ESG / CSR

Industries

What Does the New Trump Tax Bill Mean For Climate Change?

- How and why the One Big Beautiful Bill Act (OBBBA) was developed and how it works

- Which Americans will be affected or subject to its benefits or potential complications

- How the new Trump tax bill could have serious long-term repercussions for climate change

Just in time for July 4th, President Donald Trump made new strides in his effort to employ his aggressive economic policy when the House voted to pass a $3.4 trillion fiscal package that will drastically reduce taxes and pull-back on many of the safety-net programs developed by former President Joe Biden’s in the midst of his attempt to guide the national towards a clean energy economy.

As a whole, Trump’s environmental policy has been a stark contrast to the position taken by the Biden administration – as the new, One Big Beautiful Bill Act (OBBBA) could cause serious repercussions for several social programs that many Americans depend on, especially as climate change worsens.

In this article, we’ll explain how the new tax bill recently passed by Trump will have an impact on the economy, climate policy, and life in the United States.

What is the New 2025 Tax Bill Trump Passed?

The new tax bill, passed by the House of Representatives by a margin of a 218-214, is a legislative act, more commonly known as the OBBBA – which was officially signed into law on July 4, 2025.

The stated goal of the One Big Beautiful Bill Act is to provide tax relief to businesses and employees under financial stress, with an aim of long term economic gain.

Key Features and Tax Provisions of Trump’s One Big Beautiful Bill Act

Notable provisions of the One Big Beautiful Bill Act include:

- Extending 2017 Individual Income Tax Rates: These permanent tax rates aim to boost domestic manufacturing, provide relief for working families, and also help the United States to keep on par with China’s rate of production.

- No Federal Income Tax on Tips and Overtime Pay: The act includes an above-the-line deduction for the first $25,000 in tips, reducing federal taxable income. Where applicable, workers will still owe state, local, and payroll taxes that go toward Social Security and Medicare.

- Qualified Production Property: The OBBBA provides a 100% first-year depreciation deduction for Qualified Production Property (QPP), which is newly constructed, nonresidential real property used in manufacturing or production, if certain timing and use conditions are met. This deduction excludes leased property and related party acquisitions.

- Expanded SALT Deduction Cap: Starting in 2025, the OBBBA raises the itemised SALT deduction cap to $40,000, with a phaseout beginning at $500,000 of modified AGI, both increasing by 1% annually for five years before reverting to $10,000 in 2030. It retains the current treatment of pass-through entity tax regimes, allowing full federal deductions for state and local taxes paid by such entities.

The OBBBA makes permanent most of the tax cuts embedded in the 2017 Tax Cuts and Jobs Act (TCJA), along with some significant additional tax changes.

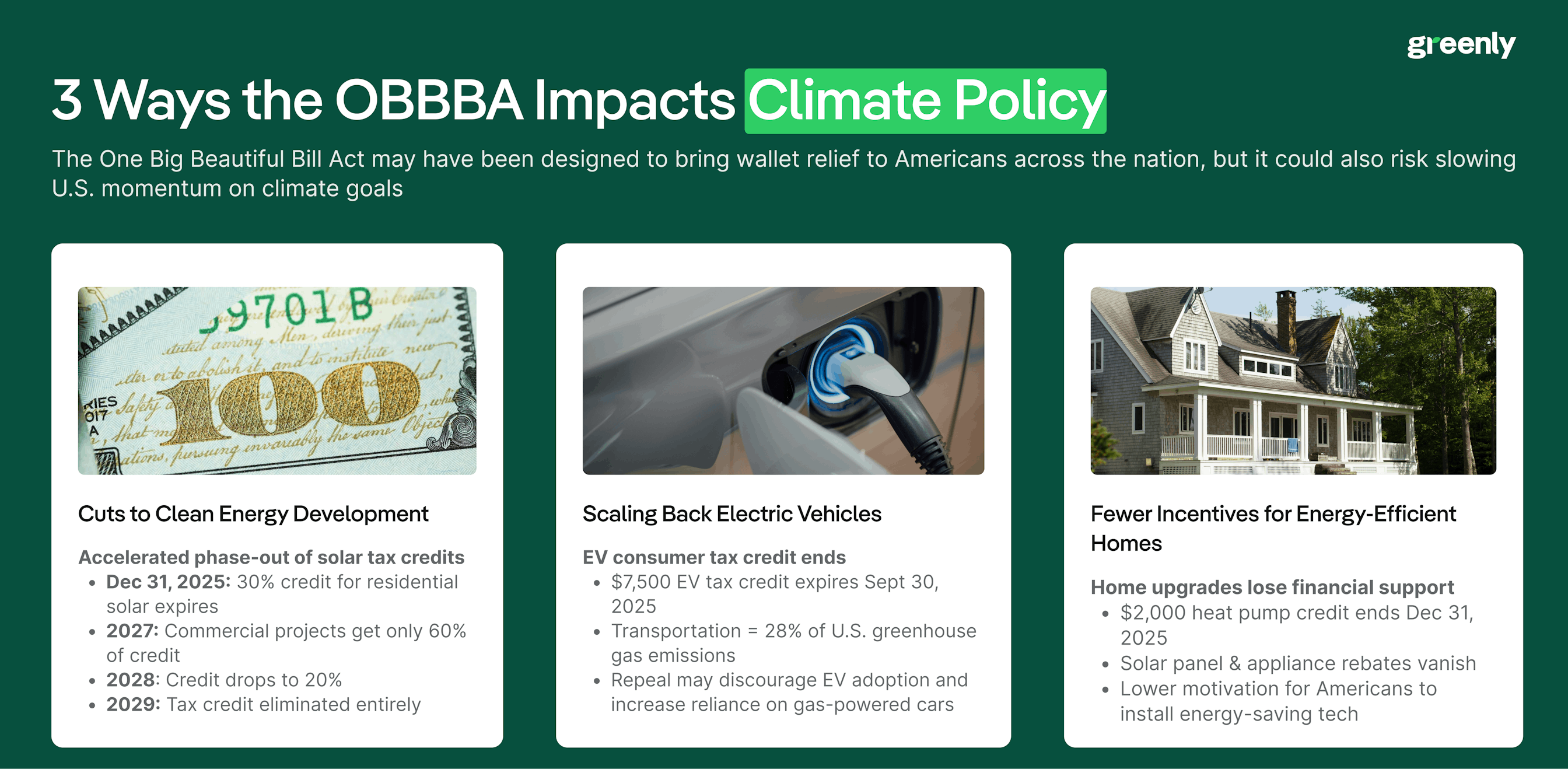

The multimodal content below will summarise the main points of the OBBBA:

How Will the New Trump Tax Bill Impact Climate Change Policy in the U.S.?

The OBBBA includes a number of provisions that fundamentally change the climate policy of the United States:

Cuts to Clean Energy Development

As a result of the One Big Beautiful Bill Act, several clean energy industries will be impacted – including many of the efforts developed by former former President Joe Biden himself as an effort to battle the near national emergency of climate change.

For instance, the new Trump tax bill will allow solar developers to begin construction starting from mid-2026 for five years onward – which will allow them to receive the tax production benefits during this time period.

However, the OBBBA is accelerating the phase-out of these federal solar tax credits – as 30% of these tax credits will expire for residential systems by the end of the year on December 31, 2025.

The drop down sections below will break down how these federal solar tax credits are being phased out between 2025 and 2029:

Scaling Back Electric Vehicles

The One Big Beautiful Bill Act will also remove the renewal of a $7,500 consumer tax credit on electric vehicles, which is set to end on September 30th, 2025.

These tax credits, which were implemented by the Biden administration through the passage of the Inflation Reduction Act of 2022 (the “IRA”), were created in an effort to encourage more clean energy incentives. The phasing out of these tax credits has a negative impact on the daily greenhouse gas emissions of Americans, whether that be through their daily commute or their annual summer road trip.

For reference, transportation accounts for 28% of GHG emissions in the country – making the end of these tax credits as a pivotal, and potentially dangerous turning point for the country and air pollution.

Fewer Incentives To Install Energy Efficient Appliances

As a result of the OBBBA – the credits previously introduced in the IRA by Biden for Americans purchasing energy efficient home appliances, installing solar panels, or other clean energy friendly technologies will be eradicated by the end of the year.

For instance, the new Trump tax bill will remove the current $2,000 tax credit for Americans purchasing heat pumps by December 31st, 2025.

The interactive flip cards (move over cursor to flip) will reveal additional ways that the new Trump tax bill could have an impact on climate policy:

As a whole, despite some of the tax relief incentives proposed by the OBBBA – contained within the 1,038 page document are deleterious setbacks that could dig the United States a deeper hole in the midst of the ongoing climate change crisis and make life more challenging in the long-term as global warming worsens.

What About Greenly?

If reading this article on the One Big Beautiful Bill Act (OBBBA) has inspired you to consider your company’s own carbon footprint, Greenly can help.

At Greenly we can help you to assess your company’s carbon footprint, and then give you the tools you need to cut down on emissions. We offer a free demo for you to better understand our platform and all that it has to offer – including assistance on how to reduce emissions, optimize energy efficiency, and more to make sure your business doesn’t contribute to devastating natural disasters.

Learn more about Greenly’s carbon management platform here.