Impacts, Risks, and Opportunities (IRO) for CSRD Reporting

In this article, we’ll break down what IROs are, how to identify and assess them, and what CSRD requires in terms of disclosure.

ESG / CSR

Industries

Nowadays businesses face a whole range of responsibilities - from protecting data and managing risks to keeping up with an endless list of regulations, including those related to environmental impact. That’s where Governance, Risk, and Compliance (GRC) comes in. Think of GRC as the backbone that helps companies stay grounded while navigating these challenges, giving them the tools to make smart decisions, stay ethical, and keep everything running smoothly.

👉 In this article, we’ll break down what GRC really means and why it’s essential for any modern business. We’ll also look at how GRC plays a key role in environmental responsibility - helping companies manage their carbon footprint and meet the increasing demand for sustainable practices.

GRC stands for Governance, Risk, and Compliance - three fundamental areas that help businesses run responsibly and respond to complex challenges. It’s not just a set of rules or guidelines, GRC is a framework that companies use to create clear structures for decision-making, handle risks effectively, and meet the legal and ethical standards expected of them.

In a nutshell, GRC enables businesses to operate with confidence. In today’s environment, where both internal and external risks are constantly evolving, GRC provides the foundation that allows companies to make better choices. Good governance ensures that a company’s vision and values drive its actions.

Effective risk management helps to identify and prepare for potential obstacles, while compliance safeguards the company from legal troubles by ensuring all activities align with relevant regulations.

When effectively integrated, GRC brings a range of advantages that extend far beyond basic compliance. For starters, GRC empowers companies to operate more strategically, aligning all levels of the business with the same goals. It also ensures that risk management is proactive, meaning potential threats are identified and mitigated before they turn into crises. This leads to smoother operations and helps companies avoid costly disruptions.

GRC also enhances a company’s reputation by fostering transparency and accountability, two qualities that build trust with customers, investors, and employees. Companies with strong GRC frameworks are often better prepared to demonstrate compliance with regulations, which can protect against legal penalties and improve stakeholder confidence.

The benefits of GRC for businesses include:

| Benefit | GRC Component | How GRC Contributes to the Benefit |

|---|---|---|

| Operational Efficiency | Governance | Clear governance provides structure, reducing overlap and improving resource allocation. |

| Compliance | Compliance streamlines workflows by embedding regulatory requirements directly into operations. | |

| Improved Decision-Making | Governance | Governance aligns business decisions with company goals, creating consistency and focus. |

| Risk Management | Risk management enables data-driven decisions by identifying threats and opportunities in advance. | |

| Stronger Regulatory Compliance | Compliance | Compliance ensures adherence to legal standards, protecting the company from fines and legal issues. |

| Enhanced Brand Reputation | Governance, Compliance | Strong governance and compliance reinforce ethical practices, improving trust with customers and partners. |

| Risk Resilience | Risk Management | Risk management anticipates and prepares for crises, making the company less vulnerable to disruptions. |

Each component of GRC - Governance, Risk Management, and Compliance - serves an important purpose within a company, yet they are all interconnected. Let’s take a closer look at how each part functions and why they’re essential to a comprehensive GRC framework:

Governance is the system that outlines how a company is directed and controlled. It encompasses the policies, procedures, and ethical standards that guide decision-making and define accountability.

Effective governance ensures that everyone (from executives to employees) understands their roles and responsibilities within the organisation. This not only promotes transparency and accountability but also aligns day-to-day actions with the company’s long-term goals. When governance is strong, the company is more likely to make decisions that reflect its core values and support sustainable growth.

Risk management is about identifying, assessing, and addressing potential threats to the company. These threats can range from financial risks, like market fluctuations, to operational risks, such as supply chain disruptions due to climate change, or reputational risks, like public perception.

By proactively managing risk, companies can minimise the impact of unexpected events, protect their assets, and maintain stability in uncertain times. Effective risk management is about more than simply reacting to issues - it involves creating strategies that anticipate and mitigate potential problems, making the company more resilient.

Compliance refers to the adherence to laws, regulations, and industry standards that are relevant to the company’s operations. In today’s highly regulated environment, businesses face many requirements across areas like data privacy, financial reporting, health and safety, and environmental standards. Compliance ensures that companies meet these requirements, reducing the risk of legal issues, fines, and reputational damage. By incorporating compliance into everyday operations, businesses not only avoid penalties but also demonstrate their commitment to ethical practices.

👉 These three components work together to create a well-rounded GRC framework. While governance provides the structure, risk management focuses on resilience, and compliance ensures legality and ethical adherence - all of which contribute to a stable, trustworthy business environment.

Building a robust GRC framework is key to navigating complex risks, maintaining strong governance, and staying compliant with regulatory standards. But a well-implemented GRC framework isn’t a one-size-fits-all solution - it requires a tailored approach that aligns with the company’s goals, industry standards, and regulatory environment. Here are key steps companies can follow to develop an effective GRC framework.

The first step in developing a GRC framework is to identify what the company wants to achieve. GRC objectives should directly support the company’s overall mission and long-term strategy. For example, a tech company focused on data privacy might prioritise strong governance and compliance in data handling, while a manufacturing company might focus more on reducing emissions and its environmental compliance.

👉 Aligning GRC goals with business objectives helps ensure that GRC becomes a central part of the company’s operations rather than a standalone process.

A solid governance structure is essential for defining roles, responsibilities, and accountability within the GRC framework. This includes setting up committees or dedicated teams that oversee governance, risk, and compliance initiatives, ensuring that they align with the company’s goals.

Establishing clear policies and decision-making hierarchies not only promotes accountability but also encourages transparent, ethical practices.

Risk management is a central aspect of GRC. It requires a thorough process for identifying and evaluating risks that may impact the business. To do this, companies should conduct regular risk assessments that account for financial, operational, reputational, and, increasingly, environmental risks.

Risk assessment tools and methodologies - such as ISO 31000 for risk management - offer guidelines to help companies evaluate their risk exposure and develop mitigation strategies. By taking a proactive approach to risk, companies can better prioritise threats and allocate resources effectively.

Compliance is most effective when it is embedded into your day-to-day operations, rather than treated as an afterthought. Companies should map out relevant regulations, industry standards, and internal policies to ensure they’re consistently applied across all business functions.

Compliance management software can help monitor compliance status in real time, track regulatory updates, and automate reporting processes. Integrating compliance into company activities not only keeps the company aligned with regulations but also minimises disruptions and potential legal issues.

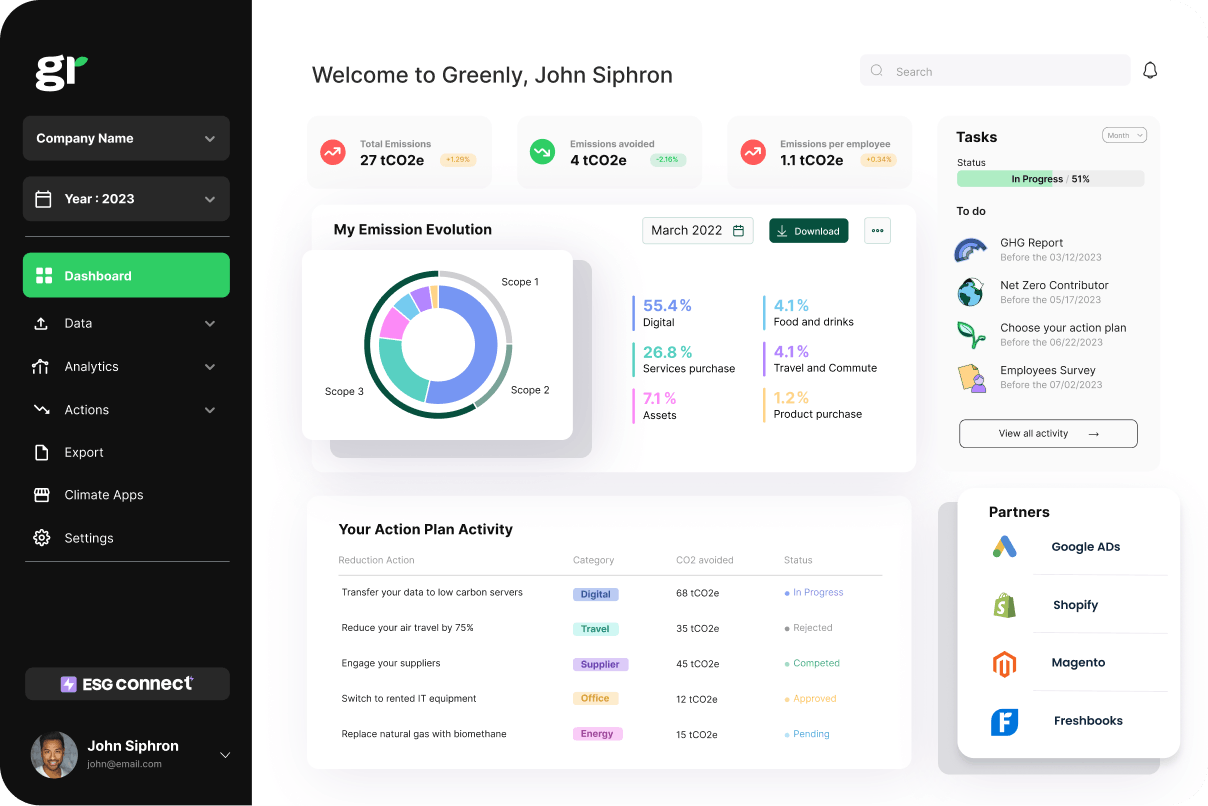

GRC tools and software can help streamline the complicated process of managing governance, risk, and compliance activities. Platforms like Archer Insight, IBM OpenPages, and Drata are just some examples of software that provides a centralised way to monitor compliance, assess risks, and track governance initiatives.

These tools often include dashboards and reporting features that make it easy to view real-time data and respond quickly to any emerging issues. Implementing GRC software can enhance coordination across teams, ensure data accuracy, and reduce workloads, allowing the company to better focus on strategic decision-making.

An effective GRC framework is not just about policies and tools - it’s about creating a culture where compliance, transparency, and accountability are part of everyday company actions. Leadership needs to communicate the importance of GRC to all employees so that everyone within the company understands their role in supporting the GRC goals. This includes regular training, channels for reporting compliance concerns, and incentives for adhering to GRC best practices. A strong culture of compliance and accountability promotes ethical behavior and reduces the risk of non-compliance.

GRC is a continuous process that requires ongoing monitoring and adjustments to stay effective. Regular audits and reviews help ensure that governance structures, risk management processes, and compliance protocols remain relevant and up-to-date.

Many GRC platforms (like the ones outlined above) provide tools for automated reporting and tracking, enabling companies to identify trends, measure performance, and make data-driven improvements. By periodically assessing and adjusting the framework, companies can respond to new regulations, emerging risks, and evolving business goals.

Environmental responsibility has become an essential part of corporate strategy and GRC frameworks are increasingly being adapted to address sustainability challenges. Incorporating environmental governance, risk management, and compliance into GRC helps companies not only meet regulatory standards but also demonstrate accountability in their environmental impact. Here’s how each component of GRC contributes to a stronger environmental focus:

Effective governance paves the way for sustainability within a company. Environmental governance is about implementing policies and practices that support sustainability goals, such as reducing emissions, conserving resources, and promoting corporate responsibility. This includes setting clear environmental targets, like working toward carbon neutrality goals or committing to zero waste, and ensuring that these objectives are integrated into the company’s overall mission. By implementing good governance around sustainability, companies demonstrate that they are accountable not just to shareholders but to the wider community and environment as well.

💡 Governance frameworks, such as the Task Force on Climate-related Financial Disclosures (TCFD), offer structured guidance for companies on integrating climate risks into governance practices. By adopting frameworks like TCFD, companies can align their environmental governance with globally recognised standards, improving transparency and accountability in their environmental reporting.

Environmental risks are a significant concern for many industries. These risks include physical risks, like extreme weather events linked to climate change, and transition risks, such as changes in regulations or shifts in consumer preferences toward more sustainable products. By integrating environmental risks into the broader risk management process, companies can better anticipate, prepare for, and mitigate these impacts.

Effective environmental risk management involves regular assessments to identify and evaluate potential environmental threats. For example, companies might conduct climate risk assessments to understand how rising temperatures or resource scarcity could affect their supply chain or production processes.

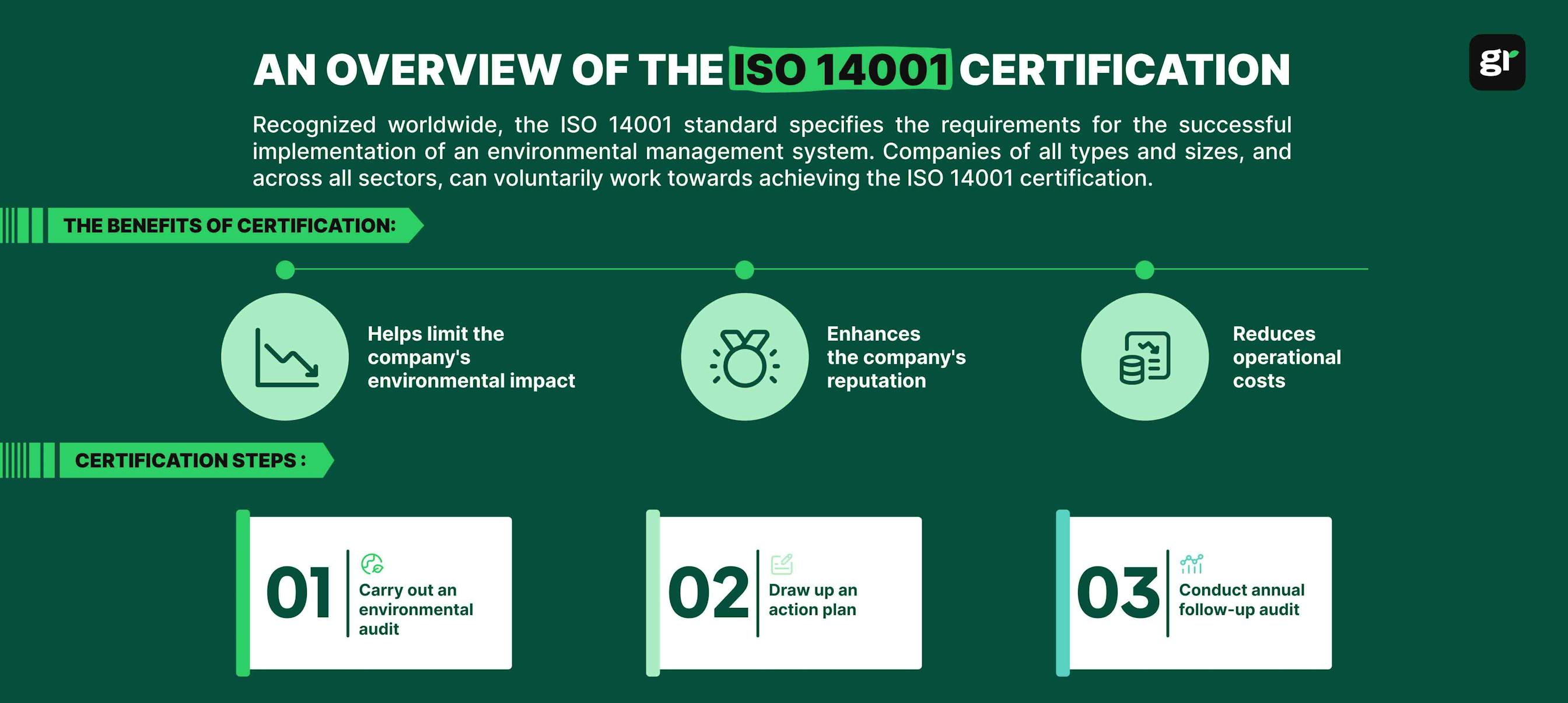

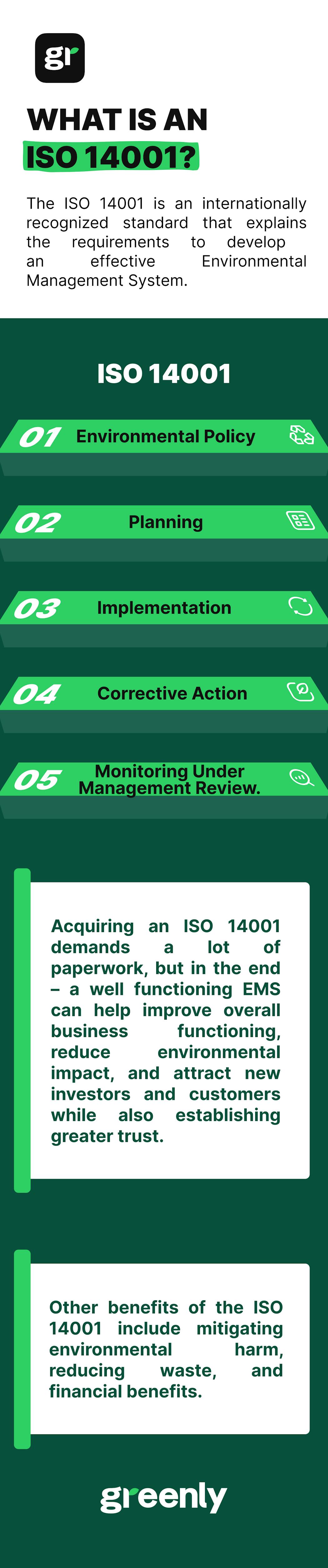

Standards like ISO 14001 for environmental management provide a structured approach to managing environmental risks, helping companies establish a more proactive stance on sustainability.

👉 Through GRC, companies can prioritise environmental risks, allocate resources to address them and develop response strategies that minimise their impact on operations.

In recent years, environmental compliance has become increasingly complex, with more strict regulations aimed at reducing emissions, protecting ecosystems, and enforcing transparency. ESG reporting requirements and carbon emissions targets now require many companies to track, report and actively work to reduce their environmental impact.

💡 Environmental compliance is now an important part of the GRC framework, ensuring that companies meet legal requirements and stay competitive in a market where consumers and investors are prioritising sustainability.

Incorporating an environmental perspective within GRC allows companies to take a more holistic approach to governance, risk, and compliance. As the demand for sustainable practices grows, companies that integrate environmental stewardship into their GRC frameworks not only meet regulatory standards but also gain a competitive edge by appealing to eco-conscious consumers and investors.

Selecting the right sustainability software can be transformative, and Greenly’s platform is built to support businesses at every stage of their sustainability journey.

In a world where sustainability is increasingly becoming a business necessity, Greenly is the trusted partner to help you drive impactful change, optimise costs, and enhance your brand’s reputation as a leader in sustainability. Get in touch with us today to find out more.