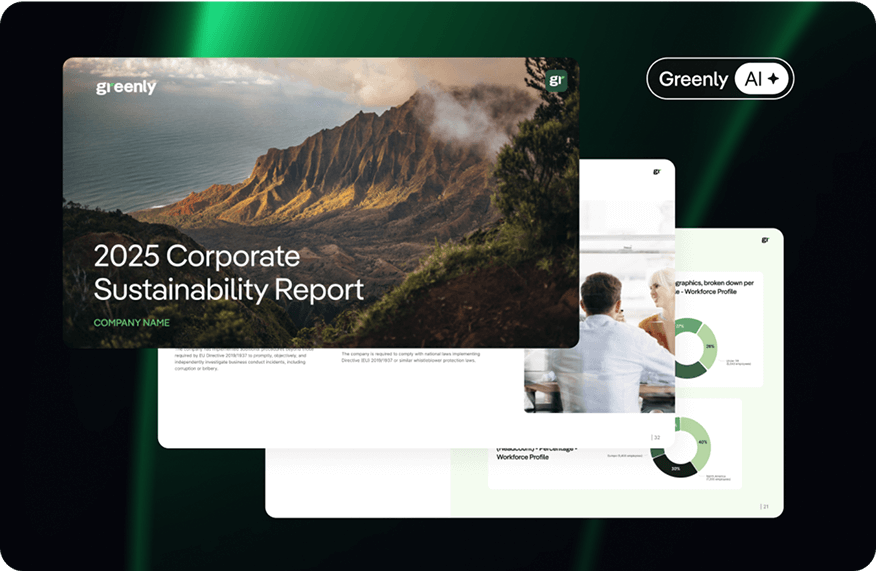

Automate Your Sustainability Report

- Collaborate with your team using intuitive templates and shared task management tools.

- Pre-fill and reformat narrative sections using AI and internal data files.

- Verify data accuracy through a hybrid of AI-powered checks and expert human audits.

- Generate an audit-ready ESG report with a single click.

Monitor Your ESG KPIs

- Prioritize material topics using automated double materiality and real-time KPI tracking.

- Navigate standards and benchmark against 600+ reports using AI guidance.

- Forecast climate risks and transform them into strategic financial opportunities with EcoPilot.

- Establish a single source of truth for your organization’s environmental impact data.

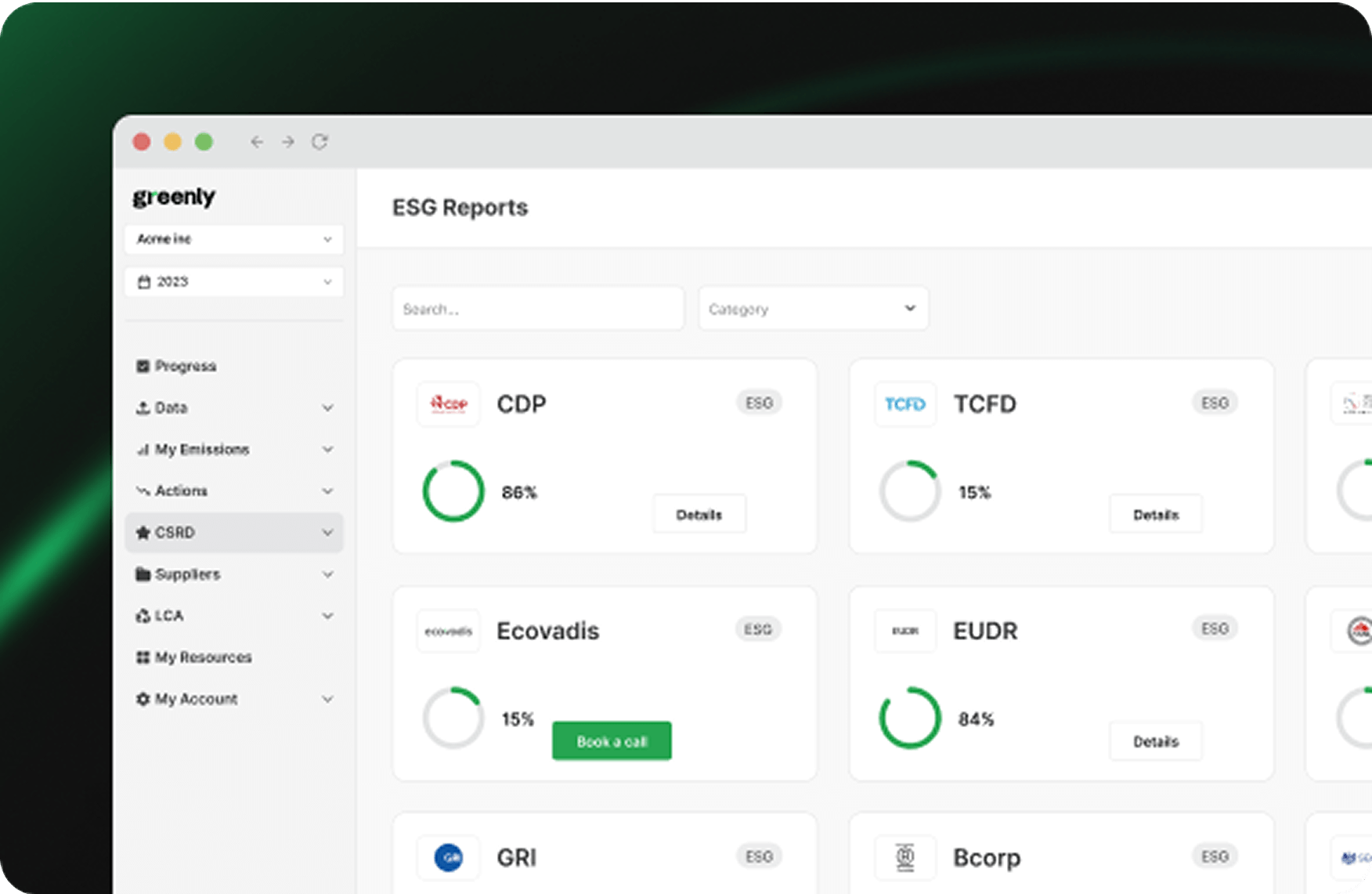

Export to All Major ESG Frameworks

- Stay ahead of regulations with automated tracking and updates from our experts.

- Apply answers once across different frameworks to ensure total data consistency.

- Leverage a centralized answer library for up-to-date proof and internal verification.

- Export data into 15+ audit-ready formats like CDP, EcoVadis, and SBTi.

Talk to an expert

Check your compliance in one click

New laws. New risks. Use our Legislation Checker to find out if your

business complies with the latest regulations!

ESG Compliance:

Which Framework?

GHG Protocol

Climate-related risks, financial focus, complementary.

Who should use this framework?

Companies of all sizes across industries aiming to measure and manage greenhouse gas emissions.

Key advantages

Enables consistent and credible GHG accounting, improves risk management, strengthens investor trust, and serves as a foundation for other sustainability frameworks.

Learn more

SBTI

Aligns corporate emissions reduction targets with climate science.

Who should use this framework?

Companies of all sizes and sectors committed to setting science-based emissions reduction targets.

Key advantages

Enhances reputation with customers, investors, and regulators; provides a clear roadmap for emissions reduction; strengthens climate risk resilience; and improves long-term competitiveness through proactive environmental leadership.

Learn more

CDP

Disclosure system for environmental impacts

Who should use this framework?

Companies, cities, and governments disclosing environmental data for transparency.

Key advantages

Enhances transparency, identifies environmental risks, supports investor relations, and improves environmental performance and supply chain visibility.

Learn more

Ecovadis

Sustainability ratings platform for supply chain transparency.

Who should use this framework?

Companies evaluating or improving sustainability performance in their value chain.

Key advantages

Enables supplier benchmarking, strengthens B2B relationships, enhances procurement decisions, and improves ESG performance visibility.

Learn more

VSME

Simplified ESG reporting for small and medium enterprises.

Who should use this framework?

Small and medium enterprises looking to report on sustainability without heavy resource burden.

Key advantages

Cost-effective way to build ESG credibility, win responsible customers, access green financing, and prepare for future regulations.

Learn more

CSRD

EU directive mandating detailed sustainability reporting

Who should use this framework?

Large EU and non-EU companies operating in the EU.

Key advantages

Ensures regulatory compliance, facilitates access to capital, increases stakeholder confidence, and provides a competitive edge in ESG transparency.

Learn more

SFDR

EU regulation for financial market participants on sustainability risks.

Who should use this framework?

Asset managers, financial advisors, and other financial market participants in the EU.

Key advantages

Builds investor trust, ensures regulatory compliance, mitigates reputational risks, and supports sustainable investment decision-making.

Learn more

TCFD / IFRS

Climate-related financial disclosures aligned with global standards.

Who should use this framework?

Public and private companies, particularly in financial sectors, disclosing climate-related risks.

Key advantages

Improves financial risk transparency, enhances strategic planning, increases investor confidence, and supports long-term resilience.

ISSB

Global baseline for sustainability-related financial disclosures.

Who should use this framework?

Public and private companies worldwide aiming to disclose financially material sustainability information to investors.

Key advantages

Provides globally consistent, investor-focused sustainability reporting; improves access to capital; enhances corporate transparency and accountability; and supports integration of sustainability into financial decision-making.

Learn more

SASB

Industry-specific ESG standards for financial materiality.

Who should use this framework?

Companies and investors needing sector-specific sustainability data.

Key advantages

Provides clarity on ESG issues most relevant to investors, improves capital allocation decisions, and enhances performance benchmarking

Learn more

B Corp

Focuses on strong ESG standards and positive social impact

Who should use this framework?

Certification for businesses balancing profit and purpose.

Key advantages

Boosts brand reputation and loyalty, attracts purpose-driven talent, opens doors to ethical investment, and provides a competitive edge in responsible markets.

Learn more

CSDDD

EU directive mandating due diligence on human rights and environmental impacts.

Who should use this framework?

Large EU and non-EU companies with significant operations in the EU.

Key advantages

Reduces legal and reputational risk, strengthens supply chain governance, increases stakeholder confidence, and promotes sustainable business growth.

Learn more

California SB 261

Requires U.S. companies to publicly disclose their climate-related financial risks.

Who should use this framework?

U.S. companies with annual revenues over $500 million that do business in California.

Key advantages

Ensures transparency for investors and the public; helps companies assess and prepare for physical and transition climate risks; holds corporations accountable for their financial exposure to climate change.

Learn more

California SB 253

Mandates annual public disclosure of greenhouse gas (GHG) emissions.

Who should use this framework?

U.S. companies with annual revenues over $1 billion that do business in California.

Key advantages

Enhances corporate transparency and accountability; provides a comprehensive inventory of emissions (including Scope 1, 2, and 3) to inform climate action; aligns with global reporting standards like the Greenhouse Gas Protocol (GHGP).

Learn more

Frequently Asked Questions

Have more questions? Check out our complete FAQs in the Knowledge Base to get the answer you’re looking for.

ESG reporting refers to the disclosure of a company's environmental, social, and governance performance. It’s increasingly required by investors, regulators (like the EU’s CSRD), and customers. Effective ESG reporting improves transparency, builds trust, and helps businesses manage long-term risks and opportunities.

Yes. Greenly supports reporting across Scopes 1, 2, and 3, including categories in Scope 3 such as purchased goods, business travel, commuting, and use of sold products. Our hybrid approach combines financial data, supplier input, and industry models for reliable estimates.

Double materiality means assessing both how sustainability issues impact your company (financial materiality) and how your company impacts people and the planet (impact materiality). It’s a core requirement of CSRD, and Greenly provides a structured, guided workflow to complete it.

Absolutely. Greenly generates traceable, verifiable ESG documentation with built-in audit logs and compliance alignment. This makes it easier for your reports to stand up to external assurance and regulatory review.

Greenly supports multiple ESG and climate frameworks, including CSRD, SFDR, ISSB, TCFD, CDP, and more. You can generate export-ready reports tailored to your specific disclosure obligations.

Unlike manual ESG consulting, Greenly combines technology + expert guidance in one platform. We streamline the entire ESG journey — from data collection to reporting — and integrate climate intelligence for a more complete sustainability strategy.