ESG Platform

CBAM Compliance

Made Easy

Report in minutes with a purpose-built, centralized

platform for you and your suppliers. Simplify compliance

and manag supply chain costs effortlessly.

Trusted by over 3,500 Ambitious Climate Leaders worldwide.

CBAM Simplified: From Complexity to Clarity

Automate, collaborate, and master every step.

Automate compliant quarterly reporting

Fast, compliant submissions ready for instant upload to the EU Portal.

Streamline supplier's data retrieval

Supplier data collection with tailored CBAM questionnaires and automated follow-ups.

Adapt to evolving products & suppliers

Automatically track, identify, and request data for new products and suppliers

All Supplier Data on a Single Platform

Dedicated spaces for your suppliers to upload data. Customized dashboards to see supplier progress in a snapshot.

Get Ready—CBAM is Fast Approaching

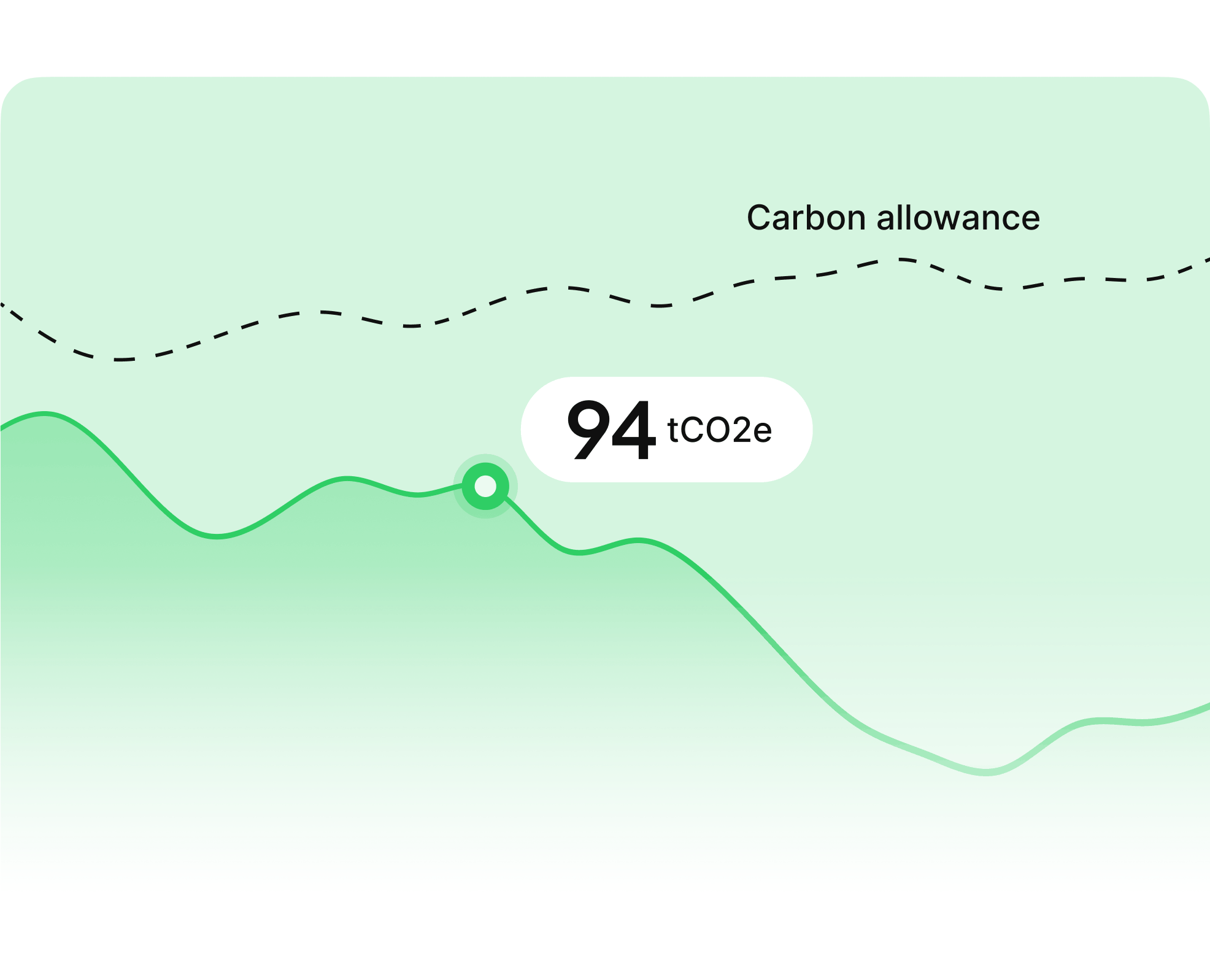

By 2026, EU importers of CBAM goods will start purchasing CO2 allowances

Why CBAM Matters. For Your Business. For the Planet.

Fine exposure

Starting in 2026, any EU declarant failing to comply with the CBAM regulations will incur a penalty ranging from €10 to €50 per ton of unreported emissions.

Financial risk

Due to the phase-in of CBAM and the projected doubling of carbon allowance prices over the next decade, effectively managing your suppliers' emissions will become increasingly crucial.

Reputation

Decarbonizing proactively provides a competitive edge. Purchasing offset allowances in advance helps reduce costs and demonstrates commitment to sustainability.

Quickly check your company’s

requirements regarding CBAM

CBAM. Compliance, reimagined.

Automate reporting, streamline supplier collaboration, and align your sustainability goals—all in one powerful solution.

Cut Costs, Reduce Risk

Gain actionable insights to lower emissions, manage rising carbon allowance costs, and protect your bottom line.

Avoid the Learning Curve

Our easy-to-use platform makes CBAM compliance easy, designed for first-timers and experts alike—no expertise needed!

Engage Suppliers Effortlessly

Simplify supplier collaboration with tools to collect real carbon data, no spreadsheets needed.

Save Time, Minimize Errors

Automate emissions data collection and reporting, cutting manual work and ensuring accuracy for CBAM compliance.

Discover Greener, Cost-Effective Suppliers

Access a robust database of 100k+ suppliers to optimize your supply chain for sustainability and savings.

A tool adapted to the evolution of your purchases

Data requests are sent automatically when you have new suppliers or purchase new products

Integrated solution for EU importers and international exporters

Most supply chain tools ask for supplier data but miss gaps. Greenly calculates carbon emissions, letting all suppliers provide accurate data to enrich a top carbon database.

CBAM Compliance: A Costly Challenge

The EU’s CBAM adds tariffs on carbon-heavy imports, pressuring businesses financially. With rising allowance costs, EU declarants must cut suppliers’ emissions or face higher expenses.

CBAM Preparation

- Identifying which products need CBAM compliance is unclear and can take time.

- Purchasing and financial teams are not aware of CBAM legislations.

- Regulation evolves frequently

Supplier data retrieval and tracking

- Large amount of data from many suppliers is overwhelming

- Suppliers may fail to submit reports, creating gaps

- Manual work induces errors risks

Quarterly reporting

- Quarterly reporting demands significant time & effort to compile

- The process is susceptible to mistakes, impacting report accuracy

- Reports are often delayed or contains inaccuracy

- Manual process for each new product / supplier

CBAM Preparation

- Identifying which products need CBAM compliance is unclear and can take time.

Supplier data retrieval and tracking

- Expensive because time-consuming without preventing manual errors risks

Quarterly reporting

- Expensive because time-consuming without preventing manual errors risks

CBAM Preparation

- Designed to simplify the complex tasks associated with CBAM compliance.

Supplier data retrieval and tracking

- Automated data retrieval

- Automated supplier tracking

- Automated quality control

Quarterly reporting

- Automated quarterly XML reports for direct upload EU Portal for Declarants

ETS comes into force

- Annual caps are set

- Carbon trading system is created in the EU

CBAM Transition Begins

- Products : Steel, Aluminum, Electricity, Fertilizer, Chemicals and Cement

- Generic and declarative values

30 April 2025

- Deadline for Q1 2025 report

- Default values cannot be used anymore

CBAM Fully Implemented

- Payment starts, free allowances disappear progressively

- Importers have to engage their suppliers

- More sectors will be added to cover all emissions from EU imports.

Full implementation

- Products : All EU ETS Final goods

- Phasing-out of free allocation under the EU ETS will take place in parallel with the phasing-in of CBAM

Still have questions about CBAM?

Have more questions? Check out our complete FAQs in the Knowledge Base to get the answer you’re looking for.

CBAM stands for Carbon Border Adjustment Mechanism. It applies a carbon price on imports into the EU to prevent carbon leakage and ensure imported goods follow EU climate standards.

US exporters sending goods like cement or fertilizer to the EU must provide emissions data. EU importers will buy CBAM certificates based on those emissions to match EU carbon pricing.

Importers must report embedded CO2 emissions of certain goods and purchase CBAM certificates. These reflect the weekly EU carbon price, creating a level playing field with EU producers.

CBAM started its transitional phase in October 2023, requiring emissions reporting. From 2026, importers must also buy certificates based on the carbon content of covered imports.

CBAM certification is third-party verified emissions data for imported goods. It proves how much CO2 was emitted during production and ensures compliance with EU CBAM rules.

CBAM is not a direct tax but works like one. Importers must buy certificates for the CO2 emissions in their goods, similar to how EU producers pay under the Emissions Trading System (ETS).

CBAM affects sectors with high CO₂ emissions: steel, aluminium, cement, fertilizers, hydrogen, and electricity. These imports now face the same carbon pricing as EU-made goods.

Importing carbon-intensive goods will cost more under CBAM. Certificate prices will rise until 2034, so reducing emissions in your supply chain is key to avoiding higher expenses.

Greenly cuts CBAM costs by automating emissions reporting, helping suppliers reduce CO2, and finding low-carbon options. This lowers your supply chain’s carbon footprint, and your CBAM exposure. You can properly forecast your carbon allowances & gain savings!

You’ll face rising CBAM costs on high-emission imports. By 2034, prices may reach €400/ton. Without emission cuts, you'll buy more certificates, raising your financial burden.