What are the 3 Pillars of Corporate Sustainability?

In this article, we'll explore what the 3 pillars of corporate responsibility are, why they're important, and how businesses can turn them into practical action.

ESG / CSR

Industries

Unbeknownst to most, ESG risks are just as pivotal as ESG data and ESG investments in protecting the financial future of a company.

This is why many companies make an effort to manage ESG risks, environmental risks, and commit to an ESG risk assessment.

What are ESG risks, and why are they important for businesses looking to adhere to many of the new environmental regulations that continue to be passed?

In this article, we'll explain what ESG risks are, why they are important the benefits of working to avoid ESG risks, examples of ESG risks, and more.

ESG risks, which stand for environmental, social, and corporate governance – refer to a company’s environmental, social, and governance factors which could create a bad reputation, such as by greenwashing or harming the company financially.

This is because ESG risks can help a business to manage their investments, for consumers and future employees to seek out new companies that adhere to their own environmentally ethical values, and for boards of directors to remain cognizant of their own ESG risks.

ESG risks are relevant to companies of all sizes, and remain pivotal to the financial success of any business. This is why many companies strive to implement an ESG strategy in order to manage their ESG risks and protect the future success and quality of their business.

Ultimately, ESG risks are social, environmental, and governance factors that have an impact on the financial success and management of a company.

ESG risks are imperative as they protect a company from facing the consequences of their investment risks.

Here are a few more reasons why ESG risks are important:

Environmental ESG risks pertain to how a company negatively impacts the environment, such as through the amount of greenhouse gas emissions they produce, how much water waste they contribute to, their impact on elements such as biodiversity and deforestation, and how they dispose of waste.

Companies that want to avoid the environmental factor jeopardizing their ESG risks must seek to adhere to all existing and future environmental regulations, as failing to do so can result in expensive fines and deplete a company's financial reserves. This also serves as a baseline or basic guideline of how companies should treat the environment.

There are a wide variety of social risks in ESG risks, such as fair pay, safe working conditions and labor practices, ensuring supplier engagement and viable practices, seeking to provide employees with human rights, advocating for diversity, equity, and inclusion, and protecting data within the company.

Companies determined to manage their social risks when cultivating an ESG risk strategy should seek to ensure that all of their suppliers remain up-to-date on the most recent ESG standards, to cultivate a safe workplace and business environment for employees that doesn’t risk compromising their health or safety, and make sure that ethical practices are put in place to prevent taking advantage of either customers or employees.

Social risks are pivotal in mitigating other ESG risks, as the social component of ESG risks impact the brand image and ultimately, the potential new or current customers interest in the company’s products or services.

Governance risks are important as they aid in the success of business operations and handling various policies, such as how ESG disclosures are made, how the board of a company is structured, how diversity is promoted, how executive compensation is handed, how corruption and fraud are avoided, and general communication strategies aimed to improve transparency.

Companies seeking to improve the governance component of the ESG risk management strategy should remain aware of new environmental regulations and the board’s motivation to monitor and manage ESG risks.

After evaluating all three components of ESG risks, an ESG risk score – otherwise known as an ESG risk rating, may be given to a company.

An ESG risk rating measures the exposure risk a company has in regards to each individual component of ESG risks: such as the environmental, social, and governance risk exposure. This score, which calculates ESG risks, helps companies to rectify the areas necessary to improve upon their ESG risk rating.

An ESG risk assessment is calculated by assessing each individual category related to ESG risks: including environmental, social, and governance factors.

Here is a breakdown of how an ESG score is calculated:

The environmental factor of an ESG risk assessment score may be determined through a company's carbon emissions, efforts to mitigate climate change, if their packaging is sustainable or not, how their water is sourced, how they impact biodiversity, and how toxic waste is handled.

The social part of an ESG risk rating will be determined through aspects such as how protected a consumer is during the purchasing process, how safe products are throughout their life-cycle, the quality of the protects, how employees are trained to avoid hazardous situations, how supply chain management is handled, and how poor working conditions are rectified.

in an ESK risk assessment will evaluate how diversity is implemented into the company, how accounting is handled, efforts to establish transparency, conduct additional assessments such as a materiality assessment, adhere to stakeholder expectations, practice good governance practices, and general business ethics.

Many companies will resort to the use of third-party agencies to assist them in calculating their ESG scores for them, but it is important to note that many third-parties use different methods to calculate a company’s ESG risk rating. In general, the higher the ESG risk rating – the better a company can demonstrate their ability to mitigate ESG risks.

There are several benefits and things to remain mindful of when managing ESG risks, but ultimately – implementing a practice in place to stay aware of the impact environmental, social, and governance factors can have on a company’s financial success does a world of good while also helping to benefit the planet and surrounding communities.

Here are additional benefits for companies that decide to manage ESG risks:

One of the overarching benefits of curating a strategy to monitor and improve the chances of ESG risks impacting a company’s finances is the increased opportunity of future investor interest. Similar to socially responsible investing, impact investing, and ESG investments – investors are becoming more interested in exclusively contributing to projects and businesses that seek sustainability and do their best to prevent contributing to climate change.

Customers are also growing more interested in companies that strive to do their part in the fight against climate change. This is why companies certified B Corp or that have other environmental certifications earn the trust of consumers with more ease, and given companies that have established ESG risk management plans can demonstrate their efforts towards both societal and environmental issues – the likelihood of maintaining old and attracting new customers is likely to increase.

Lastly, seeking to create an action plan to monitor and mitigate ESG risks can help companies maintain the motivation to adhere to environmental regulations before they are even passed. In other words, striving to prevent ESG risks can help companies stay one step ahead of the game and avoid needing to go into “panic” mode to adjust to the new regulations being passed under a time constraint.

Ultimately, companies that seek to implement ESG risk management strategies into their business models could not only protect their current finances, but improve the chances of acquiring new financial opportunities to further expand their business.

| Benefit | Description |

|---|---|

| Increased Investor Interest | Investors are becoming more interested in contributing to projects and businesses that seek sustainability and do their best to prevent contributing to climate change. Companies that manage ESG risks effectively are more likely to attract future investment. |

| Improved Customer Trust | Customers are growing more interested in companies that strive to fight climate change. Companies certified B-Corp or with other environmental certifications earn consumer trust more easily. ESG risk management demonstrates efforts towards societal and environmental issues, increasing customer retention and attraction. |

| Proactive Regulatory Compliance | Monitoring and mitigating ESG risks help companies adhere to environmental regulations before they are enforced. This proactive approach prevents the need to make rushed adjustments to comply with new regulations, maintaining operational stability. |

| Financial Protection and Growth | Implementing ESG risk management strategies can protect current finances and improve the chances of acquiring new financial opportunities, aiding business expansion. |

It’s easy for companies to feel like they’re invincible from harm and ignore the value in establishing a plan to mitigate the repercussions of ESG risks, but some of these previous stories just may serve as the inspiration for a company to take action and get their ESG risk assessment started today.

Here are just a few examples of companies that have battled ESG risks before:

Back in April 2010, popular gasoline company BP suffered financially when an oil rig of theirs called “Deepwater Horizon” erupted near the Gulf of Mexico – and subsequently impacted the surrounding wildlife and biodiversity. BP ended up paying a hefty cleaning fee after the oil explosion, totalling around $65 billion dollars for both the fines issued and fees to clean the surrounding areas. BP could have avoided this from happening with ESG risk management, as the governance component wouldn’t have allowed for BP to be subject to those exorbitant fines in the first place.

The city of Flint in Michigan has also lost millions of dollars following an incident where high levels of lead were found in the city's drinking water. Not only did the city have to cough up money for putting residents in danger, but the state of Michigan also had to succumb to a $600 million settlement deal.

Keep in mind, this incident occurred back in 2014, meaning this incident would run Michigan over $700 million dollars today in settlement fees alone. Given ESG risks seek to protect the health of consumers, this occurrence could have been avoided.

This well-known German car company was subject to a form of greenwashing after being accused of tampering with emissions tests for their vehicles. Millions of cars were recalled, and the car company had to pay over $30 billion in fines, settlements, penalties – and returning customer loans for those who chose to lease Volkswagen cars.

PG&E, or the Pacific Gas and Electricity company which aims to provide people with natural gas and electric services to millions of people, have been subject to almost $30 billion due to their roles in multiple California wildfires – such as the one in Sacramento in 2015 and Napa’s 2017 wildfire. This is because PG&E failed to keep their power lines stable, something that could have been avoided if the company valued ESG risk management over profit.

Following these fires, PG&E was forced to file for bankruptcy protection in 2019.

Thailand suffered from extreme floods back in 2011, which in turn impacted various supply chain networks for the automotive and technology industries. The World Bank, who assisted Thailand in calculating the damages following the floods, discovered nearly $47 billion worth of economic damages and losses were to blame from these floods.

ESG risk management, assessments, and risk ratings can help companies in a multitude of ways: such as staying ahead of environmental legislation, reducing business costs from potential fines, and maintaining customer loyalty and investor interest. ESG risks may seem like an optional component to manage when running a business, but if you ask us – it’s never been more important.

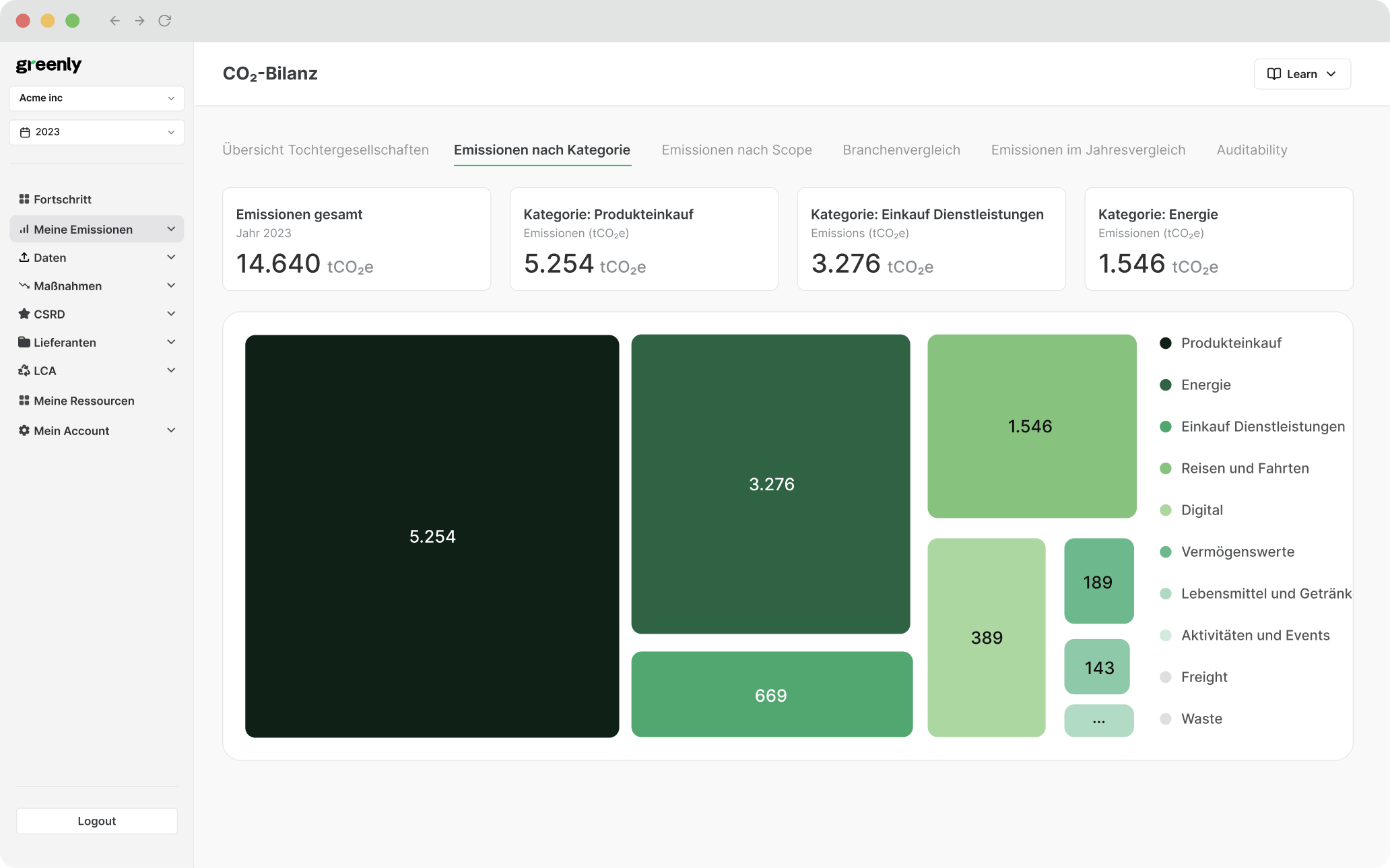

If reading this article about ESG risks including ESG examples and the assessment method has made you interested in reducing your carbon emissions to further fight against climate change – Greenly can help you!

At Greenly we can help you to assess your company’s carbon footprint, and then give you the tools you need to cut down on emissions. We offer a free demo for you to better understand our platform and all that it has to offer – including assistance with boosting supplier engagement, personalized assistance, and new ways to involve your employees.

Click here to learn more about Greenly and how we can help you reduce your carbon footprint.