ESG / CSR

Industries

CSR report: why it matters and how to create one effectively

Writing a CSR report might not be at the top of your to-do list, but it probably should be. As more companies recognise the value of transparency, accountability, and purpose-driven business, CSR reporting has quietly become one of the most powerful tools for building trust and long-term credibility.

Done well, a CSR report doesn’t just satisfy stakeholder expectations, it helps shape your company’s narrative, spotlight your impact, and spark conversations that matter.

- What CSR reporting is and why it matters

- Key elements of a strong CSR report

- Current UK reporting requirements

- Practical steps to create your first report

- Examples of brands excelling in CSR reporting

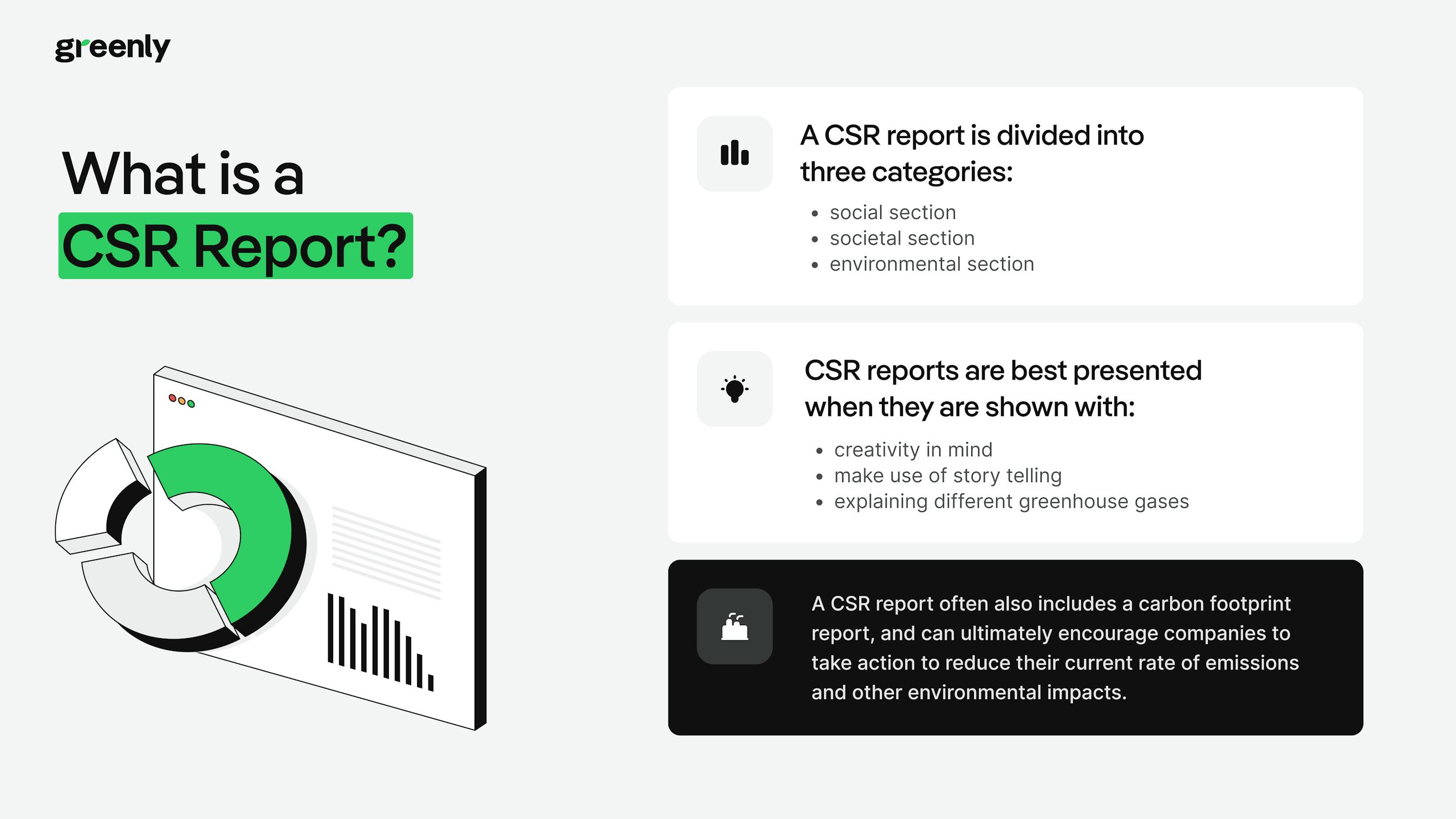

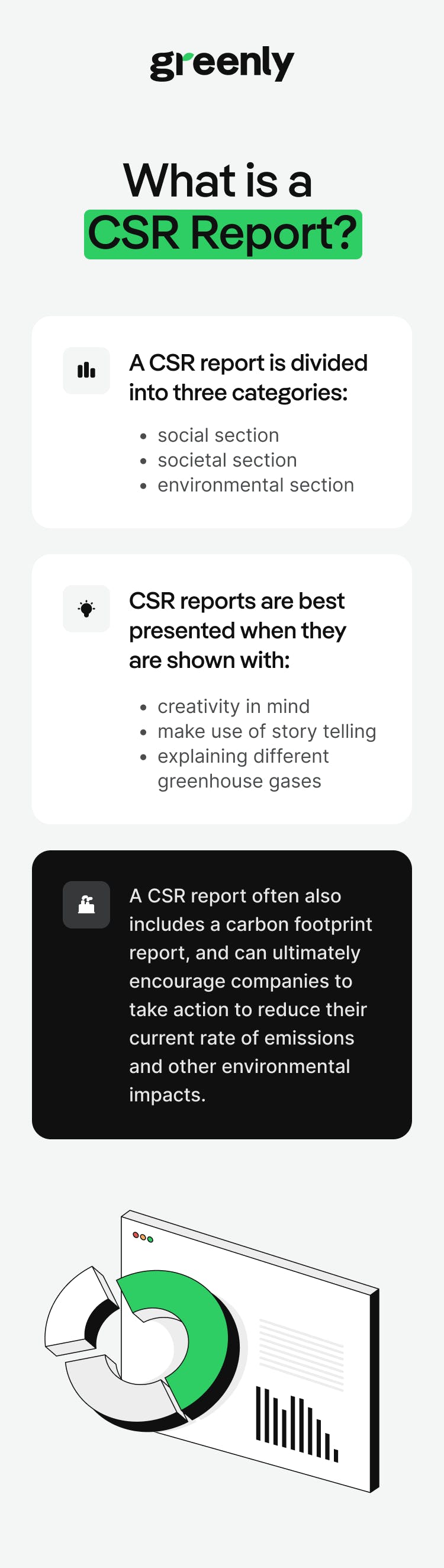

What is a CSR report?

It’s a structured document that lays out the company’s commitments and actions related to environmental sustainability, social responsibility, and ethical business practices. This might include efforts to reduce carbon emissions, improve working conditions in the supply chain, support local communities, or promote diversity and inclusion. A good CSR report will also include targets, track progress, and openly acknowledge areas for improvement.

But it’s not just about listing initiatives, it’s about showing accountability. CSR reports are increasingly used by investors, customers, employees, and regulators to understand whether a company is genuinely committed to doing business responsibly or just saying the right things. In short, a CSR report turns values into something visible, measurable, and trackable.

How did CSR reporting evolve?

1970s – Early CSR movement: Businesses began facing pressure to consider social and environmental impacts. Early CSR efforts were voluntary, focused mainly on philanthropy and community programs.

Globalisation era: With growing public scrutiny on labour conditions and environmental harm, stakeholders demanded more transparency from businesses.

1997 – GRI launch: The Global Reporting Initiative introduced a standardised framework for non-financial reporting, marking a turning point in CSR disclosure practices.

2000s – Modern CSR reporting: Reports shifted from marketing brochures to data-driven publications, integrating measurable sustainability goals and corporate accountability.

Today: CSR reporting has become standard practice, often legally required in many jurisdictions, with growing alignment to ESG frameworks and global standards.

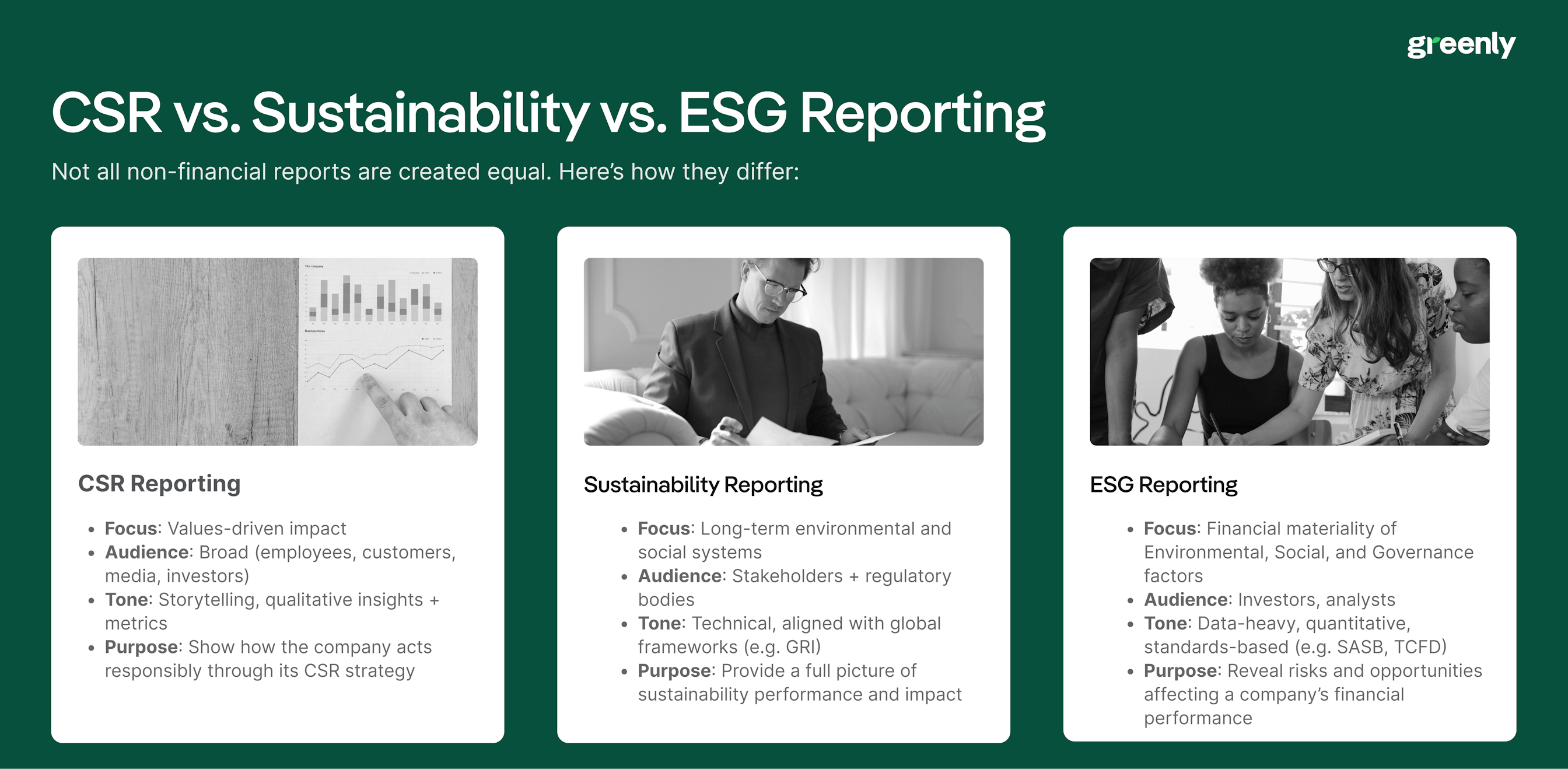

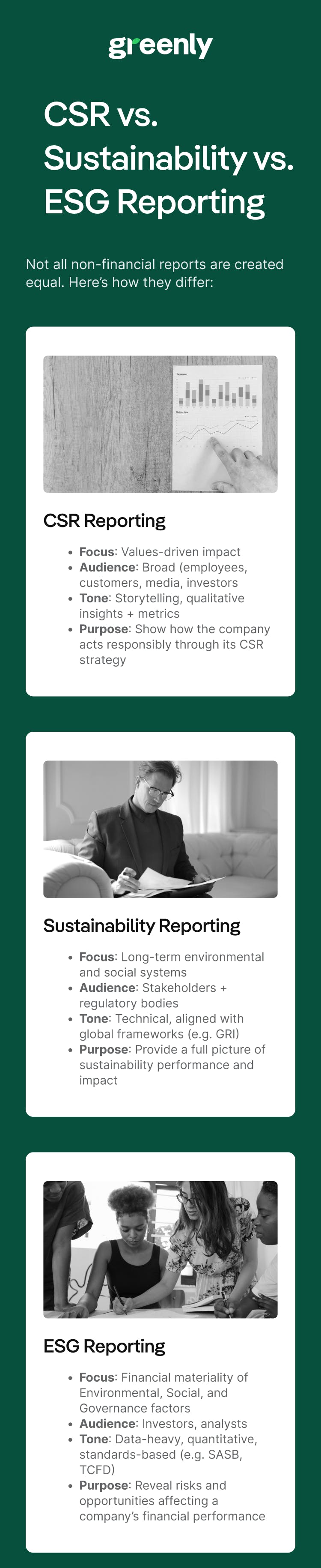

CSR, ESG, and sustainability reporting: What’s the difference?

As sustainability has moved into the mainstream, the language around reporting has evolved too. You’ve probably come across terms like ESG reporting or sustainability reporting, and while they often overlap with CSR reporting, they’re not quite the same thing.

Here’s how CSR reporting compares to other common forms of non-financial reporting:

What’s included in a CSR report?

CSR reports can vary depending on the size, industry, and maturity of a company’s sustainability strategy, but most follow a similar structure. The goal is to provide a clear, honest overview of how the company is addressing its social and environmental responsibilities.

Here are some of the most common elements you’ll find in a CSR report:

- Greenhouse gas emissions (Scope 1, 2, and sometimes Scope 3)

- Energy consumption and efficiency measures

- Waste management and recycling

- Water usage and conservation efforts

- Climate adaptation and biodiversity initiatives

- Labour practices and working conditions

- Health and safety

- Diversity, equity, and inclusion (DEI)

- Employee well-being and engagement

- Community investments and volunteering

- Business ethics and anti-corruption policies

- Supply chain due diligence

- Risk management processes

- Stakeholder engagement strategies

Is CSR reporting mandatory in the UK?

Strictly speaking, there’s no law in the UK that requires companies to publish a standalone 'CSR report'. But that doesn’t mean businesses are off the hook when it comes to reporting on their environmental and social performance.

At the same time, many companies are choosing to go further by voluntarily publishing full CSR or sustainability reports. Doing so helps them bring all their initiatives together in one place and meet the growing expectations of customers, employees, investors, and regulators.

Here’s an overview of the main CSR-related reporting requirements in the UK:

| Requirement | Applies to | Key disclosures required | Regulation / framework | Mandatory? |

|---|---|---|---|---|

|

Strategic report (non-financial information)

|

Large UK companies (listed or > 500 employees, or > £500 m turnover) | Environmental, employee, social, human rights, anti-corruption disclosures | Companies Act 2006 §§ 414C / 414CB (implementing EU NFRD & CSRD standards) | ✅ Yes |

|

SECR (Streamlined Energy & Carbon Reporting)

|

Quoted companies, large UK companies or LLPs | Annual energy use, GHG emissions (Scope 1 & 2, Scope 3 optional), energy efficiency measures | Companies (Directors’ Report) and LLP (Energy and Carbon) Regulations 2018 / BEIS SECR rules | ✅ Yes |

|

Climate-related financial information (TCFD / UK SRS)

|

Listed companies and large private entities (> 500 employees & > £500m turnover) | Governance, strategy, risk management, climate metrics, emissions, targets | Climate Disclosure Regulations 2022 (TCFD-aligned); transitioning to UK Sustainability Reporting Standards S2 (from 2026) | ✅ Yes |

|

s. 172 statement & related director disclosures

|

Large companies (> 250 UK employees) | How directors considered employee interests, suppliers, customers, environment to promote success | Companies (Misc Reporting) Regulations 2018 (s. 172 statements) | ✅ Yes |

|

Gender pay gap reporting

|

Companies with ≥ 250 UK employees | Gender pay gap statistics and quartile pay distribution | Equality Act 2010 (Gender Pay Gap Information) Regulations 2017 | ✅ Yes |

|

Modern Slavery statement

|

Companies with ≥ £36 m turnover operating in UK | Due diligence steps to prevent slavery and trafficking in supply chains | Modern Slavery Act 2015, Section 54 | ✅ Yes |

|

Voluntary CSR or sustainability reports

|

Any company | Broader narrative on sustainability performance, initiatives, and goals | Voluntary frameworks like GRI, CDP, B Corp, UN SDGs | ❌ No |

- On 25 June 2025, the UK government launched consultations on draft UK SRS (S1 and S2), derived from ISSB IFRS S1 & S2, with six UK‑specific amendments. These consultations are due to close later in 2025.

- The final standards are expected to be mandatory for companies with financial years starting 1 January 2026 or later, meaning first UK SRS-compliant reports will appear in 2027.

- UK SRS S2 will gradually replace current TCFD-based rules, retiring previous climate disclosure obligations.

Summary:

While no specific law requires a standalone CSR report, large UK businesses must already disclose core CSR-related topics via strategic reporting, SECR, TCFD/UK SRS, and other legal mechanisms. If your company meets thresholds for size or listing status:

- You're already disclosing climate, social, environmental, and governance information through annual reports or director statements.

- To stay ahead, preparing for UK SRS adoption is crucial, especially as regulations tighten from 2026 onwards.

Why should your company publish a CSR report?

Publishing a Corporate Social Responsibility (CSR) report isn't just about compliance or public relations, it's a strategic move that can yield substantial benefits. Data indicates that companies engaging in CSR reporting experience enhanced customer satisfaction, improved employee morale, and increased market value. Here's why your company should consider it:

Meet rising expectations

According to PwC’s Consumer Intelligence Series on ESG, 76% of consumers say they would stop buying from companies that treat the environment, employees, or their community poorly. And 83% believe companies should actively shape ESG best practices, not just respond to regulation.

CSR reporting is one of the clearest ways to show customers that your business is listening and acting.

Strengthen trust

Transparency fosters trust. According to the Edelman Trust Barometer, trust is now the second most important factor in purchasing decisions, just behind price. CSR reporting is a concrete way to demonstrate your company’s values and the impact of your actions.

Attract & retain talent

People want to work for companies that reflect their values. Research shows that employees who view their company as socially responsible are more engaged, loyal, and committed. Nearly 70% of employees say they wouldn’t work for a company that lacks a strong sense of purpose.

A CSR report communicates not only what you’re doing for customers and the environment, but also for employees.

Get ahead of regulation

The regulatory environment is tightening, particularly around climate and supply chain transparency. Even if CSR reporting isn’t mandatory today, it could be soon. In the UK and EU, climate disclosures and supply chain due diligence are already required for large companies.

Reporting voluntarily now helps build internal systems for future compliance.

Spot risks & opportunities

Creating a CSR report isn’t just about showcasing achievements; it’s a chance to analyse operations, uncover environmental risks, and identify vulnerabilities. Insights can reduce risk, cut costs, and drive innovation.

According to Deloitte’s 2024 Sustainability Action Report, 51% of executives say enhanced ESG or CSR reporting delivers internal benefits like operational efficiency, improved risk management, and stronger stakeholder trust.

Contribute to global goals

Many businesses use CSR reports to align efforts with frameworks like the UN SDGs or GRI, positioning themselves as contributors to global progress.

A GRI/Support the Goals study found 83% of companies report SDG support in their disclosures, underscoring the value of incorporating these goals.

How to create a CSR report: step-by-step guide

Putting together your first CSR report might feel like a big task, but with a clear plan, it’s absolutely achievable. Whether you’re starting from scratch or formalising existing initiatives, the process is a great opportunity to bring teams together, track your progress, and show the world what your company stands for.

Here’s a step-by-step guide to help you get started:

1. Clarify your goals and audience

Before you begin collecting data or drafting content, take a moment to define the purpose of your report. Are you writing for investors? Customers? Your own employees? Is the goal to meet regulatory expectations, attract new talent, or build stakeholder trust?

Being clear on who you're speaking to, and why, will shape the tone, focus, and format of your report.

2. Choose a reporting framework

While there’s no one-size-fits-all model, using a recognised CSR reporting framework can help give structure to your report and ensure you’re covering key topics.

Some of the most widely used frameworks include:

| Framework | What it covers | Who it's for | Mandatory? |

|---|---|---|---|

|

GRI (Global Reporting Initiative)

|

A wide range of sustainability topics including environmental impact, labour practices, human rights, anti-corruption, and community engagement. | Organisations of all sizes and sectors, especially those looking to communicate broadly with stakeholders including investors, customers, and the public. | Voluntary (though often expected in many countries and by stakeholders) |

|

ISSB (IFRS S1 and S2)

|

Financially material sustainability-related risks and opportunities. Focused on sustainability (S1) and climate-related disclosures (S2). | Primarily aimed at publicly listed companies and those preparing financial filings. Focused on investor-relevant sustainability disclosures. | Voluntary (but may be integrated into regulations over time) |

|

SASB (Sustainability Accounting Standards Board)

|

ESG factors most likely to affect financial performance within specific industries. Includes standards covering 77 sectors. | Companies aiming to disclose financially material ESG issues that vary by industry. Often used by companies operating in capital markets. | Voluntary (increasingly adopted by publicly traded companies) |

|

UN Sustainable Development Goals (SDGs)

|

17 global goals addressing poverty, inequality, climate change, and other social and environmental priorities. Often used to align impact with global aims. | Any organisation looking to demonstrate how their work contributes to sustainable development. Often used for storytelling rather than formal disclosure. | Voluntary |

3. Gather your CSR data

This is where your internal collaboration begins. You’ll need input from across departments - HR, operations, facilities, procurement, and legal, to name a few - to collect the quantitative and qualitative data that forms the backbone of your report. Many companies also choose to use CSR reporting software to centralise this data and streamline the process.

Key areas might include:

- Energy use and emissions

- Diversity and inclusion data

- Employee engagement and wellbeing

- Community programmes and volunteering

- Ethical sourcing and supply chain policies

Start with what you can access, and don’t worry if your data isn’t perfect. Transparency about gaps is far better than greenwashing.

4. Focus on what matters most

Rather than trying to report on everything, zoom in on the themes that matter most to your business and stakeholders. This could be reducing your environmental footprint, improving working conditions across your supply chain, or increasing transparency in how decisions are made.

A simple materiality assessment can help identify and prioritise the most relevant issues to focus on.

5. Write the report

There’s no fixed format, but a good CSR report typically includes:

The best reports combine data with storytelling, using real-world examples, case studies, and visuals to bring the numbers to life.

6. Review, publish, and share

Before publishing, make sure key stakeholders, including legal, HR, and your chief sustainability officer or sustainability lead, have reviewed the report for accuracy. Some companies also seek external assurance to validate the content and boost credibility.

Once finalised, publish your report in a visible place on your website and share highlights through social media, your annual report, newsletters, or even investor presentations. Don’t forget to tell your internal teams too, your employees are some of your most important stakeholders.

Brands leading the way in CSR reporting

Brands that excel in CSR reporting

Leading brands like Patagonia and Unilever demonstrate how strong CSR policies and transparent reporting can build trust, attract purpose-driven talent, and deliver measurable business growth. Here’s how they’ve set the standard:

FAQ on CSR Reports

Q: What is a CSR report?

A: A Corporate Social Responsibility (CSR) report outlines a company’s efforts and impact in areas such as environmental sustainability, social responsibility, and ethical governance. It provides transparency to stakeholders about how the company manages its broader responsibilities beyond financial performance.

Q: Why is a CSR report important for businesses?

A: CSR reports build trust with stakeholders, improve corporate reputation, and demonstrate accountability. They help companies showcase their progress in sustainability, highlight community engagement, and ensure alignment with consumer expectations and investor requirements.

Q: What should be included in a CSR report?

A: A CSR report usually includes a company's environmental impact (such as emissions and resource use), social initiatives (like employee well-being and diversity), community contributions, governance policies, and future sustainability goals. As a whole, data transparency and measurable results are paramount when it comes to a CSR report.

Q: How does a CSR report differ from an ESG report?

A: While both cover sustainability, a CSR report focuses more on voluntary initiatives and company-driven responsibility, whereas ESG reports are more structured and compliance-driven, aligned with global standards such as CSRD, GRI, or SASB.

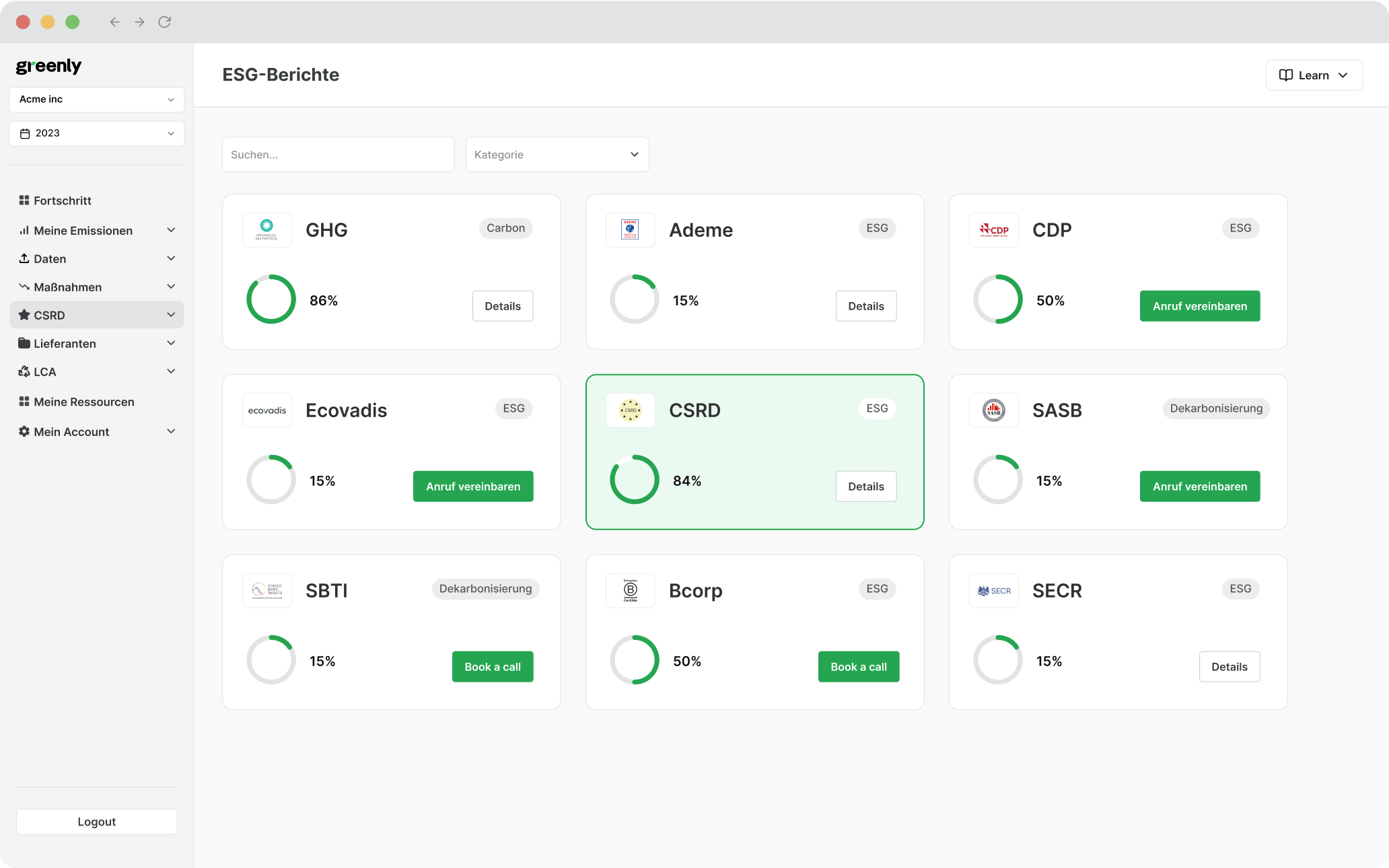

Q: How can Greenly help with CSR reporting?

A: Greenly supports companies in drafting audit-ready CSR reports by automating data collection, tracking Scope 1, 2, and 3 emissions, and providing expert guidance. Our platform ensures that CSR reporting is transparent, impactful, and aligned with international sustainability frameworks.

What About Greenly?

If your company is just starting out with CSR reporting, one of the most valuable areas to focus on is your environmental impact, and that’s where Greenly can help.

Our carbon management services make it easier for businesses to measure, understand, and reduce their emissions. Whether you’re building your first report or strengthening an existing one, we give you the tools and support to bring substance to your sustainability commitments.

Here’s how Greenly can support your CSR reporting:

| Feature | How it helps your CSR reporting |

|---|---|

|

Track your carbon footprint

|

Our platform helps you calculate your company’s emissions across Scope 1, 2, and 3. This data can be directly used in the environmental section of your CSR report. |

|

Monitor progress over time

|

We provide dashboards and visualisations that show how your emissions are changing year-on-year, making it easier to include performance metrics and demonstrate progress toward climate goals. |

|

Identify hotspots and opportunities

|

See where your biggest emissions come from and get tailored recommendations to reduce them. This adds depth and credibility to your reporting and shows stakeholders that your business is focused on continuous improvement. |

|

Support alignment with global standards

|

Whether you want to align your CSR reporting with frameworks like the GRI, ISSB, or SDGs, we help ensure your environmental disclosures are robust, accurate, and ready for scrutiny. |

|

Strengthen your sustainability narrative

|

A carbon assessment isn’t just about numbers, it’s about impact. Our insights help you craft a clearer, more compelling story around your climate efforts, backed by data and real action. |

We give you more than just emissions figures, we give you the confidence and clarity to report transparently, take meaningful action, and meet stakeholder expectations. Get in touch with Greenly today to find out more.