Estimate your future CBAM costs & savings with Greenly

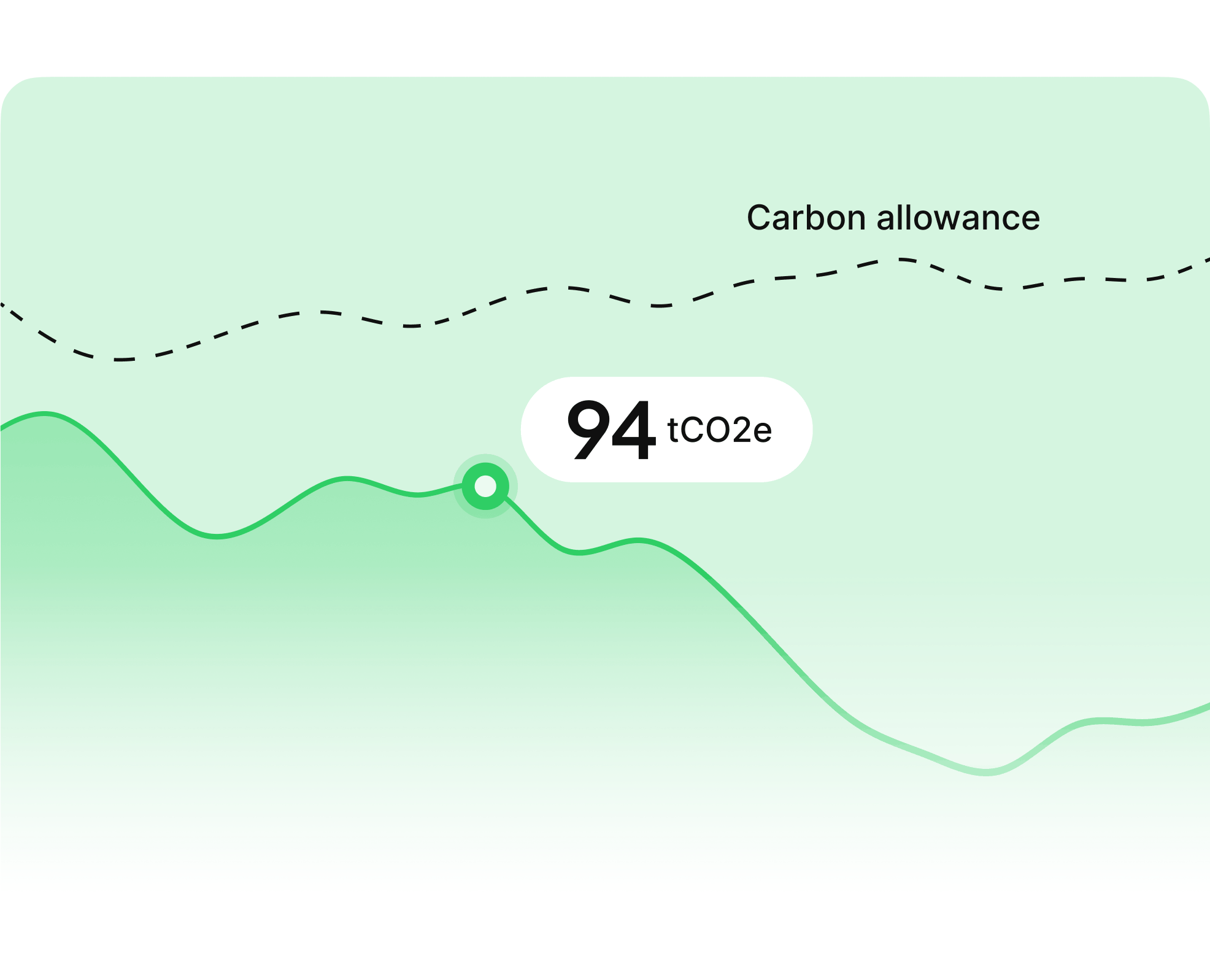

As the price of allowances is expected to rise in the coming years, EU declarants will have to reduce their suppliers' emissions, otherwise their expenses will increase dramatically.

Estimate your costs now

Try out our CBAM Calculator

Get started

Answer a few quick questions about your annual goods imports

Your results

Find out how CBAM will affect your business, and determine your costs at a glance.

Go further

Let's meet! Our solution helps companies comply fully and easily with CBAM requirements.

Why CBAM Matters?

Fine exposure

Starting in 2026, any EU declarant failing to comply with the CBAM regulations will incur a penalty ranging from €10 to €50 per ton of unreported emissions.

Financial risk

Due to the phase-in of CBAM and the projected doubling of carbon allowance prices over the next decade, effectively managing your suppliers' emissions will become increasingly crucial.

Reputation

Decarbonizing proactively provides a competitive edge. Purchasing offset allowances in advance helps reduce costs and demonstrates commitment to sustainability.