ESG / CSR

Industries

Carbon Tax: What is it and How Does it Work?

In the midst of a post-pandemic world, production is booming in every sense of the word – people are socializing, traveling more, and many businesses are ready to take advantage of the fact that people have pent-up energy from saving their money these past couple of years.

According to climate policy experts and the OECD, implementing effective carbon tax proposals is one of the most economically efficient ways to reduce greenhouse gas emissions across multiple sectors of the economy.

However, with all of that demand comes a need for supply – something that also results in excessive emissions that the world needs to start avoiding if it’s to successfully combat climate change.

How can carbon tax be implemented to successfully incentivize people and businesses to reduce their energy consumption and overall emissions?

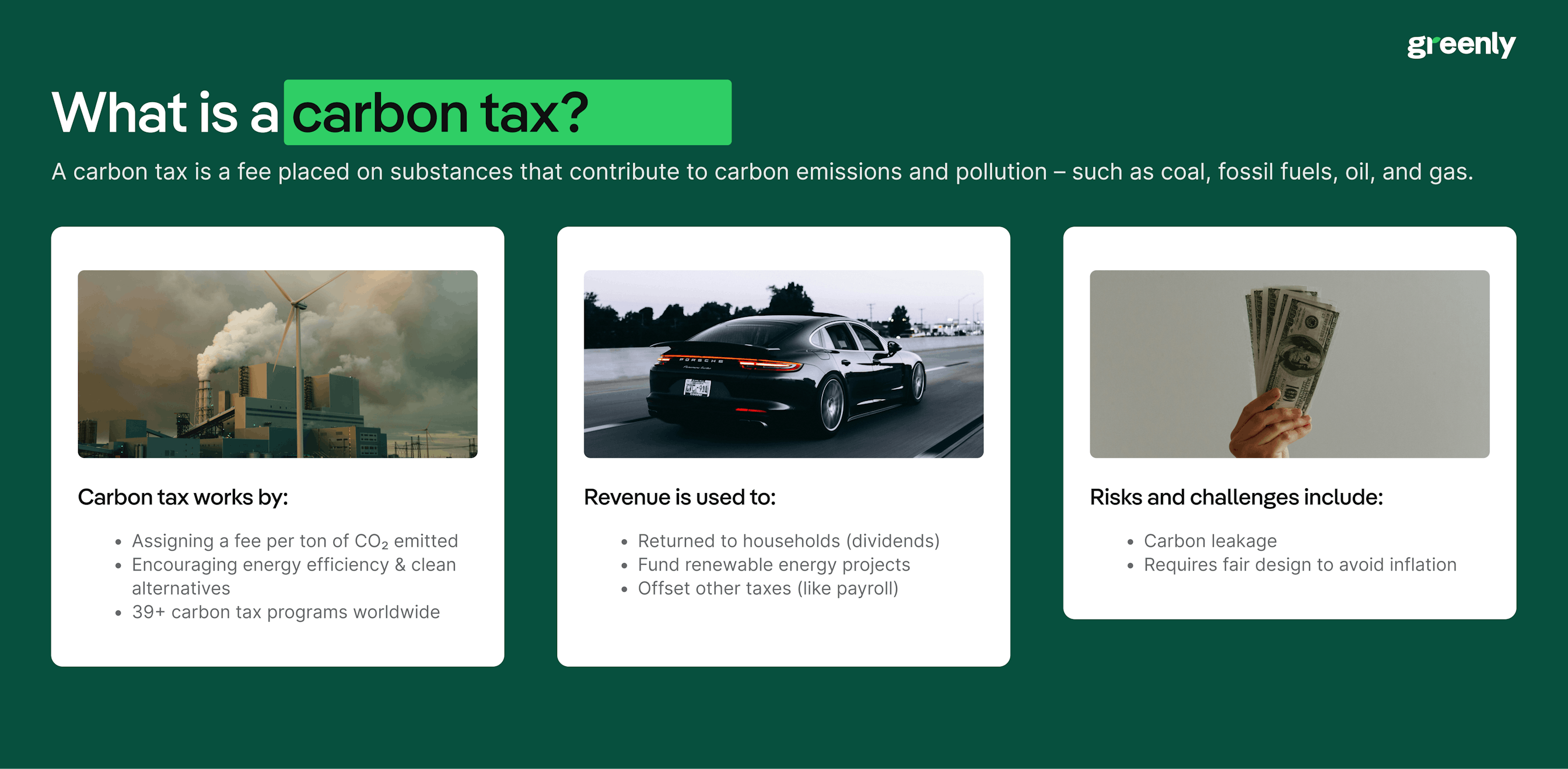

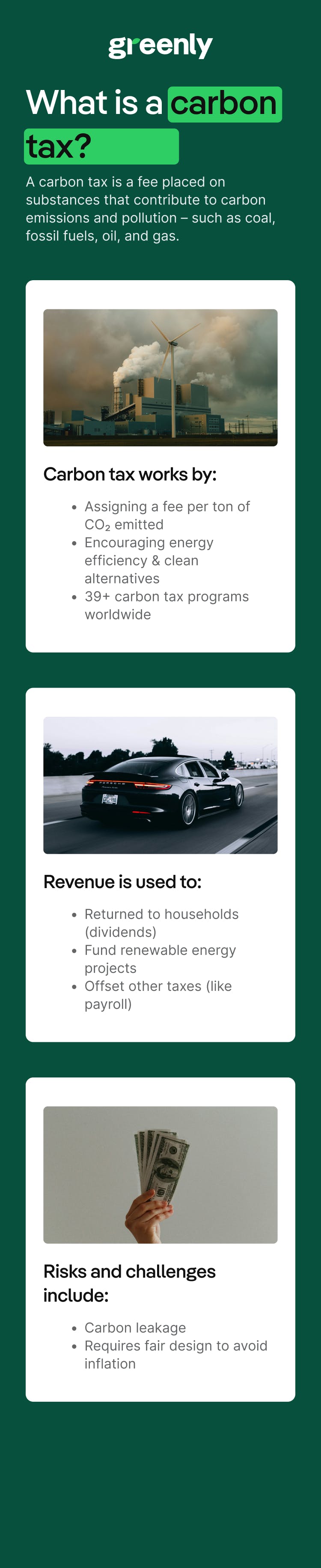

What is Carbon Tax?

A carbon tax is a fee placed on substances that contribute to carbon emissions and pollution – such as coal, fossil fuels, oil, and gas. The main goal of carbon tax is to incentivize businesses to reduce their use of harmful substances and prevent further global warming.

As a whole, carbon tax is a form of carbon pricing that places a fee on the production, distribution, or use of fossil fuels based on how much carbon their combustion emits – which is meant to encourage companies to avoid excessive carbon dioxide emissions and employ emission reductions strategies.

Think of carbon tax as similar to a driving ticket. What is going to stop someone from turning right at a stop sign or running a red light? If no police are present, these dangerous driving tactics will continue – that’s why so many streets are now dedicated to placing hidden cameras to catch drivers in the act and issue hefty fines for speeding or other misconduct on the road. Eventually, most drivers will become more cautious when driving as they don’t want to pay an expensive driving ticket.

Carbon tax works in the exact same way, as it tries to encourage companies to mitigate the use of these substances from the start. In fact, research published by the World Journal of Advanced Research and Reviews stated that carbon tax implemented in Canada led to a 12% decrease in fossil fuel consumption in British Columbia – a province known for its carbon intensive, film-making business in Vancouver. This demonstrates how federal carbon tax proposals could have a positive impact on mitigating carbon pollution.

What is the Difference Between Carbon Pricing and Carbon Taxes?

The main difference between carbon pricing and carbon taxes is that a carbon price, often mistaken as a synonym for carbon tax, is a charge placed on greenhouse gas pollution from burning fossil fuels.

Carbon pricing can be employed by placing a surcharge on sources of carbon, such as with business activities that may contribute to air pollution or heat trapping greenhouse gases. However, it is important to remember that carbon taxes are a form of carbon pricing – and that both seek to mitigate future and existing emissions.

The battle cards below will further depict how carbon tax differs from carbon pricing:

How Does Carbon Tax Work?

Carbon tax is imposed on companies or households that use large amounts of substances, such as fossil fuels, that create excessive carbon emissions. The value of a carbon tax is usually calculated by determining if the carbon tax should be placed upstream or downstream in the supply chain of the entity in question to be taxed.

Difference Between Upstream & Downstream in Carbon Emissions Taxation

In a supply chain, “upstream” refers to all activities that engage the company’s suppliers – such as their tier 1, tier 2, or tier 3 suppliers. On the other hand, “downstream” refers to the actions and activities of the product after the raw materials have been provided, up until the product is distributed into the hands of the customer.

"Upstream" is often referred to as supply, whereas "downstream" is often referred to as demand. Most economists advocate for upstream carbon taxation as it generally covers more emissions with lower administrative costs.

Benefits of Upstream & Federal Carbon Tax Proposals

In fact, Niskanen Center discovered that upstream carbon tax would be the most effective and uniform carbon tax to implemented in the United States to reduce the emissions created by natural gas and other finite resources. Gilbert Metcalf and David Weisbach, who published a study titled The Design of Carbon Tax, concluded that carbon pricing schemes in the U.S. could account for a whopping 80 percent of the country’s emissions by putting a price on carbon for less than 3,000 companies.

These studies demonstrates how carbon tax puts various nations in a better environmental position as it can help to utilize low carbon technologies, boost economic growth, and reduce global temperatures.

Therefore, this fee is imposed in order to give both consumers and producers a financial incentive to reduce their own carbon footprints, become more sustainable, and protect the environment.

Various Methods to Implement Carbon Taxation

Carbon tax revenue can be implemented in various ways, including dividend payments to households, funding clean energy investments, or reducing other taxes — each approach having different economic and distributional impacts.

The flip cards below will explain some of the way these carbon pricing mechanisms could help to reduce the use of carbon intensive fuels:

However, carbon tax cannot mitigate all emissions by itself, as some carbon that is already integrated into products like plastic water bottles aren’t subject to carbon tax.

The production and consumption of plastic creates excessive greenhouse gasses and carbon emissions, but even the most widely used culprits of these emissions won’t be subject to carbon tax. In addition to this, carbon dioxide that is emitted into the atmosphere but later captured and sequestered by a carbon capture and storage system will not be subject to carbon tax.

According to the World Resources Institute, comprehensive carbon pricing strategies could help the United States to decarbonize by 2050 and allow the nation to effectively contribute to climate change mitigation.

If all detrimental items or substances are not subject to carbon tax, then why is it important?

Why is Carbon Tax Important?

Carbon tax is important for the same reasons as introduced with the driving ticket example explained above. If there are no driving tickets, how will people stop driving recklessly? The same goes for households and businesses that emit too much carbon dioxide or greenhouse gasses – money serves as the ultimate motivation to get people to do the things they want to do the least.

Remember, a well-designed carbon tax system will price emissions in line with the carbon content of fuels. In the same way that wealthier people might be taxed more, the higher-polluting energy sources face proportionally higher costs. According to the International Monetary Fund, this approach creates the most economically fair and effective incentives to reduce emissions.

However, the problem with carbon tax is that many governments and policymakers are hesitant to go through the grueling process of establishing carbon taxes in their vicinity – out of fear of creating unsuitable financial circumstances for low-income households. In order to address these concerns regarding equity, several economists have proposed the need for carbon dividend programs, which is where carbon tax revenue is returned directly to households as equal per-capita payments.

Ultimately, carbon tax is meant to encourage households and businesses to make the switch to low-carbon sources to power their activities, such as through the use of energy efficient appliances or renewable energy. The problem is, many will find these sustainable alternatives more expensive than a carbon tax itself – and will ultimately resort to the continued, excessive use of the very substances carbon tax is trying to mitigate people from using.

This might raise the question if carbon tax is effective, and how frequently it is used around the world.

Is the Use of Carbon Tax Well Established?

Several countries around the world make use of carbon tax, or something similar to carbon taxes in order to deter companies and households from contributing to carbon leakage, excessive energy production, and overall climate change.

What is a Cap and Trade System?

While carbon taxes directly set a price on emissions, some opt for cap and trade systems – which establish emissions limits and allow companies to trade permits. The Environmental Defense Fund has stated that while both approaches can prove effective, they differ in terms of how difficult each mechanisms may be to implement and carbon pricing policies.

Carbon Taxes Around the World

As of 2025, there are 39 different carbon tax programs around the world – such as in British Columbia, South Africa, and Boulder, Colorado in the United States. Overtime, the interest in developing a nation-wide carbon tax across the U.S. has been increasing. Therefore, while carbon tax is still not as effective as it could be – the premise has been successful in achieving support in the future of carbon tax.

The drop down sections below will break down how carbon tax programs work in Canada, South Africa, and Colorado in the United States:

🍁 Canada (British Columbia)

British Columbia has one of the most well-known carbon tax programs. Implemented in 2008, it covers most fossil fuels and returns revenue to households and businesses through tax cuts and credits. It has been praised for reducing emissions without harming the economy.

🌍 South Africa

South Africa introduced a national carbon tax in 2019, targeting sectors such as electricity, manufacturing, and transport. The system includes allowances and exemptions to help industries adjust gradually, and revenue supports renewable energy and energy-efficiency initiatives.

🇺🇸 Boulder, Colorado

Boulder became the first U.S. city to implement a carbon tax in 2007. It applies to electricity consumption and helps fund the city’s Climate Action Plan. Though small in scale, it's a notable example of local government leadership on climate policy.

For instance, Congress has already proposed several different carbon tax principles. Although these principles have been proposed without further development or implementation of new carbon taxes, there continues to be a growing number of supporters interested in implementing carbon tax as an effort to mitigate climate change – even if it remains a political debate on how to fairly impose a carbon tax.

Prior to pricing carbon or implementing carbon tax, the Senate Committee on Finance must review the benefits and drawbacks of imposing carbon tax as a means to pay for other political responsibilities – such as the creation of a reconciliation package. There are several ways that the Senate Committee on Finance could implement this, one being to create a carbon tax contingent to be calculated per-ton of emissions created from the substance, such as fossil fuels, over time.

The use of carbon tax is established, but policymakers are still working on making it more prominent and a new-norm.

However, the road to full implementation could be a lengthy process – as policymakers need to consider numerous factors as they venture into the journey of imposing carbon taxes.

What Do Policymakers Who Create Carbon Taxes Need to Consider?

The process of developing carbon tax is multifaceted and often contingent on locale, but what are some of the general areas that all policy makers involved in the creation of carbon tax need to pay attention to?

Substances Involved

Carbon tax implementation requires precise measurement of greenhouse gas intensity across different fuel types.

According to the Center for Climate and Energy Solutions, different sources of carbon will result in various carbon taxes, such as how:

- Coal equates to around 206 lbs/MMBtu

- Oil equates to around 161 lbs/MMBtu

- Natural gas equates to around 117 lbs/MMBtu

Carbon tax can not be properly implemented without full knowledge of the substances that will fall under the scope of the carbon tax. For example, carbon tax can be implemented differently depending on the amount of carbon dioxide or greenhouse gas emissions created by an amount of fossil fuels. Policymakers should become familiar with the different substances involved in carbon tax.

Develop a Reason for Imposing the Carbon Tax

While carbon tax can be imposed anywhere in the supply chain, policy makers should strive to define the reasoning for the tax – whether it be downstream, upstream, or midstream.

It is easier for policymakers to place a carbon tax on activities that take place in the “upstream” component of the supply chain, but it can also be done in the middle of the supply chain process – sometimes referred to as, “midstream” and also in the “downstream” phase.

For example, policy makers could place a carbon tax on industries or households that use excessive amounts of energy, or the gasoline used to power an automobile.

Determine Viable Carbon Tax Rates

Policymakers must strive to follow the guidelines provided by common economic theories and set the carbon taxes accordingly. In general, economic theory claims that a carbon tax should be equivalent to the price of social carbon by creating an estimated value of how much damage the carbon dioxide to be emitted into the atmosphere will cause in the future.

Therefore, as climate change continues to worsen, these carbon tax rates should continuously increase – serving as a sign to those subject to the carbon tax that they should alter their business models to mitigate the use of ozone depleting substances immediately for the sake of the planet and their financial revenue.

The Impact of Imposing Carbon Tax

Policymakers have to be mindful of the financial impact that imposing a carbon tax can have on low-income households. While it can help to serve as motivation for companies and families to reduce their energy consumption, as carbon tax will create more of a financial burden on low-income households than it will on the middle or upper class households. Therefore, it is imperative that policymakers impose the carbon tax in accordance with the income of each household or enterprise.

Prevent Competition

Imposing a carbon tax could create unwanted competition between various enterprises that use intensive amounts of domestic energy. Demand from these different entities could increase, and in turn create a volatile rise in emissions from various countries or companies trying to compete with one another. In this sense, carbon tax could completely backfire if it isn’t imposed with this potential consequence in mind.

The content below will illustrate how carbon tax could backfire:

🧾 Carbon Leakage Risk

If local firms face higher taxes than foreign competitors, they may relocate operations to less regulated countries—causing global emissions to rise instead of fall.

📉 Demand Elasticity

Without viable low-carbon alternatives, people may continue using carbon-intensive fuels despite higher prices, weakening the tax's impact.

📊 Inflation & Rebound Effects

Carbon taxes may increase consumer prices. If the policy doesn't include offsets or relief, it can spark inflation or reduce public support.

Revenue

The income generated from carbon taxes is bound to be substantial and raise significant revenue, and policymakers must decide how that revenue will be used. It is likely that some of it could be returned to the initial consumers in an annual large sum, but it could also be invested into other areas that will help fight against climate change – such as towards research for developing new technologies, funding a climate leadership council, or in support of sustainable infrastructure.

Clearly, there is a lot that policymakers need to consider when implementing carbon tax. If companies strayed away from the need to make use of fossil fuels and other business activities that stimulate the need for carbon taxes in the first place – would the process of imposing carbon tax become easier, or entirely unnecessary?

How Can Companies Avoid Carbon Tax?

The predominant goal of carbon tax to begin with is to deter companies from using substances or suppliers that increase overall global emissions.

Carbon Tax Revenue in the U.S.

According to an analysis conducted by the Congressional Budget Office, an emissions tax of $25 per metric ton, which would be increased annually – could generate $100 billion USD in a single year. This would allot for $1 trillion in government revenue in a decade, while simultaneously reducing greenhouse gas emissions and incentivizing cleaner business practices across the U.S. economy. In turn, this could inspire the global economy to also implement a cap and trade program, reconsider energy costs, and employ greater energy efficiency.

Businesses: Complying with Carbon Taxes

If more businesses and households were to operate in conjunction with the measures necessary to mitigate carbon emissions, then the need for carbon tax wouldn’t be as pivotal as it is now.

Remember, the U.S. Department of Energy highlights that optimizing compressed air systems in industrial settings can improve energy efficiency by 20 to 50%. This demonstrates why companies should strategically avoid carbon tax exposure through investments in energy efficiency technologies that reduce their overall emissions profile.

Companies can easily avoid carbon tax, and enjoy several other business perks, if they make the effort to switch to a more sustainable business model or commit towards establishing net-zero carbon emission tactics.

There are so many different ways to incorporate the use of renewable energy or new technologies like carbon capture and storage to ultimately reduce emissions and become a more environmentally friendly company.

The flip cards below will show some of the ways that companies can achieve this:

The cost for many of these carbon emission reducing tactics may seem overwhelming to many at the beginning, but the reality is – it will be more cost effective and beneficial to the environment over time if companies are to bite the bullet and start investing in the measures necessary to reduce carbon emissions.

While it's true that critics argue how carbon taxes inevitably lead to higher energy prices affecting economic growth, research from the Brookings Institution demonstrates that strategic implementation can allow for long-term economic benefits and newfound innovation – all of which are needed to thoroughly address distributional concerns while maintaining strong incentives to meaningfully reduce emissions. represent our most economically efficient pathway toward meaningful climate action.

Think of all the things you could you have bought with your additional income if you never had to pay for any of your parking tickets. Carbon tax works the same way – and the resources that could become available to those who avoid the need to pay carbon taxes could be exponentially revolutionary in the fight against climate change.

What about Greenly?

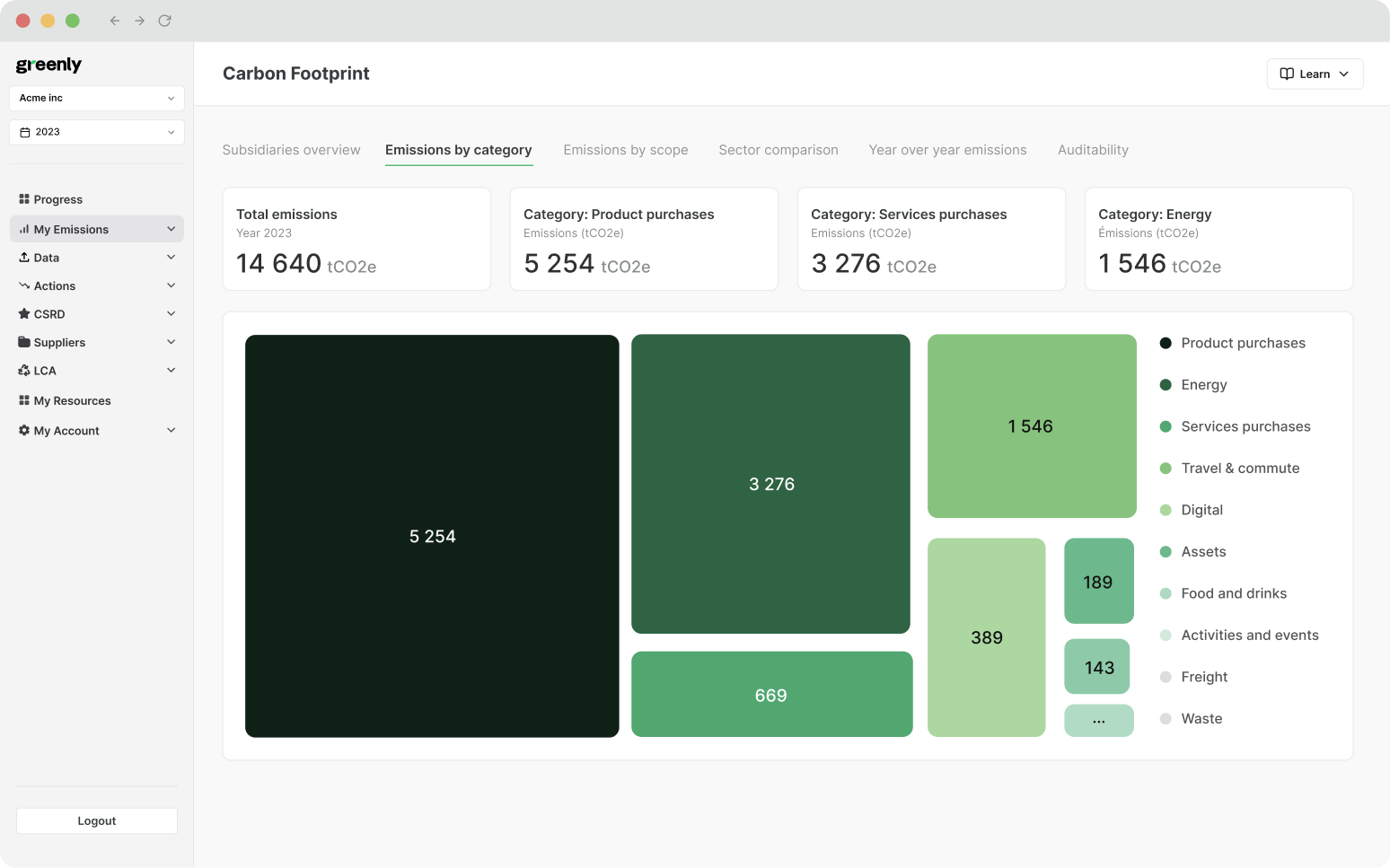

If reading this article about carbon tax and how it works has been impacted by climate change has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

Greenly can help you make an environmental change for the better, starting with a carbon footprint assessment to know how much carbon emissions your company produces.