What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

Many consumers are unaware that the seemingly harmless products sitting on their shelves - like coffee, chocolate, or items containing palm oil - are actually driving the destruction of vital forests across the world. From rainforests in Southeast Asia to the Amazon, deforestation caused by the production of these commodities is fueling biodiversity loss and climate change. The EU Deforestation-Free Products Regulation (EUDR) aims to tackle this by ensuring that products sold in the EU are not contributing to deforestation or forest degradation. Covering key commodities like palm oil, soy, cocoa, and coffee, the EUDR requires businesses to prove their products are deforestation-free.

In a recent update, the EU Commission proposed a delay to the enforcement of the EUDR. Originally planned for December 2024, the deadline, if approved by the European Parliament and Council, will be extended to December 2025 for large companies and June 2026 for smaller businesses. While this gives businesses more time to comply, critics worry it could allow deforestation to continue unchecked in the interim.

👉 In this article, we explore the EUDR’s goals, the products it covers, and the broader impact it could have on global supply chains and environmental sustainability.

The EU Deforestation-Free Products Regulation (EUDR) was introduced in response to the increasing global demand for commodities like palm oil, soy, cocoa, and coffee - products often linked to deforestation and forest degradation. The EU’s consumption of these commodities contributes to an estimated 10% of global deforestation. Recognizing this, the EUDR aims to reduce the EU’s ecological footprint by ensuring that products entering the EU market do not originate from land cleared after December 31, 2020, or that have caused forest degradation.

The regulation not only addresses deforestation driven by illegal practices but also covers deforestation that may be legal in the country of origin. This goes beyond previous regulations, such as the EU Timber Regulation, by including agricultural commodities and ensuring that even legally deforested areas are no longer acceptable sources. This broad scope is crucial, as much deforestation worldwide occurs legally but still leads to significant environmental damage.

The EUDR is part of the EU’s larger environmental strategy, which includes the European Green Deal and the EU Biodiversity Strategy for 2030. By enforcing stricter regulations on products linked to deforestation, the EU seeks to not only protect forests but also reduce greenhouse gas emissions and preserve biodiversity on a global scale.

The EU Deforestation-Free Products Regulation (EUDR) is not just about reducing deforestation; it is part of a wider effort by the European Union to combat climate change, preserve biodiversity, and minimize the EU’s environmental footprint. The key objectives of the EUDR are to:

💡 The EUDR builds on earlier efforts like the EU Timber Regulation, but it goes further by tackling both legal and illegal deforestation. Unlike previous laws that focused primarily on illegal deforestation, the EUDR targets all forms of deforestation, ensuring that even products sourced legally must meet strict environmental standards if they are to enter the EU market.

In addition to these raw commodities, the regulation also applies to derived products such as leather, chocolate, furniture, tires, and paper. This wide scope means that companies will need to ensure the traceability of not just the raw materials but also the products that are made from these materials.

The EU Commission has proposed a delay to the enforcement timeline to allow businesses time to adjust. If the delay is approved, large companies must comply by December 2025, while small and medium-sized enterprises (SMEs) have until June 2026. This extended deadline aims to give businesses more time to map their supply chains and meet the EUDR’s strict deforestation-free requirements.

It’s important to note that the regulation applies to all products placed on the EU market or exported from the EU. This means that businesses exporting these commodities from the EU must also prove that their products are not linked to deforestation. The EUDR’s scope goes beyond EU borders, making it a significant piece of legislation for global trade.

❗️This wide scope makes the regulation particularly challenging for companies with global supply chains, as it requires a high level of transparency and traceability. Companies will need to map their supply chains to the level of individual plots of land and ensure compliance with local laws and environmental standards.

According to the European Commission's impact assessment, the primary products imported by the EU from deforested land are:

| Product | Percentage of EU Imports from Deforested Land | Description/Details | Forest Locations and Types |

|---|---|---|---|

| Palm oil | 34.0 | Found in processed foods, cosmetics, cleaning products, and biodiesel. | Palm oil plantations are a major cause of deforestation in Southeast Asia, particularly in Indonesia and Malaysia, affecting tropical rainforests. |

| Soya | 32.8 | Used primarily as animal feed and in processed foods like tofu, soy milk, and oils. | Soya is linked to deforestation in South America, especially in Brazil’s Amazon and Cerrado biomes, as well as parts of Argentina. |

| Wood | 8.6 | Utilized in construction, furniture making, paper production, and biomass energy. | Wood is sourced from forests in Europe, North America, and tropical regions, with deforestation impacting temperate and tropical forests. |

| Cocoa | 7.5 | A key ingredient in chocolate, baked goods, and other confectionery products. | Cocoa production contributes to deforestation in West Africa, especially in Côte d'Ivoire and Ghana, targeting tropical rainforests. |

| Coffee | 7.0 | Used in coffee beverages, both instant and ground varieties, widely consumed globally. | Coffee production leads to deforestation in Central and South America, particularly in Brazil and Colombia, affecting tropical and subtropical forests. |

| Rubber | 3.4 | Utilized in tires, shoes, industrial goods, and other rubber-based products. | Rubber plantations cause deforestation in Southeast Asia, especially in Thailand and Vietnam, affecting tropical forests. |

| Maize | 1.6 | Commonly used for animal feed and processed food products like corn syrup. | Maize cultivation contributes to deforestation in the United States and South America, particularly in savannah and forest areas. |

| Cattle (Beef) | NaN | Cattle farming linked to beef and leather production; a major cause of deforestation in South America. | Cattle farming, especially for beef and leather production, drives deforestation in South America, particularly in the Amazon and surrounding areas. |

The EU Deforestation-Free Products Regulation (EUDR) applies to a wide range of operators and traders responsible for introducing deforestation-linked products to the EU market or exporting them from the EU. Specifically, the regulation targets:

In essence, the EUDR covers all entities involved in the supply chain of deforestation-linked products, whether within or outside the EU, and requires compliance to ensure that the products entering the EU market are deforestation-free.

One of the cornerstones of the EU Deforestation-Free Products Regulation (EUDR) is the rigorous due diligence process that companies must follow to ensure their products are not linked to deforestation. This process is designed to ensure transparency and accountability across global supply chains, requiring companies to prove that the commodities they are sourcing are deforestation-free. The due diligence process involves three key steps:

Companies are required to collect extensive information about the products they place on the EU market or export from the EU. This includes:

Based on the information gathered, companies must perform a risk assessment to determine the likelihood that the commodities they are sourcing are linked to deforestation or forest degradation. This risk assessment should include:

If a company identifies any non-negligible risk of deforestation or non-compliance, it must take action to mitigate these risks. Risk mitigation measures include:

Once the risk assessment and mitigation measures are complete, companies are required to submit a due diligence statement to their national authorities. This statement certifies that the product has been sourced in compliance with the EUDR, with no more than a negligible risk of deforestation. The European Commission’s information system will generate a unique reference number for each shipment, which must accompany the product as it enters the EU market.

The EU Deforestation-Free Products Regulation (EUDR) includes strict enforcement mechanisms and penalties to ensure that businesses comply with the regulation’s requirements. The European Commission and EU member states will play key roles in overseeing compliance and penalizing non-compliant companies. The severity of penalties reflects the EU’s commitment to combating deforestation and ensuring the integrity of the supply chains that feed into its markets.

Businesses that fail to comply with the EUDR face significant penalties, which can include:

Enforcement of the EUDR will be carried out by the competent authorities of each EU member state. These national authorities are responsible for conducting checks and ensuring that businesses are following the due diligence process outlined in the regulation. Regular inspections will be conducted, especially for companies sourcing products from high-risk countries. The EUDR sets minimum inspection rates, which vary depending on the risk classification of the source country:

Authorities have the power to conduct unannounced inspections, and in cases of non-compliance, they can impose corrective measures, such as removing products from the market or issuing fines. Member states are also required to submit regular reports to the European Commission, detailing the results of their inspections and any enforcement actions taken.

The EUDR allows for the involvement of private parties in monitoring and reporting non-compliance. Individuals, NGOs, and other stakeholders can submit substantiated concerns to national authorities if they believe that a company is not complying with the regulation. These private parties can use administrative or judicial procedures to challenge the decisions of national authorities if they believe that the regulation is not being properly enforced.

This feature of the EUDR is intended to increase transparency and ensure that civil society plays an active role in holding businesses accountable for their environmental impact.

The EU Deforestation-Free Products Regulation (EUDR) is expected to have a significant impact on global trade, especially in countries that are major producers of commodities linked to deforestation. Countries such as Brazil, Indonesia, and Malaysia, which are key exporters of palm oil, soy, and beef, are likely to feel the effects the most.

The EUDR introduces a country benchmarking system, classifying countries into low, standard, or high-risk categories based on their levels of deforestation and governance. High-risk countries, like Brazil, where deforestation in the Amazon rainforest is a significant issue, will be subject to more stringent checks and due diligence requirements. Companies sourcing from these regions will need to provide detailed geolocation data, satellite images, and proof of compliance with local environmental and social laws. This heightened level of scrutiny may lead to delays in exports and increased costs for businesses operating in these areas.

In response to the EUDR’s stringent requirements, companies may begin shifting their sourcing to low-risk jurisdictions where the due diligence process is simpler. For example, countries with lower deforestation rates and stronger governance frameworks, such as the United States or European Union member states, may become more attractive sourcing destinations. However, this shift could disproportionately impact developing countries where deforestation is a more complex issue, both environmentally and economically. It may also lead to the relocation of supply chains to regions that can more easily meet the EUDR’s compliance standards, creating a reshuffling of global trade patterns.

Businesses involved in the trade of products covered by the EUDR, particularly those sourcing from high-risk regions, are likely to face significant operational costs. The need for extensive due diligence - including independent audits, satellite monitoring, and the collection of detailed geolocation data - will add new layers of expense to supply chain management. According to the European Commission’s impact assessment, the compliance costs for companies could range from $170 million to $2.5 billion annually, depending on the complexity of their supply chains.

Small and medium-sized enterprises (SMEs) may find it particularly difficult to absorb these additional costs, potentially leading to a consolidation of supply chains where larger firms are better equipped to meet the regulatory demands. The increased operational costs may also be passed on to consumers in the form of higher prices for goods such as chocolate, coffee, and furniture.

While the EU Deforestation-Free Products Regulation (EUDR) has been hailed as a significant step towards reducing deforestation, it has also faced various challenges and criticisms from different stakeholders. The regulation’s broad scope and rigorous requirements have raised concerns about its impact on both producer countries and the businesses that will need to comply.

One of the main criticisms of the EUDR is its potential to disproportionately affect small-scale farmers in developing countries, particularly in regions like Indonesia, Brazil, and Malaysia. These countries are major exporters of commodities like palm oil, soy, and cattle, which are essential to their economies. For small farmers, the costs of compliance with the EUDR’s due diligence requirements - such as providing satellite imagery, geolocation data, and independent audits - can be prohibitively high. This has led to concerns that small producers may be excluded from the EU market, further deepening economic inequalities between large agricultural businesses and smaller-scale farmers.

In response to these challenges, producer countries have lobbied for more flexibility in the regulation, particularly for smallholders. Some countries, like Indonesia, have argued that the EUDR imposes unfair burdens on small-scale farmers and could result in trade barriers that impact their livelihoods. These concerns have led to calls for increased financial and technical support from the EU to help small farmers adapt to the new standards.

The recent proposed delay in the EUDR’s enforcement has sparked criticism from environmental groups. While this extension gives companies more time to adjust to the new requirements, environmental advocates argue that the delay could allow deforestation to continue unchecked during this period.

Organisations such as Human Rights Watch and Mighty Earth have expressed concerns that the delay is a missed opportunity for urgent climate action. Critics argue that by giving businesses more time to comply, the EU risks undermining its own environmental goals, particularly at a time when deforestation rates are rising in key regions like the Amazon. Some environmental groups have urged the EU to introduce interim measures to ensure that deforestation is curbed while companies prepare for full compliance with the EUDR.

Another challenge posed by the EUDR is the complexity of compliance for companies with global supply chains. The regulation’s strict requirements - particularly for companies sourcing from high-risk regions—require extensive due diligence, independent audits, and geolocation data. For large multinational corporations, this can mean reconfiguring entire supply chains to ensure compliance. While large businesses may be able to absorb the additional costs, smaller companies may struggle with the financial burden of compliance.

In addition, businesses have raised concerns about the lack of clear guidance on how to implement the EUDR’s requirements effectively. Many companies have expressed frustration that key compliance documents were only shared by the EU in October 2024, just two months before the original enforcement date. This has led to calls for more detailed guidance and resources to help businesses, particularly SMEs, navigate the complexities of the regulation.

As the EUDR takes shape, its future implications are expected to extend beyond the initial scope of the law. The regulation is set to evolve in the coming years as the EU refines its enforcement processes and potentially expands the list of products and ecosystems covered by the law.

The EUDR currently focuses on preventing deforestation in forests, but there is growing pressure to include other ecosystems, such as savannahs and wetlands, which are also threatened by agricultural expansion. Many environmental advocates believe that the regulation should address deforestation and land conversion in these critical ecosystems, as they are equally important for biodiversity and carbon storage.

The European Commission is expected to review the EUDR by 2025, and this review may result in an expansion of the regulation’s scope to cover more ecosystems. Including ecosystems beyond forests would increase the regulation's global impact, particularly in regions like Brazil’s Cerrado biome, which has experienced significant agricultural expansion and deforestation due to soy farming.

In addition to expanding the ecosystems covered, the EU may consider including additional commodities under the EUDR. Maize and biodiesel are two products that could be added to the regulation, given their links to deforestation and land degradation. The expansion of the EUDR to include these products would further strengthen the EU’s efforts to combat deforestation-driven supply chains.

If maize and biodiesel are added, it will particularly impact producers in South America, where these products are widely cultivated. Maize production in countries like Brazil and Argentina has been associated with deforestation and land use changes, and including these products under the EUDR would place additional compliance burdens on companies sourcing from these regions.

The EUDR is already influencing trade negotiations between the EU and countries that rely on exports of commodities linked to deforestation. Brazil, for example, has voiced concerns about how the EUDR will affect its agricultural sector, particularly with respect to the EU-MERCOSUR trade agreement. Brazilian President Luiz Inácio Lula da Silva has argued that the regulation could impose significant trade barriers on Brazilian products like beef and soy, making it difficult for Brazil to maintain its trade with the EU.

Similarly, countries like Indonesia and Malaysia, which are major exporters of palm oil, have raised concerns about how the EUDR could impact their economies. These countries have lobbied for exemptions or flexibility in the regulation, particularly for smallholders who may struggle to meet the due diligence requirements.

As the EU continues to negotiate trade agreements, the EUDR will likely play a central role in shaping the future of trade relations. The EU’s stance on deforestation is expected to influence not only its bilateral trade agreements but also multilateral discussions on environmental sustainability and trade.

The European Commission is currently scheduled to review the EUDR’s implementation by June 2025. This review will assess how well the regulation has been implemented, identify areas for improvement, and consider potential expansions. The review process will likely include consultations with businesses, environmental groups, and producer countries to ensure that the EUDR’s objectives are being met while addressing any unintended consequences.

The review may also consider extending compliance timelines for certain sectors or offering additional support to smallholders in high-risk countries. This flexibility would help mitigate some of the challenges that have been raised by producer countries and businesses.

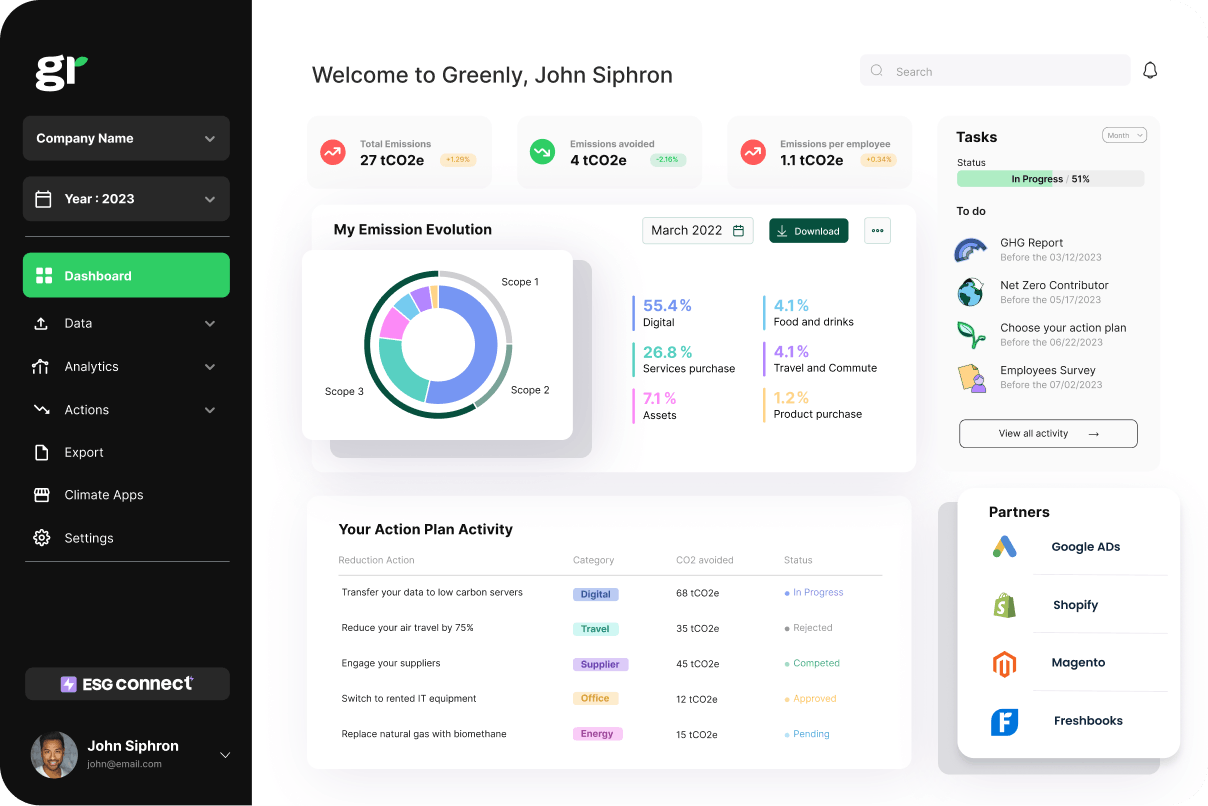

As the EU Deforestation-Free Products Regulation (EUDR) comes into effect, businesses must adapt their supply chains to meet the stringent requirements. Managing deforestation risks and ensuring sustainability in global supply chains can be complex, but that’s where Greenly steps in. At Greenly, we offer a range of solutions to help companies reduce their overall GHG emissions and environmental impact.

Greenly provides businesses with the tools and expertise they need to minimize their environmental footprint. Our advanced carbon management platform allows companies to track, analyze, and reduce their greenhouse gas emissions efficiently.

Greenly specializes in supply chain decarbonization, helping companies engage with their suppliers to transition toward low-carbon alternatives. We assist in building more sustainable supply chains and reducing emissions throughout the product lifecycle.

Greenly’s intuitive platform streamlines the process of managing emissions and environmental impacts. From tracking carbon footprints to ensuring progress against Environmental, Social, and Governance (ESG) goals, our platform makes integrating sustainability into your business seamless and efficient.

Greenly provides end-to-end support for businesses. By partnering with us, your company will position itself as a leader in sustainability. Let Greenly help you manage your environmental footprint and drive meaningful progress in the fight against climate change.

Start your journey to a more sustainable future with Greenly today.